Business

Gold prices keep rising, and jewelry companies are sounding the alarm

Gold prices held steady on Thursday, hovering near the record high hit the day before, helped by expectations of further U.S. rate cuts and political uncertainty.

David Gray | Afp | Getty Images

Amid global economic turbulence, the prices of precious metals have been climbing higher and higher.

The price of gold in particular has skyrocketed over the past year, rising more than 50%. For midsize jewelry companies aiming to offer fine gold necklaces, earrings and more at lower price points than legacy luxury jewelry brands, gold futures could be spelling trouble.

Though gold is often subject to market fluctuations, investors have been increasing their holdings over the past year over recession fears and market uncertainty, according to Goldman Sachs. Gold is on pace for its third straight year of double-digit gains, even hitting record highs this week during the government shutdown.

On Tuesday, gold prices hit $4,000 an ounce for the first time in history — and they’re showing no signs of slowing down.

Analysts from UBS wrote last week that lower interest rates, weakness in the dollar and political uncertainty will only continue to drive the price of gold higher.

“We now expect inflows for this year to be 830 metric tons, which is almost double our initial forecast of 450 metric tons at the start of the year,” the UBS analysts wrote in a note. “The key risk for gold is better U.S. growth and if the Fed is forced to raise rates due to inflation-related upside surprises.”

A Goldman Sachs report from late last month predicted the climb, forecasting that the price of gold will rise 6% through the middle of 2026 to $4,000 per troy ounce, a unit of measurement used for precious metals. The report categorized buyers of gold into two groups: conviction buyers, who purchase the metal consistently, and opportunistic buyers, who jump in “when they believe the price is right.”

The analysts said they expect central banks to continue buying gold for three more years.

“Our rationale is that emerging market central banks remain significantly underweight gold compared to their developed market counterparts and are gradually increasing allocations as part of a broader diversification strategy,” analyst Lina Thomas wrote.

And according to July survey data from the World Gold Council, roughly 95% of central banks expect global gold holdings to rise in the next year.

Gold futures

That uncertainty comes on top of an already turbulent global economy reeling from changing tariff policies from President Donald Trump. Though he made clear in August that gold will not be tariffed and that bars from Switzerland will not be subject to the country’s 39% tariff, Trump’s steep rates on other countries have been disrupting the global supply chain.

For jewelers, the rising price of the precious metal may be a cause for concern. Large retailers like Pandora and Signet have signaled that they are exploring price hikes or alternative manufacturing methods to counteract the hit they’re taking from gold.

And some jewelry companies that aim to offer gold products at lower price points, like Mejuri, are feeling the pressure too.

Mejuri, which aims to sell gold and luxury jewelry at more affordable levels than its competitors, announced last month that the company was being forced to raise its prices due to the rising cost of gold, silver and tariffs.

“While we’ve been doing everything we can to absorb the impact and preserve the quality and craftsmanship you expect from us, you’ll see some prices update on Monday, September 29th,” Mejuri wrote in an email to customers. “We’re tackling these shifts head-on: streamlining our supply chain, strengthening sourcing and designing with pricing in mind.”

The company said it’s also innovating new products like 10 karat solid gold to keep offering quality jewelry at affordable prices. Mejuri declined to comment.

‘A fear indicator’

With the price of gold rising and showing no signs of stopping, some jewelry companies are being forced to be innovative with their pricing and products.

In its second-quarter earnings report in August, Pandora said it faced an 80-basis point hit due to higher prices of gold and silver and that it planned some price adjustments to offset those headwinds. And on Signet’s most recent earnings call in early September, the company said it had seen more than 30% increase in the cost of gold.

BaubleBar, which specializes in fine jewelry, offers a large selection of “demi-fine” gold pieces, which co-founder Daniella Yacobovsky said has allowed the company to somewhat avoid the brunt of the pressure from gold prices.

The company’s demi-fine jewelry features a thick, high-quality 18k gold plated over a sterling silver base, which allows BaubleBar to avoid the costs associated with solid gold jewelry. The brand’s demi-fine earrings range from anywhere between $50 to $150.

“We’ve actually seen a really huge increase in interest in demi-fine,” Yacobovsky told CNBC. “I think that it offers people a really fantastic alternative to solid gold. … You’re going to get a really fantastic quality similar to that for a lower price point.”

Still, Yacobovsky said it’s concerning that significant events affecting the global economy are happening at higher rates than even five years ago. She said she hasn’t seem something as volatile as the skyrocketing price of gold in the industry “for a long time.”

The key, she said, will be for businesses to capitalize on their ability to make smart choices.

For Alexis Bittar, CEO of his eponymous jewelry company, the smart choice meant leaning into gold-plated pieces, which allows the company to save costs over solid gold, and raising prices slightly to match the products that are coming in.

But the company is not repricing any of its existing products, Bittar said.

“You’re constantly juggling between the tariff and the acceleration of the gold prices, so you’re staying within a price point that you’re known for,” Bittar said. “From the consumer side, they’re not really caring. They vaguely know the prices of gold are going up … but mentally, they have an unconscious price point that they’re looking to spend, and when you start to way exceed it, you’re pricing people out.”

Bittar said his company is seeing a “cautious” consumer, but that any pullback in spending is likely more related to solid gold than plated gold, and that the wealthy consumer base is more willing to pay higher prices than lower- or middle-income shoppers.

Even for ear piercing company Rowan, which also offers gold jewelry, the rapidly changing industry may be spelling trouble. CEO Louisa Schneider told CNBC that it’s hard to imagine any other industry whose raw material costs have risen as dramatically as gold.

Rowan Piercing Studio’s Suburban Square location in Ardmore, PA.

Courtesy: Rowan

Because ear piercing requires some level of surgical steel or titanium for ideal healing, Rowan often uses 14k gold to coat those materials, leaving the company “somewhat insulated” from the rising price of gold because it is required to uphold certain health and safety standards.

Still, Schneider said Rowan had to raise prices on some of its gold pieces in the beginning of the third quarter, which she said customers are willing to pay for because the company specializes in employing trained nurses for the piercings.

“This is a fear indicator. So that, from my standpoint, is quite concerning,” Schneider said. “Our expectation is that we do not see a significant reduction in the current pricing – if anything, we expect that gold will continue to be quite expensive. So we will continue to hedge ourselves and to work really closely with our vendors.”

Schneider said she’s seeing an “inflection point” in the price of gold and that it’s a cause for concern for all jewelry companies, but especially those that are unable to raise their prices to counteract the costs because they sell to non-luxury consumers who are less flexible with price changes.

Ultimately, she said this serves as a warning sign for the broader economy, even if it might not be hitting Rowan too hard.

“The demand is not coming from consumers that want to wear gold or industries that require gold as a component of manufacturing,” Schneider said. “This is coming from a hoarding of gold given an uncertainty around the U.S. dollar, and that’s unlike anything that we’ve seen.”

Correction: A previous version of this story misstated Signet’s sales.

Business

Budget 2026: Punjab, Telangana flag higher fiscal burden under VB-G RAM G; seek more central funds – The Times of India

Opposition-ruled states Punjab and Telangana on Saturday sought additional fiscal support from the Centre in the Union Budget 2026-27, arguing that the proposed Viksit Bharat Guarantee for Rozgar and Ajeevika Mission (Gramin) (VB-G RAM G) will place a heavier financial burden on states due to its revised cost-sharing formula, PTI reported.The demands were raised at the pre-Budget meeting chaired by Union Finance Minister Nirmala Sitharaman, which was attended by finance ministers of states and Union Territories, along with Union Minister of State for Finance Pankaj Chaudhary. The meeting also saw participation from the Governor of Manipur, chief ministers of Delhi, Goa, Haryana, Jammu and Kashmir, Meghalaya and Sikkim, and deputy chief ministers of several states, including Telangana.Opposition-ruled states said the changes to the rural employment framework weaken the employment guarantee and go against the spirit of cooperative federalism.Parliament last month passed the VB-G RAM G Bill, replacing the two-decade-old Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). Under the new scheme, the Centre will bear 60 per cent of the cost and states 40 per cent, compared with the 90:10 funding pattern under MGNREGA.Punjab Finance Minister Harpal Singh Cheema strongly opposed the proposed changes, saying the new framework dilutes the employment guarantee while shifting a significant financial burden to states.“Proposed MGNREGA changes weaken employment guarantee and burden states,” Cheema said at the meeting, calling for the restoration of the original demand-driven structure and funding pattern of the scheme.Telangana Finance Minister Mallu Bhatti Vikramarka said the Union government had replaced MGNREGA with VB-G RAM G without consulting states. He noted that the shift from a 90:10 to 60:40 funding ratio would further strain state finances.He also pointed out that any additional man-days beyond the normative allocation would now have to be borne by states, which would create a serious obstacle in providing demand-based work to job seekers.“This is entirely against the spirit of cooperative federalism and starving them of funds for capital outlay, which is essential for maintaining growth momentum,” Vikramarka said.The Telangana finance minister also suggested that surcharges on income tax and corporation tax be credited to a non-lapsable infrastructure fund, from which states could receive grants for infrastructure development. Alternatively, he said, surcharges should be merged with basic tax rates to expand the divisible pool of central taxes.On GST reforms, Vikramarka said GST 2.0 may boost demand but questioned its sustainability, warning that states’ revenues could fall due to rate reductions. He called for a suitable mechanism to compensate states for any revenue loss.Punjab also sought a special fiscal package, citing the “double whammy” of border tensions and floods in 2025. On GST, Cheema said Punjab is facing an annual revenue loss of nearly Rs 6,000 crore following GST 2.0 and pressed for a predictable GST stabilisation or compensation mechanism for states.

Business

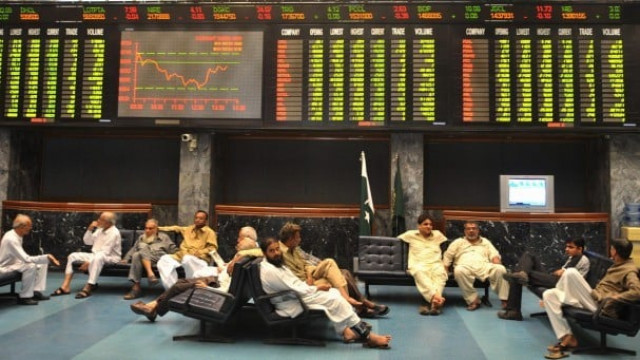

CY26 buying, macros propel PSX further higher | The Express Tribune

Shares of 324 companies were traded. At the end of the day, 90 stocks closed higher, 211 declined and 23 remained unchanged. PHOTO: FILE

KARACHI:

Pakistan’s equity market opened the new year on a strong footing as the benchmark KSE-100 index extended its bullish momentum in the second week, climbing 5,375 points, or 3% week-on-week (WoW), to close at 184,410.

The rally was triggered by renewed buying in heavyweight stocks amid improved market participation, supportive macroeconomic indicators, and positive company-specific developments, while easing yields in the latest T-bill auction and robust remittances further strengthened investor sentiment. On a day-on-day basis, the bullish momentum at the Pakistan Stock Exchange (PSX) continued unabated on Monday as the KSE-100 index surged past 182k, closing at 182,408, up 3,373 points (+1.88%).

On Tuesday too, the market’s surge continued, when the index gained 2,654 points (+1.45%) to close at 185,602. The powerful and sustained bullish trend remained intact on Wednesday as well, with the bourse maintaining its full strength and closing at a fresh all-time high of 186,518. In the initial five sessions of CY26, the index added a massive 12,464 points (+7.2%).

However, following the sharp rally, the PSX witnessed its first profit-taking session on Thursday, where the index closed at 185,543, down 976 points (-0.52%). On Friday, the PSX took a breather and the KSE-100 remained volatile, swinging in both directions before closing at 184,410, down 1,133 points (-0.61%). Despite the decline, the CY26-to-date gains stood strong at 5.95%, equivalent to a rise of 10,356 points.

Arif Habib Limited’s (AHL) weekly report noted that the KSE-100 index climbed from 179,035 points last week to 184,410 in the outgoing week, gaining 5,375 points (+3%), supported by a rally in heavyweight stocks driven by new year buying, and positive company-specific news and updates.

Among economic developments, the government through a T-bill auction raised Rs979.3 billion against the target of Rs850 billion. Yields were down across all tenors by 28.6 to 33.8 basis points. Participation remained strong at Rs2,554.6 billion.

Worker remittances reached $3.6 billion in Dec’25, marking a 17% year-on-year (YoY) increase. Cumulatively, 1HFY26 remittances clocked in at $19.7 billion, up 11% YoY.

AHL mentioned that tariff rebasing, following shift from financial year to calendar year, was likely to pull the power purchase price down by Rs0.51 per kilowatt-hour (kWh) in CY26 versus FY26. Cotton arrivals in factories remained stable as of end-Dec’25. In Punjab, cotton arrivals declined 4% in CY25, while Sindh arrivals improved by 4% YoY. However, total production are estimated at 6.8 million bales in FY26, representing a significant 33% shortfall against projections.

Meanwhile, the central government debt stood at Rs77.5 trillion as of Nov’25 compared with Rs70.4 trillion in Nov’24, up 10.2% YoY and 0.7% month-on-month, AHL added.

JS Global’s Syed Danyal Hussain, in his report, said that the benchmark KSE-100 index extended its bullish run in the second week of the year, closing at 184,410, up 3% WoW. The rally was largely led by banks, which contributed 57% to index gains, while cement stocks (8%) and auto shares (5%) provided limited support. Market participation improved notably, with average daily traded volumes rising 25% WoW.

On the macro front, he said, Pakistan recorded monthly remittances of $3.6 billion in Dec’25, reflecting a 17% YoY increase. Meanwhile, total public debt declined by Rs345 billion to Rs77.5 trillion in 5MFY26, largely supported by the transfer of State Bank’s profits to the government.

In policy developments, the government was exploring options to seek relaxations from the IMF ahead of the FY27 budget, with key proposals including a phased reduction in super tax over the next four years and lower power tariffs to enhance competitiveness.

Separately, the gas-sector circular debt climbed to Rs3.2 trillion, driven mainly by a sharp rise in late payment surcharges (Rs1.45 trillion). In the T-bill auction, the government raised Rs979 billion against the target of Rs850 billion, with yields falling by 29-33 basis points across different tenors. SBP’s reserves rose $141 million to $16 billion.

Business

Budget 2026: Haryana seeks higher allocations for infra, agriculture and medical education; pushes RIDF, UIDF cap hikes – The Times of India

Haryana Chief Minister Nayab Singh Saini on Saturday urged the Centre to step up allocations for the state’s rural and urban infrastructure, agriculture and allied sectors in the Union Budget for FY27, citing growing development needs and the state’s proximity to the national capital, PTI reported.Saini, who also holds the finance portfolio, raised the demands at the pre-Budget meeting chaired by Union Finance Minister Nirmala Sitharaman with finance ministers of states and Union Territories, according to an official Haryana government statement.The chief minister sought an increase in the general allocation under the Rural Infrastructure Development Fund (RIDF) to Rs 2,000 crore in 2026-27, saying this was necessary to sustain the momentum of rural development. He also flagged constraints under the Urban Infrastructure Development Fund (UIDF), arguing that the current Rs 100 crore cap on project size was limiting execution of large urban projects, and proposed that the ceiling be raised to Rs 500 crore.Saini thanked the Centre for continuing the Special Assistance to States for Capital Investment scheme and sought higher untied allocations for Haryana, along with relaxations in utilisation conditions, citing the state’s special requirements due to its location in the National Capital Region (NCR).He said the upcoming Budget would further pave the way for Haryana’s progress and reaffirmed the state’s commitment to contributing towards making India a developed nation by 2047.Highlighting Haryana’s agrarian profile, Saini said the state ranks second in the country in foodgrain production and is known as the breadbasket of India. He said around six lakh acres of land are affected by salinity and waterlogging, and sought central financial assistance to prevent further damage.He also underlined the need for modernising agriculture through digital agriculture, micro-irrigation, agri-logistics and value addition, adding that agri-processing clusters and MSMEs could become engines of rural prosperity.On the social sector, Saini said Haryana plans to open a medical college in every district, for which substantial support under centrally sponsored schemes would be required. He also sought higher assistance for social security pensions, noting that over 44 lakh people in the state receive such benefits.The chief minister said Haryana’s NCR region is being developed as a logistics hub, requiring higher central capital investment to improve connectivity and time-bound movement of goods. Stressing the importance of entrepreneurship, he said Haryana ranks fourth nationally in startups and is setting up a Rs 2,000 crore Fund of Funds to support them.He added that the state is developing 10 new Industrial Model Townships (IMTs) to boost MSMEs and attract investment, for which additional central assistance is needed.Saini also emphasised the importance of human capital, calling for greater focus on education, health and skills, particularly in emerging areas such as artificial intelligence, semiconductors, green technology and biotechnology.

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment3 days ago

Entertainment3 days agoDoes new US food pyramid put too much steak on your plate?

-

Politics3 days ago

Politics3 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment3 days ago

Entertainment3 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Entertainment6 days ago

Entertainment6 days agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Sports6 days ago

Sports6 days agoFACI invites applications for 2026 chess development project | The Express Tribune