Business

Market watch: India’s equity valuations dip below long-term averages; but stay elevated versus peers – The Times of India

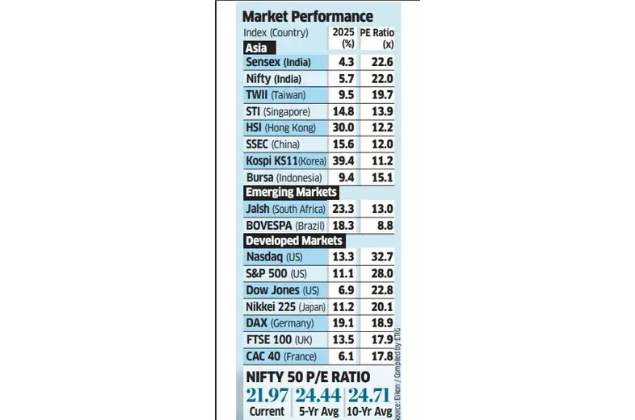

India’s equity valuations are trading marginally below their historical averages but continue to remain expensive compared with regional peers, raising concerns amid slowing earnings growth.The benchmark Nifty currently trades at a price-to-earnings (PE) ratio of 21.97 times, lower than its five- and 10-year averages of 24.4 and 24.8, respectively. In contrast, Hong Kong’s Hang Seng is at 11.7, South Korea’s Kospi below 13, and South Africa at around 12.7, according to an ET report.Valuations in India have traditionally traded at a premium to peers, supported by strong growth prospects. However, with corporate earnings momentum weakening, foreign investors are paring exposure and holding back fresh allocations.

“Valuations have begun mattering now because nominal GDP growth has slipped into single digits compared to around 12-13%,” said Ritesh Jain, founder of Pinetree Macro, a global macro asset allocation fund. “Corporate profitability is a function of nominal GDP. So, for an overseas fund manager looking at various markets, a country with slowing nominal growth and rich valuations is far less appealing despite its inherent strengths.”India is now the second-most expensive major market after the US, with some global fund managers increasingly shifting allocations to cheaper Chinese, European, and Japanese equities.Fund managers also noted that index composition plays a key role in valuation levels. “The composition of Indian indices must be taken into account while looking at valuations,” said Nilesh Shah, managing director, Kotak Mutual Fund. “If the Sensex and Nifty are full of expensive consumer names and there are fewer commodity players, it’s bound to push up valuation levels. If we were to remove some of the consumer names, our valuations are around averages on a historical basis.”

Business

BP cautions over ‘weak’ oil trading and reveals up to £3.7bn in write-downs

BP has warned it expects to book up to five billion dollars (£3.7 billion) in write-downs across its gas and low-carbon energy division as it also said oil trading had been weak in its final quarter.

The oil giant joined FTSE 100 rival Shell, after it also last week cautioned over a weaker performance from trading, which comes amid a drop in the cost of crude.

BP said Brent crude prices averaged 63.73 dollars per barrel in the fourth quarter of last year compared with 69.13 dollars a barrel in the previous three months.

Oil prices have slumped in recent weeks, partly driven lower due to US President Donald Trump’s move to oust and detain Venezuela’s leader and lay claim to crude in the region, leading to fears of a supply glut.

In its update ahead of full-year results, BP also said it expects to book a four billion dollar (£3 billion) to five billion dollar (£3.7 billion) impairment in its so-called transition businesses, largely relating to its gas and low-carbon energy division.

But it said further progress had been made in slashing debts, with its net debt falling to between 22 billion and 23 billion dollars (£16.4 billion to £17.1 billion) at the end of 2025, down from 26.1 billion dollars (£19.4 billion) at the end of September.

It comes after the firm’s surprise move last month to appoint Woodside Energy boss Meg O’Neill as its new chief executive as Murray Auchincloss stepped down after less than two years in the role.

Ms O’Neill will start in the role on April 1, with Carol Howle, current executive vice president of supply, trading and shipping at BP, acting as chief executive on an interim basis until the new boss joins.

Ms O’Neill’s appointment has made history as she will become the first woman to run BP – and also the first to head up a top five global oil company – as well as being the first ever outsider to take on the post at BP.

Shares in BP fell 1% in morning trading on Wednesday after the latest update.

Business

Budget 2026: Kolkata realtors seek tax relief, revised affordable housing cap; eye demand revival – The Times of India

Real estate developers in Kolkata have urged the Centre to use the Union Budget to recalibrate housing policies to reflect rising land and construction costs, calling for higher tax benefits for homebuyers and a long-pending revision of the affordable housing definition to revive demand, especially in the mid-income segment, PTI reported.With the Budget set to be tabled on February 1, industry players said measures such as revisiting price caps for affordable homes, rationalising GST on under-construction properties and easing approval processes could significantly improve affordability and sales momentum.Sushil Mohta, president of CREDAI West Bengal and chairman of Merlin Group, said reforms must align with current market realities. “Revisiting the affordable housing definition, rationalising housing loan interest deductions and streamlining GST rates will significantly improve affordability and demand, especially for middle-income homebuyers,” he told PTI, adding that a policy push for rental housing and wider access to formal housing finance is crucial amid rapid urbanisation.Mahesh Agarwal, managing director of Purti Realty, said continued policy support through tax rationalisation and infrastructure spending remains critical. “A re-evaluation of affordable housing price limits in line with rising land and construction costs, along with adjustments to GST on under-construction property, will enhance affordability,” he said, stressing that simpler tax frameworks and incentives for first-time buyers would help stabilise the market and speed up project execution.Echoing similar concerns, Merlin Group MD Saket Mohta pointed to sharp increases in construction costs since the introduction of GST in 2017, underscoring the need for further rationalisation. He also called for raising the affordable housing price cap from Rs 45 lakh to around Rs 80–90 lakh and expanding unit size norms. “Mid-income housing will be the key demand driver going into 2026, and supportive tax and policy measures are essential to sustain growth,” he said.Eden Realty MD Arya Sumant said the Budget must strike a balance between fiscal discipline and growth-oriented reforms. “Higher home loan interest deductions for mid-income and first-time buyers, an updated affordable housing definition, GST rationalisation and faster approvals will improve project viability and speed-to-market,” he said, adding that sustained urban infrastructure investment would unlock demand across residential and commercial segments.Sahil Saharia, CEO of Bengal Shristi Infrastructure Development Ltd, said policy focus should shift towards large, integrated developments. “Support for mixed-use townships, rental housing and commercial hubs, along with faster clearances and digital single-window mechanisms, can help create self-sustained urban ecosystems and improve execution efficiency,” he said.Developers said clear and stable policy signals in the Budget could help restore homebuyer confidence, attract long-term capital and ensure sustainable growth for the real estate sector in eastern India.

Business

Power sector’s circular debt shoots up by Rs223 billion – SUCH TV

Circular debt in the power sector has increased in the first five months of the ongoing financial year (FY). Sources told that the debt shot up by Rs223 billion since July 2025 to reach Rs1,837 billion in November 2025 within two months of the signing of agreements to reduce the debt by Rs1225 billion.

Despite the fact that the government had signed agreements with banks in September last year to reduce the debt, it increased by Rs144 billion in October and November.

In September, the debt stood at Rs1,693 billion, while it was Rs1,614 billion in June 2025.

Sources informed that compared with November 2024, the debt in November 2025 came down by Rs544 billion.

It was Rs2,381 in November 2024, they added.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports4 days ago

Sports4 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Business1 week ago

Business1 week agoGold prices declined in the local market – SUCH TV