Business

Small Cars Poised To Clock Double-Digit Surge In Sales Due THIS Reason

New Delhi: The sales of entry-level cars are expected to record a robust double-digit growth year-on-year in the forthcoming festive season due to the GST rate cut that kicks in from Monday, according to a report by HSBC Research. “The passenger vehicle segment is now expected to grow by double digits (YoY) during the upcoming festive season compared to single digits before the GST cut announcement,” the report states.

The report is based on an interaction with more than 10 dealers across geographies in India and calls to a larger dealer. It points out that the market leader, Maruti Suzuki, has announced its new price list after the announcement of the GST cut. Consequently, enquiries have increased significantly, both online and walk-in, across segments by 15-20 per cent, and more for entry-level cars (K10, Celerio, S-presso and Wagon R) in Tier-1 cities.

The share of first-time buyers increased by 5-7 per cent in total bookings so far. The premium hatchback segment (Swift, Baleno, etc.) is also seeing a decent uptick, the report further states.

Maruti Suzuki has announced steep price cuts to the tune of 11-21 per cent on its entry-level portfolio, 9-11 per cent on premium hatchbacks and up to 8 per cent on Brezza (Exhibit 1), which is more than the GST cut of 3.5-8 per cent on these models. This should support a revival of the entry-level segment and keep Brezza competitive as well. Brezza’s cost differential with competing models such as Nexon, Venue, Sonet and 3XO had increased by 5-6 per cent following the GST cut, and now this should normalise post price cut, the report states.

WagonR continues to lead in the entry-level cars segment, though the yellow board (cabs) percentage has increased over time. WagonR is strong among personal-use vehicle customers in Tier 2 cities. Interestingly, it had started sliding in Tier 1 cities last year, but an increase in enquiries and bookings post GST cut announcement suggests a trend reversal towards growth now, the report points out.

The new Maruti SUV ‘Victoris’ is getting a good response from customers. However, there might be some cannibalisation of Grand Vitara (GV) as pricing is similar. We expect it to add 5,000-6,000 units per month net of cannibalisation. The Victoris also introduces an entry-level hybrid priced at INR 1.64m to the Maruti stable, which is available only in Toyota HyRyder and not in Grand Vitara, the report further states.

It also observes that the entry-level two-wheeler segment is seeing a healthy uptick from the rural market with a double-digit increase in enquiries. Credit-based approvals have also increased over the past 1-2 months, which is positive for overall two-wheeler retail sales.

Business

FTSE 100 closes choppy week higher amid US rally

The FTSE 100 closed a volatile, and record-breaking, week on the front foot on Friday, recouping some of Thursday’s heavy falls.

The FTSE 100 Index closed up 60.53 points, 0.6%, at 10,369.74.

The FTSE 250 ended up 104.54 points, 0.5%, at 23,207.89, and the AIM All-Share advanced 3.90 points, 0.5%, at 806.80.

For the week, the FTSE 100 was up 1.4%, the FTSE 250 was down 0.2%, and the AIM All-Share declined 1.5%.

Despite the gains, data providers and software stocks in London ended a turbulent week with further losses amid fears of AI‑driven disruption, although US technology stocks rallied after Thursday’s slump.

Goldman Sachs explained the launch of a legal automation tool and a new large language model by US AI firm Anthropic, along with broad ramping of AI capacity and services, has led to a sharp rotation out of software and related sectors globally.

“Any company which collates, aggregates, disseminates software and data as a service are seen as increasingly vulnerable to disruption from AI-driven tools. The Anthropic announcement was just a catalyst to realise fears that have been growing,” Goldman said.

On the FTSE 100, Relx, which owns legal publisher LexisNexis, fell 4.6%, credit checking agency Experian declined 4.7%, accountancy software company Sage dipped 3.1% and financial data provider London Stock Exchange eased 1.1%.

On Relx, JPMorgan analyst Daniel Kerven attempted to placate investor fears.

“Relx is not a software business that is going to be eaten by AI,” he claimed.

“It is a data and analytics company. Its value is in owning, curating and licensing authoritative information, and applying technology to its data to provide analytics and models that help the decision making of its customers. Whether decisions are made by human professionals or automated AI workflows, Relx will remain the trusted source of the underlying data, content and analytics that those decisions depend on”, Mr Kerven wrote.

In European equities on Friday, the CAC 40 in Paris closed up 0.4%, while the DAX 40 in Frankfurt advanced 0.9%.

Stellantis plummeted 25% as it unveiled preliminary second-half figures showing a deep net loss, after the car maker took a heavy charge to scale back its push into electric vehicles, while also announcing the sale of its stake in a Canadian battery joint venture and suspending its dividend.

The Hoofddorp, Netherlands-based auto group said it expects a net loss of between 19 billion euros and 21 billion euros, widening from a 100 million euro loss, after recognising around 22 billion euros of charges.

The charges were largely driven by what Stellantis described as a “strategic shift” to better align its product plans with customer demand, including a slower-than-expected transition to battery electric vehicles.

UBS said “given the magnitude of the kitchen sinking and the soft 2026 guide, we would expect a negative initial share price reaction”.

But it said the “decisive cleaning up” of new management in combination with the operational turnaround in North America, supported by solid overall market fundamentals in the region, leaves Stellantis shares “attractive” on a US “comeback” case in the coming quarters.

But Citi said given the announcement does not include any factory closures “we do not think the news yet resets fully the cost base at Stellantis which is likely necessary on the reduced market shares. We think any upside to Stellantis most likely feature capacity reductions to fully reset the North America and European businesses”.

Stocks in New York rallied after Thursday’s heavy falls. The Dow Jones Industrial Average soared 1.8%, and the S&P 500 jumped 1.4%, as did the Nasdaq Composite.

Missing out on the rebound, Amazon plunged 8.0% after first-quarter guidance disappointed and the technology firm outlined plans for a significant ramp in capital expenditure in the coming year.

Chief executive Andy Jassy said the Bellevue, Washington-based technology company plans to invest 200 billion dollars in 2026, comfortably above FactSet consensus of 146.6 billion dollars, and around 52% ahead of 2025’s 131.8 billion dollars.

Mr Jassy told a conference call with investors the increased spend would “predominantly” go to Amazon Web Services (AWS), Amazon’s cloud computing business.

“We have very high demand, customers really want AWS for core and AI workloads and we’re monetising capacity as fast as we can install it,” he added.

The plans come a day after Google owner Alphabet said it will spend between 175 billion dollars and 185 billion dollars in 2026, while Facebook owner Meta Platforms recently said its capital expenditure could nearly double from 2025 to 115 billion dollars to 135 billion dollars.

Mr Jassy pointed out Amazon has “deep experience understanding demand signals” in the AWS business and then turning that capacity into a strong return on invested capital.

“We’re confident this will be the case here as well,” he added.

Analysts at Wedbush, who remain bullish on Amazon, think the increase in spending will remain an “overhang as investors digest the guide and will likely need to see more tangible returns before regaining comfort”.

The yield on the US 10-year Treasury was quoted at 4.22%, widened from 4.21%. The yield on the US 30-year Treasury was quoted at 4.87%, stretched from 4.86% on Thursday.

The pound was quoted higher at 1.3612 dollars at the time of the London equities close on Friday, compared with 1.3536 dollars on Thursday.

The euro stood higher at 1.1814 dollars, against 1.1791 dollars. Against the yen, the dollar was trading slightly higher at 157.04 yen compared with 156.96 yen.

Back in London, Metlen Energy & Metals sank 20% on the FTSE 100 after it revised down its earnings expectations for the full year, as it noted challenges with its M Power Projects business and the timing of transactions in its asset rotation plan of M Renewables.

Metlen is an Athens and London-based aluminium producer and electricity generator. It also invests in network infrastructure, battery storage, and other green technologies.

The company explained that further to the challenges noted in its interim report back in September, it has identified additional cost overruns and schedule delays solely impacting the performance of MPP.

Gold was quoted higher at 4,946.87 dollars an ounce on Friday, against 4,848.34 dollars at the same time on Thursday.

Brent oil was quoted at 68.47 dollars a barrel on Friday, up from 67.37 dollars late on Thursday.

The biggest risers on the FTSE 100 were Burberry Group, up 58p at 1,180p, International Consolidated Airlines, up 18.2p at 438.5p, Fresnillo, up 138p at 3,694p, Barclays, up 12.65p at 479.1p and Airtel Africa, up 7.4p at 327.6p.

The biggest fallers on the FTSE 100 were Metlen Energy & Metals, down 9.1p at 35.8p, Experian, down 122p at 2,499p, Relx, down 104p at 2,145p, Sage Group, down 26.8p at 844.4p and Compass Group, down 54p at 2,125p.

Next week’s global economic calendar has delayed US nonfarm payrolls and US inflation figures plus a GDP reading in the UK.

Monday’s UK corporate calendar has full-year results from Plus500 and Porvair.

Contributed by Alliance News

Business

Zee Real Heroes Awards 2026: ‘The world will have to yield before India…’ Baba Ramdev calls US trade deal a reflection of India’s strength

The fourth edition of ‘Zee Samvaad with Real Heroes’ is being held in Mumbai today, February 6, 2026. The event saw the presence of several prominent personalities from politics, entertainment and sports. It was hosted by lyricist Manoj Muntashir.

Yoga guru Baba Ramdev also joined him on stage, where they discussed a range of topics including the India–US trade agreement and the changing global order. During the conversation, Baba Ramdev also targeted the Opposition.

‘The World Will Have to Yield Before India…’

Manoj Muntashir asked Baba Ramdev about the recent India–US trade agreement. Responding to the question, Baba Ramdev said, “I don’t see it merely as India’s achievement, but as India’s strength. Whether it is Trump or any other global power, they will ultimately have to yield before India. This is the power of India’s market. It is the strength of India’s millions of people — and also America’s compulsion.”

He added that if Trump wants to control inflation in the United States, reducing tariffs becomes a necessity. According to him, that necessity reflects India’s growing strength. Baba Ramdev further said that no country can become a superpower by ignoring India, and that India itself is the next superpower. He remarked that if others choose to approach India first, they would be welcomed respectfully.

Is the Reduction from 50% to 18% Tariff India’s Victory?

Responding to the question, Baba Ramdev said that as India moves forward, some people — whom he described as immature in their political thinking and lacking a clear vision for the country — continue to question such developments. However, he stressed that India is progressing rapidly across sectors, whether it is agriculture, manufacturing, science and technology, innovation and invention-driven creation, healthcare, education, or future research initiatives.

He added that India is strong in terms of natural resources, land, scientific capability, climate, knowledge, cultural depth, and the spirit of hard work and determination. According to him, with this strength and momentum, not just Trump or America, but the entire world will eventually have to acknowledge and bow before India’s rise.

Opposition Says India Has ‘Knelt Down’

Manoj Muntashir asked Baba Ramdev about the Opposition’s claim that India had “knelt down” and that key decisions related to India would now be taken by Trump. Responding to this, Ramdev said that if Trump raises tariffs, he can also reduce them. He added that Prime Minister Modi is acting with patience, as Trump can change his stance at any time.

Ramdev further remarked that Trump has a tendency to stay in the headlines. He said the global order is now changing and that India will have to maintain a balance in its relations with China. He also stated that although some Muslims in India may criticise Prime Minister Modi, many of the world’s most influential Muslim leaders respect him — which, according to Ramdev, reflects the Prime Minister’s diplomatic success.

Business

India likely to add 2.7 billion sq ft of academic space, see $100 bn investment by 2035

New Delhi: Nearly 30,000 acres of new campus land and about 2.7 billion square feet of academic infrastructure are expected in India by 2035 to meet surging student demand, marking world’s largest institutional real estate opportunities over the next decade, a report said on Thursday.

The report from ANAROCK Capital said that meeting the National Education Policy (NEP) 2020 target of a gross enrolment ratio (GER) of 50 per cent by 2035 will require roughly 25 million additional seats and about $100 billion in construction-led investment for academic facilities alone, excluding land acquisition and student accommodation infrastructure.

“This scale of expansion, underpinned by demographic momentum, rising enrolments, globalisation of education, and landmark regulatory reforms, represents arguably the largest higher-education build-out market globally,” the report mentioned.

The real estate services firm highlighted India’s higher-education enrolments rose from 27 million in 2010-11 to 45 million in 2022-23, driven by powerful demographic engines and rising household aspirations, and universities increased from 760 in 2015 to 1,338 in 2025, while total higher education institutions grew from 51,534 to 70,018.

“We believe the provision in the Union Budget 2026 to support the creation of five university townships reflects a recognition of the gap in academic infrastructure,” said Shobhit Agarwal, CEO-ANAROCK Capital.

After the FHEI Regulations foreign higher-education institutions ranked within the top 500 globally can now establish campuses without affiliating with Indian universities, noted Aashiesh Agarwaal, SVP-Investment Advisory, ANAROCK Capital.

In addition to the three global university campuses that have already opened, thirteen institutions have announced upcoming campuses, such as Lancaster (UK), Liverpool (UK), Illinois Institute of Technology (US), and Instituto Europeo di Design (Italy), signalling strong international confidence in India’s education market, Agarwaal added.

Uttar Pradesh has rolled out stamp duty exemptions and capital subsidies for higher education institutions.

GIFT City in Gujarat has created a dedicated international campus framework with shared academic infrastructure. Maharashtra has anchored its strategy around a 250-acre ‘Educity’ near Navi Mumbai International Airport, securing commitments from five foreign higher education institutions, said the report.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech1 week ago

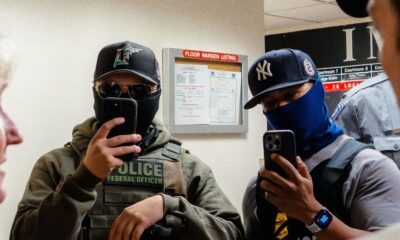

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Business4 days ago

Business4 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Business7 days ago

Business7 days agoLabubu to open seven UK shops, after PM’s China visit

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Fashion1 week ago

Fashion1 week agoUS Upland cotton exports down 51%, Pima rises: USDA