Business

School costs a ‘real struggle’ for parents in Wales

Bethan LewisFamily and education correspondent, BBC Wales News

A mum says she starts to dread the new school year from Christmas because of the cost of uniform and other kits her children will need in September.

Vicky Williams, from Caerphilly, said she gets “anxious” her children will not have everything they need and has to start budgeting months in advance.

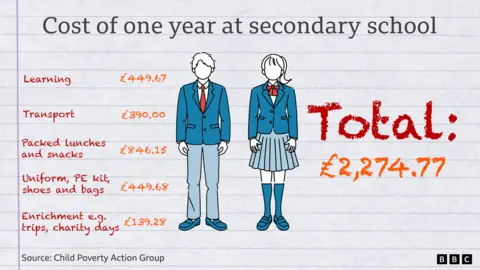

It is estimated the minimum cost of sending a child to secondary school has reached almost £2,300 a year, up £600 since 2022, with the Child Poverty Action Group (CPAG) saying lower and middle-income families face “a real struggle”.

The Welsh government said it was doing everything it could to support families.

Ms Williams starts budgeting at the start of the year for the items her nine and 14-year-old will need.

She said: “I dread it after Christmas – I know if I don’t plan or budget I am going to be struggling August, September time.

“I’ll be getting anxious that my children aren’t going to school with the proper equipment so I’ve got to plan well in advance in order to prepare and be able to afford to buy their uniforms and everything else they need.”

She said while her daughter’s primary school uniform does not require logos, her 14-year-old son needs a separate PE kit, rugby kit and football kit.

Trips are another source of stress and even though schools help parents with payment plans, Ms Williams said sometimes there was not enough notice of upcoming expenses.

“You want your children to get involved in everything, want to go out for trips with their friends, go on a bus and have the experience and everything.

“But then when the cost of most trips are so high and it’s not doable for some, then you feel guilty then as a parent that your child is missing out.”

The part-time supermarket delivery driver also has a two-year-old and said she was already anticipating “that constant stress and anxiety on my mind that I’ll have three children in school” in two years’ time.

On the Lansbury Park estate, Caerphilly Uniform Exchange sells pre-loved and donated uniform for a minimal cost or items can be swapped for free.

Director Lisa Watkins said about 120 families a month use the Caerphilly shop.

They have other hubs in the borough, an online shop and give free bundles for children referred by schools and social services.

“Some schools have changed their uniform to make things more generic and accessible, but more work could be done definitely”, she said.

“I think that we should be treating school uniform more like workwear. It doesn’t matter if it’s got a hole or a bit of paint on it, you know, that’s kind of what it’s for.”

As well as uniform, the shop also supplies other costumes and outfits.

“Prom is a huge cost to parents at the moment. Things like World Book Day, Children in Need, Christmas Nativity, Christmas jumper days,” Ms Watkins said.

“As time progresses, we find all of these different celebrations and things to take part in but I think there’s little thought on how much it actually burdens parents financially.”

She added parents faced “absolutely huge” financial pressures, and did not want to have “the only child that isn’t going to prom, or hasn’t got the fancy dress outfit, or the new football boots.”

A report published by the CPAG in May estimated the minimum cost of education is more than £1,000 for primary school children and almost £2,300 for secondary school children, a rise of 30% on three years ago.

It said the cost of food for the school day and technology for learning were the main sources of increases for secondary school children.

“This is a really significant amount of money for families,” said Ellie Harwood, senior education policy officer for CPAG.

“It can be a real struggle for households on low and middle incomes to meet the cost and obviously the more children you have the greater the cost”.

Ms Harwood said research had suggested uniform costs had “flat-lined”, which she hoped was a “reflection in changes of school policy”.

At primary level in Wales, universal free school meals “saves families around £500 a year per child”, Ms Harwood said, but a strict means test still applied for secondary age children.

She said access to Welsh government support with the costs of school should be expanded .

“There are a lot of households living in poverty in Wales who cannot currently access free school meals or the school essentials grant,” she said.

“They can’t get help with the cost of school trips.

“We know there’s about 25,000 secondary aged learners who are living in poverty who don’t qualify for support with these grants and with free school meals.”

The Welsh government said: “We are doing everything we can to support families in Wales”.

“We continue to monitor the potential impact of inflation on the number of learners eligible for a free school meal and the School Essentials Grant.”

It said it recognised the “financial burden” of school uniform.

“Our statutory guidance on school uniform policy says that affordability should be a priority, and branded items should not be compulsory.

“We are currently reviewing the impact of the changes to the guidance”.

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

Business

Education Budget 2026 Live Updates: What Will The Education Sector Get From FM Nirmala Sitharaman?

Union Education Budget 2026 Live Updates: Union Finance Minister Nirmala Sitharaman will present the Union Budget 2026–27 on February 1, with a strong focus expected on the Education Budget 2026, a key area of interest for students, teachers, and institutions across the country.

In the previous budget, the Bharatiya Janata Party government announced plans to add 75,000 medical seats over five years and strengthen infrastructure at IITs established after 2014. For 2025, the Centre had earmarked Rs 1,28,650.05 crore for education, a 6.65 percent rise compared to the previous year.

Meanwhile, the Economic Survey 2025–26, tabled in the Parliament of India, points to persistent challenges in school education. While enrolment at the school level is close to universal, this has not translated into consistent learning outcomes, especially beyond elementary classes. The net enrolment rate drops sharply at the secondary level, standing at just over 52 per cent.

The survey also flags concerns over student retention after Class 8, particularly in rural areas. It notes an uneven spread of schools, with a majority offering only foundational and preparatory education, while far fewer institutions provide secondary-level schooling. This gap, the survey suggests, is a key reason behind low enrolment in higher classes.

Stay tuned to this LIVE blog for all the latest updates on the Education Budget 2026 LIVE.

Business

LPG Rates Increased After OGRA Decision – SUCH TV

The Oil and Gas Regulatory Authority (Ogra) has increased the price of liquefied petroleum gas (LPG). According to a notification, the price of LPG has risen by Rs6.37 per kilogram. Following the increase, the price of a domestic LPG cylinder has gone up by Rs75.21. The revised prices have come into effect immediately.

The rise in LPG prices has added to the inflationary burden on household consumers.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports1 week ago

Sports1 week agoTransfer rumors, news: Saudi league eyes Salah, Vinícius Jr. plus 50 more

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoTikTok seals deal for new US joint venture to avoid American ban

-

Fashion1 week ago

Fashion1 week agoTamil Nadu wind policy tweaks to boost textile sector competitiveness

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say