Business

Trump’s 50% Tariff On India To Leave Americans Paying More, Here’s What Gets Costlier

Last Updated:

Donald Trump Tariffs: Trump’s 50 percent tariffs on Indian imports, sharply raises US prices on textiles, jewellery, shrimp, chemicals and more, impacting consumers, manufacturers.

Donald Trump India Tariffs: A person shops in a supermarket as inflation affected consumer prices in Manhattan, New York City, US. (IMAGE: REUTERS FILE)

Donald Trump India Tariffs: The United States is bracing for a wave of price increases as US President Donald Trump’s administration is set to impose sweeping tariffs on Indian imports to the country, doubling duties to 50 per cent in retaliation for New Delhi’s purchase of Russian oil. The move, covering $48 billion worth of Indian goods, is one of the most punitive tariff actions US has ever taken against an ally.

The sectors most affected include textiles, gems and jewellery, shrimp, carpets, handicrafts, furniture, leather, organic chemicals and machinery.

That means everyday items for American households, ranging from linens, rugs and apparel to jewellery, mattresses and shrimp, will now carry a sharply higher price tag. Diamonds, gold jewellery and household furnishings will attract more than 50 per cent duty, while knitted clothes face nearly 64 per cent.

A Moneycontrol report said that apparel and home textiles face particularly sharp hikes: knitted clothing could see duties near 64 percent, woven garments around 60 percent, and bed linens and towels roughly 59 percent.

Americans who love jewellery will also feel the pinch as diamonds, gold, and other Indian-made ornaments are now subject to more than 52 percent in import duties. Also burdened are leather goods and footwear, a staple in US wardrobes, the news report by the financial news outlet said.

Even non-fashion categories aren’t spared—organic chemicals now face duties up to 54 percent, while mechanical appliances and engineering goods cross the 51 percent threshold, making mid-range equipment markedly less affordable for American buyers. Seafood such as shrimp, another Indian export, will also become costlier and on top of existing anti-dumping duties, the new tariff will push the total levy beyond 33 percent.

Blow to US Manufacturers Too

Tariffs were pitched as a way to protect American manufacturing jobs, but survey data from the Dallas Fed, accessed by broadcaster CNN, shows the opposite effect. Nearly 70 per cent of manufacturers report being hurt by higher tariffs this year, with many passing on costs to industrial and military clients. One Texas furniture maker told the Fed, “We are probably going out of business within 90 days.”

Postal services in Europe and Asia are already suspending shipments to the US after the scrapping of a tariff exemption on low-value packages. That means fewer options for American online shoppers relying on e-commerce platforms like Etsy, Shopify and TikTok Shop.

American Consumers Caught in the Middle

The tariff escalation, which leaves India facing one of the highest US import duties alongside Brazil, may shift supply chains toward competitors like Vietnam, Bangladesh and Mexico. But for US shoppers, the immediate result is fewer choices and higher prices.

“Tariffs will raise input costs for American companies, strain profit margins, and disrupt supply chains with long-term inefficiencies even if the policy is reversed later,” said Professor Trilochan Tripathy of XLRI Jamshedpur while speaking to news agency PTI.

In the short term, American households are set to pay more for Indian goods they rely on.

Economists speaking to the US broadcaster CNN called it “sneakflation”, defining it as small, incremental price hikes that quietly eat into household budgets.

For lower-income Americans, already living paycheck to paycheck, such gradual increases mean tough choices: skipping groceries to pay utility bills or cutting back on healthcare to afford children’s clothes.

From toys and sporting goods to furniture and shrimp cocktails, tariff-driven inflation is expected to spread over the next year. The Federal Reserve Bank of Atlanta noted that both tariff-exposed and non-exposed US businesses plan to raise prices in 2025, raising fears of another inflationary impulse.

Shankhyaneel Sarkar is a senior subeditor at News18. He covers international affairs, where he focuses on breaking news to in-depth analyses. He has over five years of experience during which he has covered sev…Read More

Shankhyaneel Sarkar is a senior subeditor at News18. He covers international affairs, where he focuses on breaking news to in-depth analyses. He has over five years of experience during which he has covered sev… Read More

- Location :

Washington/New Delhi

Read More

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

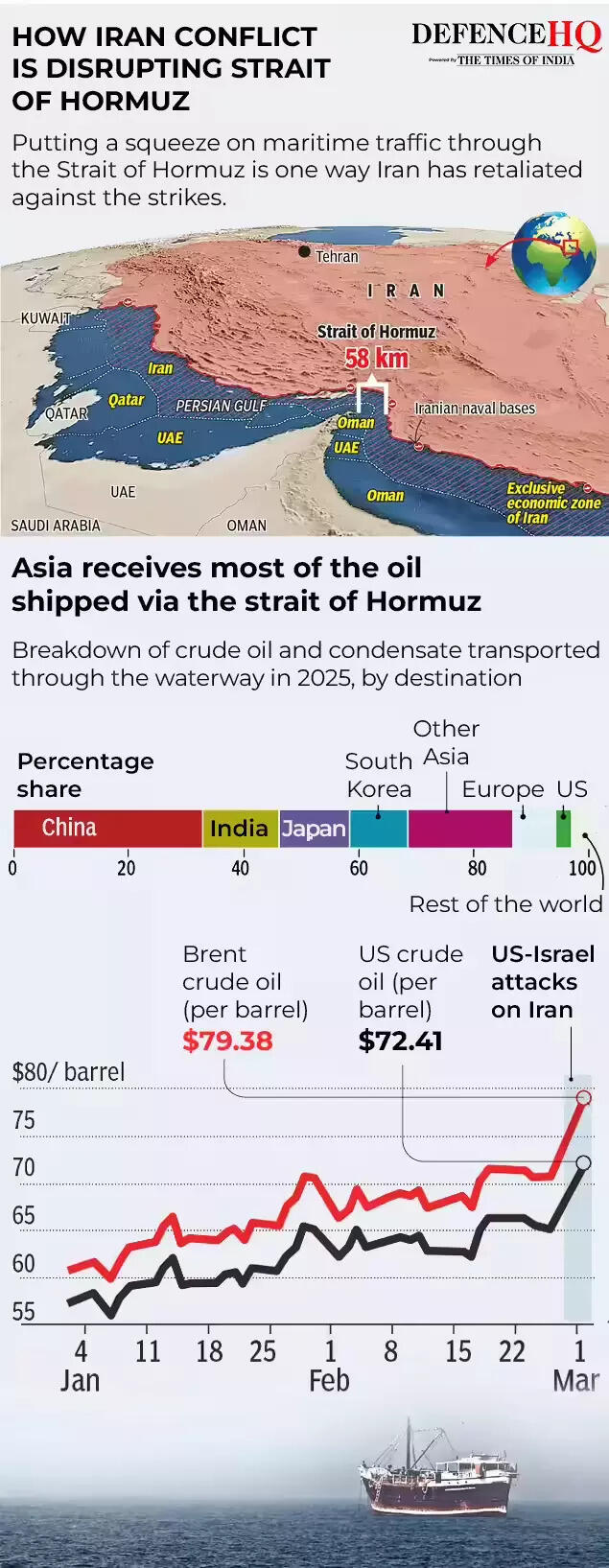

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

Business

FDA vaccine head will step down in April after string of controversial decisions

The logo for the Food and Drug Administration is seen ahead of a news conference at the Health and Human Services Headquarters in Washington, April 22, 2025.

Nathan Posner | Anadolu | Getty Images

A key U.S. Food and Drug Administration official who oversees vaccines and biotech treatments will step down from the agency following multiple decisions that raised concerns within the industry.

Vinay Prasad, director of the Center for Biologics Evaluation and Research, will leave the FDA at the end of April, an agency spokesperson confirmed on Friday. It is his second departure from the position: He briefly left the post in July following backlash over his regulatory decisions, and returned only two weeks later in August.

In a post on X, FDA Commissioner Marty Makary said the FDA will appoint a successor before Prasad returns next month to the University of California San Francisco, where he taught before taking the FDA position last year. Makary said Prasad “got a tremendous amount accomplished” during his tenure at the agency.

Prasad’s decision to step down comes after criticism of the FDA mounted within the biotech and pharmaceutical industry and among former health officials. In the past year, the agency has denied or discouraged the approval applications of at least eight drugs, according to RTW Investments, after taking issue with data the companies used to support their applications. The FDA also initially refused to review Moderna’s flu shot before it later reversed course.

All of those companies accused the FDA of reversing previous guidance about the evidence they could use to back their applications, sparking criticism within the industry that an unreliable regulatory process could stifle development of drugs for hard-to-treat diseases.

A former FDA official who spoke to CNBC on the condition of anonymity to speak freely on the issue called the reversals the worst kind of regulatory uncertainty because companies say they are being told one thing and then experience another.

In a statement earlier Friday, an FDA spokesperson said there was “no regulatory uncertainty,” adding the agency “makes decisions based on the evidence, but does not make assurances about outcomes.” The spokesperson said the FDA is “conducting rigorous, independent reviews and not rubber-stamping approvals.”

The most recent controversy came after the FDA discouraged UniQure from applying for expedited approval of its experimental treatment for Huntington’s disease.

The agency, which underwent staff cuts and an overhaul under Health and Human Services Secretary Robert F. Kennedy Jr., has faced broader backlash for its drug and vaccine approvals process. Critics have worried the agency could stifle the development of new treatments and risk the safety of patients.

The Wall Street Journal earlier reported Prasad’s departure.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’