Business

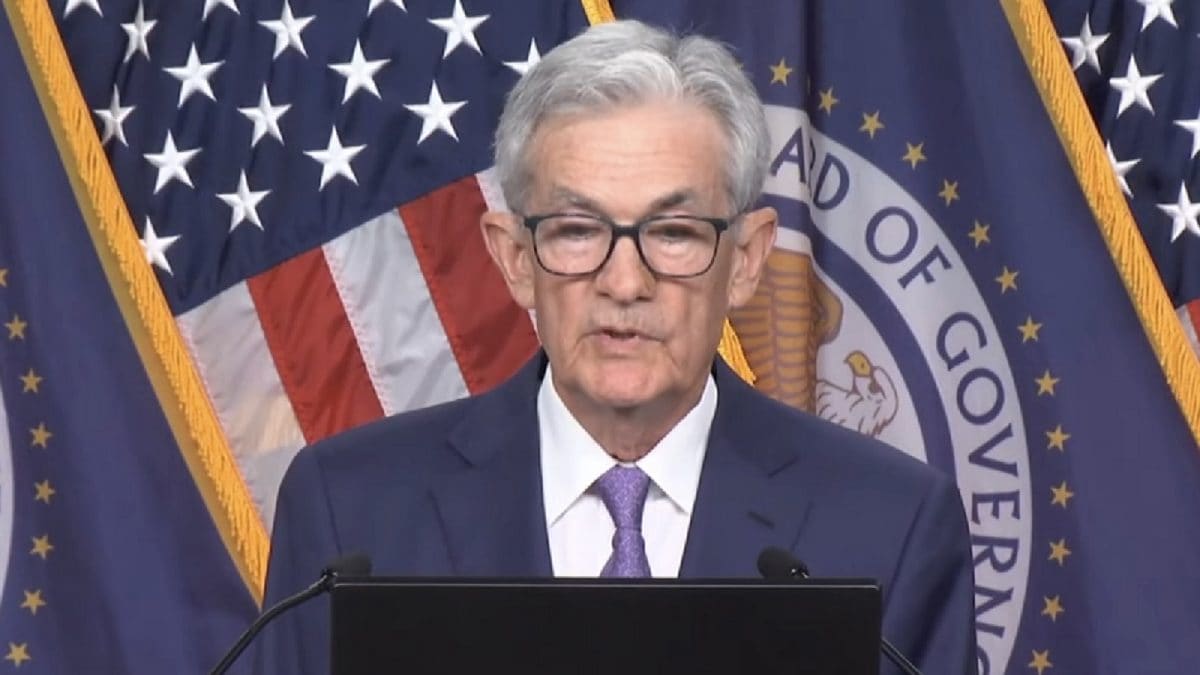

US Fed Rate Cut: Jerome Powell Reduces Interest Rates By Another 25 Bps

Last Updated:

US Fed Meeting Outcome: In a second consecutive rate cut, the US Federal Reserve on October 29 reduced its key interest rates by another 25 basis points (bps) to 3.75%-4.00%.

US Federal Reserve’s latest interest rate decision.

US Fed Rate Cut, US Fed Meeting Latest News: The US Federal Reserve on October 29 reduced its key interest rates by another 25 basis points (bps) to 3.75%-4.00%, in line with market expectations. This is the second consecutive rate cut following the last reduction in September 2025, when the US central bank announced a similar 25 bps reduction after a gap of nine months.

The Federal Open Market Committee (FOMC) approved the rate cut with a 10-2 majority. Governor Stephen Miran dissented, arguing for a steeper half-point reduction, while Kansas City Fed President Jeffrey Schmid also voted against the move, favouring no rate cut at all.

“In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-3/4 to 4 percent,” the Federal Open Market Committee (FOMC) said in a statement on October 29.

It added that uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.

“Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated,” the FOMC stated.

US Fed to Halt Quantitative Tightening from December 1

Alongside the rate cut, the Federal Reserve announced that it will end the reduction of its asset holdings, a process known as quantitative tightening, effective December 1.

The post-meeting statement did not provide any direction on what the committee’s plans are for December.

The next US Fed meeting will take place on December 9-10, and the decision will be announced on December 10.

In September, the US central bank’s officials expected two more cuts this year, according to the ‘dot plot’.

The Fed had reduced borrowing costs three times last year till December 2024. But, it then put any further cuts on hold to evaluate the impact of President Donald Trump’s sweeping tariffs on the economy. The US central bank kept its key interest rates unchanged at 4.25%-4.50% for five times in a row till the previous July 2025 policy review.

Currently, CPI inflation in the US stands at 3%, which was cooler than expected by most analysts. The US Fed targets to bring in the retail inflation rate at 2%.

US Fed Rate Cut: How Will It Impact Indian Markets?

Currently, the Nifty futures (GIFT Nifty) are trading nearly 90 points lower at 26,166, suggesting a gap-down opening on Thursday.

For Indian markets, the US Fed rate cut is positive for sectors like IT, pharma, and other export-oriented industries.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

October 29, 2025, 23:32 IST

Read More

Business

Prices Of Imported Agricultural Goods Rise Amid Strong US Dollar in S. Korea

New Delhi: The prices of major imported agricultural goods in South Korea have risen sharply in recent years, outpacing global price increases due to the weakening of the South Korean won against the US dollar, data showed on Sunday.

According to the Bank of Korea, the import price index for coffee came to 307.12 in November in U.S. dollar terms and 379.71 in Korean won terms, with 2020 set as the base year at 100, reports Yonhap news agency.

The figures indicate that global coffee prices have risen about threefold over the past five years but increased nearly fourfold when converted into the Korean won. The data showed that the price of imported beef increased 30 percent over the period in U.S. dollar terms but surged 60.6 percent in Korean won terms.

Over the same period, the price of imported pork rose 5.5 percent in U.S. dollar terms but jumped 30.5 percent in Korean won terms. The Korean won traded at around the 1,100-won level in 2021 before weakening into the upper 1,200-won range in 2022. In the fourth quarter of 2025, the average exchange rate stood at 1,450 won per dollar.

The price of imported fresh seafood fell 11 percent in terms of U.S. dollars but rose 10 percent in Korean won, reflecting the impact of currency depreciation, the data also showed. South Korea imports a lot of raw materials, such as sugar and flour, said Choi Chul, a professor of consumer economics at Sookmyung Women’s University.

As the price of domestically produced (agricultural products) are rising due to climate change, a hike in imported goods due to the foreign exchange rate will push up overall food prices, including processed products, Chul added.

Business

Elon Musk Hits $700 Billion Net Worth, Surpasses Combined Wealth Of Next Three Richest People

Last Updated:

Musk becomes the first person to surpass $700 billion net worth after a US court reinstates his Tesla compensation package, placing him far ahead of Larry Page and Larry Ellison.

Elon Musk’s wealth crosses $700 billion. (Photo Credit: X)

Elon Musk Net Worth: Tech billionaire Elon Musk continues to accumulate record-breaking wealth unabated and has created history by becoming the first individual ever to cross a net worth of $700 billion. His wealth surged after a US court reinstated his long-pending compensation package linked to electric-vehicle maker Tesla, according to Reuters. Following the ruling, Musk’s estimated net worth jumped to about $749 billion, firmly placing him at the top of the global rich list.

The scale of Musk’s lead over other billionaires is unprecedented. The second-richest person in the world, Larry Page, has a net worth of around $252.6 billion, while third-ranked Larry Ellison is worth about $242.7 billion. This means Musk is richer by nearly $500 billion than the person just below him. In simple terms, Musk’s net worth is equal to the combined net worth of the next three richest people in the list – Larry Page, co-founder of Google, Larry Ellison, founder of Oracle, and Jeff Bezos, founder of Amazon.

Why Is Musk Wealth Rising?

This extraordinary jump in wealth came after the Delaware Supreme Court restored stock options from Musk’s 2018 pay package that had earlier been cancelled by a lower court. Those options are now valued at roughly $139 billion, far higher than the original estimate of $56 billion when the deal was first approved. The court said the earlier ruling that scrapped the package was unfair and wrong, reversing a 2024 judgment that had described the deal as “unfathomable”.

Musk’s wealth rose so sharply mainly because his compensation is almost entirely linked to company performance rather than salary. As Tesla’s market value expanded dramatically over the years, the value of Musk’s stock options multiplied. Once the court restored these options, the impact on his net worth was immediate and massive. Unlike many other billionaires, Musk’s fortune is heavily concentrated in shares, which makes it more volatile but also capable of extreme upside.

Musk’s Mega Empire

Earlier, Musk’s wealth hit $600 billion mark after the rocket company he founded launched a tender offer valuing the firm at $800 billion, up from $400 billion in August, according to two of the company’s investors speaking to Forbes. With Musk owning roughly 42% of SpaceX, this valuation boost increased his fortune by $168 billion.

The dramatic jump in Musk’s net worth is largely tied to SpaceX’s latest valuation. The company is targeting an initial public offering in 2026 that could see it valued at around $1.5 trillion, one investor told Forbes. Even without an IPO at that scale, Musk’s estimated $336 billion stake in SpaceX now ranks as his most valuable asset.

Musk also holds a 53% stake in xAI Holdings, valued at an estimated $60 billion by Forbes. The company is reportedly in discussions to raise funds at a $230 billion valuation, more than double the $113 billion valuation Musk assigned when he merged his AI startup xAI with X in March.

December 21, 2025, 09:19 IST

Read More

Business

Supply ‘too reliant’ on one asset, says South East Water boss

Fiona Irving,South East environment correspondentand

Craig Buchan,South East

BBC

BBCThe boss of South East Water has said the company is too dependant on individual facilities after a six-day supply failure affected thousands of people in Kent.

About 24,000 properties in and around Tunbridge Wells had no or low pressure tap water from 29 November until supplies returned to most on 4 December. For the next nine days, residents were told to boil the restored tap water before consumption.

A disinfection problem at Pembury Water Treatment Works had caused the failure but there was no evidence supply became infected, said South East Water.

The water company’s chief executive, David Hinton, said the firm was “just too reliant in some areas on one asset”.

Mr Hinton was speaking to the BBC earlier in the week and said the company wants to “do more” at a separate works at Bewl Water reservoir, near Wadhurst in East Sussex, and spend £30m on expanding output capacity.

The proposal would give the company the ability to “rapidly fill the area of Tunbridge Wells, for example, as soon as we see any issue”, said Mr Hinton.

He said this would allow “extra resilience should any other challenges hit any other treatment works” without further draining the reservoir.

“It’s not only for Tunbridge Wells, it’s for the wider parts of Kent as well,” added the chief executive, who has faced calls to resign over the supply issues.

South East Water was one of five companies to contest regulator Ofwat’s latest price controls, which already allowed it to increase an average annual bill from £232 to £274 by 2030.

The firms argued the 36% average price increase for customers in England over the next five years was not enough to deliver better infrastructure.

The Competition and Markets Authority has provisionally agreed that South East Water can increase bills by an extra 4%, pending a final decision in 2026.

Mr Hinton said the Bewl Water proposal was a reason why the company was asking the competition regulator to allow it to raise more money from customers.

South East Water suspects “something to do with the level” of water at its Pembury reservoir contributed to the supply failure but the firm wants to “do a full investigation”, he said.

The company introduced hosepipe restrictions in July for Kent and Sussex customers after dry weather earlier in 2025.

The Drinking Water Inspectorate said it was investigating the Tunbridge Wells loss of supply incident.

-

Business1 week ago

Business1 week agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Business6 days ago

Business6 days agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Business6 days ago

Business6 days agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Sports6 days ago

Sports6 days agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Tech7 days ago

Tech7 days agoFor the First Time, AI Analyzes Language as Well as a Human Expert

-

Business1 week ago

Business1 week agoIPO Explained: Meaning, Process, Benefits, Risks

-

Tech3 days ago

Tech3 days agoT-Mobile Business Internet and Phone Deals

-

Business3 days ago

Business3 days agoBP names new boss as current CEO leaves after less than two years