Business

Maruti Suzuki targets mini-car surge: Alto and S-Presso prices cut 11-13%; 2-wheeler buyers lured by festive finance – The Times of India

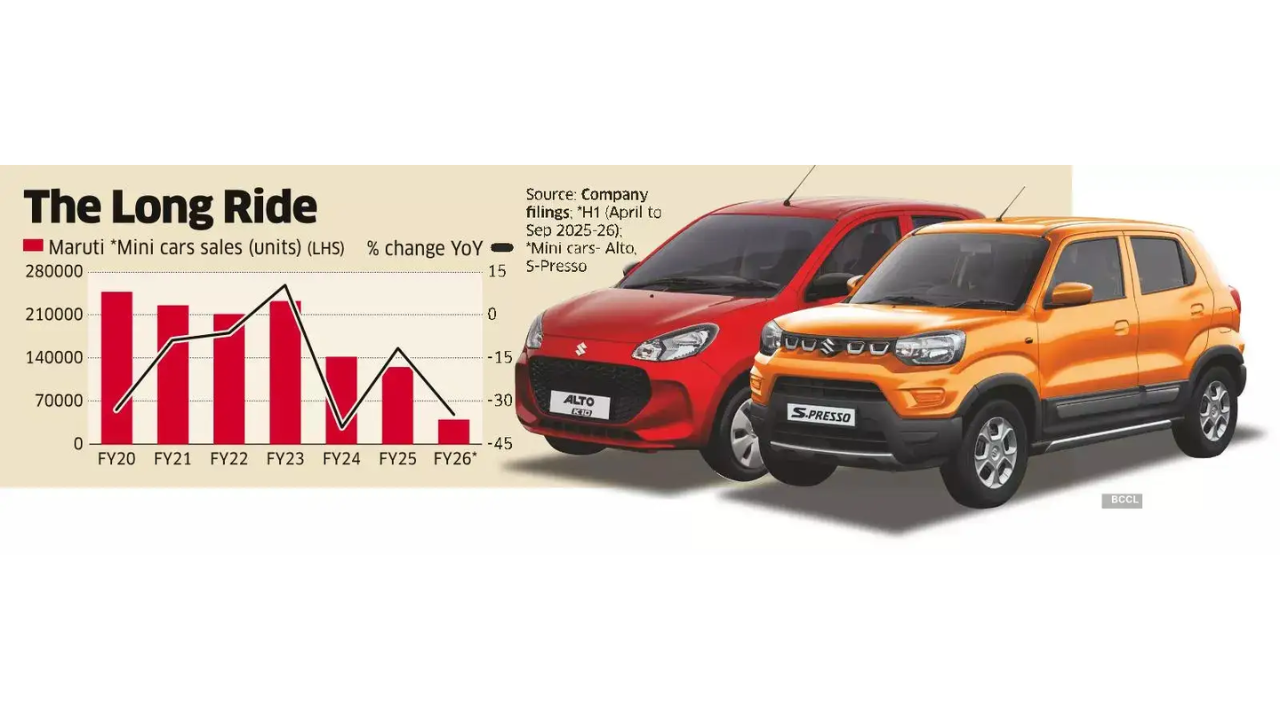

Maruti Suzuki India is intensifying efforts to boost sales of its entry-level cars, aiming to achieve record volumes for the Alto and S-Presso in the ongoing fiscal 2026. The company is relying on aggressive price reductions, festive finance schemes, and a focused push to attract two-wheeler riders into the four-wheeler segment.According to sources familiar with the matter told ET, Maruti has set a target to sell between 220,000 and 250,000 mini cars this fiscal year. The previous record for the segment was around 247,000 units in FY20.The renewed focus on small cars is part of Maruti’s broader strategy to arrest declining market share, which has been under pressure due to a slump in small-car sales alongside rising SUV demand. In FY25, the overall passenger vehicle market grew only 2% in cumulative wholesale dispatches, while Maruti’s market share fell to 40.9%, the lowest since FY13 when it stood at 39%. The company had commanded over 51% market share in FY19 and FY20.Maruti’s optimism is reinforced by a GST rate cut on small cars, which has effectively lowered prices by 11-13%. The company has also introduced a festive Rs 1,999 EMI scheme for entry-level models, launched during Navratri and extending through Diwali, to appeal to two-wheeler owners.

Dealers reported a surge in showroom footfalls and enquiries, particularly from rural and small-town buyers, though actual conversions remain limited. “The offer is very attractive and has brought new buyers into showrooms. We expect a major pickup during Dhanteras and Diwali,” said a Maruti dealer in western India.Partho Banerjee, Senior Executive Officer (Sales and Marketing) at Maruti Suzuki, said the entry-level segment is showing early signs of revival. “The response to the Rs 1,999 EMI offer has been very positive. Many two-wheeler customers who earlier did not consider buying a car are now visiting our showrooms. We are literally seeing helmets on discussion tables – that’s a very good indicator,” he told ET.Banerjee added that overall festive-period booking momentum has been strong. “Just to give you a perspective, the Alto bookings in October (till date) were up around 60% compared to the same month last year.” He noted that bookings for cars in the 18% GST bracket, including small cars, have risen sharply, though it is still early to quantify their full impact on overall sales.Industry observers, however, expressed caution over Maruti’s ambitious targets. “It’s a very tall target. Over the last five years, the car buyer has become a lot more aspirational. Even a first-time buyer is not keen on an entry-level model and prefers a second-hand premium hatchback like a Baleno,” said an industry executive, requesting anonymity.Analysts believe that while the push on affordability may come at the cost of average selling price and near-term margins – potentially around 100 basis points – it could expand market share and improve operating leverage if consumer response remains positive. Kapil Singh of Nomura Research noted that the initiative may strengthen Maruti’s base.According to Puneet Gupta, Director, S&P Global Mobility, the GST reduction could reignite demand in the mini-car segment. “Expect a wave of innovation in financing, product offerings, and ownership schemes aimed at reviving this category,” he said. With only 36 cars per 1,000 people, India’s vehicle ownership remains among the lowest globally, and this push could serve as a catalyst for two-wheeler users to transition to four-wheelers.Maruti has reduced prices across its lineup by 2-21%, with the steepest cuts on the Alto, S-Presso, and Celerio (13-22%). Larger models, including the Brezza, Grand Vitara, and Invicto, have seen reductions of 2-8%.Banerjee emphasised that Maruti is committed to maintaining a balanced presence across all segments. “As a market leader, we must have a play across all segments – hatchbacks, SUVs, MPVs, CNG, hybrids, and EVs. That’s what leadership means,” he said.

Business

Zipcar to end UK operations affecting 650,000 drivers

Car-sharing firm Zipcar has confirmed it is stopping operations in the UK after launching a consultation late last year.

The move will hit the company’s roughly 650,000 drivers across the country.

On December 1, the US-based company told customers in the UK that it planned to suspend new bookings temporarily at the turn of the year.

The business, which had 71 UK employees at the end of 2024, launched a formal consultation with staff as a result.

On Friday, in a fresh email to customers, the business said it “can now confirm that Zipcar will cease operating in the UK”.

The company added: “In accordance with clause 7.5 of the member terms, please take this as your written notice that we will formally close your account in 30 days’ time.

“It’s not possible to make any new bookings with Zipcar UK at this time, but your account will remain open until February 16.”

It added that customers will be entitled to a pro-rated refund for any remaining periods on current plans or subscriptions, from the start of 2026.

Zipcar said this will be done automatically and will not require any action from users.

Accounts showed that the van and car hire firm saw losses deepen to £5.7 million in 2024 after a decrease in customer trips.

Business

Budget 2026: Will Markets Be Open On February 1? Full Details Inside

New Delhi: Good news for investors and market watchers! Even though February 1 falls on a Sunday this year, the Indian stock markets will remain open for trading on Budget Day. Both the BSE and NSE announced on January 16 that trading will take place as per normal market hours on February 1 for Budget 2026. This special arrangement ensures that investors can react to Budget announcements in real time, without waiting for the next trading session.

The NSE clarified the special trading arrangement in a circular, stating, “On account of the presentation of the Union Budget, members are requested to note that Exchange shall be conducting live trading session on February 01, 2026, as per the standard market timings (9:15 am-3:30 pm),” said NSE in a circular.

Union Budget 2026 to be presented on February 1 at 11 am

The Union Budget for 2026 will be presented at 11 am on Sunday, February 1, the Lok Sabha Speaker confirmed on January 12. In recent years, February 1 has become the fixed date for the annual Budget presentation, a trend that continued with the 2025 Budget as well. The upcoming Budget will also be a significant milestone for Finance Minister Nirmala Sitharaman, as it will be her ninth consecutive Union Budget, placing her among finance ministers with the longest uninterrupted Budget tenures.

Trading details for Budget Day explained

While most core market segments will remain open during regular trading hours on Budget Day, some services will stay shut. The BSE has clarified that the T+0 settlement session and the auction session meant for settlement defaults will not be operational. At the same time, the NSE confirmed that trading in capital markets and derivatives will continue as usual.

Stock market holiday list remains the same

The stock market holiday calendar for 2026 remains unchanged, with Indian exchanges observing 16 public holidays apart from weekends. The next scheduled market closure this month will be on January 26. In the first half of the year, markets will remain shut on key occasions such as Holi (March 3), Ram Navami (March 26), Mahavir Jayanti (March 31) and Good Friday (April 3). Trading will also be suspended on Ambedkar Jayanti (April 14), Maharashtra Day (May 1) and Bakri Id (May 28).

In the second half of the year, markets will close on Muharram (June 26), Ganesh Chaturthi (September 14), Gandhi Jayanti (October 2), Dussehra (October 20), Diwali Balipratipada (November 10) and Guru Nanak Jayanti (November 24). Christmas, on December 25, will be the final market holiday of 2026.

Business

What Are Bulk And Block Deals? Here’s How They Can Change A Stock’s Price Overnight

Last Updated:

While bulk deals may reflect emerging interest in a stock, block deals are usually pre-planned and involve large institutional investors

Market experts say tracking bulk and block deals can offer useful insights into the actions of large investors and institutions. (Representational Photo)

Investors tracking stock market movements often come across terms such as ‘bulk deal’ and ‘block deal’ in daily trading updates. At times, a sharp rise or fall in a stock price can be traced back to these large transactions. Understanding what these deals mean, how they differ, and why they matter can help investors make better sense of market activity.

Bulk Deal

A bulk deal occurs when an investor or institution buys or sells 0.5% or more of a company’s total equity shares in a single trading day. Such transactions take place during normal market hours and are disclosed by the stock exchanges after the market closes.

Bulk deals can have an immediate impact on a stock’s price, as heavy buying or selling often signals strong interest or exit by a large investor. Retail investors sometimes view bulk purchases by institutional players as a vote of confidence in the company.

Block Deal

A block deal is executed through a special trading window provided by the stock exchanges. To qualify as a block deal, the transaction must involve at least 5 lakh shares or be valued at more than Rs 5 crore. These deals are carried out during a specific time slot known as the block deal window, and both the buyer and seller are identified beforehand.

The main objective is to facilitate large transactions without causing excessive volatility in the open market. Unlike bulk deals, block deals are reported to the exchanges immediately.

Differences Between Bulk and Block Deals

Bulk deals are executed during regular trading hours and typically involve relatively smaller quantities compared to block deals. They are disclosed at the end of the trading session. Block deals, on the other hand, are meant for very large transactions, take place in a designated time window, and are reported in real time.

While bulk deals may reflect emerging interest in a stock, block deals are usually pre-planned and involve large institutional investors.

Types of Deals in the Stock Market

There are broadly four types of transactions in the equity market. Regular trading deals involve routine buying and selling by investors on the exchange. Bulk deals refer to large trades crossing the 0.5% threshold of a company’s equity in a day. Block deals are high-value or high-volume transactions conducted through a special window.

Off-market deals involve the transfer of shares outside the exchange platform, such as inter-promoter transfers or strategic stake sales.

What Should Investors Keep in Mind?

Market experts say tracking bulk and block deals can offer useful insights into the actions of large investors and institutions. However, they caution against making investment decisions based solely on these transactions. Investors are advised to also consider a company’s fundamentals, financial performance, management quality and long-term growth prospects.

January 16, 2026, 20:26 IST

Read More

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Tech4 days ago

Tech4 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports7 days ago

Commanders go young, promote David Blough to be offensive coordinator