Business

PPF calculator: Public Provident Fund can make you a crorepati, but is it the right investment option for you? Explained – The Times of India

Public Provident Fund or PPF is one of the most popular investment options available – and one that can make you a crorepati with disciplined investing. In fact if you were to start a PPF account by the age of 21, you can easily become a crorepati by the age of 46 – way ahead of the conventional retirement age.PPF is a government-backed investment which currently offers an interest rate of 7.1% making it a suitable option for not only risk-averse investors, but also those who are looking at fixed income instruments. Who can open a PPF account and what is the maximum investment limit? Are there any tax benefits of PPF and how long is the lock-in period? Importantly, is PPF the right investment option for you to become a crorepati? How do other investment alternatives compare? Here is a detailed explainer:

Who Can Open a PPF Account?

Any resident Indian can open one PPF account in their own name. Additionally, an individual can open one PPF account on behalf of a minor child or a person with mental illness or intellectual disability, provided they serve as the guardian.However, PPF does not allow for joint accounts. Each minor or dependent is allowed only one account and that too through a guardian.PPF accounts can be opened at post offices, designated banks, and e-banking services.

PPF: What is the minimum & maximum investment limit?

- Minimum investment: Rs 500 per financial year

- Maximum investment: Rs 1.5 lakh per financial year

Deposits can be made in one lump sum or in multiple installments. The overall limit of Rs 1.5 lakh includes contributions made to your own account as well as any accounts you operate for minors.

PPF: What are the tax benefits?

PPF is a EEE product – making it a preferred option for tax saving investments. EEE products or Exempt, Exempt, Exempt are those instruments where the principal investment, interest, and maturity amount are all tax-free.All PPF contributions qualify for tax deduction under Section 80C. This means that individuals opting for the old income tax regime can avail a deduction of up to Rs 1.5 lakh for their PPF investment. While Section 80C benefits are not available under the new income tax regime, the interest earned and the final maturity amount continue to be tax-free.

PPF Interest: How Earnings Are Calculated

Interest rate on PPF is reviewed quarterly by the Ministry of Finance. For your PPF account, the interest calculation is done monthly on the lowest balance between the 5th and the last day of the month. This interest is credited annually, typically at the end of the financial year.This means that to accrue the maximum benefit of the full Rs 1.5 lakh investment limit for a year, investors should look at a lump sum deposit between April 1-5 of a financial year.

PPF: Premature Withdrawal, Loan & More

You can opt for premature withdrawal after five years from the end of the year in which the account was opened. Account holders may withdraw up to 50% of the balance—calculated based on either the fourth year preceding the withdrawal year or the previous year, whichever is lower. Any outstanding loan must be fully repaid before a withdrawal can be made, and discontinued accounts are not eligible for this facility. You can take a loan against your PPF balance between the 3rd and 6th financial year, up to 25% of the balance from two years prior. The loan must be repaid within 36 months, after which only 1% interest per year is charged — but delays push this to 6%. Only one loan can be taken in a year, and no new loan is allowed until the previous one is fully repaid.Premature closure of a PPF account is permitted only under specific circumstances: life-threatening illness of the account holder or immediate family, higher education needs of the account holder or dependent children, or a change in residency status to NRI. In such cases, the account earns interest at a rate 1% lower than originally credited over time. In the event of the account holder’s death, the PPF account must be closed; the nominee or legal heir cannot continue it, although interest is payable until the end of the month preceding the final payout.

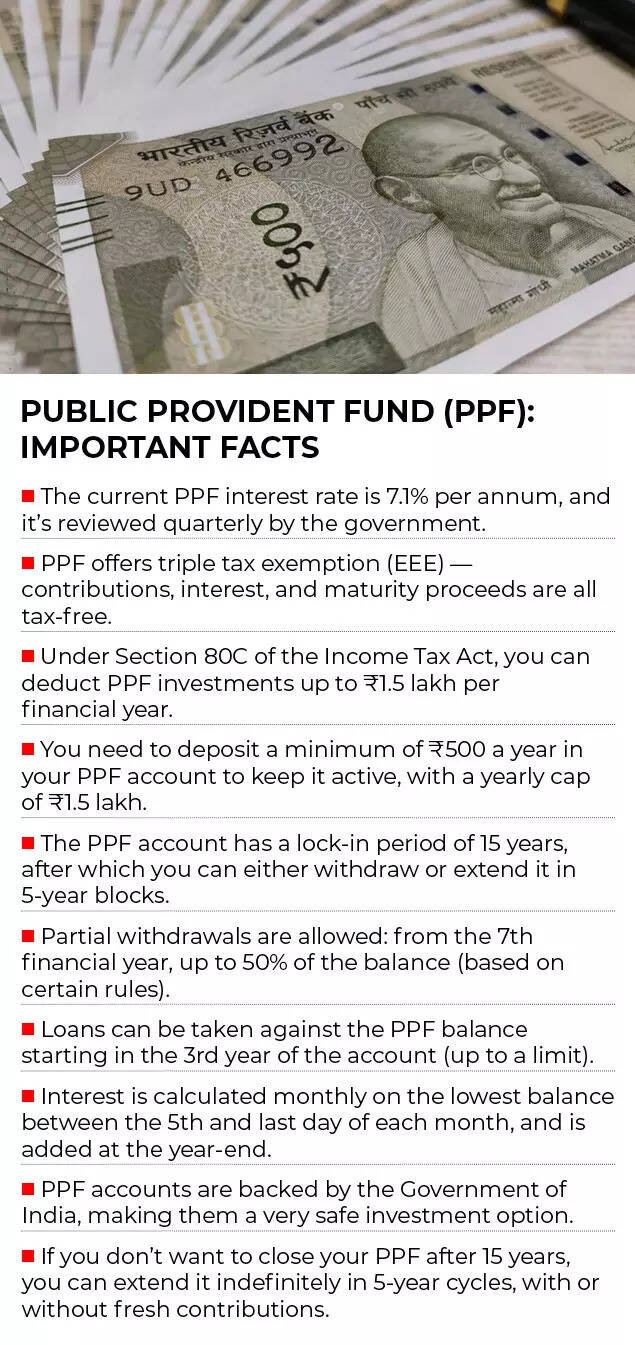

PPF Important Facts

Understanding PPF Account Maturity & Extension

A PPF account matures 15 years after the end of the financial year in which it was opened. At maturity, you have three options:

1. Close the Account

You may withdraw the entire balance and close the account.

2. Continue Without Further Deposits

You may choose to let the account remain active without additional deposits. The balance continues to earn interest, and you may make one withdrawal per year. However, once you opt for continuation without deposits, you cannot revert to deposit-based continuation later.

3. Extend in Blocks of 5 Years With Deposits

You may continue the account with deposits for additional 5-year blocks, provided the request is submitted within one year of maturity. It is this provision that allows you to become a crorepati – as explained in the section below

How to become crorepati with PPF

The provision to extend your PPF account beyond the lock-in period of 15 years allows you to earn the benefits of compounding. The biggest advantage of a PPF investment is compounding. Your money grows – not just on the amount you invest each year – but also on the interest that you accumulate over time, creating a powerful snowball effect. Since PPF has a long 15-year lock-in, the interest added annually continues to earn more interest in the following years, leading to exponential growth—especially in the later years of the account. Even though the yearly contribution limit is capped, compounding ensures that disciplined, consistent deposits can grow into a significantly larger corpus by maturity. This makes PPF one of the most effective long-term wealth-building tools for risk-free, tax-free returns. Let’s understand this better over different investment time-frames. In a scenario where you invest the full Rs 1.5 lakh investment limit every year, you will accumulate a corpus of over Rs 40 lakh in 15 years, of which you would have invested Rs 22.5 lakh. But, if you continue to contribute to your PPF account in blocks of 5 years – then with 25 years of investment your accumulated corpus would be over Rs 1 crore, with an investment of only Rs 37.5 lakh! The interest accrued as a result of compounding would be over Rs 65 lakh!

Is PPF the right investment for you?

The answer depends entirely on your investment time-frame, risk taking ability and investment purpose. Experts say that PPF is ideal for conservative investors – backed by the government of India – and offering 7.1% returns with the benefits of compounding, it works well for risk averse individuals, long-term wealth builders and those who are looking to save tax.Apart from the above-mentioned category of investors, Mohit Gang – Co-Founder & CEO Moneyfront says PPF is ideal for investors looking for stable debt allocation, and those without EPF/NPS.According to Prableen Bajpai, Founder, Finfix Research & Analytics, in India, fixed income continues to dominate investor portfolios. “These asset classes provide a sense of security and comfort, but while they are popular, they often fail to reward investors over the long term. For example, bank fixed deposits do not offer true compounding, are rarely able to beat inflation, and are not tax-efficient—especially for high-income individuals,” she tells TOI.However, Prableen is of the view that government-backed schemes such as the PPF stand out due to their specific benefits. “Within the fixed-income category, PPF remains one of the best vehicles for building a long-term portfolio, particularly when the Employee Provident Fund (EPF) is not available as an investment option,” she says.

Source: Finfix

Mohit Gang says that PPF’s nominal return (historically ~7–9%) beats inflation, but only by a small margin. To put it simply, the long-term average rate of return for PPF is around 8%, while the average inflation is around 6%, which makes the real return around 2%, he says.

Mohit Gang shares a practical comparison of PPF with commonly chosen Indian debt & hybrid options:

A.NPS (National Pension System)

Better than PPF when:

• You want equity exposure + tax efficiency• You want 80CCD(1B) extra ₹50,000 tax benefit• Investment horizon is very long (till age 60)

Worse than PPF:

• Partial withdrawal restrictions• Taxable annuity at retirement• No guaranteed return

B. EPF/VPF (Employee Provident Fund)

Better when:

• EPF rate (usually ~8.1–8.25%) > PPF• Mandatory contributions form the base; voluntary VPF can top-up• Salary-based compounding is larger for high earners

Worse than PPF:

• Only available for salaried employees• Interest rate is revised annually and can reduce• Withdrawals are restricted unless conditions met

C. Debt Mutual Funds (post 2023 tax rules)

Better:

• Liquidity• Potentially higher returns depending on category• No lock-in

Worse:

• Gains are fully taxable at slab rate (no indexation) after April 2023 amendments• No guarantee of returns• Credit & duration risk possible• For >30% tax slab investors, post-tax returns become unattractive

D. Sukanya Samriddhi Yojana (SSY) – only if you have a girl child

Better:

• Highest guaranteed small-savings rate (8.2% currently)• Similar EEE tax advantages

Worse:

• Use-case limited• Long lock-in

So should PPF be a part of your portfolio?

Prableen believes that any long-term portfolio should ideally include a mix of debt and equity, and PPF can serve as an effective fixed-income component. “But if a higher-interest, employer-linked EPF is available, then PPF can be replaced with other higher return–generating fixed-income alternatives,” she adds.

(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Budget 2026: Punjab, Telangana flag higher fiscal burden under VB-G RAM G; seek more central funds – The Times of India

Opposition-ruled states Punjab and Telangana on Saturday sought additional fiscal support from the Centre in the Union Budget 2026-27, arguing that the proposed Viksit Bharat Guarantee for Rozgar and Ajeevika Mission (Gramin) (VB-G RAM G) will place a heavier financial burden on states due to its revised cost-sharing formula, PTI reported.The demands were raised at the pre-Budget meeting chaired by Union Finance Minister Nirmala Sitharaman, which was attended by finance ministers of states and Union Territories, along with Union Minister of State for Finance Pankaj Chaudhary. The meeting also saw participation from the Governor of Manipur, chief ministers of Delhi, Goa, Haryana, Jammu and Kashmir, Meghalaya and Sikkim, and deputy chief ministers of several states, including Telangana.Opposition-ruled states said the changes to the rural employment framework weaken the employment guarantee and go against the spirit of cooperative federalism.Parliament last month passed the VB-G RAM G Bill, replacing the two-decade-old Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). Under the new scheme, the Centre will bear 60 per cent of the cost and states 40 per cent, compared with the 90:10 funding pattern under MGNREGA.Punjab Finance Minister Harpal Singh Cheema strongly opposed the proposed changes, saying the new framework dilutes the employment guarantee while shifting a significant financial burden to states.“Proposed MGNREGA changes weaken employment guarantee and burden states,” Cheema said at the meeting, calling for the restoration of the original demand-driven structure and funding pattern of the scheme.Telangana Finance Minister Mallu Bhatti Vikramarka said the Union government had replaced MGNREGA with VB-G RAM G without consulting states. He noted that the shift from a 90:10 to 60:40 funding ratio would further strain state finances.He also pointed out that any additional man-days beyond the normative allocation would now have to be borne by states, which would create a serious obstacle in providing demand-based work to job seekers.“This is entirely against the spirit of cooperative federalism and starving them of funds for capital outlay, which is essential for maintaining growth momentum,” Vikramarka said.The Telangana finance minister also suggested that surcharges on income tax and corporation tax be credited to a non-lapsable infrastructure fund, from which states could receive grants for infrastructure development. Alternatively, he said, surcharges should be merged with basic tax rates to expand the divisible pool of central taxes.On GST reforms, Vikramarka said GST 2.0 may boost demand but questioned its sustainability, warning that states’ revenues could fall due to rate reductions. He called for a suitable mechanism to compensate states for any revenue loss.Punjab also sought a special fiscal package, citing the “double whammy” of border tensions and floods in 2025. On GST, Cheema said Punjab is facing an annual revenue loss of nearly Rs 6,000 crore following GST 2.0 and pressed for a predictable GST stabilisation or compensation mechanism for states.

Business

Export credit boost: Banks clear Rs 3,362 crore under CGSE in first month; 774 exporters covered – The Times of India

Lenders have sanctioned Rs 3,361.83 crore to 774 applicants under the Rs 20,000-crore Credit Guarantee Scheme for Exporters (CGSE) within a month of its rollout, as the government steps up support for exporters facing headwinds from steep US tariffs, official data showed as reported PTI.The scheme, approved by the Union Cabinet on November 12 and made operational from December 1, 2025, provides 100 per cent credit guarantee cover by the National Credit Guarantee Trustee Company Ltd (NCGTC) to member lending institutions (MLIs) for extending additional credit facilities of up to Rs 20,000 crore to eligible exporters, including MSMEs.“Applications worth Rs 8,764.81 crore (1,840 applications) received, out of which Rs 3,361.83 crore (774 applications) sanctioned by the lenders” till January 2, 2026, the Department of Financial Services (DFS) under the finance ministry said in a statement.Implemented by the DFS, the CGSE aims to enable banks and financial institutions to extend additional financial assistance to Indian exporters during a period of external trade uncertainties, helping them diversify markets and enhance global competitiveness. The scheme will remain valid till March 31, 2026, or until guarantees worth Rs 20,000 crore are issued, whichever is earlier.The DFS also highlighted progress under the Mutual Credit Guarantee Scheme for MSMEs (MCGS-MSME), which offers credit guarantees to incentivise MLIs to provide additional credit facilities of up to Rs 100 crore to MSME borrowers for the purchase of plant, machinery and equipment. As of December 2025, banks have sanctioned Rs 16,836 crore against 8.96 lakh applications under the scheme.Sharing broader banking sector performance, the DFS said scheduled commercial banks (SCBs) recorded their highest-ever aggregate net profit of Rs 4.01 lakh crore. Public sector banks (PSBs) posted a record aggregate net profit of Rs 1.78 lakh crore in 2024-25, while their net profit stood at Rs 0.94 lakh crore in the first half of 2025-26.Global deposits and advances of PSBs rose to Rs 146.27 lakh crore and Rs 114.85 lakh crore, respectively, in September 2025, compared with Rs 71.95 lakh crore and Rs 56.16 lakh crore in March 2015.The gross non-performing assets (GNPA) ratio of PSBs declined to 2.30 per cent (Rs 2.65 lakh crore) in September 2025, down from 4.97 per cent (Rs 2.79 lakh crore) in March 2015 and a peak of 14.58 per cent (Rs 8.96 lakh crore) in March 2018. The capital adequacy ratio of PSBs improved by 451 basis points to 15.96 per cent in September 2025 from 11.45 per cent in March 2015.

Business

Gen Z and social media are helping men’s makeup go mainstream. The beauty industry is trying to capitalize

Pixdeluxe | E+ | Getty Images

It often starts small.

A dab of concealer. A tinted moisturizer. Maybe a brow gel that goes from borrowed to bought. For many men, like Daniel Rankin, makeup has transformed from something taboo into a tool to make them look less tired and more put together.

“I remember thinking, ‘Am I really doing this?'” Rankin, a 24-year-old advertising agent from New York who likes to shop at Sephora, told CNBC. “But once I tried it, it just became normal.”

In front of bathroom mirrors and in gym locker rooms, more men are now adding cosmetics to their routines, industry experts told CNBC. The men’s makeup market is now one of the most lucrative — and largely untapped — growth opportunities left in beauty, and specialty retailers like Ulta Beauty and Sephora along with big-box companies like Target and Walmart all see opportunity.

“Men’s beauty is one of the last categories left where brands can likely still see easy double-digit growth potential simply by showing up,” said Delphine Horvath, professor of cosmetics and fragrance marketing at the Fashion Institute of Technology.

Men’s grooming sales in the United States topped $7.1 billion in 2025, up 6.9% year over year, according to market research firm NielsenIQ. The global market was valued at $61.6 billion in 2024 and projected to surpass $85 billion by 2032, with the biggest growth driven by the skin-care sector, according to Fortune Business Insights.

Much of the momentum is coming from Gen Z.

In the U.S., 68% of Gen Z men ages 18 to 27 used facial skin-care products in 2024, a sharp jump from 42% just two years earlier, according to data from market intelligence firm Mintel.

“This is no longer niche,” said Linda Dang, CEO of Canada-based Asian beauty retailer Sukoshi. “Men are forming routines, that usually starts at skin care and then expands further, they are no longer just buying random products. That’s what makes this market so valuable.”

Bloomberg | Bloomberg | Getty Images

Unlike one-off grooming purchases, makeup encourages repeat use and experimentation. A man who starts with concealer often adds primer, setting powder or tinted SPF over time, said Farah Jemai, global marketing associate lead at beauty brand Unleashia.

“When men discover makeup that works, they don’t use once and never again,” Jemai told CNBC. “They restock.”

Market researchers estimate that in 2022, about 15% of U.S. heterosexual men ages 18 to 65 were already using cosmetics and makeup, while another 17% said they would consider it, according to Ipsos. Industry experts say those figures are likely higher in 2026.

Openness to cosmetics has grown, as the share of U.S. men who say they never wear makeup has fallen from more than 90% in 2019 to about 75% in 2024, Statista survey data show.

Retailers cater to men

Beauty conglomerates and startups alike are responding to the growth in men’s beauty.

Ulta Beauty and and Sephora have begun integrating men’s complexion products into gender-neutral, skin care-first displays rather than having “Men’s” aisles. Those gender-specific displays can feel intimidating or stigmatizing to some men, Horvath said.

Big-box retailers like Walmart and Target have also expanded their men’s cosmetics or grooming offerings.

For example, in 2025, Target partnered with online streaming collective AMP, Any Means Possible, to launch TONE. The men‑forward personal care brand debuted in Target stores nationwide in July, leveraging AMP’s massive Gen Z male following across YouTube and Twitch.

Online — where much of the growth and discovery is happening — many beauty brands are pouring money into influencer partnerships to increase engagement and sales on TikTok Shop and Amazon.

“So many brands are now putting most of their marketing budget into influencer marketing to meet people where they already are online and make it easier to click ‘buy,'” said Janet Kim, a vice president at K-beauty brand Neogen.

Others are leaning into digital education to teach men what different items do.

The brand War Paint sells makeup products like concealer pens, tinted moisturizers and anti-shine powders that feature QR codes on the packaging. Scanning them launches video tutorials explaining what each product does — without forcing customers to ask questions in a store.

“The biggest barrier isn’t price, it’s uncertainty,” Dang said. “Men want to know what a product does and how to use it without feeling awkward.”

But the path to mass adoption isn’t guaranteed.

Industry analysts warn that social stigma remains high and inflation threatens to curb spending on experimental, nonessential goods. Retailers also face a steep learning curve: It is difficult to scale a market when the core customer doesn’t know how to use the product.

Target’s SoHo store has an eye-catching “Beauty Bar” that shows off fragrances, makeup items and more.

Courtesy of Target

The emergence of men’s makeup

While men have worn makeup for centuries, from ancient Egypt to Elizabethan England, the modern commercial men’s makeup movement traces its roots to the mid-2010s.

In 2016, CoverGirl made history by appointing then 17-year-old YouTuber James Charles as its first-ever “CoverBoy,” placing a male face on a mass-market cosmetics brand for the first time.

Still, beauty conglomerates largely focused on women until recently, Sukoshi’s Dang said. Now, a broader cultural reset around masculinity is taking place and companies are racing to monetize it, FIT’s Horvath said.

Social media has been the single biggest accelerant, Dang said.

On TikTok and Instagram, male creators post step-by-step makeup routines, product breakdowns and before-and-after results that often emphasize subtle changes rather than dramatic looks. Hashtags tied to men’s grooming and makeup have amassed billions of views, with #mensgrooming alone surpassing 26 billion views on TikTok.

“TikTok democratized the ‘how-to,'” said Dang. “You don’t have to ask your sister or guess anymore. You just scroll, see a guy who looks like you fixing his acne in 30 seconds, and click ‘buy.’ It removed the gatekeepers.”

Gen Z men are also more comfortable rejecting rigid gender categories and more skeptical of marketing that frames products as inherently masculine or feminine, Horvath said.

At the same time, makeup has increasingly been folded into a broader wellness and optimization culture — sometimes referred to as “looksmaxxing” — that includes fitness tracking, supplements, hair-loss prevention and longevity routines.

“Many men have started framing grooming and, for some, makeup as maintenance, not vanity,” Horvath said. “That reframing removes stigma and unlocks spending.”

Celebrity influence has further accelerated adoption, with stars like Harry Styles, Brad Pitt and Dwayne “The Rock” Johnson launching their own skin care and makeup brands, mirroring the trend of celebrity saturation largely seen in spirits.

Johnson’s brand Papatui, which launched at Target in 2024 and spans skin, hair, body and tattoo care, was created in response to ongoing questions about his grooming regimen. It now competes directly with legacy names like Clinique, L’Oréal and Kiehl’s.

CoverGirl James Charles

Source: COVERGIRL

Moving ahead

As the market matures, a debate is forming: Do men want “men’s makeup,” or do they just want makeup?

Horvath said there is a “bifurcation” in how companies are marketing their products.

Brands like War Paint and Stryx argue that men need products designed for their thicker, oilier skin, and packaged in masculine, tool-like containers that feel at home in a gym bag.

But Gen Z consumers are increasingly gravitating toward gender-neutral brands like LVMH co-owned Fenty Beauty, The Ordinary and Haus Labs. For them, labels that say “For Men” can feel outdated or even patronizing, Horvath said.

“In ten years, I don’t think we’ll be talking about ‘men’s makeup’ anymore,” Horvath said. “We will just be talking about makeup. The gender binary in beauty is dissolving, and the sales data is finally catching up to the culture.”

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment3 days ago

Entertainment3 days agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment3 days ago

Entertainment3 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Politics3 days ago

Politics3 days agoUK says provided assistance in US-led tanker seizure

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Sports6 days ago

Sports6 days agoFACI invites applications for 2026 chess development project | The Express Tribune

-

Business6 days ago

Business6 days agoAldi’s Christmas sales rise to £1.65bn