Business

Stocks tumble amid US banking fears

The FTSE 100 closed down sharply on Friday, although well above early lows, as investors weighed Thursday’s hefty falls on Wall Street sparked by fears surrounding US regional banks.

The FTSE 100 index closed down 81.52 points, 0.9%, at 9,354.57. It had earlier traded as low as 9,276.91.

The FTSE 250 ended 208.40 points lower, 1.0%, at 21,782.96 while the AIM All-Share shed 17.24 points, 2.2%, to 772.65.

For the week, the FTSE 100 was down 0.8%, the FTSE 250 was 0.1% lower, and the AIM-All Share declined 1.7%.

Wall Street took a tumble on Thursday and shares of regional banks took a hit after Zions Bancorp and Western Alliance said they had been victims of fraud on loans to funds that invest in distressed commercial mortgages.

Zions Bancorp said it would take a 50 million-dollar (£37 million) charge related to a loan issued by its California Bank & Trust division, while Western Alliance said it had begun legal proceedings over a bad loan.

“While everyone has been watching the tech sector for signs of a bubble, it’s the banking sector that’s the root cause of a minor market sell-off today,” said Russ Mould, investment director at AJ Bell.

Mr Mould noted “pockets” of the US banking sector including regional banks have given the market cause for concern.

“This includes Zions flagging an unexpected loss on two loans and Western Alliance alleging a borrower had committed fraud,” he added.

But he said the pullback in UK-listed banks will be “sentiment-driven”.

“Investors have been spooked and moved to trim positions in the sector, possibly opting to have lower exposure in case a crisis is brewing. There is no evidence of any issues with the London-listed core banking names, but investors often have a knee-jerk reaction when problems appear anywhere in the sector,” he added.

Barclays shed 5.7%, while Standard Chartered fell 3.5% and HSBC 2.5%. Lloyds Banking Group and NatWest ended down 2.4% and 2.9% respectively.

ICG, which has exposure private credit and asset backed finance fell 5.5%.

Stocks in New York were lower at the time of the London close. The Dow Jones Industrial Average was down 0.1%, the S&P 500 was 0.3% lower, while the Nasdaq Composite declined 0.6%.

Shares in Zions rallied 2.5% while Western Alliance firmed 0.9% at the time of the London equity market close, although both were well below opening highs.

Gold miners were also prominent fallers in London as the price of the yellow metal retreated from record highs.

Gold traded at 4,242.28 dollars an ounce on Friday, down from 4,270.73 dollars on Thursday.

The latest volatility saw Fresnillo fall 11% and Endeavour Mining drop 5.5%.

The pound was quoted lower at 1.3398 dollars at the time of the London equity market close on Friday, compared with 1.3429 dollars on Thursday.

The euro stood at 1.1664 dollars, lower compared with 1.1671 dollars. Against the yen, the dollar was trading at 150.31 yen, lower compared with 150.83 yen.

The yield on the US 10-year Treasury was quoted at 4.00%, trimmed from 4.03% on Thursday. The yield on the US 30-year Treasury stood at 4.60%, narrowed from 4.62% on Thursday.

In European equities on Friday, the CAC 40 in Paris closed ended 0.2% lower, while the DAX 40 in Frankfurt slid 1.7%.

Bucking the weaker trend in London, Pearson rose 2.3% as it said it remains on track to meet 2025 market expectations after reporting a pick-up in sales growth during the third quarter, driven by growth of its Virtual Learning segment.

The London-based educational materials publisher said underlying group sales rose 4% year-on-year in the third quarter, taking growth for the first nine months of 2025 to 2%. Pearson said it expects stronger sales growth in the fourth quarter due to “known business unit dynamics”.

Chief executive Omar Abbosh said Pearson is “well positioned for the opportunities that lie ahead”.

Smiths Group climbed 1.7% after announcing the sale of Smiths Interconnect to Molex Electronic Technologies Holdings, part of Wichita, Kansas-based Koch Industries, at an enterprise value of £1.3 billion.

The London-based engineering group said the sale price for its electronic connectors business represents 15.1 times headline earnings before interest, tax, depreciation and amortisation of £86.1 million for financial year 2025, which ended July 31.

Analysts at Jefferies said it is a “good price” and “marks a significant milestone in the group’s strategy of unlocking value across its portfolio of businesses”.

Despite Friday’s falls, Morgan Stanley said it is positive on UK equities from a European equity strategy perspective.

“Our call is less about UK macro, and more UK equities’ rising level of attractive, bottom-up drivers, growing interest from investors from relatively low levels this year, and the added benefit of the market’s low beta,” the bank said.

Morgan Stanley said investor interest in the UK is on the rise from relatively low levels, while even some of the “more challenged” portions of the UK equities market (discretionary, rate sensitive) are beginning to face relief as expectations start to pick-up that the November 26 budget will be “less bad than feared” for equities and rates markets.

“UK equities are low beta, underowned, and awash with idiosyncratic drivers,” the broker added.

Brent oil traded at 60.03 dollars a barrel, down from 61.70 dollars late on Thursday.

The biggest risers on the FTSE 100 were Pearson, up 25.5 pence at 1,119.5p, Haleon, up 6.7p at 351.8p, Reckitt Benckiser, up 106.0p at 5,910.0p, Coca-Cola HBC, up 62.0p at 3,556.0p and Smiths Group, up 40.0p at 2,406.0p.

The biggest fallers on the FTSE 100 were Fresnillo, down 276.0p at 2,352.0p, Barclays, down 21.45p at 357.8p, ICG, down 113.0p at 1,929.0p, Endeavour Mining, down 194.0p at 3,356.0p, and Antofagasta, down 124.0p at 2,663.0p.

Monday’s global economic diary sees retail sales and industrial production in China.

Later in the week inflation reports are due in the US, UK, Japan and Canada.

Next week’s UK corporate calendar sees third quarter results from lenders Barclays, Lloyds Banking Group and NatWest plus consumer goods groups Unilever and Reckitt Benckiser.

Contributed by Alliance News.

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

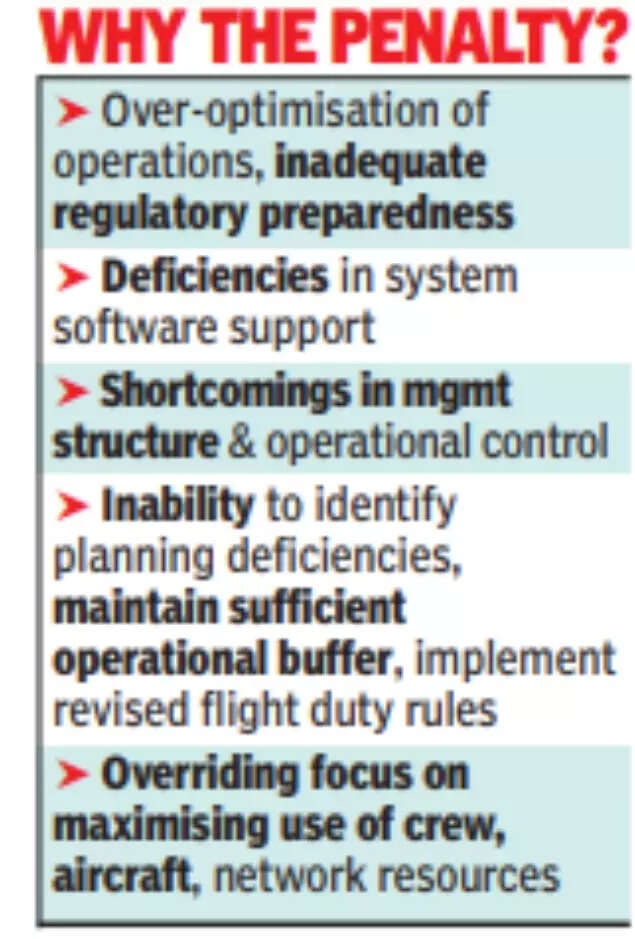

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

Business

Number of SMEs in Scotland down since 2020, figures from Lib Dems show

New figures from the Scottish Liberal Democrats show that small businesses have declined in Scotland since 2020.

The party’s economy spokesman, Jamie Greene MSP, has called on the SNP Government to urgently boost support for small businesses as he revealed significant drops in the number of small or medium-sized enterprises (SMEs) across Scotland.

Mr Greene asked the Scottish Government to provide the number of SMEs in every Scottish parliamentary constituency in each year since 2015.

The data showed that since 2020, the number of SMEs in Scotland has fallen from 177,020 to 171,660 – a decline of 5,360.

Over the past decade, 24 parliamentary constituencies have seen a fall in the number of SMEs, with notable declines in more rural parts of the country, according to the Scottish Liberal Democrats.

This includes a 13.8% fall in SMEs in constituencies across Aberdeen and Aberdeenshire since 2015, and an 8% fall in Caithness, Sutherland and Ross.

The Scottish Liberal Democrats have secured tens of millions in support for business in this year’s draft Scottish budget, including a new £2.5 million package backing young entrepreneurs and an initial £36 million for business rates relief.

Mr Greene said: “These figures show concerning drops in the number of small and medium-sized businesses across Scotland.

“I’ve spoken to lots of skilled and entrepreneurial people who feel there are too many barriers to starting their own business, from the SNP’s economic incompetence to the crushing burden of red tape.

“I am pleased that Scottish Liberal Democrats secured some support for businesses in the draft budget, but we think the Scottish Government can go further.

“That’s why, in the coming weeks, we will be squeezing the Scottish budget for every penny to deliver for businesses.”

Deputy First Minister Kate Forbes said: “Entrepreneurs and start-up companies are the backbone of our economy and the Scottish Government has been working systematically to develop the pipeline of support required to help them develop, grow and prosper.

“The facts show that we are making clear progress in establishing the right conditions to help business founders succeed.

“There was a 17.9% increase in Scottish start-up businesses in the first half of 2025, while investment deals in Scotland grew by 24% in the first half of 2025 compared to the second half of 2024.

“The Scottish Budget 2026-27 continues to support business, investment and a skilled workforce to accelerate economic growth, including record funding for our entrepreneurs and start-ups as we act to harness Scotland’s strengths and opportunities to drive long-term prosperity.”

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment4 days ago

Entertainment4 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion7 days ago

Fashion7 days agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion7 days ago

Fashion7 days agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports7 days ago

Sports7 days agoUS figure skating power couple makes history with record breaking seventh national championship