Business

‘Zero faith’: If Trump’s tariffs are overturned, how easily will businesses get back billions in refunds? It could be a nightmare! – The Times of India

Donald Trump administration’s tariff collections – running into billions of dollars – is threatened in case the Supreme Court decides to strike down the US President’s tariff policies. Trump himself has warned that any decision against his tariff policies would spell disaster.Businesses, which have paid huge amounts in the last few months due to country-based tariffs, believe that getting back refunds in case the tariffs are deemed illegal by the Supreme Court, would be a nightmare.

Tariff refund nightmare

To begin with, this would create administrative challenges involving extensive refund processing. If these nation-specific tariffs are ruled unlawful, the United States might need to return most of the $165 billion in customs duties collected in the current fiscal year to the businesses that paid them, according to a Bloomberg report.However, obtaining refunds will be complicated; reimbursements typically come via paper cheques through a slow process, and whilst the government could expedite mass repayments, experts believe this is doubtful.“The customs authorities won’t simply distribute refunds to importers freely,” Lynlee Brown, global trade partner at EY was quoted as saying by Bloomberg.The uncertainty surrounding the potential refund process exemplifies the broader confusion that businesses and financial markets have experienced since the implementation of Trump’s tariff policies.Several importers have abandoned expectations of receiving reimbursements, even if the court rules in their favour.“I have zero faith we’d ever get anything. Just zero,” expressed Harley Sitner, who owns Peace Vans, a Seattle-based classic camper van repair and restoration business.

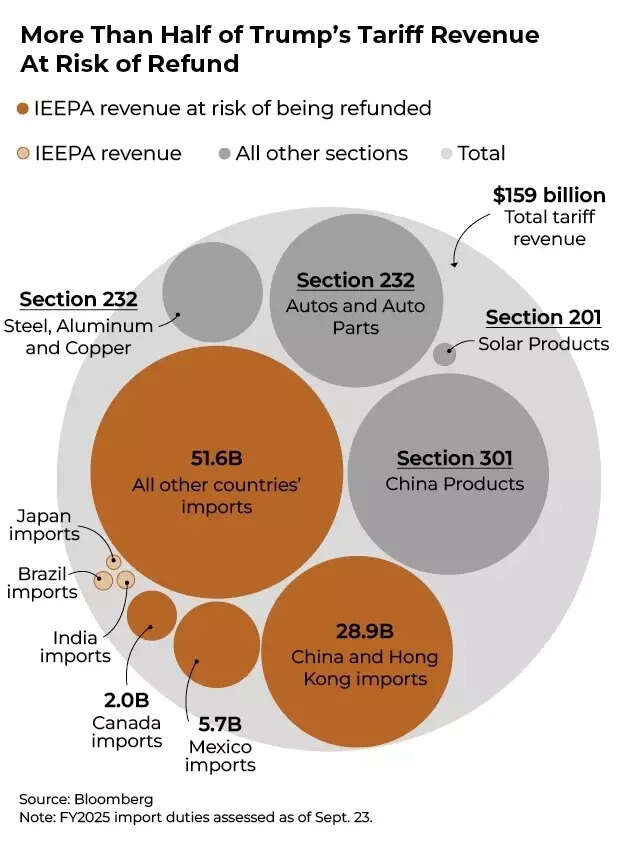

More than half of tariff revenue at risk of refund

Sitner told Bloomberg that the unpredictability of Trump’s trade policies is more problematic than the actual tariff payments, which he views as irretrievable expenses. Following unexpected tariff charges ranging from $221 to $17,000, sometimes arriving months after receiving goods, Sitner has discontinued importing international inventory.“Just yesterday we got a small shipment from Germany worth $2,324 and it came with a $1,164 tariff charge. We can’t back out,” Sitner stated.Various customs brokers report being approached by Wall Street organisations interested in purchasing rights to potential refunds, offering importers an opportunity to recover a portion of their possible entitlements.The significant increase in customs duties – a rise of $95 billion compared to the previous year – is primarily attributed to Trump’s import tariffs affecting multiple economies, which became effective in August, as analysed by Bloomberg Economics. Two lower judicial bodies have ruled that Trump lacked the authority to implement tariffs under the International Emergency Economic Powers Act.Should the Supreme Court uphold these earlier decisions, approximately 50% of the customs duties collected by the United States this year could be subject to refund. However, the process for businesses to reclaim these funds remains uncertain. Despite the government shutdown, tariff-related operations have largely continued uninterrupted.The United States Customs and Border Protection regularly processes refunds for importers in cases of overpayment or regulatory changes, with the Treasury Department issuing the payments. However, this reimbursement process is not automatically initiated.In line with statutory requirements, importers and their customs brokers must adhere to precise timelines and documentation procedures to maintain eligibility for refunds. Currently, the system predominantly relies on paper cheques for disbursement.Despite the Treasury’s directive from the Trump administration to discontinue cheque payments by September 30, the Customs and Border Protection (CBP) only initiated its first phase last Tuesday in what will be an extended implementation process. The system’s completion before any court decision appears unlikely without accelerated efforts.Tom Gould, a customs consultant from Seattle, suggests that potential refunds might result in “it’s possible that we’ll see millions and millions of paper checks being mailed out because each shipment, each customs entry, will have its own.”The process could be problematic. According to the Bloomberg report, due to regulatory requirements, customs refunds are exclusively sent to sanctioned domestic banks in dollars, requiring foreign importers to receive their refunds through international postal services or utilise a broker’s account within the United States.Worryingly, there has been a series of stolen cheque incidents in recent years. According to Gould, refund cheques were intercepted during postal delivery and traded on the dark web before being encashed.The administration possesses various options to expedite refunds, including automated processing of claims using existing system data. CBP has previously implemented refund rationalisation measures.Customs officials developed a framework to facilitate refund disbursement for items eligible under duty exemptions through the Generalised System of Preferences. Despite Congress allowing this programme to expire multiple times since the 1980s, it was subsequently renewed retroactively.Importers would input specific codes indicating GSP eligibility, even during programme inactivity. Gould suggested that the agency could similarly analyse internal data to identify IEEPA code-related tariff payments.Alternative procedures exist, though they might be complex. Legal experts indicate individual importers could be compelled to initiate separate legal proceedings to recover their funds.The authorities might require submission of protests or post-summary amendments, accompanied by comprehensive payment documentation and importer records, despite the government already possessing this information.EY’s Brown recommends importers maintain complete records from CBP’s Automated Commercial Environment platform, documenting entry dates and deadlines systematically to enhance refund possibilities.Despite potential simplified procedures by CBP, the complex nature of financial transactions within supply chains presents additional challenges.For shipments managed through commercial carriers like FedEx Corp. and United Parcel Service Inc., who handle documentation and tariff payments, CBP would direct refunds to the registered importer – the courier service rather than the goods’ owner.This arrangement could generate complications between the actual importers and courier services, creating another obstacle for businesses seeking reimbursement.

Tariff collections: Trump admin may not let go easily

Trump has valued the tariff income, declaring it has restored national wealth. He and his supporters have suggested various uses for these funds, including reducing national debt, supporting struggling agricultural sectors, and potentially distributing payment cheques to US citizens.This suggests the Trump administration will be reluctant to release these funds if the tariffs are invalidated, and they are likely to swiftly implement new levies using alternative legal frameworks should this occur. The Supreme Court is scheduled to review arguments in November regarding this matter.

Business

Gold price soars to new record as US Federal Reserve faces fresh threats

The price of gold has soared to a new record high as concerns about fresh threats to the independence of the US central bank fuel demand for the asset.

The metal climbed by around 2% on Monday morning to a high of 4,600 US dollars (£3,415) per ounce, beating a previous record set in late December.

Rising gold prices typically indicate that investors are seeking out so-called safe haven assets.

These tend to carry less risk than other investments, such as stocks and shares, and often outperform financial markets during periods of turbulence.

Gold prices have shot up by about 70% over the past year, strengthening against broader economic and political uncertainty.

The latest rush to the precious metal came after US central bank chairman Jerome Powell said it was being threatened with a criminal indictment over his testimony about renovations at Federal Reserve office buildings.

It represents a significant escalation in President Donald Trump’s criticism of the Federal Reserve and its decisions not to cut interest rates as quickly as he would prefer.

Mr Powell said in a video statement that the threat of criminal charges undermined the Fed’s role and questioned whether monetary policy will in future be “directed by political pressure or intimidation”.

The news stoked fears that threats to the independence of the central bank were becoming more severe.

While gold prices soared, the US dollar was weakening against key currencies.

The pound was up by nearly 0.5% against the US dollar on Monday morning, to 1.346.

The euro was also up by about 0.4% against the US dollar, at 1.168.

Susannah Streeter, chief investment strategist at Wealth Club, said Wall Street has been “rattled by what’s being viewed as another assault on the independence of the US Federal Reserve”.

“It certainly marks a sharp escalation in the Trump administration’s criticism of the Fed and is unnerving investors given that an independent central bank is considered to be crucial to maintaining sound monetary policy, especially at a time when the mounting US debt pile is coming under scrutiny,” she said.

Chris Beauchamp, chief market analyst at IG, said the dispute “represents a major crisis for markets and has the potential to restart worries about the dollar and US monetary policy”.

The UK’s FTSE 100 took a step back after enjoying a run in recent weeks, having hit new record highs and surpassing the milestone 10,000 mark for the first time.

It was more or less flat by mid-morning on Monday at about 10,123 points.

Barclays was among the biggest fallers on the FTSE 100 on Monday, with its share price down by about 2.5%.

The UK-listed bank has been caught up in the reaction to Mr Trump calling for a one-year cap of 10% on credit card interest rates.

The president said Americans were being “ripped off” by high interest rates on credit and they should be limited from January 20.

Russ Mould, investment director at AJ Bell, said Barclays was one of the largest issuers of credit cards in the US.

“While consumers would love to see lower rates on credit cards, Trump may not be able to enact such a move without approval from Congress,” he said.

“It also raises questions about the knock-on effect of a cap on credit and whether a drop in associated earnings for lenders could lead to reduced availability of credit in general, forcing some consumers and businesses to seek more costly alternatives.”

Business

Ofcom investigates Elon Musk’s X over Grok AI sexual deepfakes

Laura CressTechnology reporter

SOPA Images via Getty

SOPA Images via GettyOfcom has launched an investigation into Elon Musk’s X over concerns its AI tool Grok is being used to create sexualised images.

In a statement, the UK watchdog said there had been “deeply concerning reports” of the chatbot being used to create and share undressed images of people, as well as “sexualised images of children”.

If found to have broken the law, Ofcom can potentially issue X with a fine of up to 10% of its worldwide revenue or £18 million, whichever is greater.

X referred the BBC to a statement posted by its Safety account at the start of January: “Anyone using or prompting Grok to make illegal content will suffer the same consequences as if they upload illegal content.”.

Elon Musk later said the UK government wanted “any excuse for censorship” in response to a post questioning why other AI platforms were not being looked at.

The BBC has seen several examples of digitally altered images on X, in which women were undressed and put in sexual positions without their consent. One woman said more than 100 sexualised images have been created of her.

If X does not comply, Ofcom can seek a court order to force internet service providers to block access to the site in the UK altogether.

Technology Secretary Liz Kendall told the BBC she welcomed the body’s investigation and urged it to complete it as soon as possible.

“It is vital that Ofcom complete this investigation swiftly because the public – and most importantly the victims – will not accept any delay,” she said.

Kendall’s predecessor Peter Kyle told BBC Breakfast it was “appalling” that Grok had “not been tested appropriately”.

“The fact that I met just yesterday a Jewish woman who has found her image of herself in a bikini outside of Auschwitz being generated by AI and put online made me feel sick to my stomach,” he said.

Other MPs who have raised concerns include Northern Ireland politician Cara Hunter, who said she had decided to leave the platform.

Downing Street meanwhile said the government remains focused on “protecting children” but would keep its presence on X “under review”.

“I think we’ve been clear that all options are on the table,” the Prime Minister’s official spokesperson said.

‘Highest priority’

Ofcom will now examine whether X has failed to take down illegal content quickly when it became aware of it, and taken “appropriate steps” to prevent people in the UK from seeing it.

It said such illegal content included “non-consensual intimate images” and child sexual imagery.

It will also check whether X has used “highly effective age assurance” measures to stop children from seeing pornographic images.

The decision follows global backlash over Grok’s image creation feature, with both Malaysia and Indonesia temporarily blocking access to the tool over the weekend.

An Ofcom spokesperson did not give an indication on how long the investigation would take but said it would be a “matter of the highest priority”.

“Platforms must protect people in the UK from content that’s illegal in the UK,” they said.

“We won’t hesitate to investigate where we suspect companies are failing in their duties, especially where there’s a risk of harm to children.”

Lorna Woods, professor of internet law at Essex University, told the BBC it was “hard to predict” how quickly the investigation would move.

“Ofcom has a degree of choice in how fast – or slow – they take the investigation,” she said.

She said the regulator could apply for a business disruption order – a court order to block access to X in the UK – straight away rather than as a last resort, but only in “rare circumstances” in response to an ongoing problem.

Business

Ho hum holiday: Retail’s early results show modest growth in critical shopping season

People shop at a mall decorated with holiday lights in Manhattan on Dec. 18, 2025 in New York City.

Spencer Platt | Getty Images

Some retailers provided early holiday results on Monday that showed the crucial shopping season was solid, but didn’t blow away expectations.

Lululemon, which is preparing for a new CEO and staring down a proxy battle with its founder, said in a release it expects its holiday quarter to be “toward the high end” of its previously released guidance. Shoe maker Birkenstock and thrift store Savers Value Village also released lackluster early holiday results.

Lululemon said it expects fiscal fourth quarter revenue to be close to $3.60 billion and earnings to be close to $4.76 per share. Both figures are at the high end of the guidance the company released in December when it announced fiscal third-quarter earnings.

It made no changes to its previous guidance for gross margin, effective tax rate and selling, general and administrative expenses.

Shares were slightly higher in premarket trading.

“We remain focused on executing our action plan to drive improvement in our U.S. business and look forward to the opportunities in front of us,” finance chief Meghan Frank said in a statement.

When announcing last quarter’s earnings on Dec. 11, outgoing CEO Calvin McDonald said the company was “encouraged” by its early holiday performance but acknowledged wide discounting had driven demand during the Thanksgiving holiday period. When the shopping stretch ended, trends slowed, he said at the time.

Like other higher-end brands, Lululemon has historically been very selective with discounts, but it has used them more liberally in recent quarters to offload old merchandise and styles that weren’t resonating with shoppers.

During its fiscal third quarter, margins fell by 2.9 percentage points, due primarily to higher tariffs and the bigger markdowns, it said at the time.

Birkenstock, which didn’t provide specific holiday-quarter guidance last year, said it expects sales in the quarter ended Dec. 31 to grow 11% to €402 million ($470 million). The results appeared to disappoint investors, with shares falling about 3% in premarket trading.

Savers Value Village saw sales grow 8.4% during its holiday quarter, with comparable sales up 5.4%, excluding the impact of an extra week the company had in its calendar. Despite relatively strong growth, the company only reaffirmed its fiscal 2025 adjusted net income and EBITDA outlooks. Shares were slightly higher in premarket trading.

The early results, which were announced ahead of the annual ICR conference in Orlando, Florida, show what many analysts had expected for the holiday shopping season. Wall Street largely anticipated results would be solid, but they wouldn’t show massive gains in consumer spending.

The National Retail Federation previously forecasted retail sales in November and December would rise between 3.7% and 4.2% compared to 2024. That’s solid growth, but when higher prices from tariffs are taken into account, some analysts expect volume growth to be largely flat.

-

Politics5 days ago

Politics5 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Entertainment5 days ago

Entertainment5 days agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment5 days ago

Entertainment5 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports1 week ago

Sports1 week agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Business5 days ago

Business5 days agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoFACI invites applications for 2026 chess development project | The Express Tribune

-

Business1 week ago

Business1 week ago8th Pay Commission: From Policy Review, Cabinet Approval To Implementation –Key Stages Explained