Fashion

Mulberry relaunches Roxanne as family of bags, with “surreal” celeb campaign

Published

September 8, 2025

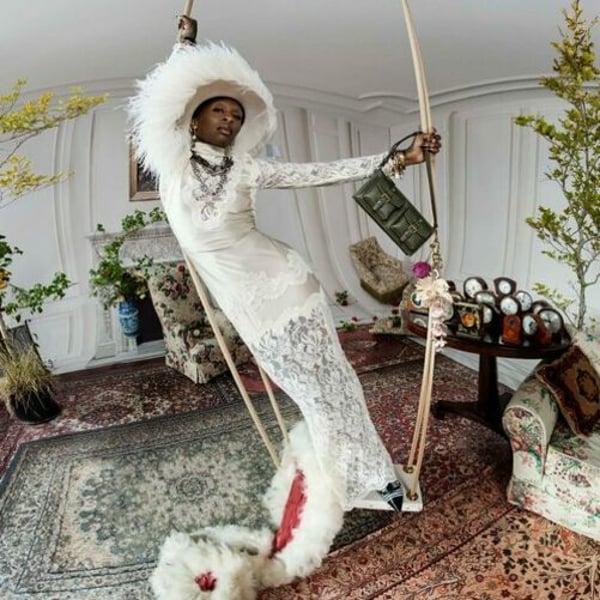

This week sees Mulberry relaunching what was one of the best-known bags it has ever made. It’s the Roxanne, which comes with a “fantastical campaign” shot by Tim Walker and featuring Wicked actor Cynthia Erivo.

The original bag was frequently seen on the arms of influencers such as Kate Moss and Alexa Chung and it now expands into a family: with four modern iterations sitting alongside the 2004 style that continues to be available via The Mulberry Exchange.

The company said the Roxanne and the Small Roxanne are “odes to the much-loved original, taking its punky, Y2K attitude and updating it, with brass buckle and streamlined details”.

Both sizes can be worn either over the shoulder or as a crossbody, and are made up of 44 individual pattern pieces. There are also two new shapes that “epitomise Mulberry in 2025” — the Roxanne Shoulder Bag and the Mini Roxanne Shoulder Bag. These are “lighter, versatile styles made for modern living, which both feature brass buckle detailing and sleek silhouettes”.

The Roxanne family is available from 8 September with prices starting at £795.

As for that campaign, Walker is a longtime Mulberry collaborator while the company has also turned to stylist and Harvey Nichols creative director Kate Phelan for the styling credits.

In a set of “surreal” and “playful” stills, the “Mulberry Spirit comes alive – with Erivo posing in a warped, dreamlike room rich in colour and texture, with rope swings, fireplaces, and decorative carpets”.

We’re told the campaign “reflects the duality of the Mulberry Spirit”.

It also includes “a softly shot video series”, Mulberry Moments – an intimate in-conversation between Erivo and Recho Omondi, the fashion journalist and host of The Cutting Room Floor. Across eight personal short films, the pair discuss topics “including Cynthia’s first Mulberry, her earliest memories of growing up in London, and how – like singing and acting – fashion is highly emotional”.

Erivo said: “As a born and bred Londoner I remember longing for a Mulberry – the ultimate statement bag – so this moment really feels full circle. The campaign has captured the Roxanne bag’s rebellious and romantic spirit, something that represents my own style. I believe that style centres on authentic self expression and collaboration, and this drew me to partnering with such an Iconic British brand who champion creativity, craftsmanship, and cultivate a sense of community.”

Copyright © 2025 FashionNetwork.com All rights reserved.

Fashion

Netherlands’ goods exports to US fall 4.7% in Jan-Oct 2025

The data showed that the decline was driven mainly by weaker domestic exports, with goods produced in the Netherlands down 8 per cent YoY. In contrast, re-exports to the US rose 3.9 per cent during the period. Exports to the US have fallen every month on a YoY basis since July, CBS said in a press release.

Trade flows were influenced by uncertainty around US import tariffs. In the first half of 2025, trade between the two countries continued to grow, possibly as companies advanced shipments ahead of announced tariff measures.

Goods exports from the Netherlands to the United States fell 4.7 per cent YoY to €27.5 billion (~$33 billion) in the first ten months of 2025, driven by an 8 per cent drop in domestic exports, according to CBS.

Re-exports rose 3.9 per cent, while tariff uncertainty weighed on trade.

Imports from the US increased 1.9 per cent to €48.1 billion (~$57.7 billion).

Meanwhile, imports from the United States rose 1.9 per cent YoY to €48.1 billion (~$57.7 billion) in the first ten months of 2025.

Fibre2Fashion News Desk (SG)

Fashion

Philippines revises Q3 2025 GDP growth down to 3.9%

The Philippines’ economic growth for the third quarter (Q3) of 2025 has been revised slightly lower, with gross domestic product (GDP) expanding 3.9 per cent year on year (YoY), down from the preliminary estimate of 4 per cent.

Gross national income growth for the quarter was also revised to 5.4 per cent from 5.6 per cent, while net primary income from the rest of the world was adjusted to 16.2 per cent from 16.9 per cent.

The Philippine Statistics Authority has revised down the country’s third-quarter 2025 GDP growth to 3.9 per cent from an earlier estimate of 4 per cent.

Gross national income growth was also lowered to 5.4 per cent, while net primary income from abroad eased to 16.2 per cent.

The PSA said the adjustments reflect its standard, internationally aligned revision policy.

The Philippine Statistics Authority said the revisions were made in line with its approved revision policy, which follows international standards for national accounts updates.

Fibre2Fashion News Desk (HU)

Fashion

US’ Levi Strauss reports solid FY25, driven by organic growth

Operating margin improved sharply to 10.8 per cent from 4.4 per cent in FY24, while adjusted EBIT margin increased to 11.4 per cent from 10.7 per cent, marking the third consecutive year of margin expansion. The net income from continuing operations more than doubled to $502 million from $210 million, with adjusted net income rising to $537 million.

Levi Strauss & Co has delivered a strong FY25, with net revenues rising 4 per cent to $6.3 billion and organic growth of 7 per cent, alongside sharp margin expansion and higher profitability.

Q4 saw 5 per cent organic growth, led by Europe, Asia and DTC, which accounted for nearly half of revenues.

The company expects mid-single digit growth and further margin gains in FY26.

Diluted EPS from continuing operations increased to $1.26 from $0.52 in the previous year, while adjusted diluted EPS rose to $1.34 from $1.24. The company generated $530 million in operating cash flow and $308 million in adjusted free cash flow. The company returned $363 million to shareholders during the fiscal, up 26 per cent YoY, LS&Co said in a press release.

In the fourth quarter (Q4) ended November 30, 2025, the company reported net revenues of $1.8 billion, up 1 per cent on a reported basis and 5 per cent organically compared with Q4 FY24. Growth was broad-based, supported by strong momentum in Europe, Asia and Beyond Yoga, alongside high-single digit comparable growth in direct-to-consumer (DTC).

Europe recorded reported revenue growth of 8 per cent and organic growth of 10 per cent, while Asia delivered growth of 2 per cent reported and 4 per cent organically. In the Americas, revenues declined 4 per cent reported but increased 2 per cent organically, with the US business flat on an organic basis. Beyond Yoga continued to outperform, posting reported growth of 37 per cent and organic growth of 45 per cent.

DTC revenues increased 8 per cent on a reported basis and 10 per cent organically, driven by strength across all regions. E-commerce revenues rose 19 per cent reported and 22 per cent organically, with DTC accounting for 49 per cent of total quarterly revenues. Wholesale revenues declined 5 per cent reported and were flat organically.

Operating margin in the quarter was stable at 11.9 per cent, while adjusted EBIT margin declined to 12.1 per cent from 13.9 per cent a year earlier due to tariff-related pressure on gross margins and higher adjusted SG&A expenses. Gross margin stood at 60.8 per cent versus 61.8 per cent in Q4 FY24. Net income from continuing operations was $160 million, with diluted EPS of $0.4 and adjusted diluted EPS of $0.41.

“Over the past few years, we’ve taken bold steps towards becoming a DTC-first, head-to-toe denim lifestyle brand,” said Michelle Gass, president and CEO of Levi Strauss & Co. “We are well on our way toward realising our strategic ambitions. We have narrowed our focus, improved operational execution and built greater agility across the organisation. As a result, we’ve elevated the Levi’s brand and delivered faster growth and higher profitability as reflected by our Q4 and full year 2025 results. While we still have important work ahead, the company is at an inflection point—emerging as a stronger, more resilient global business ready to define the next chapter of LS&Co.”

“We are sustaining our momentum, delivering 5 per cent organic growth in the fourth quarter on top of 8 per cent growth in the prior year. Our success in denim lifestyle has enabled us to expand our addressable market, positioning us for mid-single digit growth in 2026 and beyond,” said Harmit Singh, chief financial and growth officer of Levi Strauss & Co. “Our disciplined approach to converting growth into profitability has improved adjusted EBIT margin again in 2025 for the third year in a row, and we are on track to expand margins further as we strive toward 15 per cent. Our confidence in this trajectory is reflected in a new $200 million ASR program.”

Looking ahead, the company expects mid-single digit revenue growth in fiscal 2026 alongside further adjusted EBIT margin expansion, supported by continued DTC momentum, disciplined cost management and ongoing brand strength, added the release.

Fibre2Fashion News Desk (SG)

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Fashion1 week ago

Fashion1 week agoAustralian wool prices climb again as exporters drive demand

-

Politics5 days ago

Politics5 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings