Business

Jeep parent Stellantis announces $13 billion U.S. investment plan

A new Jeep Wrangler 4-Door Sahara 4×4 vehicle displayed for sale at a Stellantis NV dealership in Miami, Florida, US, on Saturday, April 5, 2025.

Eva Marie Uzcategui | Bloomberg | Getty Images

DETROIT — Stellantis, the parent company of Chrysler, Jeep and other auto brands, plans to invest $13 billion in U.S. manufacturing operations over the next four years, as the company executes a domestic turnaround under CEO Antonio Filosa.

The trans-Atlantic automaker on Tuesday said the investments will add more than 5,000 jobs to its domestic workforce and increase domestic production by 50%. The plans include bringing new vehicles to plants in Michigan, Illinois, Indiana and Ohio through 2029.

U.S.-listed shares of Stellantis rose more than 5% in after-hours trading Tuesday. The company’s stock is off 24% this year.

The announcement comes amid President Donald Trump‘s efforts to create more manufacturing jobs in the U.S. through the use of aggressive tariffs, especially for the automotive industry. The company said the plans expand those Stellantis Chair John Elkann detailed to Trump in January.

“Since day one, me and the team set out a clear priority that was to grow in the largest market that we operate, which is the U.S.,” Filosa, who led the company’s North American operations before starting as CEO on June 23, told CNBC on Tuesday. “We know what we need to do to grow this market.”

Incoming Stellantis CEO Antonio Filosa, head of the company’s Americas operations, greets a Windsor Assembly Plant employee during an event celebrating Chrysler’s 100th anniversary on June 6, 2025.

Stellantis

The company’s U.S. sales peaked in 2018, when it was known as Fiat Chrysler, at more than 2.2 million vehicles. Sales last year were down 42% since then as the company and its former CEO Carlos Tavares, who was ousted late last year, focused on profits over volumes.

Stellantis’ new vehicles under the investments include a midsize truck for a plant in Toledo, Ohio; two new Jeep vehicles for a shuttered facility in Belvidere, Illinois; and a next-generation version of the Dodge Durango SUV and “an all-new range-extended EV and internal combustion engine large SUV” at plants in Michigan.

Other investments include research and development and supplier costs to execute the company’s new product strategy, as well as additional investments in the company’s U.S. powertrain hub in Kokomo, Indiana.

Filosa said the investment decisions were a result of discussions with the company’s new leadership team as well as stakeholders such as the company’s franchised dealer network. He downplayed tariffs as a main driver for the decisions, saying automakers need to make long-term plans.

It’s not immediately clear how many of the investments and jobs are new or how many have been previously announced as part of the company’s 2023 contract with the United Auto Workers union that included $18.9 billion in new investments by April 2028.

But there are some differences. For example, a midsize truck was previously planned for Stellantis’ Belvidere Assembly plant in Illinois through a $1.5 billion investment. That vehicle, or a different midsize truck, is now expected to be added to the company’s plant in Toledo through a $400 million investment.

The investments cover most of the company’s main U.S. manufacturing plants. Stellantis’ U.S. footprint includes 34 manufacturing facilities, parts distribution centers and research and development locations across 14 states. The operations employ more than 48,000 people, according to the company.

Business

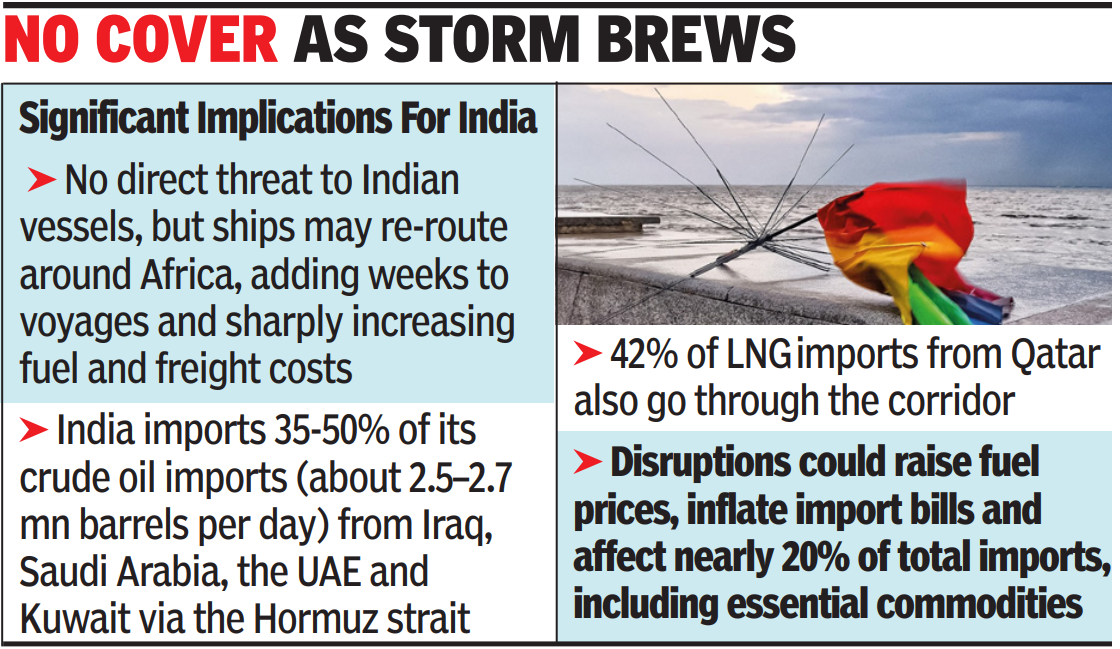

Oil Prices: US, Israel attack Iran: With oil prices up, forex volatility set to continue – The Times of India

MUMBAI: The rupee is likely to come under renewed pressure when forex markets open on Wednesday as the conflict in West Asia has worsened the trade and energy situation beyond expectations of analysts.On Tuesday, the Indonesian rupiah, South Korean won and Thai baht each fell by more than 1%, leading losses in Asia, while broader emerging-market currency indices dropped about 0.5% in their worst session since Nov 2024. The selloff followed a sharp escalation in the conflict, with Iran moving to effectively choke tanker traffic through the Strait of Hormuz, sending crude prices up roughly 9% in London trading. The spike in oil heightened concerns over inflation, wider current account deficits and delayed rate cuts in oil-importing economies. Investors rushed into the US dollar and gold, pushing the dollar to multi-month highs and triggering capital outflows from riskier assets.According to KN Dey, forex consultant, the rupee is most likely to breach 92 level this week. “Oil prices have risen sharply and supply chains are getting disrupted. Most Asian currencies have already fallen, with the Korean won and the Malaysian ringgit down over 1%. The rupee will open under pressure and a gap-down start is likely. Stop-loss levels could trigger early, adding to volatility,” he said. “Going ahead would be very tough, RBI’s intervention would only act as a speedy breaker.“What has worsened the conflict situation is that it has created a supply-chain crisis. “Beyond the immediate risk to oil and gas supplies from the Gulf, the broader concern is how the conflict may influence trade behavior across Asia,” said Choon Hong Chua, senior director, Moody’s. “This raises the risk of selective export restrictions, informal boycotts, and tighter customs scrutiny as govts seek to limit exposure to secondary sanctions or political repercussions,” he added.

Business

Iran Conflict: Middle East tensions: Global insurers exit Iranian waters as conflict deepens – The Times of India

MUMBAI: India’s trade and energy supplies face fresh risks after reinsurers and Protection & Indemnity (P&I) clubs announced cancellation of war risk insurance for vessels transiting the Strait of Hormuz and Iranian waters, following an escalation in the Iran conflict. The cancellations, effective from this week, have left over 150 vessels stranded and disrupted a corridor that handles nearly one-fifth of global oil flows.P&I clubs are mutual, non-profit insurance associations owned by shipowners. They provide third-party liability cover through a pooled premium for risks such as cargo damage, pollution, crew injuries and collisions that are not covered under hull insurance. The clubs also provide legal support and dispute resolution across jurisdictions.“The industry is currently in a wait-and-watch mode, as much depends on how long the conflict persists. If it turns prolonged, insurers are likely to come together to create additional capacity for war-risk cover. Typically, there is an immediate surge in demand when hostilities break out, but that demand tends to ease quickly if the situation stabilises in a short span,” said Tapan Singhel, MD & CEO, Bajaj General Insurance.

Brokers said that in the past when international reinsurers ceased to provide cover for some risks like terrorism the Indian market had provided the capacity by building an insurance pool where domestic companies come together and share the risks. However, this tie state-owned reinsurer GIC Re, which leads domestic marine pools, has itself issued cancellation notices for marine hull war risk covers effective March 3, 2026, mirroring global reinsurers and P&I clubs. The crisis has brought marine insurance centerstage, the share of this line of non-life had shrunk to around 2% of industry premium as risks ebbed due to containarisation and more safety in transport. The size of the premium also determines the capacity of the industry to provide large covers.Their role is central to global shipping. Without P&I cover, shipowners face potentially unlimited liabilities in the event of accidents, pollution or war-related damage. In high-risk zones, the absence of insurance effectively halts voyages, as operators are unwilling to expose vessels to uninsured losses. In previous crises in the Red Sea, war risk exclusions by insurers sharply curtailed traffic and drove up freight rates.In the current episode, major P&I clubs and reinsurers have issued notices cancelling war risk cover for Iranian waters, the Persian Gulf and the Strait of Hormuz, citing tanker damage, casualties and threats from Iranian forces. Reports of VHF warnings and GPS disruptions have added to concerns. Insurers have invoked standard cancellation clauses following US and Israeli strikes on Iran, with broader policy implications if the conflict further widens.Fresh war risk cover may be available, but at sharply higher premiums. Rates that were around 0.25% of vessel value have surged multiple times, rendering transits commercially unviable for many operators. Even where cover is available, shipowners remain wary of risks such as seizures or missile strikes.

Business

UK economy could face ‘very significant’ impact from Iran conflict – OBR

The UK economy could face a “very significant” hit from the conflict in Iran, the official budget watchdog has warned.

The Office for Budget Responsibility (OBR) said that the outlook for inflation would be “particularly uncertain” following spikes in gas and oil prices in recent days following attacks in the Middle East.

It came as the budget watchdog reduced its inflation forecast for this year, indicating that UK inflation will drop to target levels quicker than previously expected.

The OBR also cut its economic growth forecast for this year and revealed a worsening unemployment outlook for the next three years.

In its latest projections alongside the Chancellor’s spring statement, the organisation however highlighted that recent volatility in the Middle East could have an impact on a number of its projections.

The forecasts were prepared before days of recent attacks as part of an intensifying conflict between US-Israeli forces and Iran.

On Tuesday, the OBR said: “Conflict in the Middle East, which escalated as we were finalising this document, could have very significant impacts on the global and UK economies.”

David Miles, from the OBR’s budget responsibility committee, said its predictions that inflation will fall to target levels early this year have become more uncertain after jumps in oil and gas prices linked to recent attacks in the Middle East.

He said: “I think what will happen to inflation is particularly uncertain in the past few days.

“Our central expectation had been that inflation would fall back towards the Bank of England’s 2% target early this year and will be around that level at the end of the year.

“There must be more uncertainty around that right now.”

The trimmed-down inflation projections indicated that this will slow to 2.3% for 2026, down from a previous 2.5% forecast.

Experts said the lower-than-expected rate is partly down to “greater slack in the economy” and falling food and energy prices.

As a result, the OBR indicated that inflation will drop to the 2% target rate set by the Bank of England and the Government later this year.

The Bank has already suggested that inflation – the rate at which the price of goods and services rises – could fall below 2% by April.

The OBR said inflation is expected to remain at the 2% target from 2027 onwards, assuming this is not knocked off course by the potential jump in energy costs.

It came as the Chancellor Rachel Reeves told MPs in Parliament that the OBR said the UK economy would grow more slowly than previously expected in 2026, although growth will pick up in the following years.

UK gross domestic product (GDP) is expected to grow by 1.1% in 2026, as the OBR cut its previous prediction of 1.4% from last November.

The budget watchdog said the downgrade was linked to a growth slowdown late last year, loosening in the labour market and subdued data from recent business surveys.

However, it also lifted its forecasts for growth for both 2027 and 2028, with the economy to expand by 1.6% in both years.

The Chancellor said she had the “right economic plan” for the UK as she laid out her spring statement on Tuesday.

Ms Reeves also said that unemployment is “set to peak later this year” before reducing over the following years.

The OBR said that the UK unemployment rate is on track to peak at about 5.33% in 2026.

Latest data from the Office for National Statistics (ONS) showed that unemployment lifted to a five-year-high of 5.2% in the three months to December.

The OBR had previously predicted that the jobless rate would increase to 4.9% in 2026.

New forecasts show that unemployment is then on track to hit 4.9% in 2027 and 4.4% in 2028.

It had previously forecast it would be 4.6% in 2027 and 4.3% the following year.

The new forecasts have also reduced the Government’s borrowing projections for each year until 2031, in a potential boost for the Chancellor.

Reduced borrowing costs, linked to an easing in the yield on Government bonds, also meant that the Government’s headroom to meet its fiscal rules widened to £23.6 billion, compared with £21.7 billion in November’s budget.

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, said: “There were few major surprises in today’s spring statement, with the Chancellor delivering the well-flagged ‘boring budget’ that we and the market were expecting.”

He added: “Chunks of the fiscal forecasts now look dated because of the rapid escalation of events in the Middle East.”

Peter Arnold, EY UK chief economist, said: “The underlying improvement in the UK’s fiscal position was supported by higher actual and expected tax receipts, driven in large part by a stronger equity market performance since November.

“There may now be doubts around how long this stock market performance can be sustained if the conflict in the Middle East is prolonged and global equity market volatility continues.”

-

Politics6 days ago

Politics6 days agoWhat are Iran’s ballistic missile capabilities?

-

Politics6 days ago

Politics6 days agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Sports6 days ago

Sports6 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Fashion5 days ago

Fashion5 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Business1 week ago

Business1 week agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Fashion5 days ago

Fashion5 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026