Business

US-India trade: Tariffs to hit leather sector; Kolkata exporters pondering ‘Made in Europe’ question – Times of India

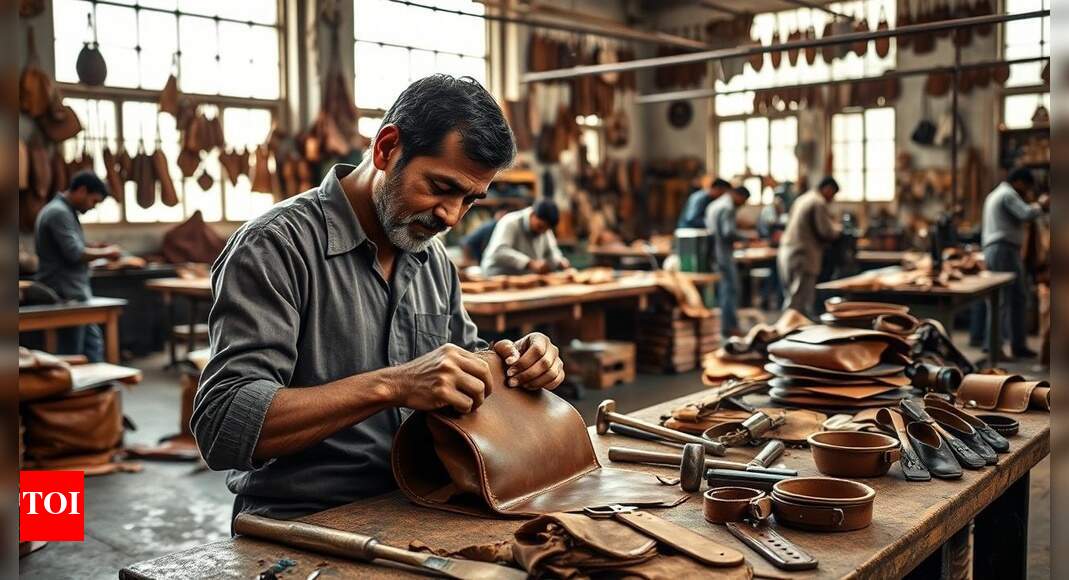

India’s leather industry, a vital labour-intensive sector with exports worth $4.1 billion, has been hit hard by US President Donald Trump’s decision to impose a 25% tariff on imports from India. The move, coupled with an additional 25% tariff on Russian oil purchases from 27 August 2025, is expected to deepen the crisis exporters are facing.Government data shows India exported nearly $4.1 billion worth of leather and leather products between April 2024 and February 2025, with the US accounting for $870 million. The American market makes up around 20% of India’s overall leather exports. Kolkata, one of the country’s key hubs for leather goods, faces the sharpest impact as West Bengal alone contributes 50% of India’s exports in this sector. Out of 2,020 tanneries nationwide, 538 operate in the state, which also houses 230 leather footwear units and 436 leather goods units, according to an ET report.According to experts, the sudden spike in duties has left them paralysed. Ramesh Juneja, vice chairman of the Council for Leather Exports, explained the uncertainty saying, “The industry is in a wait-and-watch mode. We are unable to offer any discounts to buyers either. Right now, we are just waiting for some clarity to emerge. Last year, the leather industry did Rs 50,000 crore business in leather and leather product exports and footwear. The US market is a significant geography for us.”Industry leaders further warned that the tariff structure will make Indian products far less competitive. “If it sticks to where it is now, we will have about an 8.5% MFN tax; 25% would be the reciprocal tax, and then the 25% extra tariff for the oil trade with Russia. This is going to have an impact on the price and cost at which the American importer imports the product from this country,” Arjun Mukund Kulkarni, president of the Indian Leather Products Association (ILPA) told ET. He also added that the shock will ripple into European markets as well, as Kolkata made products are sold to the Europe which then sells them to America.“So, it is going to be a challenge, and we will have to figure out ways and means around this situation,” Kulkarni noted.Exporters are already considering workarounds, such as partial production in Europe, ET reported. “A lot of people are thinking on these lines, and it could then be labelled as a ‘Made in Europe’ product, or from any other country where the final production takes place before being sold to the US. So, people are looking at such ideas where the final product can have a ‘Made in Europe’ stamp,” Kulkarni said.The footwear category is expected to suffer the most, given that it represents 40% of leather products worldwide. Kanishk Maheshwari, co-founder and managing director of Primus Partners India, highlighted the scale of the problem saying, “In 2024-25, leather footwear exports to the US were close to $500 million, which had been growing steadily over the last four years. With this new tariff, a pair of shoes that landed at $100 in US retail will now face almost 10 times more duty (from 5-8% to 50% now) and add an extra $50 to the price, while Vietnamese or Indonesian footwear competes at a duty of just 19-20%. This cost gap alone explains why US buyers are already pivoting orders away from the Agra and Kanpur clusters.”Although Vietnam, Indonesia and China also face tariffs, theirs remain significantly lower, Vietnam at 20%, China at 30%, and Bangladesh at 35%. “Only India and Brazil are subject to a 50% US tariff. This has instantly wiped the competitiveness that India had worked to build through various schemes like rebates under RoDTEP and various export incentives. India’s 1% share in the $100-billion US leather import market is about to shrink further,” Maheshwari told the outlet.Experts suggest market diversification, product repositioning, and quality upgrades may soften the blow, but stress that government support will be crucial. Kulkarni calls for urgent intervention, “The government needs to come up with some revolutionary ideas, subsidising or supporting the industry. The Brazilian government, for instance, has reached out and is giving subsidies. The Indian government will also have to think about something to keep the exporters afloat amid such high tariffs.”

Business

India’s $5 Trillion Economy Push Explained: Why Modi Govt Wants To Merge 12 Banks Into 4 Mega ‘World-Class’ Lending Giants

India’s Public Sector Banks Merger: The Centre is mulling over consolidating public-sector banks, and officials involved in the process say the long-term plan could eventually bring down the number of state-owned lenders from 12 to possibly just 4. The goal is to build a banking system that is large enough in scale, has deeper capital strength and is prepared to meet the credit needs of a fast-growing economy.

The minister explained that bigger banks are better equipped to support large-scale lending and long-term projects. “The country’s economy is moving rapidly toward the $5 trillion mark. The government is active in building bigger banks that can meet rising requirements,” she said.

Why India Wants Larger Banks

Sitharaman recently confirmed that the government and the Reserve Bank of India have already begun detailed conversations on another round of mergers. She said the focus is on creating “world-class” banks that can support India’s expanding industries, rising infrastructure investments and overall credit demand.

She clarified that this is not only about merging institutions. The government and RBI are working on strengthening the entire banking ecosystem so that banks grow naturally and operate in a stable environment.

According to her, the core aim is to build stronger, more efficient and globally competitive banks that can help sustain India’s growth momentum.

At present, the country has a total of 12 public sector banks: the State Bank of India (SBI), the Punjab National Bank (PNB), the Bank of Baroda, the Canara Bank, the Union Bank of India, the Bank of India, the Indian Bank, the Central Bank of India, the Indian Overseas Bank (IOB) and the UCO Bank.

What Happens To Employees After Merger?

Whenever bank mergers are discussed, employees become anxious. A merger does not only combine balance sheets; it also brings together different work cultures, internal systems and employee expectations.

In the 1990s and early 2000s, several mergers caused discomfort among staff, including dissatisfaction over new roles, delayed promotions and uncertainty about reporting structures. Some officers who were promoted before mergers found their seniority diluted afterward, which created further frustration.

The finance minister addressed the concerns, saying that the government and the RBI are working together on the merger plan. She stressed that earlier rounds of consolidation had been successful. She added that the country now needs large, global-quality banks “where every customer issue can be resolved”. The focus, she said, is firmly on building world-class institutions.

‘No Layoffs, No Branch Closures’

She made one point unambiguous: no employee will lose their job due to the upcoming merger phase. She said that mergers are part of a natural process of strengthening banks, and this will not affect job security.

She also assured that no branches will be closed and no bank will be shut down as part of the consolidation exercise.

India last carried out a major consolidation drive in 2019-20, reducing the number of public-sector banks from 21 to 12. That round improved the financial health of many lenders.

With the government preparing for the next phase, the goal is clear. India wants large and reliable banks that can support a rapidly growing economy and meet the needs of a country expanding faster than ever.

Business

Stock market holidays in December: When will NSE, BSE remain closed? Check details – The Times of India

Stock market holidays for December: As November comes to a close and the final month of the year begins, investors will want to know on which days trading sessions will be there and on which days stock markets are closed. are likely keeping a close eye on year-end portfolio adjustments, global cues, and corporate earnings.For this year, the only major, away from normal scheduled market holidays in December is Christmas, observed on Thursday, December 25. On this day, Indian stock markets, including the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), will remain closed across equity, derivatives, and securities lending and borrowing (SLB) segments. Trading in currency and interest rate derivatives segments will continue as usual.Markets are expected to reopen on Friday, December 26, as investors return to monitor global developments and finalize year-end positioning. Apart from weekends, Christmas is the only scheduled market holiday this month, making December relatively quiet compared with other festive months, with regards to stock markets.The last trading session in November, which was November 28 (next two days being the weekend) ended flat. BSE Sensex slipped 13.71 points, or 0.02 per cent, to settle at 85,706.67, after hitting an intra-day high of 85,969.89 and a low of 85,577.82, a swing of 392.07 points. Meanwhile, the NSE Nifty fell 12.60 points, or 0.05 per cent, to 26,202.95, halting its two-day rally.

Business

North Tyneside GP says debt stress causing mental health issues

A GP says patients are presenting with mental health problems because of stress they feel over their levels of personal debt.

According to Citizens Advice, north-east England has the second highest number of people who require professional assistance with debt problems – only London is higher.

Debt charity StepChange said in 2024 the highest concentration of their clients were in the North East, with 37 clients per 10,000 adults.

Dr Kamlesh Sreekissoon, who works as a GP in North Tyneside, said people were juggling “three or four jobs” in the build up to Christmas in order to manage and subsequently struggling with their mental health.

The most common reason for personal debt as reported by Stepchange’s North East clients is a rise in the cost of living (19.3%) and a lack of control over finances (19%).

Both these statistics outstrip the UK figures of 17.7% and 17.9% respectively.

Citizens Advice said thousands of people were falling deeper into debt to meet the cost of basic essentials such as food and fuel, rather than luxuries, but that people also felt under pressure to provide for Christmas.

Dr Sreekissoon said the stress caused by the debt people faced was compounded by issues relating to their family situations.

“At this time of year you will see people juggling three or four jobs, also after caring for elderly relatives, parents, [they’re] stressed out and unfortunately struggling with their mental health,” said Dr Sreekissoon.

He said the debt his patients described was not caused by buying unnecessary things, but by simply struggling to make ends meet.

“It’s more the basics,” he said. “I see people taking on working long hours, doing two or three jobs, and just being kind of stretched out, not being able to see their kids, and that just burns people out which is really sad to see”.

-

Sports7 days ago

Sports7 days agoWATCH: Ronaldo scores spectacular bicycle kick

-

Entertainment7 days ago

Entertainment7 days agoWelcome to Derry’ episode 5 delivers shocking twist

-

Politics7 days ago

Politics7 days agoWashington and Kyiv Stress Any Peace Deal Must Fully Respect Ukraine’s Sovereignty

-

Business7 days ago

Business7 days agoKey economic data and trends that will shape Rachel Reeves’ Budget

-

Tech5 days ago

Tech5 days agoWake Up—the Best Black Friday Mattress Sales Are Here

-

Fashion7 days ago

Fashion7 days agoCanada’s Lululemon unveils team Canada kit for Milano Cortina 2026

-

Tech5 days ago

Tech5 days agoThe Alienware Aurora Gaming Desktop Punches Above Its Weight

-

Politics7 days ago

Politics7 days ago53,000 Sikhs vote in Ottawa Khalistan Referendum amid Carney-Modi trade talks scrutiny