Business

Market watch: India’s equity valuations dip below long-term averages; but stay elevated versus peers – The Times of India

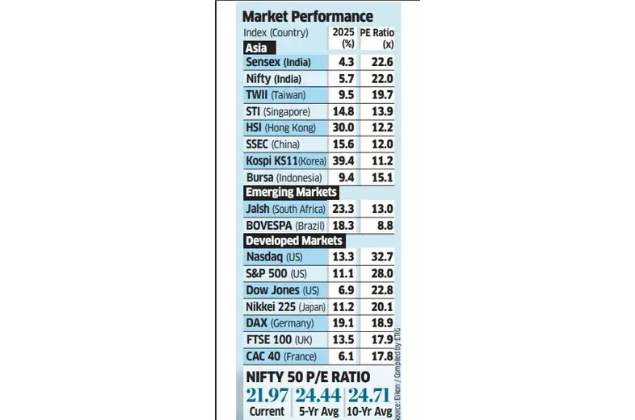

India’s equity valuations are trading marginally below their historical averages but continue to remain expensive compared with regional peers, raising concerns amid slowing earnings growth.The benchmark Nifty currently trades at a price-to-earnings (PE) ratio of 21.97 times, lower than its five- and 10-year averages of 24.4 and 24.8, respectively. In contrast, Hong Kong’s Hang Seng is at 11.7, South Korea’s Kospi below 13, and South Africa at around 12.7, according to an ET report.Valuations in India have traditionally traded at a premium to peers, supported by strong growth prospects. However, with corporate earnings momentum weakening, foreign investors are paring exposure and holding back fresh allocations.

“Valuations have begun mattering now because nominal GDP growth has slipped into single digits compared to around 12-13%,” said Ritesh Jain, founder of Pinetree Macro, a global macro asset allocation fund. “Corporate profitability is a function of nominal GDP. So, for an overseas fund manager looking at various markets, a country with slowing nominal growth and rich valuations is far less appealing despite its inherent strengths.”India is now the second-most expensive major market after the US, with some global fund managers increasingly shifting allocations to cheaper Chinese, European, and Japanese equities.Fund managers also noted that index composition plays a key role in valuation levels. “The composition of Indian indices must be taken into account while looking at valuations,” said Nilesh Shah, managing director, Kotak Mutual Fund. “If the Sensex and Nifty are full of expensive consumer names and there are fewer commodity players, it’s bound to push up valuation levels. If we were to remove some of the consumer names, our valuations are around averages on a historical basis.”

Business

Serial rail fare evader faces jail over 112 unpaid tickets

One of Britain’s most prolific rail fare dodgers could face jail after admitting dozens of travel offences.

Charles Brohiri, 29, pleaded guilty to travelling without buying a ticket a total of 112 times over a two-year period, Westminster Magistrates’ Court heard.

He could be ordered to pay more than £18,000 in unpaid fares and legal costs, the court was told.

He will be sentenced next month.

District Judge Nina Tempia warned Brohiri “could face a custodial sentence because of the number of offences he has committed”.

He pleaded guilty to 76 offences on Thursday.

It came after he was convicted in his absence of 36 charges at a previous hearing.

During Thursday’s hearing, Judge Tempia dismissed a bid by Brohiri’s lawyers to have the 36 convictions overturned.

They had argued the prosecutions were unlawful because they had not been brought by a qualified legal professional.

But Judge Tempia rejected the argument, saying there had been “no abuse of this court’s process”.

Business

JSW Likely To Launch Jetour T2 SUV In India This Year: Reports

JSW Jetour T2 Launch: JSW Motors Limited, the passenger vehicle arm of the JSW Group, is reportedly preparing to enter the Indian car market this year. It has partnered with Jetour, a China-based automotive brand owned by Chery Automobile, and the Jetour T2 SUV could be the company’s first product, according to the reports.

Media reports suggest that the launch will happen independently and not under the JSW MG Motor India joint venture. The SUV will wear a JSW badge and name, instead of the Jetour branding. The upcoming SUV will be assembled at JSW’s upcoming greenfield manufacturing facility in Chhatrapati Sambhaji Nagar, Maharashtra.

According to the reports, the company plans to have the vehicle on sale by the third quarter of this year. With this move, JSW aims to establish itself as a standalone carmaker in India.

Expected Powertrain

The SUV is likely to arrive with a 1.5-litre plug-in hybrid setup. Internationally, this hybrid powertrain is offered with both front-wheel drive and all-wheel drive options. It is still unclear which version will be introduced in India.

Design

In terms of design, the T2 is a large and rugged-looking SUV. It has a boxy and upright stance, similar to vehicles like the Land Rover Defender. Despite its tough appearance, it uses a monocoque chassis instead of a ladder-frame construction.

Size

The SUV measures around 4.7 metres in length and nearly 2 metres in width. This makes it larger than the Tata Safari, even though it is a five-seater. A longer 7-seat version is also sold in some markets.

Price

Pricing details for India are yet to be announced. For reference, the front-wheel-drive five-seat T2 i-DM is priced at AED 1,44,000 (around Rs 35 lakh) in the UAE.

Jetour

Jetour is a brand owned by Chinese automaker Chery. Launched in 2018, it focuses mainly on SUVs and is present in markets across China, the Middle East, Africa, Southeast Asia and Latin America.

Business

John Swinney under fire over ‘smallest tax cut in history’ after Scottish Budget

John Swinney has been pressed over whether this week’s Scottish Budget gives some workers the “smallest tax cut in history” – with Tory leader Russell Findlay branding the reduction “miserly” and “insulting”.

The Scottish Conservative leader challenged the First Minister after Tuesday’s Holyrood Budget effectively cut taxes for lower earners, by increasing the threshold for the basic and intermediate bands of income tax.

But Mr Findlay said that would leave workers at most £31.75 a year better off – saying this amounts to a saving of just £61p a week

“That wouldn’t even buy you a bag of peanuts,” the Scottish Tory leader said.

“John Swinney’s Budget might even have broken a world record, because a Scottish Government tax adviser says it ‘maybe the smallest tax cut in history’.”

Raising the “miserly cut” at First Minister’s Questions in the Scottish Parliament, Mr Findlay demanded to know if the SNP leader believed his “insulting tax cut will actually help Scotland’s struggling households”.

The attack came as the Tory accused the SNP government of increasing taxes on higher earners, with its freeze on higher income tax thresholds, which will pull more Scots into these brackets.

This is needed to pay for the “SNP’s out of control, unaffordable benefits bill”, the Conservative added.

Mr Findlay said: “The Scottish Conservatives will not back and cannot back a Budget that does nothing to help Scotland’s workers and businesses.

“It hammers people with higher taxes to fund a bloated benefits system.”

Hitting out at Labour – whose leader Anas Sarwar has already declared they will not block the government’s Budget – Mr Findlay said: “It is absolutely mind-blowing that Labour and other so-called opposition parties will let this SNP boorach of a budget pass.

“Don’t the people of Scotland deserve lower taxes, fairer benefits and a government focused on economic growth?”

Mr Swinney said the Budget “delivers on the priorities of the people of Scotland” by “strengthening our National Health Service and supporting people and businesses with the challenges of the cost of living”.

He insisted income tax decisions in the Budget would mean that in 2026-27 “55% of Scottish taxpayers are now expected to pay less income tax than if they lived in England”.

The First Minister went on to say that showed “the people of Scotland have a Government that is on their side”.

Referring to polls putting his party on course to win the Holyrood elections in May, the SNP leader added that “all the current indications show the people of Scotland want to have this Government here for the long term”.

Benefits funding is “keeping children out of poverty”, he told MSPs, adding the Budget contained a “range of measures” that would build on existing support.

The First Minister said: “What that is a demonstration of is a Government that is on the side of the people of Scotland and I am proud of the measures we set out in the Budget on Tuesday.”

Meanwhile he said the Tories wanted to make tax cuts that would cost £1 billion, with “not a scrap of detail about how that would be delivered”.

With the weekly leaders’ question time clash coming less than 48 hours after the draft 2026-27 Budget was unveiled, the First Minister also faced questions from Scottish Labour’s Anas Sarwar, who insisted that the proposals “lacks ambition for Scotland”.

Pressing his SNP rival, the Scottish Labour leader said: “While he brags about his £6 a year tax cut for the lowest paid, one million Scots including nurses, teachers and police officers face being forced to pay more.

“Even his own tax adviser says this is a political stunt. So why does John Swinney believe that someone earning £33,500 has the broadest shoulders and therefore should pay more tax in Scotland?”

Mr Swinney, however, said that many public sector workers would be better off in Scotland.

He told the Scottish Labour leader: “A band six nurse at the bottom of the scale will take home an additional £1,994 after tax compared to the same band in England.

“A qualified teacher at the bottom of the band will take home £6,365 more after tax in Scotland than the equivalent in England. There are the facts for Mr Sarwar.”

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator