Business

Hurricane season brings financial fears in the Caribbean

Gemma HandyBusiness reporter, St Johns, Antigua

Getty Images

Getty ImagesFor some Barbudans, thunderstorms still trigger flashbacks of the night in September 2017 when they lost everything they owned to Hurricane Irma’s devastating winds.

Eight years on, while memories may be close to hand, home insurance for many on Barbuda and other islands in the Caribbean’s hurricane belt is more prohibitively expensive than ever.

Across the region premiums have gone through the roof in the past two years, surging by as much as 40% on some islands, according to industry figures.

Experts blame a perfect storm of increasing risk – as the region sees worsening and more rapidly intensifying cyclones – yet tiny populations of people to pay for policies, equating to poor returns for insurance companies.

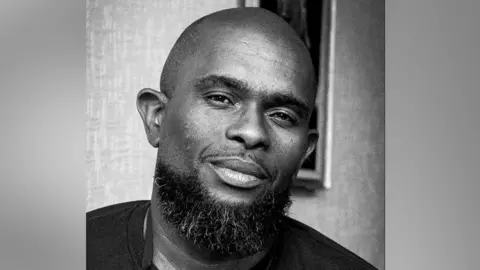

Dwight Benjamin’s Barbuda home was one of few left relatively undamaged by Irma. After the storm, he invested in a one-room extension topped with a concrete roof that will serve as a shelter for his family should disaster strike again.

“I think the house should be sound enough but that’s my added protection,” he says.

With peak hurricane season now in full swing, Dwight is among many Caribbean people anxiously monitoring weather platforms for activity in the Atlantic. Should a system head his way, he will do as he did during Irma – hope and pray.

“I’ve never had insurance; most Barbudans don’t really think it’s worth it. It’s just an added expense to the meagre resources we have,” he explains.

“Plus, we believe in what we have built and that it should be able to withstand the weather.”

Courtesy Dwight Benjamin

Courtesy Dwight BenjaminLike Dwight, many Caribbean people build homes “out of pocket”, rather than opting for mortgages that can have high interest rates in this part of the world.

And the majority of homes on islands affected by hurricanes are uninsured. In Jamaica only 20% are reported to have cover, and just half in Barbados.

It is not just storms threatening the region, but earthquakes and volcanos too, points out Peter Levy, boss of Jamaican insurance company BCIC.

As a result of these threats of natural disaster, which Mr Levy calls the Caribbean’s “unique market”, the cost of home insurance will always be high.

One Antiguan insurance firm, Anjo, typically charges premiums of between 1.3% and 1.7% of a home’s value. Whereas in the UK, for example, it can be less than 0.2%.

Getty Images

Getty ImagesThe Atlantic hurricane season runs from 1 June to 30 November, with the most activity occurring between mid-August and mid-October. The northern Caribbean nations, such as Antigua and Barbuda, the Bahamas, British Virgin Islands, and the Dominican Republic, are among the most at risk of a direct hit.

The peak months can be torturous for people with Irma-related trauma, says Mohammid Walbrook, another Barbudan resident. “Whenever there’s an announcement of a storm coming our way, it brings back bad memories. For some, even thunder and lightning are a trigger,” he says.

Back in 2017, Mohammid took shelter in a bathroom with his mother, father, sister and nephews when Irma’s category five winds tore the roof from his parents’ home.

His own uninsured two-bedroom property was also badly damaged. He was one of several Barbudans to receive a new house through assistance from international donors.

Courtesy Mohammid Walbrook

Courtesy Mohammid WalbrookWhile some Caribbean countries – like British territory Turks and Caicos, also battered by Irma – have emergency cash reserves that can help with post-storm restoration, others do not have that luxury.

For deeply indebted nation Antigua and Barbuda, agencies like the United Nations Development Programme (UNDP) are a lifeline in the aftermath of a natural disaster.

The country’s prime minister Gaston Browne estimated the cost of rebuilding Barbuda after Irma, where 90% of buildings were damaged, topped $200m (£148m). Help came from China, the European Union and Venezuela, among others.

In 2017, the UNDP stumped up $25m for Barbuda and the island country of Dominica, which was ravaged by Hurricane Maria that same month.

The money restored more than 800 wrecked buildings across the two islands. But the body’s intervention was crucial in other ways too.

With livelihoods destroyed, the UNDP’s cash-for-work programme hired hundreds of local residents who had suddenly found themselves unemployed.

They assisted with everything from debris removal to reconstruction of homes and infrastructure, including Barbuda’s hospital and post office, the UNDP’s Luis Gamarra tells the BBC.

“Injecting economic resources into affected families helps reactivate the local economy,” he says.

Almost 1,000 contractors were also trained in more resilient “build back better” techniques, to safeguard structures against future disasters.

“The climate is changing and putting more pressure on governments and communities. Storms are becoming more frequent, more intense and happening earlier in the year too,” Mr Gamarra continues.

He thinks the expansion of partnerships with the private sector and with other countries in the region might help mitigate the impacts.

One such mechanism is the Caribbean Catastrophe Risk Insurance Facility, of which 19 Caribbean governments are members. Set up after Hurricane Ivan in 2004, the first-of-its-kind risk-pooling venture allows member governments to buy disaster coverage at low cost.

Last year it made record payments topping $85m to Hurricane Beryl-hit islands.

In Antigua and Barbuda, hurricane preparedness is a year-round endeavour, explains Sherrod James, director of the country’s office of disaster services.

Assessments of buildings to be used as storm shelters, along with training of volunteers to man them, starts months before the season starts, he says.

“We also meet with the private sector, helping them put policies and preparations in place, looking at the safety and resilience of their buildings. We make sure our critical partners, such as the ports, are prepared.

“And we do a lot of proactive work to address chokepoints within waterways that can exacerbate flooding,” adds Mr James. “These days, storms can go from a category one to five in a day. The new norm has thrown out the old regiment of what has to be done; we have to be much more proactive now.”

For many Barbudans, this time of year will always bring trepidation. Dwight was among dozens who recently attended a Hurricane Irma remembrance service at the island’s Pentecostal Church.

“It was very touching and brought back a lot of memories,” he says. “This time of year, we keep an eye on the weather and our fingers crossed. But we are resilient people and we know how to survive.”

Business

Lawsuit over $21 million donor-advised fund highlights risks of DAF giving

Ridvan_celik | Istock | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

With donor-advised funds gaining popularity as a vehicle for the wealthy to give back, risks and potential conflicts of interests are emerging — and being put on display in a lawsuit over a family’s $21 million charitable fund.

Philip Peterson, a 63-year-old Kansas resident, filed suit in January alleging that the nonprofit that administers his family’s donor-advised fund has refused to communicate with him and has failed to make charitable grants that he has recommended since early 2024. The suit, filed in Colorado federal court, alleges the Christian nonprofit, called WaterStone, cut off his access to information about the account and that he doesn’t know how the fund has fared since the end of 2023, when it had $21 million in assets.

Counsel for WaterStone, founded as the Christian Community Foundation, said in a statement that the Colorado Springs nonprofit has respected the wishes of Peterson’s late father, who originally created the fund in 2005 and died in 2019.

The case sheds light on the growing uptake, and dangers, of donor-advised funds, or DAFs, which have quickly become one of the most dominant forces in philanthropy. Americans donated nearly $90 billion to DAFs in 2024, per the most recent annual report from the DAF Research Collaborative. According to the most recent data available, DAFs held $326 billion combined in assets in 2024.

For Americans looking to give back and save on taxes, DAFs are marketed as a flexible and simple way to do so, often described as charitable saving accounts or credit cards. Instead of writing a check to a nonprofit, donors contribute cash and other assets to a DAF. While the tax deduction is immediate, the funds can be allocated to charities later.

DAFs, unlike private foundations, are not required to distribute assets within a given timeframe, a common criticism among opponents who say DAFs are wealth hoarding vehicles.

The Peterson case offers a cautionary tale on the tradeoffs – especially when it comes to control. While donors are able to recommend how the funds are distributed to charity, the assets are legally controlled by the organizations that administer the DAF on their behalf. Though these organizations, also known as sponsors, typically respect their donors’ wishes, donors have little recourse if they do not.

“It’s sold to the public as, ‘This is your account, and you can decide where it goes, and you can move it, and you maintain full control.’ But if you don’t give up dominion and control, you don’t get the tax benefits,” said Ray Madoff, tax scholar and professor at Boston College Law School. “There’s a disconnect between the legal rules that govern it and the understanding of the parties. And this case is a perfect example of it.”

How much to give

Peterson told Inside Wealth that the rift with WaterStone started with a disagreement over how much to distribute.

In early 2024, Peterson alleges, WaterStone CEO Ken Harrison told him that the organization was going to keep the fund’s principal in perpetuity and only make grants from investment income. Peterson said he did not agree to the proposal as this would not allow the fund to make its customary annual grants of between $2.3 million and $2.5 million.

He further alleges that in March 2024, after he told Harrison over Zoom that he wanted to move the DAF to another sponsor, Harrison told him never to contact WaterStone again and abruptly ended the call.

Now Peterson is suing to assert his advisory privileges and regain access to the DAF, which was started by his late father, Gordon Peterson, a real estate investor and devout Christian, to support evangelical Christian causes. Peterson ultimately seeks the court to compel WaterStone to transfer the DAF to another organization so he can bring the fund’s giving back up to speed.

He said he requested WaterStone make a $1 million grant in 2024 but does not know if that grant – or if any grants – were issued that year. In 2025, WaterStone notified Peterson it would permit a $400,000 distribution from the fund, he said.

“I made a promise to my father. I promised him that if I was the remaining person on the account that I would direct the funds as I knew that he would 100% approve,” he said. “I want to be a man of my word.”

Philip Peterson, left, pictured with his father Gordon in 2015. Gordon Peterson passed away in 2019.

Courtesy of Philip Peterson

WaterStone declined to comment on specifics of Peterson’s allegations. The deadline for WaterStone to answer the complaint in court or move to dismiss it is mid-March.

“WaterStone has consistently carried out the articulated wishes of the donor since the donor advised fund in question was established,” WaterStone’s legal counsel said in a written statement, referring to Peterson’s father. “The plaintiff in this case is not the donor.”

Andrew Nussbaum, Peterson’s lawyer, said that WaterStone helped Gordon Peterson appoint his wife, Ruth, and son Philip as co-advisors to the DAF before he died. Ruth Peterson died in 2021, leaving Philip Peterson as the sole successor-advisor. Prior to 2024, WaterStone granted Philip Peterson’s grant requests, Nussbaum said.

Nussbaum said the lawsuit could set a chilling precedent if the court upholds WaterStone’s argument that designated successors do not have advisory privileges.

“If WaterStone is right, you’re talking about billions of dollars being beyond any kind of legal reach of the original donor-advisors or their successors to have any oversight related to the funds,” Nussbaum said.

Moreover, Peterson said he believes WaterStone has not honored his father’s wishes. He alleges that WaterStone has delayed or denied his grant recommendations even though they met the mission statement written by his father, which included a list of approved charities.

“I can tell you this: My dad would never have created a donor-advised fund if he knew that this was going to be the outcome. He felt very passionately about this,” he said.

DAF trade-offs

Law professor and DAF critic Roger Colinvaux said in his view, donors who want control of DAF assets are trying to have their cake and eat it too.

“Whether you like DAFs or not, the DAF sponsor is an independent charity. It’s an independent entity, and its duties are not to the donor,” said Colinvaux, professor at the Columbus School of Law at the Catholic University of America. “If the plaintiff wanted the sort of control that the plaintiff seems to want, as evidenced in the complaint, there’s a structure for that, and that’s a private foundation.”

Dana Brakman Reiser, professor at Brooklyn Law School, cautioned that Peterson’s story is a rare scenario. She said the biggest DAF sponsors like Fidelity Charitable and Schwab Charitable (now DAFgiving360) are affiliated with financial institutions and generally inclined to keep donors happy.

“It’s in their interest as long as honoring the donor’s request is not going to get the sponsor in trouble,” she said. Brakman Reiser added that the IRS prohibits using DAF assets to buy gala tickets or pay college tuition.

Still, the interests of sponsors and donor-advisors are rarely perfectly aligned.

Sponsors typically collect fees for managing DAF assets, creating an inherent financial incentive to disburse fewer assets, according to Chuck Collins, the director of the Program on Inequality and the Common Good at the Institute for Policy Studies, a progressive think tank. While community foundations pioneered the DAF model, they are now competing with larger commercially-affiliated sponsors for donors’ dollars, he added.

“More and more, they are having to compete with the commercial DAFs like Fidelity that have very low overhead and don’t take much in the way of fees. And so what’s the business model for a community foundation where, you know, 80% of the donations coming in are from people wanting to create DAFs?” he said. “In reality, their business model now depends on people parking their assets for longer periods of time.”

While Peterson’s case is unusual, it’s not the first legal challenge surrounding DAFs.

In 2018, a hedge fund couple sued Fidelity Charitable, contending the sponsor broke an agreement to liquidate their donated shares gradually and instead sold off 1.93 million shares, a position originally worth $100 million, in a matter of hours. Fidelity Charitable argued that it had followed the law and the case was ruled in their favor.

In another noteworthy debacle, in 2009, a Virginia-based charity called the National Heritage Foundation wiped out 9,000 DAFs worth $25 million combined to pay out creditors after it filed for bankruptcy.

Giving directly to charity doesn’t necessarily guarantee the assets will be used to the donor’s intent. But adding an intermediary into the equation adds another layer of complexity.

The handful of lawsuits filed by donor-advisors over how DAF assets are spent or invested have thus far been largely unsuccessful in court.

In short, according to Colinvaux, courts have upheld that donors have ceded any control in order to qualify for the tax break. If donors had the right to control assets — as opposed to the privilege to advise — they would not be able to claim a deduction, he said.

Nussbaum said Peterson’s case is different as it focuses on his rights to advise grants rather than control over how the assets are investments.

Peterson said he tried to resolve the dispute with Waterstone for about two years before going to court. While he knows his suit faces considerable odds, he said he felt he had no choice.

“People put an enormous amount of trust in these companies, and we’re hopefully going to find out what these companies can and can’t do,” he said. “It may have a big effect on the industry, and I don’t want to be that guy. All I want to do is to be able to continue my father’s legacy.”

Correction: This story has been updated to correct the IRS limitations on use of DAF assets.

Business

Mandelson referred to EU anti-fraud agency over Epstein emails

The European Commission says it is assessing whether the peer breached its code of conduct while its trade envoy.

Source link

Business

The NBA doesn’t just want to build a European basketball league — it wants to revolutionize the international pro game

-

Tech7 days ago

Tech7 days agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Fashion6 days ago

Fashion6 days agoICE cotton ticks higher on crude oil rally

-

Business6 days ago

Business6 days agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Business5 days ago

Business5 days agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Entertainment6 days ago

Entertainment6 days agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Sports5 days ago

Sports5 days agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Tech1 week ago

Tech1 week agoDonald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past

-

Entertainment5 days ago

Entertainment5 days agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs