Business

Jeep parent Stellantis announces $13 billion U.S. investment plan

A new Jeep Wrangler 4-Door Sahara 4×4 vehicle displayed for sale at a Stellantis NV dealership in Miami, Florida, US, on Saturday, April 5, 2025.

Eva Marie Uzcategui | Bloomberg | Getty Images

DETROIT — Stellantis, the parent company of Chrysler, Jeep and other auto brands, plans to invest $13 billion in U.S. manufacturing operations over the next four years, as the company executes a domestic turnaround under CEO Antonio Filosa.

The trans-Atlantic automaker on Tuesday said the investments will add more than 5,000 jobs to its domestic workforce and increase domestic production by 50%. The plans include bringing new vehicles to plants in Michigan, Illinois, Indiana and Ohio through 2029.

U.S.-listed shares of Stellantis rose more than 5% in after-hours trading Tuesday. The company’s stock is off 24% this year.

The announcement comes amid President Donald Trump‘s efforts to create more manufacturing jobs in the U.S. through the use of aggressive tariffs, especially for the automotive industry. The company said the plans expand those Stellantis Chair John Elkann detailed to Trump in January.

“Since day one, me and the team set out a clear priority that was to grow in the largest market that we operate, which is the U.S.,” Filosa, who led the company’s North American operations before starting as CEO on June 23, told CNBC on Tuesday. “We know what we need to do to grow this market.”

Incoming Stellantis CEO Antonio Filosa, head of the company’s Americas operations, greets a Windsor Assembly Plant employee during an event celebrating Chrysler’s 100th anniversary on June 6, 2025.

Stellantis

The company’s U.S. sales peaked in 2018, when it was known as Fiat Chrysler, at more than 2.2 million vehicles. Sales last year were down 42% since then as the company and its former CEO Carlos Tavares, who was ousted late last year, focused on profits over volumes.

Stellantis’ new vehicles under the investments include a midsize truck for a plant in Toledo, Ohio; two new Jeep vehicles for a shuttered facility in Belvidere, Illinois; and a next-generation version of the Dodge Durango SUV and “an all-new range-extended EV and internal combustion engine large SUV” at plants in Michigan.

Other investments include research and development and supplier costs to execute the company’s new product strategy, as well as additional investments in the company’s U.S. powertrain hub in Kokomo, Indiana.

Filosa said the investment decisions were a result of discussions with the company’s new leadership team as well as stakeholders such as the company’s franchised dealer network. He downplayed tariffs as a main driver for the decisions, saying automakers need to make long-term plans.

It’s not immediately clear how many of the investments and jobs are new or how many have been previously announced as part of the company’s 2023 contract with the United Auto Workers union that included $18.9 billion in new investments by April 2028.

But there are some differences. For example, a midsize truck was previously planned for Stellantis’ Belvidere Assembly plant in Illinois through a $1.5 billion investment. That vehicle, or a different midsize truck, is now expected to be added to the company’s plant in Toledo through a $400 million investment.

The investments cover most of the company’s main U.S. manufacturing plants. Stellantis’ U.S. footprint includes 34 manufacturing facilities, parts distribution centers and research and development locations across 14 states. The operations employ more than 48,000 people, according to the company.

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

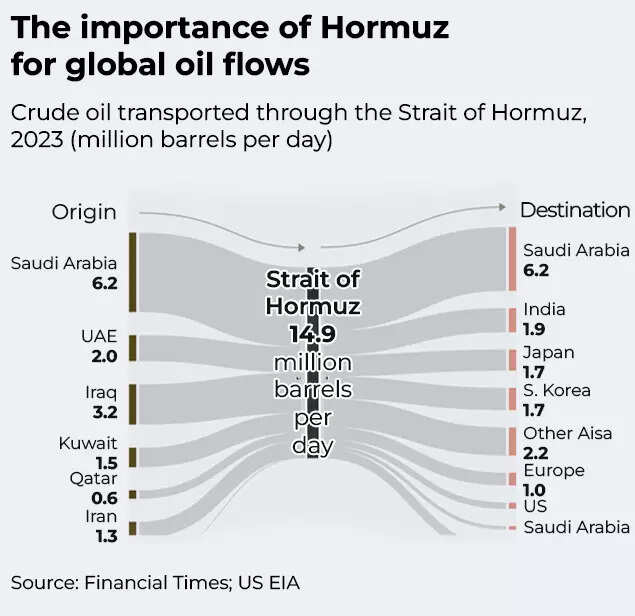

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

Business

IIP sees 4.8% YoY growth in January; manufacturing & electricity support rise – The Times of India

India’s Index of Industrial Production saw a 4.8% increase year-on-year in January 2026, according to the Ministry of Statistics & Programme Implementation. The rise in industrial output was largely driven by a 4.8 per cent expansion in manufacturing and a 5.1 per cent improvement in electricity generation. Mining activity also supported overall growth, registering a 4.3 per cent uptick during the month.Estimates placed IIP at 169.4 for January 2026, compared with 161.6 in January 2025. This follows a stronger reading in December 2025, when industrial production had grown by 7.8 per cent. For January 2026, the sector-specific indices stood at 157.2 for mining, 167.2 for manufacturing and 212.1 for electricity.Within manufacturing, 14 of the 23 industry groups at the NIC two-digit level posted year-on-year gains in January. The strongest contributors were manufacture of basic metals, which rose 13.2 per cent; manufacture of motor vehicles, trailers and semi-trailers, up 10.9 per cent; and manufacture of other non-metallic mineral products, which increased 9.9 per cent. Growth in basic metals was supported by items such as flat products of alloy steel, MS slabs, and hot-rolled coils and sheets of mild steel.The automobile category advanced on the back of higher output of auto components and spare parts, commercial vehicles, and bus and minibus bodies or chassis. In the non-metallic mineral products segment, cement of all types, cement clinkers and stone chips were key contributors.According to use-based classification, output of primary goods grew 3.1 per cent, capital goods rose 4.3 per cent and intermediate goods increased 6 per cent compared with January 2025. Infrastructure and construction goods recorded the sharpest rise at 13.7 per cent, while consumer durables expanded 6.3 per cent. In contrast, consumer non-durables declined by 2.7 per cent. The ministry identified infrastructure and construction goods, intermediate goods and primary goods as the leading drivers of growth under this classification.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Sports1 week agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026