Business

Wafi Energy may invest up to $100m in Pakistan in 2–3 years | The Express Tribune

ISLAMABAD:

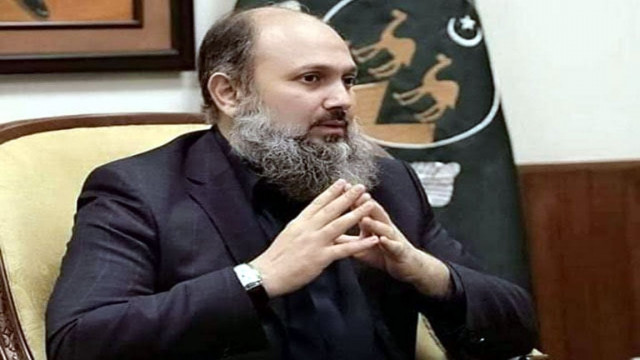

Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb on Monday said sustaining macroeconomic stability and strengthening foreign exchange buffers were central to restoring investor confidence, as Wafi Energy Pakistan Ltd indicated it was considering investments of up to $100 million in Pakistan over the next two to three years.

According to a statement issued by the Ministry of Finance, the meeting was held at the Finance Division with a delegation of Wafi Energy Pakistan Ltd led by Javaid Akhtar, Chief Finance Officer of Asyad Group and a board member of Wafi Energy Pakistan Ltd. The delegation also included Zubair Shaikh, Chief Executive Officer, and Zarrar Mahmud, Chief Finance Officer, Wafi Energy Pakistan Ltd. The discussion reviewed the company’s existing operations, its investment outlook and broader issues affecting the oil marketing and energy sector.

The finance minister said sustained macroeconomic stability remained the cornerstone of the government’s economic strategy and was essential for maintaining and deepening investor confidence. He said recent improvements in foreign exchange availability reflected the impact of macroeconomic discipline and reforms, adding that stronger external buffers would allow smoother facilitation of legitimate business transactions, including dividend repatriation and cross-border payments.

Aurangzeb said improving macroeconomic indicators were already translating into greater confidence among domestic and foreign investors and described these trends as fundamental to a healthy investment climate. He added that stronger participation by local investors helped reinforce foreign investment inflows and contributed to broader market confidence.

The meeting also discussed the role of public-private partnership models and structured finance in delivering large-scale infrastructure projects. The finance minister said experiences at the provincial level had demonstrated the potential of such approaches and underlined the need to encourage structured finance solutions and deeper engagement with the banking sector to support infrastructure development.

The Wafi Energy delegation said the company had benefited from improved operating conditions amid greater macroeconomic stability and shared its intention to expand its retail and storage footprint over the coming years. The delegation said the outlook had improved following greater predictability in the operating environment and noted growing interest among international and regional stakeholders in expanding engagement with Pakistan. The delegation briefed the minister on the company’s current operations, saying Wafi Energy Pakistan Ltd operated an extensive nationwide retail network supported by ongoing investments in modernisation and efficiency. It said improved macroeconomic conditions had enabled the company to resume and scale up investment activity following recent business integration.

Wafi Energy Pakistan Ltd informed the minister that it was considering potential investment of up to $100 million over the next two to three years to expand its retail footprint and storage capacity. The planned investments would focus on network growth, infrastructure development and technology-driven improvements aimed at strengthening supply resilience, improving service standards and contributing to long-term growth of Pakistan’s energy sector. The delegation said the company had undertaken significant digitisation initiatives across its operations as part of a broader modernisation strategy, citing efforts to improve transparency, operational efficiency and regulatory compliance.

Industry-related issues were also discussed, with the delegation emphasising the importance of a stable, transparent and predictable policy framework for long-term investment decisions in the oil marketing sector. It said clarity and consistency across regulatory, fiscal and operational domains were critical for sustaining investment momentum in a capital-intensive and highly regulated industry.

The delegation raised fiscal and taxation-related considerations and stressed the need for a clear and consistent framework to support business planning and investment confidence. It said continued engagement between the government and industry stakeholders would help align policy measures with broader reform and investment objectives.

Aurangzeb reaffirmed the government’s commitment to privatisation and outsourcing as a core policy direction, saying the private sector was better positioned to manage and operate commercial assets efficiently. He said recent privatisation initiatives had attracted strong investor interest and that future transactions would follow transparent, competitive and well-publicised processes.

The minister also highlighted digitisation as a national priority, noting uneven progress across sectors. He said firm policy measures were required to accelerate implementation and ensure transparency and regulatory oversight, adding that sector-related matters would be reviewed with relevant ministries and regulators.

Aurangzeb referred to ongoing high-level engagement with international partners, including Saudi Arabia, and said reforms, privatisation, digitisation and investment facilitation formed interconnected pillars of the government’s economic agenda.

Business

Sensex Gains 2,072 Points, Nifty Above 25,700; US-India Trade Deal Among Key Factors Behind Rally

Last Updated:

Indian benchmark indices staged a powerful rally, with the Nifty and Sensex surging up to 4.7% and 4.4% respectively; Know key reasons

Nifty50

Indian benchmark indices staged a powerful rally, with the Nifty and Sensex surging up to 4.7% and 4.4%, respectively, marking one of their strongest single-day advances. The sharp upswing followed the announcement of a long-awaited India–US trade agreement, which helped ease tariff-related worries that had weighed on domestic equities for months.

The benchmark BSE Sensex ended 2072.67 points higher or 2.54% to end at 83,739.13. The Nifty 50 climbed 639.15 points, or 2.55%, to end at 25,727.55 during the session.

Earlier in the day, the BSE Sensex jumped 5.1% during the session to hit an intraday peak of 85,871.73. Meanwhile, the Nifty 50 advanced by 1,252 points, or 5%, climbing to 26,341.2 as buying intensified across the board.

The sharp move also led to a massive rise in investor wealth. The combined market capitalisation of BSE-listed companies increased to Rs 467.35 lakh crore from ₹455 lakh crore in the previous session, translating into a gain of more than Rs 12.5 lakh crore in a single day as participation broadened across sectors.

Highlighting the reasons that are fueling the Indian stock market today, Santosh Meena, Head of Research at Swastika Investmart, said, “The Indian stock market today is in a bull trend due to the announcement of the India-US trade deal. The much-awaited trade deal has the potential to significantly improve sentiment across markets and among FIIs. After a strong gap-up opening during the Opening Bell, the possibility of the Nifty 50 index hitting fresh all-time highs in the near term cannot be ruled out. The Indian rupee is also expected to strengthen meaningfully.”

On segments that may benefit in upcoming sessions after the India-US trade deal, Santosh Meena of Swastika Investmart, said, “Export-oriented sectors are likely to be the key beneficiaries—textiles and apparel, gems & jewellery, leather, marine/seafood (shrimp), auto ancillaries, engineering goods, speciality chemicals, and select electronics and consumer goods. Pharma and IT/services may also witness an indirect sentiment boost.”

What’s driving the rally

India–US trade deal

After prolonged negotiations, India and the US sealed a trade agreement under which Washington cut reciprocal tariffs on Indian goods to 18% from 50%. In return, India will reduce tariffs and non-tariff barriers on American products. The breakthrough removes a major uncertainty that had kept foreign investors cautious and contributed to Indian equities’ underperformance. Through January, the Nifty had slumped over 1,000 points at its worst, even as foreign portfolio investors sold heavily.

Rupee strength adds comfort

A stronger rupee also supported sentiment, easing some pressure from global volatility. The currency opened at 90.40 against the dollar versus its previous close. Analysts believe the combined effect of the India–US deal, progress on the EU trade front and a growth-focused Budget could lift sentiment and revive risk appetite across markets.

FII short covering

Short covering by foreign institutional investors amplified the rebound. With bearish positions estimated to be close to 90%, traders rushed to unwind shorts as indices rebounded from oversold levels and the Nifty reclaimed the 26,000 mark. Anand James, Chief Market Strategist at Geojit Investments, said a sustained move above 25,000 opens the door to 25,800 and possibly 26,200, though failure to hold above 25,800 could trigger consolidation toward the 25,430–25,340 zone.

Heavyweights power gains

Large-cap stocks led from the front. Reliance Industries climbed nearly 4%, while Adani Ports surged about 8%, giving strong momentum to the benchmarks. HDFC Bank, L&T, Bajaj Finance, ICICI Bank, Infosys and Eternal gained up to 5%. Optimism around the Union Budget 2026’s capital expenditure push further strengthened expectations of better order flows.

Buzz for strong quarterly numbers

On how the India-US trade deal may benefit the Indian stock market in the medium to long term, Seema Srivastava, Senior Research Analyst at SMC Global Securities, said, “The India-US deal is expected to benefit export-oriented companies, especially the auto, IT, textile, pharma, gems and jewellery. So, companies from these segments are expected to report strong quarterly numbers in the upcoming quarters.” She said that the market would try to discount that buzz much before the companies start reporting such robust quarterly numbers.

Supportive global cues

Global markets also offered tailwinds. The Dow Jones rose roughly 515 points (1.05%), the S&P 500 gained 0.5%, and the Nasdaq advanced about 0.6%. Asian equities rallied, with Japan’s Nikkei jumping around 3% and South Korea’s Kospi soaring over 5%. Hong Kong’s Hang Seng and China’s CSI 300 posted modest gains, while Australia’s S&P/ASX 200 climbed 1.3% after the Reserve Bank of Australia raised its policy rate by 25 basis points to 3.85%, its first hike since November 2023.

Stocks to buy after India-US trade deal

On stocks to buy in the wake of the India-US trade deal and the reduction of Trump’s tariffs on India, Anuj Gupta, a SEBI-registered market expert, recommended 21 stocks to buy today from the auto, IT, pharma, textile, and defence sectors.

Pharma: Aurobindo Pharma, Cipla, and Glenmark Pharmaceuticals.

Defence: BEL, HAL, and Cochin Shipyard.

IT: TechM, HCL Tech, Wipro, and Infosys.

Textile: Trident and Welspun Living.

Auto and Auto Ancillary: Eicher Motors, Tata Motors, TVS Motor, Bajaj Auto, JBM Auto, Bosch, Amara Raja, and Exide Industries.

February 03, 2026, 11:30 IST

Read More

Business

Hyundai Motor India’s Q3 profit rises 6.3% to Rs 1,234 crore

Mumbai: Hyundai Motor India Limited on Monday reported a solid performance in the third quarter (Q3) of FY26, with its consolidated net profit rising 6.3 per cent year-on-year to Rs 1,234.4 crore. The growth was supported by steady demand in the domestic market, strong export numbers and higher sales during the festive season, the company said in its stock exchange filing.

Revenue from operations during the quarter increased 8 percent compared to last year to Rs 17,973.5 crore. Operating performance also improved, with EBITDA rising 7.6 percent year-on-year to Rs 2,018.3 crore. The EBITDA margin stood at 11.2 percent, remaining broadly stable compared to the same period last financial year.

The company said domestic demand during the quarter benefited from GST 2.0-related advantages and festive-season momentum.

Wholesale volumes rose 5 per cent sequentially, supported by strong retail sales across key models.

Exports played an important role in overall growth, with export volumes jumping 21 per cent year-on-year in the December quarter.

Exports contributed around 25 per cent to Hyundai Motor India’s total sales during the period.

On the product front, the Creta once again emerged as a key growth driver. The SUV reclaimed its position as India’s best-selling SUV and achieved its highest-ever annual sales of more than 2 lakh units in calendar year 2025.

The newly launched Venue also saw healthy demand, with nearly 80,000 bookings so far. The company said first-time buyers accounted for 48 per cent of the total bookings for the model.

For the nine months ended December 31, 2025, Hyundai Motor India reported EBITDA of Rs 6,632.5 crore, marking a year-on-year growth of 3.3 per cent.

EBITDA margins expanded to 12.8 per cent despite higher costs related to capacity stabilisation and commodity prices. Net profit for the nine-month period rose to Rs 4,175.9 crore.

Commenting on the results, Managing Director and CEO Tarun Garg said the company delivered healthy growth in volumes, revenue and profitability during the quarter.

He added that an improved sales mix and disciplined cost management helped support margins on a year-to-date basis.

Garg also highlighted strong sales in January 2026 as a positive sign for the rest of the financial year.

Business

India-US trade deal: Hope and uncertainty as Trump cuts tariffs

Indian industry has welcomed lower tariffs, but experts caution against celebration until details are clearer.

Source link

-

Sports7 days ago

Sports7 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports7 days ago

Sports7 days agoCollege football’s top 100 games of the 2025 season

-

Entertainment7 days ago

Entertainment7 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics7 days ago

Politics7 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade

-

Entertainment6 days ago

Entertainment6 days agoK-Pop star Rosé to appear in special podcast before Grammy’s