Business

Stocks up as Powell leaves door ajar for rate cut

The FTSE 100 posted another record closing peak on Friday as Jerome Powell said shifting economic risks may justify an interest rate cut in the US.

The FTSE 100 index closed up 12.20 points, 0.1%, at 9,321.40. It earlier traded as high as 9,357.51.

The FTSE 250 ended up 259.39 points, 1.2%, at 22,077.23 and the AIM All-Share finished 6.17 points higher, 0.8%, at 765.03.

For the week, the FTSE 100 rose 2.0%, the FTSE 250 advanced 1.5% and the AIM All-Share climbed 0.6%.

In a keenly awaited speech, Federal Reserve chairman Jerome Powell left the door open to an interest rate cut at its September meeting, noting a “shifting” balance of economic risks may warrant such a move.

Speaking at the Jackson Hole economic symposium, Mr Powell said: “The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

But he added “the stability of the unemployment rate and other labour market measures allow us to proceed carefully as we consider changes to our policy stance”.

Padhraic Garvey at ING commented: “Chair Powell could have been super balanced, or even hawkish. But he effectively chose to endorse the market discount for a rate-cutting phase ahead. It’s had quite the reaction. Risk assets are up, the dollar down.”

In New York, the Dow Jones Industrial Average soared 2.0%, as did the Nasdaq Composite, while the S&P 500 jumped 1.6%.

On the labour market, the Fed chairman said while it “appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising”.

On tariffs, Mr Powell said a “reasonable base case” is that they create a “one-time” shift up in the price level, although he added those effects will take time to fully work their way into the economy.

“In the near-term, risks to inflation are tilted to the upside, and risks to employment to the downside – a challenging situation,” Mr Powell said.

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he added.

While stocks rose, the dollar fell, while US bond yields declined.

The pound jumped to 1.3539 US dollars late on Friday in London, compared to 1.3426 US dollars at the equities close on Thursday.

The euro firmed to 1.1726 US dollars, higher against 1.1619 US dollars. Against the yen, the dollar was trading lower at 146.61 yen compared to 148.21 yen.

In Europe, the CAC 40 in Paris ended up 0.5%, while the DAX 40 in Frankfurt closed up 0.3%.

The yield on the US 10-year Treasury was at 4.26%, narrowed from 4.34%. The yield on the US 30-year Treasury was 4.87%, trimmed from 4.94%.

In London, trading recovered from a sluggish start supported by news that UK consumer confidence improved in August, boosted by the latest interest rate cut, although uncertainty over the possibility of future tax hikes and inflationary pressures weighed on expectations going forward.

The GfK consumer confidence index rose to minus 17 in August from minus 19 in July, above the FXStreet-cited consensus forecast of minus 20.

Consumer expectations for their personal financial situation over the next 12 months rose to plus 5 in August from plus 2 in July, while expectations for the general economic situation over the next 12 months declined to minus 30 from minus 29.

Neil Bellamy, consumer insights director at GfK, said: “The biggest changes in August are in confidence in personal finances, with the scores looking back and ahead a year each up by three points.

“This is likely due to the Bank of England’s August 7 cut in interest rates, delivering the lowest cost of borrowing for more than two years.”

AJ Bell investment analyst Dan Coatsworth said the slight uptick is “good news” for retailers, hospitality and travel businesses, but “no-one will be getting carried away given this is just a case of people feeling a bit less bad rather than genuinely optimistic about the economic outlook”.

On the FTSE 100, gains were broad-based with Asian-focused bank Standard Chartered leading the way, up 4.2%, while housebuilders Persimmon and Berkeley climbed 2.3% and 2.2% respectively, and British Airways owner, IAG, added 2.3%.

On the FTSE 250, WH Smith rallied 11%, recouping a small slice of Thursday’s dramatic 42% fall in the wake of lowered guidance after an accounting error.

Morgan Advanced Minerals rose 3.6% after Vesuvius agreed to buy its Molten Metal Systems business for a total enterprise value of £92.7 million.

In addition, the England-based manufacturer of carbon and ceramic materials, said it has instructed Investec Bank to launch the third tranche of its ongoing share buyback immediately upon completion of the second tranche.

Each tranche to date has been for up to £10 million, under a total buyback programme for up to £40 million.

Revolution Beauty leapt 20% as it announced the return of its co-founders to the business after terminating its formal sales process.

The news came as the firm pledged to slash costs amid declining sales and profitability, and raised £15 million via a placing and subscription.

This includes cornerstone investment from the make-up brands co-founders, Tom Allsworth and Adam Minto, and from its largest shareholder, boohoo, now trading as Debenhams.

Between them the cornerstone investors hold just under 58% of Revolution Beauty stock, with boohoo having a 27% stake.

Mr Allsworth will step in as chief executive over the “coming days”, the firm said, with Colin Henry stepping down as interim chief executive at that point, while Mr Minto will also return to the business in a consulting capacity.

A barrel of Brent traded at 67.59 US dollars late Friday, up from 67.13 US dollars on Thursday. Gold pushed up to 3,375.22 US dollars an ounce against 3,343.46 US dollars.

The biggest risers on the FTSE 100 were Standard Chartered, up 57.0 pence at 1,417.0p, Persimmon, up 25.5p at 1,128.5p, International Consolidated Airlines, up 8.8p at 394.5p, Scottish Mortgage Trust, up 24.0p at 1,095.0p and Berkeley Group, up 80.0p at 3,792.0p.

The biggest fallers on the FTSE 100 were British American Tobacco, down 78.0p at 4,315.0p, Coca-Cola Europacific down 120.0 pence at 6,710.0p, Coca-Cola HBC, down 52.0p at 3,892.0p, Tesco, down 5.2p at 426.3p and National Grid, down 10.5p at 1,049.0p.

Financial markets in London are closed on Monday for the August bank holiday.

Later in the week results are due from insurer Prudential and sports retailer JD Sports Fashion.

The global economic calendar on Monday has the German ifo business climate report and US new home sales figures.

Contributed by Alliance News.

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

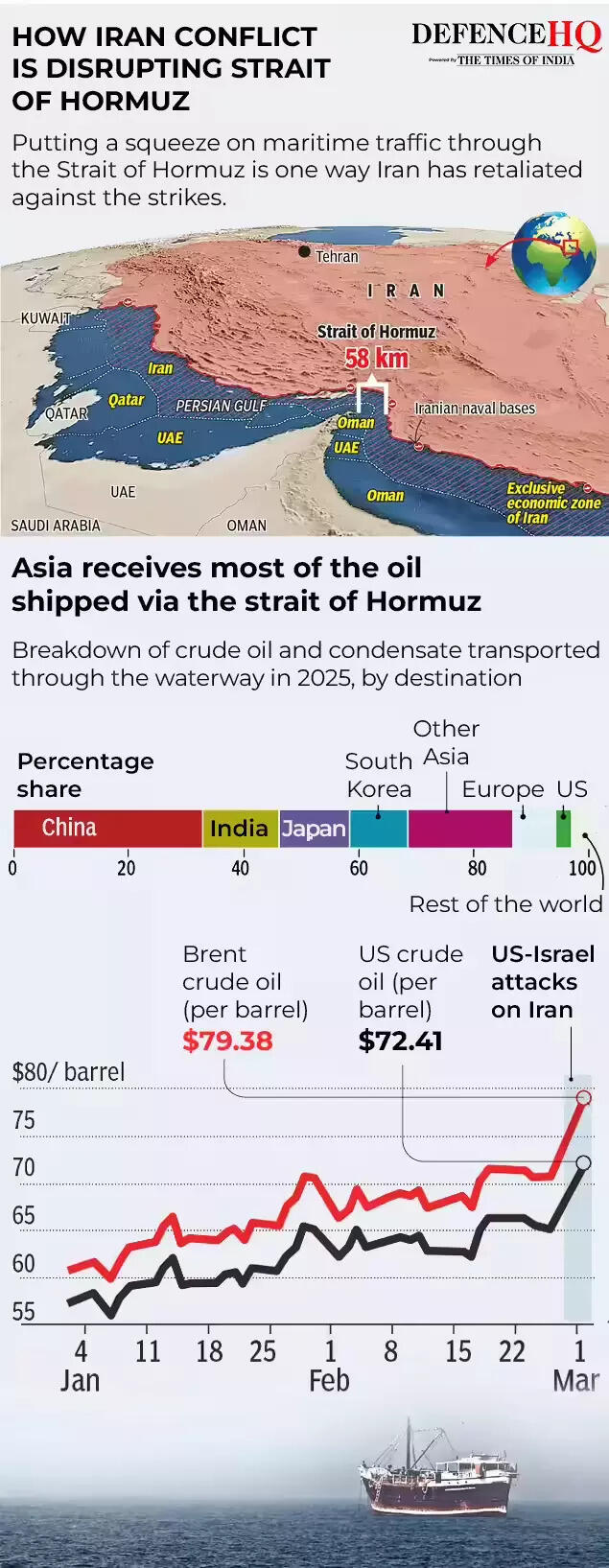

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition