Business

Trump’s 50% tariffs on India take effect: Industry analysts warn of fallout as export hubs brace for pain; trade deal still in limbo— key takeaways – Times of India

NEW DELHI: The additional 25 per cent tariff imposed by US President Donald Trump on Indian goods over New Delhi’s purchases of Russian oil have come into effect, raising the overall levy on exports to 50 per cent.Trump had first announced reciprocal tariffs of 25 per cent on India from August 7, alongside similar levies on about 70 other countries. He later doubled tariffs on Indian goods to 50 per cent, citing Russian crude imports, but allowed a 21-day window for negotiations.

Who’ll pay the price?

Several sectors, including textiles and apparels, gems and jewellery, seafood (primarily shrimp), and leather goods, are set to be affected by the newly imposed tariffs. The Indian pharmaceutical industry, a crucial supplier of generic drugs to the US, along with electronics and smartphones, including Apple iPhones, have been exempted from the tariffs. While some of the tariff costs may be absorbed by Indian exporters through price reductions and US importers by incurring higher expenses, the tariffs are expected to render Indian exports less competitive compared to exporters from neighbouring countries that face tariffs in the 10–25 percent range. The resulting decline in orders from the US, India’s largest market for these products, is anticipated to adversely impact hundreds of MSMEs (micro, small and medium enterprises), leading to layoffs and increased unemployment.

Exemptions and transit Clause

Indian products already “loaded on a ship and in transit” to the US before the August 27 deadline will be exempt from the additional 25 per cent duty, provided they are cleared for consumption by September 17, 2025, and importers declare the special code HTSUS 9903.01.85 to US Customs, DHS said.

FIEO sounds alarm as US tariffs bite

Apex exporters body Federation of Indian Export Organisations (FIEO) on Tuesday had warned that steep US tariffs have forced textile and apparel manufacturers in Tirupur, Noida, and Surat to halt production, reported PTI.President S C Ralhan said about $47–48 billion worth of India’s exports to the US now face 30–35 per cent cost disadvantages, making them uncompetitive against rivals from Vietnam, Bangladesh and China. Labour-intensive sectors like leather, shrimp and handicrafts are also at risk.He urged immediate support through cheaper credit, loan moratoriums, and faster trade deals, while stressing urgent diplomatic engagement with Washington.Also read: Indian refiners unlikely to stop Russia crude oil trade under US pressure

India stays firm

The government has ruled out retaliation but is preparing measures to cushion exporters from the 50% US tariffs. Senior officials told ET that a Rs 25,000-crore Export Promotion Mission is under consideration, covering trade finance, SEZ reforms, warehousing, ecommerce hubs, and “Brand India” promotion. Commerce minister Piyush Goyal said India will protect domestic interests through GST tweaks to boost demand in sectors like textiles and food processing, while also diversifying trade ties with other economies.Earlier, on Monday, Prime Minister Narendra Modi had said he could not compromise on the interests of farmers, cattle-rearers, and small-scale industries. “Pressure on us may increase, but we will bear it,” he asserted. India had described the US move as “unjustified and unreasonable.”

Experts call it a ‘lose-lose’

Trade experts warned the escalation risks damaging both economies. Mark Linscott, Senior Advisor with The Asia Group, was quoted by that “unfortunately”, the US and India have managed to convert what appeared to be a true and unprecedented win-win on trade into a “remarkable lose-lose.”“Hopefully, we will find a way to conclude a satisfactory mutually beneficial Free Trade Agreement with the United States early rather than late and that would certainly take us to the next step of the visit of President Trump to India,” said former foreign secretary and Rajya Sabha MP Harsh Vardhan Shringla.Meanwhile, Raj Manek, Executive Director and Board Member of Messe Frankfurt Asia Holdings Ltd stated India must intensify its focus on innovation and sustainability to achieve its $100 billion target in textiles. He stressed that investment in man-made fibres (MMF) and performance fabrics would be critical at this stage. “Over 60 per cent of global fibre consumption is now in MMF. With the PLI scheme targeting MMF apparel and technical textiles, India is well-positioned to build scale and future-ready capacity,” Manek said after the conclusion of the 13th edition of Gartex Texprocess India, a tradeshow on garment and textile machinery held in the capital, as reported by ET. He added, “At the same time, adopting energy-efficient machinery, managing effluents effectively, and converting waste into value will help meet ESG expectations while lowering costs.”

Indian refiners unlikely to stop Russia crude oil trade

Indian refineries are continuing their imports of Russian crude despite the Trump administration’s 25 per cent additional tariffs, with officials indicating minimal likelihood of halting purchases. Executives told ET that September-loading cargoes were slightly lower due to reduced discounts on Russian oil, but October volumes could rise as prices adjust. They stressed that there are no official instructions to stop procurement, reflecting the government’s clear message of “country first, commerce later.” Officials, including PM Narendra Modi, External Affairs Minister S Jaishankar, and Commerce Minister Piyush Goyal, have conveyed that India will support exporters through challenges rather than yield to US pressure. Industry representatives also noted that while transitioning from Russian oil is technically feasible, rapid changes are unnecessary as supply lines and global markets remain stable.Also read: India prepares multi-pronged strategy to shield economy; details here

Blow to the US too?

The tariff shock is also expected to hit the American economy. According to a report by the State Bank of India (SBI), US GDP could be shaved by 40–50 basis points, while inflationary pressures are likely to rise due to higher input costs and a weaker dollar.Also read: 50% tariffs on India to blowback on Trump? US GDP could shrink 40–50 bps, inflation to flare “We believe that US tariffs are likely to affect US GDP by 40–50 bps along with higher input cost inflation,” the SBI report noted. Import-sensitive sectors such as electronics, automobiles, and consumer durables are already feeling the strain. The report added that US inflation is expected to remain above the Federal Reserve’s 2 per cent target through 2026, driven by tariff pass-through and currency effects.

Trade deal still in limbo

Talks on a bilateral trade agreement (BTA) between India and the US have stalled, with the American delegation having postponed its scheduled August 25 visit to New Delhi.US Treasury Secretary Scott Bessent has accused India of “profiteering” by reselling Russian oil, while trade talks between the two sides remain on “thin ice,” according to experts. Analysts warn that unless Prime Minister Modi and President Trump engage directly, chances of reviving the deal remain slim. The deadlock raises uncertainty for exporters, who had earlier hoped for tariff relief through a limited trade pact.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

Business

Gas prices rocket as Qatar halts production after Iranian attacks

Gas prices have leapt at the fastest pace since the outbreak of war in Ukraine, after Qatar halted production of liquified natural gas after attacks by Iran.

Oil prices also soared and global financial markets reeled from the fallout of an intensifying conflict between Iran and US-Israeli forces.

European whole gas prices soared by 52% on Monday, marking the sharpest rise since prices were pushed dramatically higher by the Russian invasion of Ukraine in March 2022.

The surge came after Qatar’s state-backed energy company QatarEnergy said it “ceased production” because of attacks on its facilities.

Qatari ministers had said earlier on Monday that an Iranian drone had attacked one of the company’s production facilities.

Qatar is a major producer of LNG, cooled gas which can be transported via ships, responsible for about a fifth of global supplies.

On Monday in London, the price of natural gas for delivery in April was up by about 43% to 115p per therm.

In the UK, gas prices are a key driver for the cost of domestic energy bills, indicating that a sustained spike could affect households in the coming months.

Neil Wilson, Saxo UK investor strategist, said: “Qatar is a top three LNG exporter, controlling roughly a quarter of expected supply over the next decade.

“Looks like Iran’s tactic is to pressure Gulf states so they in turn pressure the US and Israel to back off.

“I am much more concerned about European natural gas prices than oil prices, in terms of seeing a repeat of the 2022 European energy crisis.”

Global financial markets faltered after intense strikes across the Middle East and attacks on ships drove fears of energy supply disruption.

London’s FTSE 100 was weaker as trading was knocked by the growing conflict between Iran and US-Israeli forces.

The blue chip share index shed 130 points, closing 1.2% lower at 10,780.11.

Other European indexes suffered bigger drops with France’s Cac 40 down about 2.2% and Germany’s Dax tumbling 2.4% on Monday.

But it was a more tentative start to trading over on Wall Street with the S&P 500 relatively flat, and Dow Jones dipping by about 0.1% by the time European markets had closed.

Israel launched strikes on Lebanon’s capital Beirut on Monday after missiles were fired by militant group Hezbollah.

The latest strikes came after the US and Israel hit targets across Iran on Sunday as part of an intensifying military campaign which followed the killing of Supreme Leader Ayatollah Ali Khamenei.

Oil supplies could be affected by the conflict after Iran reportedly warned tankers on the strait of Hormuz that no ships would be allowed to pass through.

UK Maritime Trade Operations Centre officials said that two vessels have been struck near to the key trade artery.

The Strait of Hormuz is used by tankers carrying about one fifth of the world’s oil supplies and seaborne gas.

On Monday, the price of Brent crude oil soared by as much as 13%, rising above 82 dollars a barrel, before paring back.

It was 8.4% higher at 79.2 dollars a barrel shortly before 2pm, before easing slightly to be 5.5% higher at 76.9 dollars a barrel by early evening.

Nevertheless, City analysts have said the markets have been relatively contained so far in reaction to the conflict.

Chris Beauchamp, chief market analyst at IG, said: “While we have seen a significant surge in oil prices since markets opened last night, the gains appear contained for now as we wait to see if shipping through Hormuz can continue at lower levels or will be blocked entirely.

“Oil and gas infrastructure in the region has not yet been extensively targeted, keeping oil well south of the 100 dollar barrel range that many expected as a result of the weekend.”

Meanwhile, the pound dipped in value against the US dollar to its weakest level since December.

The fall is partly linked to the strength of the dollar, with investors pouring funds into the US “safe haven” currency.

The pound was down about 0.8% at 1.338 versus the dollar during the day, before parring back some losses to be down around 0.3% at 1.34 against the dollar by early evening.

London stocks were broadly weaker, with travel stocks among those dropping particularly sharply.

Cruise giant Carnival slid by 8%, while airline firm IAG, the parent firm of British Airways, dipped by 7.6%.

Rival Wizz Air, which typically runs flights to Dubai and Abu Dhabi, was also down 7.3% in early trading on Monday, while travel-focused retail groups SSP and WH Smith were also firmly lower.

However, defence stocks were among the gainers, with BAE Systems lifting by 7.4% to 2,268p.

Elsewhere, oil and energy stocks were also stronger – Shell and BP rose by 4.5% and 3.5% respectively as prices lift.

International stock markets also opened weaker after the start of trading, with the Nikkei 225 in Tokyo falling by 1.5% after Asian markets opened.

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

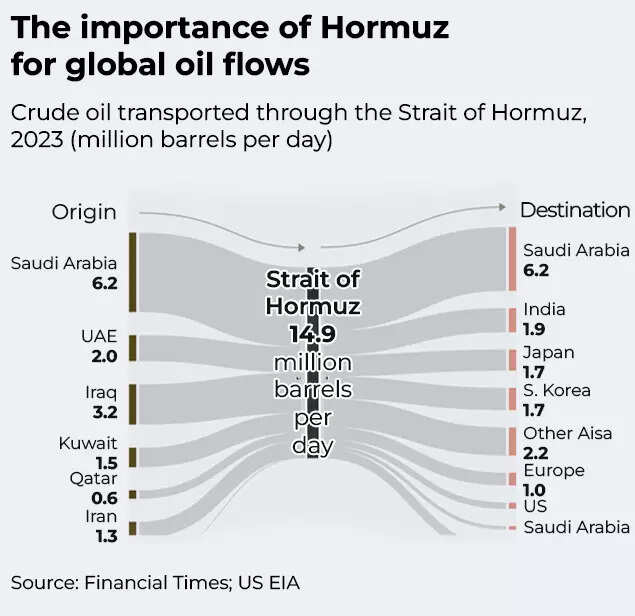

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Entertainment1 week ago

Entertainment1 week agoHailee Steinfeld shares big life update amid excitement for baby’s arrival

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%

-

Sports1 week ago

Sports1 week agoSouth Africa thrash India by 76 runs in T20 World Cup Super 8 – SUCH TV

-

Business1 week ago

Business1 week agoHaryana Govt bars IDFC First Bank, AU Small Finance Bank over alleged Rs 590 crore fraud

-

Sports7 days ago

Sports7 days agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns