Business

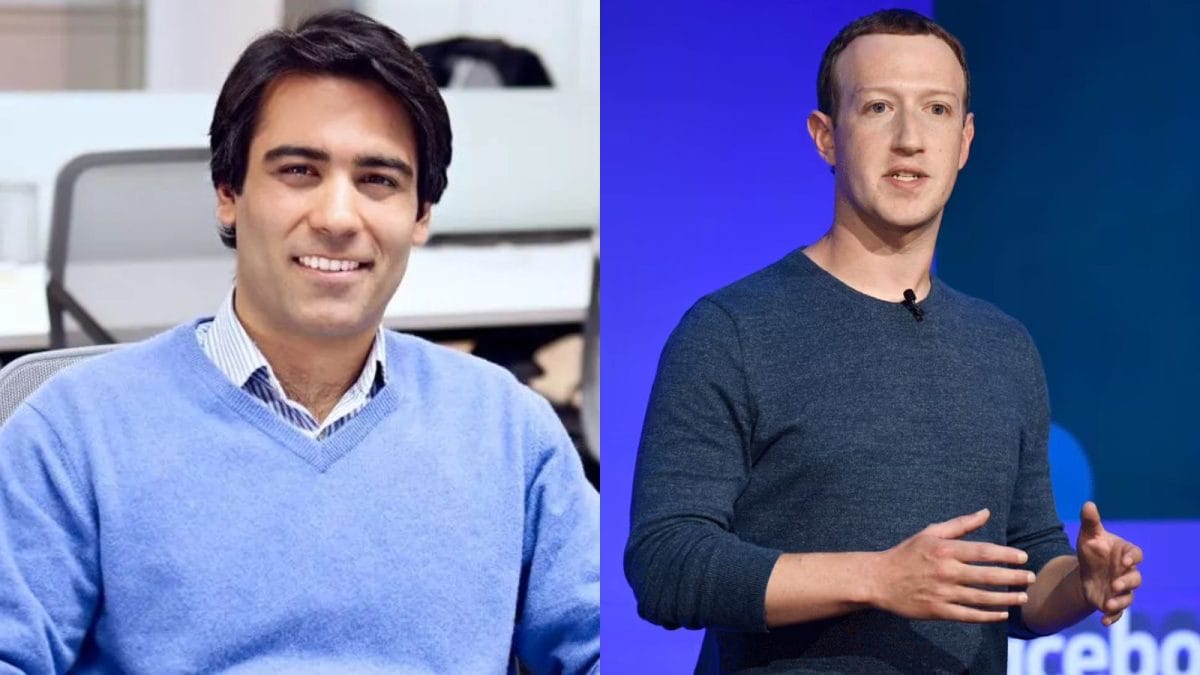

This Indian-Origin Harvard Student Took Mark Zuckerberg To Court For ‘Stealing’ His Facebook Idea

Last Updated:

Divya Narendra and the Winklevoss twins accused Mark Zuckerberg of idea theft over HarvardConnection, leading to a $65 million settlement and inspiring ‘The Social Network’ film

Facebook grew at breakneck pace, spreading from Harvard to universities across the United States and then to the wider world.

Long before Facebook became a global habit, a small group of Harvard students believed they had spotted a gap in the internet. Among them was Divya Narendra, a New York-born Indian-origin student who later accused Mark Zuckerberg, now the face of the world’s biggest social network, of running away with their idea.

What followed was one of the most closely-watched legal tussles in the history of the tech industry.

In the early 2000s, when broadband internet was still a novelty and students largely relied on email, Narendra and his friends, the twins Cameron and Tyler Winklevoss, began work on a project called HarvardConnection (later renamed ConnectU). The idea was simple yet radical for its time; a closed online network where Harvard students could create profiles, discover classmates and build social connections.

Narendra, the son of doctor parents and a standout student through school, had secured admission into Harvard after studying at some of New York’s top institutions. At Harvard, the trio quickly bonded, and as the project took shape, they began looking for a gifted programmer to bring the platform to life.

According to court filings later made public, the group approached Mark Zuckerberg, then an undergraduate known on campus for his coding skills. Emails exchanged between the parties, many of which later surfaced in legal documents, showed detailed discussions about the proposed network, its scope and its expansion beyond Harvard.

Narendra and the twins believed Zuckerberg would help write the code. Instead, they alleged, communication slowed, replies tapered off, and on February 4, 2004, Zuckerberg launched ‘TheFacebook’, a site that bore striking similarities to their concept.

News of the launch spread rapidly across the campus. Shocked by what they believed was a case of idea theft, the trio complained to Harvard authorities and eventually took the matter to court.

A Legal Battle That Gripped The Tech World

The dispute ran from 2004 to 2008, with Narendra and the Winklevoss brothers accusing Zuckerberg of breaching an oral agreement and misappropriating their concept. Facebook, meanwhile, grew at breakneck pace, spreading from Harvard to universities across the United States and then to the wider world.

In 2008, the parties reached an out-of-court settlement reportedly valued at $65 million, a mix of cash and Facebook stock. Although Zuckerberg did not admit wrongdoing, the settlement was widely seen as acknowledgement that the complainants had a legitimate case.

The legal clash later formed a key plotline in the Oscar-winning Hollywood film ‘The Social Network’, where Narendra’s character featured prominently. He has since said that while the film dramatised events, it helped spotlight the Indian-origin role in Facebook’s origin story.

Life After Facebook, And Another Startup Story

Far from being defined by the controversy, Divya Narendra chose to move forward. He completed advanced degrees in finance and law before launching SumZero in 2008, a professional network for serious investors and analysts to share research and insights.

Unlike Facebook, SumZero caters to a niche audience of finance professionals. Today, the platform counts thousands of vetted members and is valued in the millions, making Narendra a significant name in the investment-tech space.

The Facebook episode continues to be debated in Silicon Valley circles as a cautionary tale about intellectual ownership, trust and the fine print of informal agreements in the startup world.

December 30, 2025, 17:32 IST

Read More

Business

Pakistan Surviving On IMF Reviews But Economy Remains Vulnerable As Ever: Report

New Delhi: Pakistan is witnessing the institutionalisation of a “survivalist” economy where every policy choice is dictated by the need to pass the next International Monetary Fund (IMF) review, regardless of whether that policy erodes the tax base for the next decade, while the economy remains vulnerable as ever — headed nowhere except, most likely, into another IMF programme, as per a news report.

The report in Business Recorder by Shahid Sattar reveals that Pakistan suffers from a chronic twin deficit: a fiscal gap (spending more than it collects) and a balance of payments crisis (consuming more foreign exchange than it earns).

“For fifty years, our imports have hovered at double the rate of our exports as a percentage of GDP. Simply, Pakistan is a country that has failed to produce,” it added.

The report argued that the fundamental flaw in the IMF’s approach is a “dogmatic adherence to revenue extraction at the cost of value creation”.

“By forcing the government to meet rigid fiscal targets, and through any means necessary at this point, the Fund has encouraged policies that stifle the very export-led growth required to break the debt cycle,” it further stated.

The historic economic model of state patronage was flawed and resulted in suboptimal allocation of resources.

“But there is a difference between weaning an addict off drugs and starving a healthy person. The IMF programme appears unable to distinguish between withdrawing support and subsidies, and actively destroying the ecosystem required for legitimate businesses to function,” the report further argued.

On paper, the IMF deals with the Finance Minister and the Governor of the State Bank. Technically, all policies within the Letter of Intent are the government’s own ideas.

“In reality, the programme reflects the behest of those holding the greatest political and economic leverage. When policies fail, the IMF claims the government designed them; the government claims the IMF demanded them. This ambiguity serves everyone but the country and its citizens,” the report lamented.

“Unless we reclaim our policymaking from the narrow, revenue-centric confines of IMF programmes, we are not just managing a crisis but rather our own decline,” it added.

Business

Revised ITR Window Closed! Here’s What You Can Do Now To Claim Your Refund

New Delhi: Missed the December 31 deadline to file a revised or belated income tax return for FY 2024–25? Don’t panic just yet. While the window to revise your ITR has officially closed, it doesn’t mean your tax refund is gone for good. The rules simply take a different turn now and there’s still a way you may be able to claim what’s rightfully yours.

What happens after the December 31 deadline?

Up to December 31, taxpayers still had the option to file a belated return if they missed the original due date or submit a revised return to fix mistakes in an already filed ITR. However, once the calendar turned to January 1, both these options were shut for AY 2025–26. This means you can no longer file or revise your return now even if the Income Tax Department has not yet processed your earlier filing.

Is your tax refund still safe?

Yes, there’s some good news here. If you have already filed your ITR within the due date and are eligible for a refund, you can still receive it even after December 31. The Income Tax Department can process returns and release refunds later as well. That said, if there are mistakes in your return, the way to fix them now depends on what kind of error it is.

How can you claim your refund now? Here are the available options

Rectification request under Section 154 (most commonly used)

If your return has already been processed and you have received an intimation under Section 143(1), but the refund amount is incorrect or has been denied due to an error, you can file a rectification request. This option is useful when the issue is related to TDS or TCS mismatch, wrong tax or interest calculation, arithmetical or clerical mistakes, or incorrect carry-forward of losses. Rectification requests can be filed online through the income tax e-filing portal and remain available even after the December 31 deadline. For most taxpayers, this is the main route to claim or increase a refund in 2026.

Wait it out if your return is still under processing

If your ITR status shows “under processing”, there is no need to rush. The Centralised Processing Centre (CPC) has a fixed time limit to process returns and issue an intimation. If a refund is due and no discrepancies are found, it will be credited automatically along with applicable interest. In case the processing gets delayed beyond the allowed period, taxpayers can raise a grievance on the e-filing portal or through CPGRAMS.

Updated Return (ITR-U): Use with caution

From January 1 onwards, taxpayers can file an Updated Return (ITR-U), but this option has clear limitations. ITR-U can only be used to report additional income or correct under-reported income. It cannot be used to claim a new refund or increase an existing one. In fact, filing an ITR-U usually means paying extra tax along with interest, making it an unsuitable option for those hoping to get a refund.

Next steps to avoid missing your refund

Taxpayers should first check the status of their ITR on the income tax e-filing portal and keep an eye out for the intimation notice once it is issued. If you spot any mismatch or error affecting your refund, file a rectification request without delay. Also, make sure your bank account details are correctly entered and verified on the portal, as incomplete or unverified information can lead to unnecessary refund delays.

Business

India-Israel FTA: Why Trade Talks Are Gaining Momentum; Who Buys What And Why It Matters

New Delhi: India and Israel are moving closer to a free trade agreement (FTA), with both sides preparing for the next round of discussions in January. Officials close to the development say teams from both countries will meet early in the New Year to take forward negotiations that formally began in November.

At that time, India and Israel signed the Terms of Reference, beginning the official start of talks on the proposed FTA. The focus of the agreement is to expand trade flows and encourage greater investment between the two economies.

According to officials, the January meetings will centre on the overall structure of the India-Israel FTA and the plan that will guide negotiations. Israeli trade representatives are expected to travel to India for these discussions.

The engagement comes as recent trade data points to a slowdown in bilateral commerce. During 2024-25, India’s exports to Israel fell by 52 per cent to $2.14 billion, compared with $4.52 billion in 2023-24. Imports from Israel also declined in the last financial year, dropping 26.2 per cent to $1.48 billion. Taken together, total bilateral trade between the two countries stood at $3.62 billion.

Despite the recent dip, India is Israel’s second-largest trading partner in Asia. Trade between the two countries has traditionally been dominated by diamonds, petroleum products and chemicals. Over the years, the basket has widened, with growing exchanges in electronic machinery, high-tech products, communication systems and medical equipment.

When it comes to exports, India sends a wide range of goods to Israel. These include pearls and precious stones, automotive diesel, chemical and mineral products, machinery and electrical equipment, plastics, textiles and garments, base metals, transport equipment and agricultural produce.

Israel’s exports to India also span major sectors. Major items include pearls and precious stones, chemical and mineral products, including fertilisers, machinery and electrical equipment, petroleum oils, defence-related equipment and machinery and transport equipment.

With both sides looking to strengthen economic ties and reverse the recent fall in trade, the upcoming FTA talks are being closely watched as a potential turning point in the India-Israel economic relationship.

-

Sports6 days ago

Sports6 days agoBrooks Koepka should face penalty if he rejoins PGA Tour, golf pundit says

-

Business6 days ago

Business6 days agoGovt registers 144olive startups | The Express Tribune

-

Politics6 days ago

Politics6 days agoThailand, Cambodia agree to ‘immediate’ ceasefire: joint statement

-

Politics6 days ago

Politics6 days agoHeavy rains, flash floods leave Southern California homes caked in mud

-

Entertainment6 days ago

Entertainment6 days agoSecond actor accuses Tyler Perry of sexual assault in new lawsuit

-

Fashion6 days ago

Fashion6 days agoArea CG’s Fernando Rius says luxury is not about buying something expensive, it is about understanding the culture, history, and time invested

-

Fashion6 days ago

Fashion6 days agoClimate change may hit RMG export earnings of 4 nations by 2030: Study

-

Entertainment7 days ago

Entertainment7 days agoInside royal families most private Christmas moments