Business

8th Pay Commission Delay: Govt Staff May Have To Wait Until 2028 For Salary Hike

New Delhi: In January this year, the Modi government announced the formation of the 8th Central Pay Commission. This commission, set up once every 10 years, reviews and revises salaries, pensions, and allowances of central government employees and pensioners.

However, even after seven months, there has been no real progress. The Terms of Reference (ToR), which outline the commission’s scope, are still not ready. Also, the members and chairman have not yet been appointed. This delay has worried over 1 crore central employees and pensioners. Their unions have written to the government asking for updates. The Finance Ministry has said it is gathering inputs from states, ministries, and employee groups before issuing the formal notification.

What Happened with the 7th Pay Commission?

Looking back, the 7th Pay Commission took almost 3 years from its announcement to the implementation of its recommendations.

Announcement: 25 September 2013 (UPA government)

ToR Notification: 28 February 2014 (5 months later)

Appointment of Members: 4 March 2014 (just 4 days after ToR)

Report Submission: 19 November 2015 (after 1 year 8 months)

Implementation: 29 June 2016 (7 months after report submission, effective from 1 January 2016)

So, the full process took about 2 years and 9 months.

What This Means for the 8th Pay Commission

The 8th Pay Commission was announced on 16 January 2025. If it follows the same pace as the 7th Commission, the final implementation may not happen before late 2027 or early 2028.

So far:

The announcement has been made.

The Staff Side of NC-JCM (a platform for government-employee dialogue) has given draft proposals with demands.

But the ToR and appointments are still pending.

If the government issues the ToR by August 2025, and the process follows the 7th Commission’s timeline, then recommendations may only be implemented by January 2028.

Even if the implementation happens late, the salary and pension revisions will be retrospective from 1 January 2026.

Business

‘Why Are Americans Paying For AI In India?’: Trump’s Trade Advisor Raises Data Centre Energy Costs

Last Updated:

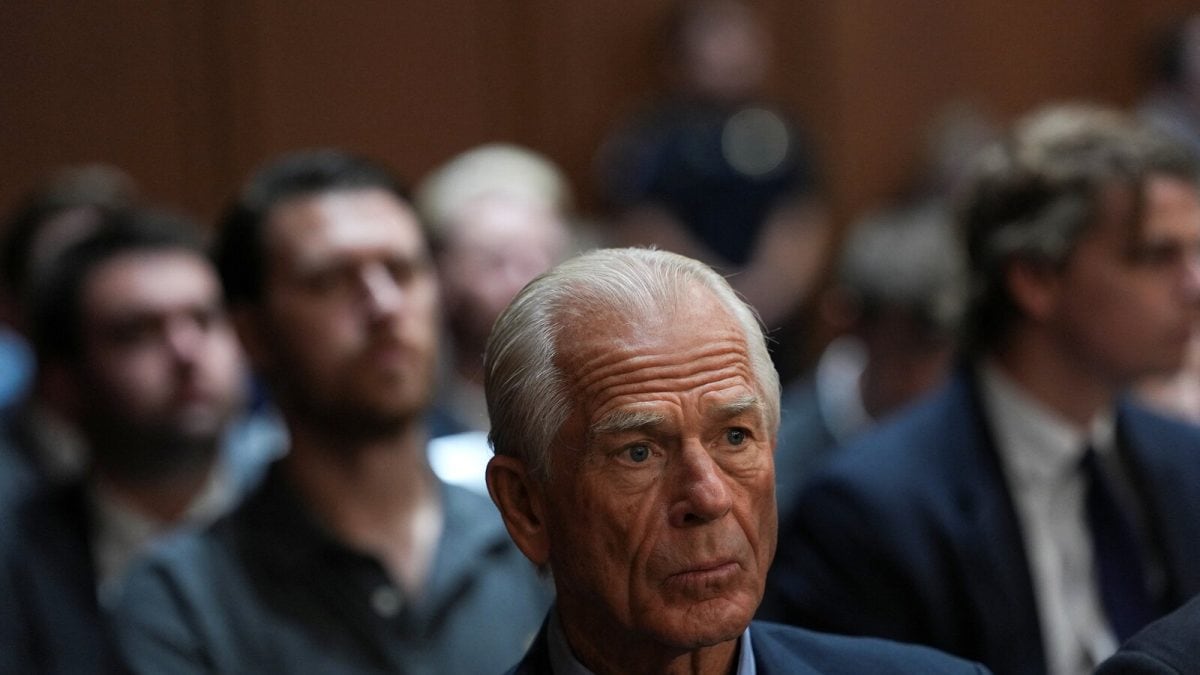

Peter Navarro questions US electricity powering AI services like ChatGPT for users in India, raising trade and energy concerns amid rising US electricity costs.

Peter Navarro questions US electricity powering AI services like ChatGPT for users in India, raising trade and energy concerns amid rising US electricity costs. (REUTERS/Kent Nishimura

US President Donald Trump’s trade adviser, Peter Navarro, has ignited a fresh political and economic debate by questioning why American electricity and infrastructure are being used to power artificial intelligence services that cater to users overseas, particularly in India.

Speaking on the podcast Real America Voice with former White House chief strategist Steve Bannon, Navarro raised concerns about US-based AI platforms operating domestically while serving millions of users abroad. He singled out OpenAI’s popular chatbot ChatGPT, arguing that its growing global footprint has trade and energy implications for the United States.

“Why are Americans paying for AI in India?” Navarro asked during the discussion. “ChatGPT operates on US soil and uses American electricity, servicing large users of ChatGPT in India and China and elsewhere around the world.” According to him, this raises fundamental questions about whether US taxpayers and consumers should bear the cost of powering AI systems that primarily benefit foreign markets.

Focus on electricity costs and data centres

Navarro’s remarks come amid mounting concern in Washington over the rapid expansion of AI data centres, which require vast amounts of electricity to run powerful servers around the clock. He suggested that the boom in AI infrastructure is already contributing to higher power prices for American households.

“We’re looking very, very carefully at this whole problem of AI data centres driving up the cost of electricity for Americans,” Navarro said. “You can expect strong action from President Trump on this. So keep an eye on that.”

Trade tensions with India in the backdrop

Navarro’s statements come at a sensitive moment in US–India relations. Washington and New Delhi are engaged in trade talks following a downturn after the Trump administration imposed a steep 50% tariff on Indian imports. This included a 25% additional duty linked to India’s continued purchase of Russian oil, a move the US has criticised amid the war in Ukraine.

Navarro has been one of the most vocal critics of India’s energy policy. In earlier remarks, he accused New Delhi of indirectly financing Russia’s war effort in Ukraine by buying discounted Russian crude and reselling refined products at higher prices on the global market.

“When India buys Russian oil at a discount and then Indian refiners, in partnership with Russian refiners, sell it at a premium to the rest of the world, Russia uses that money to fund its war machine,” Navarro had said.

US government moves on AI and energy

Against this backdrop, the Trump administration on Friday announced plans to work with US states to ensure that the rapid growth of the AI sector does not result in higher electricity bills for millions of Americans. According to data from the Energy Information Administration, the average electricity bill in the US rose by 5% in October compared with the same period last year, heightening political sensitivity around energy costs.

AI companies have increasingly come under scrutiny for the environmental and economic impact of large-scale data centres, which consume enormous amounts of power and water.

Washington D.C., United States of America (USA)

January 18, 2026, 20:04 IST

Read More

Business

Silver Prices Jump 22% In January, Near Rs 3 Lakh Mark

New Delhi: Silver prices have continued their remarkable rally, rising another 22 per cent in January so far, strengthening investor interest and keeping the white metal firmly in focus.

The sharp surge has helped silver emerge as the top performer among major asset classes, supported by strong demand and multiple positive global factors.

After an extraordinary 170 per cent rise earlier, MCX silver prices have maintained strong momentum this month.

From the April close of Rs 95,917, silver has climbed nearly 200 per cent to settle at Rs 2,87,762 on Friday, a performance usually associated with multibagger stocks rather than commodities.

Prices have also touched fresh record highs, with the latest peak of Rs 2,92,960 recorded last week.

As silver surged past earlier expectations much faster than anticipated, analysts have been quick to revise their targets upward.

Last year, domestic brokerages had projected silver prices at around Rs 1,10,000 by the end of the year, but those levels were crossed well before the midpoint.

The rally did not stop there, with prices going on to hit Rs 2,54,000, more than doubling earlier estimates.

As these above-ground reserves shrink, holders of physical silver are demanding higher prices, further pushing rates upward.

At the beginning of 2025, silver was largely overlooked by investors, with few expecting it to deliver such a sharp rally amid ongoing economic uncertainty and geopolitical tensions.

Adding to the bullish sentiment is a shift in global central bank behaviour. After accumulating significant quantities of gold over the past three years, central banks are now reported to be adding silver to their reserves as well.

This trend has provided additional support to prices, keeping MCX silver close to the Rs 3 lakh level.

With the latest close of Rs 2,87,762, silver is now just about 4.2 per cent away from crossing the Rs 3 lakh milestone.

Business

Top 3 Firms Add Rs 75,855 Crore In Market Valuation Last Week

New Delhi: The combined market valuation of three of India’s top companies surged by Rs 75,855.43 crore last week, even as the overall stock market showed a sluggish trend during the holiday-shortened week.

State Bank of India (SBI) and Infosys were the biggest gainers among the top firms. While the Sensex slipped 5.89 points, the Nifty inched up by 11.05 points over the week.

Commenting on Nifty technical outlook, an expert said that “immediate resistance is placed at 25,875, followed by 26,000 and 26,100 levels. On the downside, support is seen at 25,600 and 25,450.”

“A breakdown below 25,300 could intensify downside pressure and accelerate corrective moves. Given the prevailing volatility, a cautious approach with strict stop-loss discipline is advised,” an analyst stated.

Among the top companies, ICICI Bank, SBI, and Infosys recorded gains, while HDFC Bank, Tata Consultancy Services (TCS), Bharti Airtel, Bajaj Finance, Hindustan Unilever, and Larsen & Toubro faced a combined erosion of Rs 75,549.89 crore in their market value.

Interestingly, the total loss of these seven companies was still slightly less than the total m-cap addition of the three gainers.

SBI emerged as the biggest gainer, with its market valuation jumping by Rs 39,045.51 crore to reach Rs 9,62,107.27 crore.

Infosys also saw a strong increase, with its m-cap rising by Rs 31,014.59 crore to Rs 7,01,889.59 crore.

ICICI Bank added Rs 5,795.33 crore, taking its market value to Rs 10,09,470.28 crore.

On the other hand, Larsen & Toubro’s market valuation fell by Rs 23,501.8 crore to Rs 5,30,410.23 crore, while HDFC Bank’s valuation dropped by Rs 11,615.35 crore to Rs 14,32,534.91 crore.

Bharti Airtel’s m-cap declined by Rs 6,443.38 crore to Rs 11,49,544.43 crore, Bajaj Finance saw a dip of Rs 6,253.59 crore to Rs 5,91,447.16 crore, Hindustan Unilever lost Rs 3,312.93 crore to stand at Rs 5,54,421.30 crore, and TCS’s valuation slipped by Rs 470.36 crore to Rs 11,60,212.12 crore.

After these movements, HDFC Bank remained the second most valued domestic company, followed by TCS, Bharti Airtel, ICICI Bank, SBI, Infosys, Bajaj Finance, Hindustan Unilever, and Larsen & Toubro.

-

Tech6 days ago

Tech6 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment5 days ago

Entertainment5 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship