Business

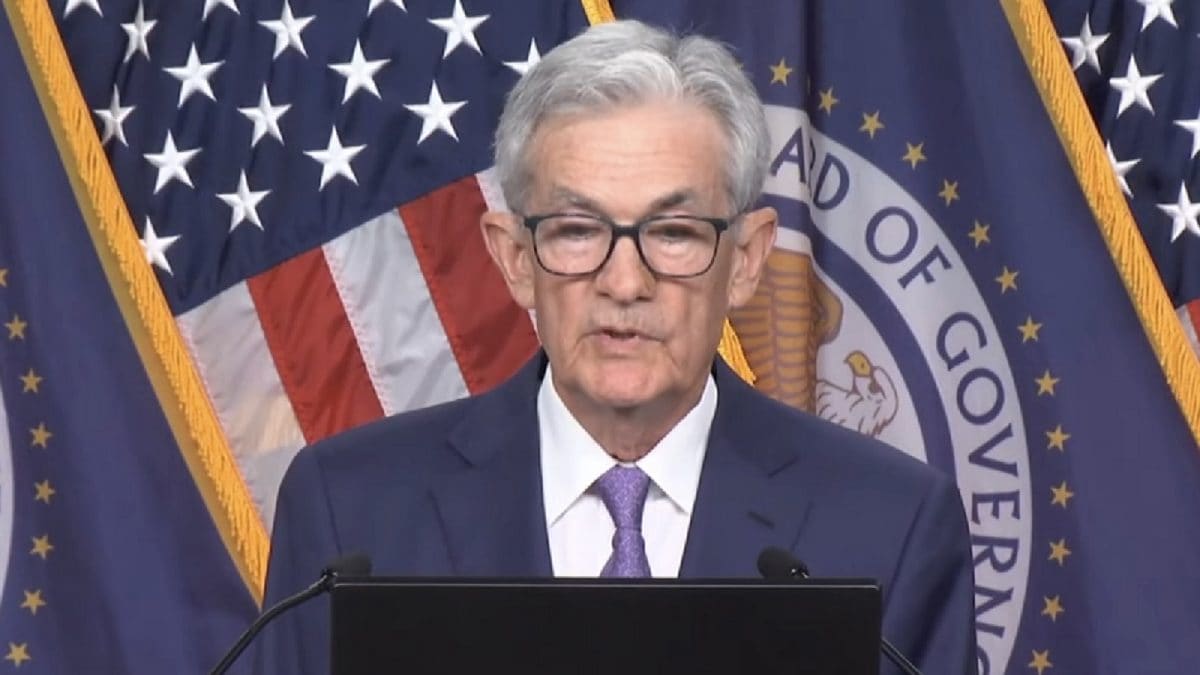

US Fed Rate Cut: Jerome Powell Reduces Interest Rates By Another 25 Bps

Last Updated:

US Fed Meeting Outcome: In a second consecutive rate cut, the US Federal Reserve on October 29 reduced its key interest rates by another 25 basis points (bps) to 3.75%-4.00%.

US Federal Reserve’s latest interest rate decision.

US Fed Rate Cut, US Fed Meeting Latest News: The US Federal Reserve on October 29 reduced its key interest rates by another 25 basis points (bps) to 3.75%-4.00%, in line with market expectations. This is the second consecutive rate cut following the last reduction in September 2025, when the US central bank announced a similar 25 bps reduction after a gap of nine months.

The Federal Open Market Committee (FOMC) approved the rate cut with a 10-2 majority. Governor Stephen Miran dissented, arguing for a steeper half-point reduction, while Kansas City Fed President Jeffrey Schmid also voted against the move, favouring no rate cut at all.

“In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-3/4 to 4 percent,” the Federal Open Market Committee (FOMC) said in a statement on October 29.

It added that uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.

“Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated,” the FOMC stated.

US Fed to Halt Quantitative Tightening from December 1

Alongside the rate cut, the Federal Reserve announced that it will end the reduction of its asset holdings, a process known as quantitative tightening, effective December 1.

The post-meeting statement did not provide any direction on what the committee’s plans are for December.

The next US Fed meeting will take place on December 9-10, and the decision will be announced on December 10.

In September, the US central bank’s officials expected two more cuts this year, according to the ‘dot plot’.

The Fed had reduced borrowing costs three times last year till December 2024. But, it then put any further cuts on hold to evaluate the impact of President Donald Trump’s sweeping tariffs on the economy. The US central bank kept its key interest rates unchanged at 4.25%-4.50% for five times in a row till the previous July 2025 policy review.

Currently, CPI inflation in the US stands at 3%, which was cooler than expected by most analysts. The US Fed targets to bring in the retail inflation rate at 2%.

US Fed Rate Cut: How Will It Impact Indian Markets?

Currently, the Nifty futures (GIFT Nifty) are trading nearly 90 points lower at 26,166, suggesting a gap-down opening on Thursday.

For Indian markets, the US Fed rate cut is positive for sectors like IT, pharma, and other export-oriented industries.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

October 29, 2025, 23:32 IST

Read More

Business

Stock Market Updates: Sensex Falls 300 Points, Nifty Tests 25,700; Nifty IT Drops Over 5%

Last Updated:

Indian equities paused on Wednesday after the previous session’s sharp surge triggered by the India–US trade agreement

Stock Market Today.

Sensex Today: Indian equities paused on Wednesday after the previous session’s sharp surge triggered by the India–US trade agreement. The pact, which reduced US tariffs on Indian goods to 18 per cent from 50 per cent, had buoyed sentiment and removed a major overhang, but markets turned cautious as traders booked profits.

A decline in information technology stocks further weighed on the mood.

At the open, the BSE Sensex was around 83,430, down 309 points or 0.37 per cent, while the Nifty 50 stood at 25,663, lower by 65 points or 0.25 per cent.

Broader markets also traded in the red, with the Nifty MidCap index slipping 0.48 per cent and the Nifty SmallCap index easing 0.18 per cent.

The Nifty IT index tumbled more than 5.5 per cent, led by losses in Persistent Systems, LTIMindtree, Infosys, HCL Tech, Coforge, TCS, Mphasis and Tech Mahindra.

Global cues

US markets ended lower overnight as investors rotated out of technology stocks into sectors more closely tied to economic recovery. The Dow Jones slipped 0.34 per cent, the S&P 500 declined 0.84 per cent, and the Nasdaq fell 1.43 per cent at the close.

Asian markets were mixed in early trade on Wednesday amid the absence of strong triggers. China’s CSI 300 index dropped 0.29 per cent, Hong Kong’s Hang Seng edged down 0.05 per cent, and Japan’s Nikkei lost 0.61 per cent. In contrast, South Korea’s Kospi rose 0.54 per cent.

In commodities, spot gold gained over 1 per cent to $5,002 per ounce, while spot silver advanced 0.69 per cent to $85.70 per ounce.

On the macro front, investors await the release of S&P Global/HSBC composite and services PMI final data for January from both India and Japan.

February 04, 2026, 09:13 IST

Read More

Business

Top stocks to buy today: Stock recommendations for February 4, 2026 – check list – The Times of India

Stock market recommendations: According to Mehul Kothari, DVP – Technical Research, Anand Rathi Shares and Stock Brokers, the top stocks to buy today (February 4, 2026) are Indian Oil Corporation, Tata Elxsi, and IFCI. Let’s take a look:IOC – Trendline Breakout with Indicator ConfirmationBuy: ₹165–₹163 | Stop Loss: ₹159 | Target: ₹172Indian Oil Corporation (IOC) has formed a strong base near its 100-DEMA, which has acted as a reliable dynamic support in recent sessions. The stock has also delivered a decisive trendline breakout, indicating a potential shift in short-term momentum.On the indicator front, a bullish MACD crossover is visible, signalling strengthening upside momentum. The Stochastic Oscillator has reversed higher near the 30 zone without entering deep oversold territory, suggesting improving price strength and underlying buying interest.The confluence of 100-DEMA support, trendline breakout, MACD bullish crossover and stochastic reversal points towards a constructive setup with scope for further upside if the breakout sustains.TATA ELXSI – Alligator Breakout with Bullish MomentumBuy: ₹5,500–₹5,400 | Stop Loss: ₹4,900 (closing basis) | Target: ₹6,275 & ₹6,550 (1–3 months)TATA ELXSI has closed decisively above the Williams Alligator indicator, confirming a fresh uptrend and improvement in overall price structure.Momentum indicators remain supportive, with DMI in bullish mode (+DI above −DI), indicating strengthening buying pressure and positive directional movement. Additionally, the MACD sustaining above the zero line reflects strong trend momentum and increases the probability of continued upside.This combination of Alligator breakout, bullish DMI structure and positive MACD trend suggests a trend-continuation setup with scope for further upside in the coming weeks.IFCI – Alligator Breakout & Retest ConfirmationBuy: ₹56–₹50 | Stop Loss: ₹46 (closing basis) | Target: ₹63.5 & ₹67 (1–3 months)IFCI has closed decisively above the Williams Alligator indicator and has successfully completed a retest of the breakout zone, confirming continuation of the emerging uptrend and strengthening bullish structure.The DMI has turned positive (+DI above −DI), indicating buyers are in control and directional momentum is favouring the upside. The MACD sustaining above the zero line further supports positive trend momentum and enhances the probability of further upside movement.The alignment of price breakout, retest confirmation and bullish indicators suggests a constructive medium-term setup with favourable risk-reward.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Younger and lower-paid workers hit hardest by rising labour costs, figures show

Younger and entry-level workers are being squeezed the hardest by higher employment costs slowing the rate that firms are hiring, new analysis shows.

Some UK businesses have seen the cost of employing workers rise on the back of recent policy measures, including tax and minimum wage increases and reforms to employment rights, the National Institute of Economic and Social Research (Niesr) said in its latest economic outlook.

These factors have raised the marginal cost of hiring by around 7%, in real terms, for an entry level position, according to its findings.

Niesr warned that sectors most exposed to cost increases were experiencing a bigger impact, pointing to data showing a link between exposure to the national minimum wage and rising unemployment.

This includes typically lower-paid industries such as hotels, hospitality and food chains, which also have a greater concentration of younger and early-career workers.

Its analysis found that, rather than cutting existing jobs, many firms have chosen to slow the rate that they hire staff.

Therefore younger workers and those “at the margins of the labour market” are being disproportionately squeezed, the think tank said.

Official figures at the end of last year showed that the unemployment rate rose to its highest level since early 2021 over the three months to September.

The Office for National Statistics (ONS) said that young people especially were struggling in the tougher hiring climate, with an 85,000 increase in those unemployed aged between 18 to 24 in the three months to October – the biggest jump since November 2022.

The number of young people not in employment, education or training – so-called Neets – has been rising since 2021, and hit the highest level since 2014.

In its report, Niesr said it was “hard to escape the conclusion that the rising cost of labour has deterred full-time job creation, particularly for younger workers”.

Lord Frost, director general of the Institute of Economic Affairs, said the findings “laid bare the costs of the Government’s national insurance and minimum wage hikes, and Employment Rights Act: a spike in the cost of hiring entry-level workers, meaning fewer jobs and opportunities for young people”.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade