Business

Zaanse Schans: The picturesque Dutch village set to charge tourists an entry fee

John LaurensonBusiness reporter, Zaanse Schans, Netherlands

Getty Images

Getty ImagesThe historic Dutch village of Zaanse Schans is well known for its windmills, which a heck of a lot of tourists want to go to see.

Indeed, they are some of the most picturesque examples in the Netherlands, and easy to get to from Amsterdam.

Last year, 2.6 million people visited – a gigantic amount for a small place with a resident population of just 100.

It is far too many tourists, says the local council. And so, it has announced that from next spring it will charge every visitor from outside the area €17.50 ($20.50; £15) to enter, to try to control the numbers.

It’s very rare for a community to take such a measure, but talking to Marieke Verweij, director of the village’s museum, you can understand why they want to do this.

“In 2017 we had 1.7 million visitors… this year we’re heading for 2.8 million,” she says. “But this is a small place! We just don’t have room for all these people!”

Worse, says Marieke Verweij, visitors often “don’t know that people live here so they walk into their gardens, they walk into their houses, they pee into their gardens, they knock on doors, they take pictures, they use selfie sticks to peek into the houses. So no privacy at all.”

I leave the museum and walk past a coach car park in the general direction of the windmills. I probably shouldn’t say this, as it’s just going to make the problem worse, but these are some fabulous windmills.

One of them is wooden and painted green. Another has thatched walls.

Every so often the wind picks up and their sails go round. It’s a fine sight – and one most people would want to get a picture with.

A lot of people are doing just that, of course. The windmills are actually still quite a long way off but, at the best spots, visitors form very civilised selfie-queues.

There’s a bit of a queue also at a little bridge that leads over a canal towards the windmills. As I edge forward I hear Chinese, English, Spanish, Arabic, Italian and Russian.

The plan is to get everyone to book and pay online. The sort of thing you often have to do now to visit museums post-Covid.

The sweetener for tourists is that for the €17.50 they get admission to two things they currently have to pay for separately anyway – entry to the museum and to the inside of the windmills.

The former contains a painting of the local windmills by French impressionist Claude Monet, who visited in 1871. In the latter you can see how, in the 17th Century, the Dutch were using windmills not just to grind grain, but to do things like grind pigments to make paint or saw wood.

If only half the current numbers keep visiting after the admission charge is introduced, annual revenues will be around €24.5m.

The council plans to spend the money on maintenance of the windmills and on new infrastructure. New toilets, for example. But the shop and restaurant owners are not happy at all.

The stores, it should be said, are a bit of an attraction in themselves. The staff wear traditional costumes in the cheese shop, they do clog-making demonstrations in the shoe store.

And they are located inside old and beautiful wooden houses. The antique and gift shop for example, dates from 1623.

The planned entrance charge is threatening the livelihoods of Zaanse Schans’s retailers and restaurant-owners, says Sterre Schaap. She co-runs the gift shop, which is called Trash and Treasures.

“It’s awful. It will mean that people who don’t have a big wallet won’t be able to come here,” says Ms Schaap. “It will mean that we will lose a lot of our shoppers.

“If you’re with a family of four and you have parking, it will be around €100. So people won’t have a lot of budget over for other stuff.”

I wander up to the windmills, past a young woman who’s photographing her friend, and a couple from Germany who are taking a selfie.

Up on the balcony of one of the windmills, looking out at the impressive flatness of Holland, I get talking to Ishan from Canada. “I don’t know if I’d pay the €17.50 to come here. It’s a bit steep just to see a couple of windmills,” he says.

But Elisia, who is Albanian, grew up in Greece, and now lives in the Netherlands, says she would definitely pay that amount. “These villages, they are not so big and they lose their charm when there are so many tourists,” she says.

Steve, who’s over with his family from Massachusetts in the US, has been doing his calculations and can see the good side of the upcoming charge.

“Cheap people like me,” says Steve, “look at the windmill and say ‘nah, I’m not gonna pay extra to go in there’, but if it’s all included I wouldn’t hesitate.”

It’d be a more complete experience, he says, and not a bad deal.

John Laurenson

John LaurensonThe deal is also a sign of the times. Rachel Dodds, a professor of tourism at Canada’s Toronto Metropolitan University, points out a few comparable cases.

“Bhutan charges an entry fee per day to visit the country. Venice, of course, is probably the most famous one with €5 for day trippers,” she says.

Meanwhile, the US and the UK both charge travel authorisation or visa fees for foreign nationals to visit them.

Yet villages that charge entrance fees are still very rare. Current other examples are the privately owned fishing village of Clovelly in Devon, England, the medieval Civita de Bagnoregio and Corenno Plinio in Italy, and Penglipuran in Bali, Indonesia.

As I wait for my bus to leave Zaanse Schans, a bus load of people arrive, swiping their credit cards to pay for their rides.

Those who arrive in a few months time will be digging around for pre-paid entry tickets, too.

Business

‘Side Hustle Generation’: Over 50% Of US Gen Z Opting For Extra Gigs Amid Economic Uncertainty

Last Updated:

At least 57% of Gen Z in the US now have side gigs, from retail to gig work, amid economic uncertainty and concerns over the impact of AI on jobs.

Gen-Z is the first generation for whom a 9-to-5 job isn’t essential for achieving financial success. (AI-Generated Image)

Amid widespread economic uncertainty, more than half of the Gen Z population in the United States is opting for side gigs to navigate the job market and for extra cash.

At least 57% of Gen Z in the US now have side gigs, compared to 21% of boomers and older, according to The Harris Poll, which dubbed them “America’s first true ‘side hustle’ generation.”

Most of them are picking up side hustles, from retail to gig work, for extra cash. Younger people “want to work [and] find success, but many of them just feel disillusioned with the opportunities to get there through the traditional career ladder,” Glassdoor chief economist Daniel Zhao told Axios.

Role Of AI

In an August report, Glassdoor researchers said that some of the youths are chasing creative or entrepreneurial goals. Moreover, AI and other technological advances have made it easier for professionals to monetise their skills and passions.

“We’re witnessing a true side hustle generation where work identity lives outside of traditional employment. Additional commentary and research also shows that there’s a growing number of Employee+ workers who diversify income streams without abandoning job security,” Glassdoor said.

“For Gen Z, the day job funds the passion project. Work pays the bills, but identity and fulfilment can come from entrepreneurial pursuits, creative endeavours, or social causes they care about,” it added.

Why Are Gen-Z Opting For Side Gigs?

One of the main reasons for this shift is job anxiety. Recent graduates are struggling to secure jobs, while those with them aren’t seeing the career growth they expect, according to Zhao.

Data shows that the financial optimism for college students has fallen to their lowest level since 2018, mostly due to concerns over unemployment and ‘AI-induced layoffs’. The advent of AI remains the most pressing concern among young workers.

As per The Harris Poll, Gen Z is the first generation for whom a 9-to-5 job isn’t essential for achieving financial success. Side hustles are not merely distractions or fallback options; they are central to Gen Z’s identity, offering creative, entrepreneurial, or activist outlets that main jobs cannot supply.

“It definitely makes me feel more financially secure,” Katie Arce, who works full-time in e-commerce and picks up shifts at a vintage clothing store in Austin, Texas, told Axios.

United States of America (USA)

January 11, 2026, 17:08 IST

Read More

Business

‘Political Stability Has Powered India’s Growth’: PM Modi At Vibrant Gujarat Conference

Last Updated:

PM Modi further emphasised that over the past 11 years, India has emerged as the largest data consumer and built the country’s largest real-time digital platform.

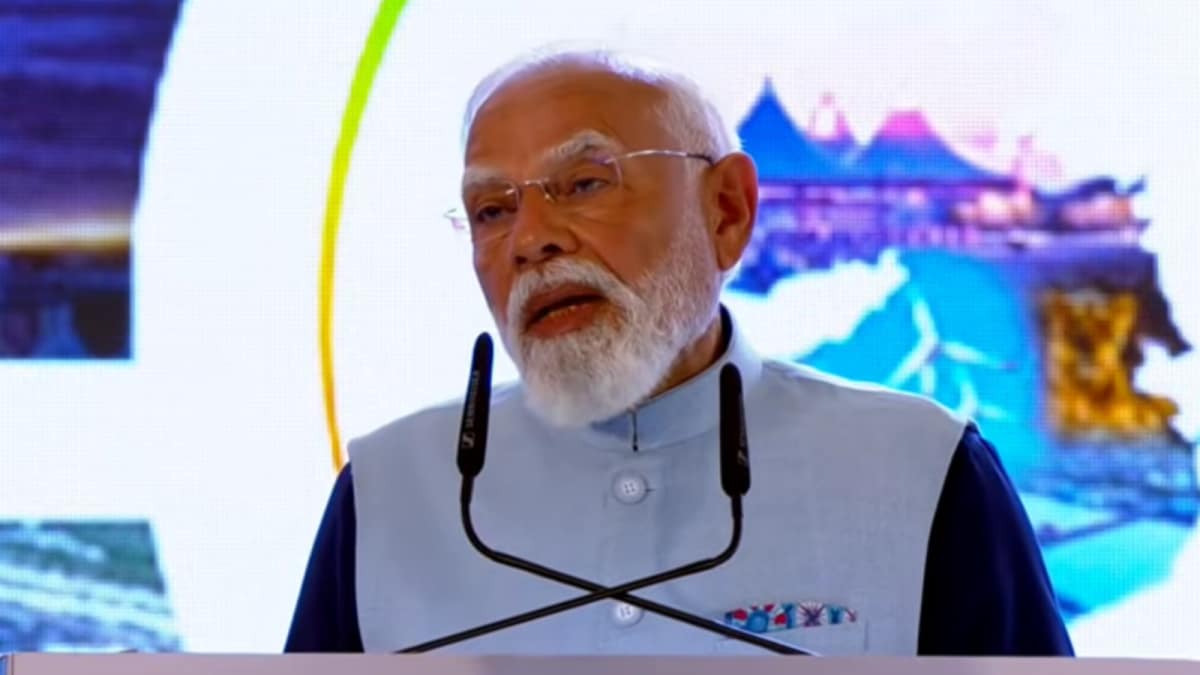

PM Modi speaking at the inauguration of Vibrant Gujarat Regional Conference. (PTI)

Prime Minister Narendra Modi on Sunday said that India’s political stability and strong macroeconomic fundamentals are driving global investor confidence, with Gujarat emerging as a key anchor of the country’s growth story.

While addressing the Vibrant Gujarat Regional Conference in Gujarat, the Prime Minister highlighted India’s economic trajectory, saying that the country is the world’s fastest-growing major economy, with inflation under control and a strong foundation for long-term growth. He said that reform express is driving India’s journey to developed nation status.

He highlighted that India is the largest producer of milk and a leading manufacturer of generic medicines, reflecting the country’s growing strength in both agriculture and pharmaceuticals.

VIDEO | Rajkot: PM Modi (@narendramodi) says, “India is the world’s fastest-growing large economy and inflation is under control. Agricultural production in India is setting new records, and the country ranks number one in milk production. India is also the world’s largest… pic.twitter.com/R6f7tDhoZD— Press Trust of India (@PTI_News) January 11, 2026

He noted that global institutions are increasingly bullish on India, with the International Monetary Fund (IMF) describing the country as the engine of global growth.

“India is the world’s 3rd largest startup ecosystem, 3rd largest aviation market, we are in the top 3 metro networks of the world,” he said, asserting that the country is heading to become the world’s 3rd largest economy.

PM Modi further emphasised that over the past 11 years, India has emerged as the largest data consumer and built the country’s largest real-time digital platform. He highlighted that India is now the second-largest mobile manufacturer, whereas earlier the country imported nine out of ten phones.

The Prime Minister also underlined Gujarat’s contribution to India becoming the world’s third-largest economy, noting that the state has grown across sectors. He said regions like Saurashtra and Kutch, once seen as remote, have now become major drivers of Atmanirbhar Bharat and investment-led growth.

Highlighting Saurashtra’s manufacturing strength, with over 2.5 lakh MSMEs producing goods ranging from basic tools to high-precision aircraft components, PM Modi pointed to the region hosting the world’s largest ship-breaking yard and being a major hub for tile manufacturing.

He further said that India’s first semiconductor fabrication plant is coming up in Dholera, with the land ready and a predictable policy environment supporting long-term growth.

Vibrant Gujarat Regional Conference

PM Modi on Sunday inaugurated the Vibrant Gujarat Regional Conference for the Kutch and Saurashtra regions.

The event saw the presence of Gujarat Chief Minister Bhupendra Patel and Deputy Chief Minister Harsh Sanghavi, among other dignitaries.

He also inaugurated 13 New Smart Industrial Estates in 7 Districts (Amreli, Bhavnagar, Jamnagar, Kutch, Morbi, Rajkot and Surendranagar) spanning an area of over 3540 Acres by Gujarat Industrial Development Corporation before his address on Sunday.

The two-day conference summit will highlight Gujarat’s leadership in the clean energy sector and its alignment with India’s ‘Panchamrit’ commitments announced by the Prime Minister. These include achieving 500 GW of non-fossil energy capacity by 2030, meeting 50 per cent of energy requirements from renewable sources, reducing projected carbon emissions by 1 billion tonnes, lowering carbon intensity by 45 per cent by 2030, and attaining net-zero emissions by 2070.

Rajkot, India, India

January 11, 2026, 16:22 IST

Read More

Business

EV adoptions gathers pace in 2025: Sales hit 2.3 million units; UP, Maharashtra lead sales – The Times of India

India sold were at 2.3 million units of electric vehicle in 2025, making up 8 per cent of all new vehicle registrations, according to a new report by the India Energy Storage Alliance, based on Vahan Portal data, cited by ANI. This boost was driven by incentives offered by the government and festive seasons. The majority portion of the sales were two-wheelers at 1.28 million units.The total registrations recorded in the overall passenger car market in the year 2025 stood at 28.2 million. Two-wheelers marked the most registrations 20 million registrations, while passenger cars were at 4.4 million and agricultural vehicles recorded 1.06 million. The recorded sales rose steadily throughout the year though slightly improved in the festival seasons due to GST benefits.Electric two-wheelers were the stars of the EV market, grabbing 57 per cent of sales. Three-wheelers came second with 0.8 million units (35 per cent), while four-wheelers logged 175,000 units. The report spotted good progress in electric delivery vehicles, especially in smaller commercial segments.Uttar Pradesh was at the forefront in this, with 400,000 units sold, taking an 18 percent market share in India’s EV segment. Maharashtra followed, with 266,000 units sold, contributing 12 percent to the segment, followed by Karnataka, with 200,000 units sold, contributing 9 percent to the market. The three accounted for over 40 percent in the country’s EV sales.Some smaller states recorded a very encouraging uptake of EVs. Delhi, Kerala, and Goa were able to reach an EV-to-ICE ratio of 14 percent, 12 percent, and 11 percent respectively. Meanwhile, states from the Northeast, Tripura, and Assam, achieved ratios of 18 percent and 14 percent, respectively.A major achievement was recorded in the three-wheeler segment, which attained a market penetration of 32 per cent. The government also created a record with their biggest ever order of electric buses—10,900 unit—valued at a massive Rs 10,900 crore through the PM E-DRIVE scheme.The report also stated that that while smaller vehicles led EV adoption, government efforts to electrify larger commercial vehicles and develop charging infrastructure were setting up India’s EV sector for continued growth beyond 2025.

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment4 days ago

Entertainment4 days agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment4 days ago

Entertainment4 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Politics4 days ago

Politics4 days agoUK says provided assistance in US-led tanker seizure

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Business6 days ago

Business6 days agoAldi’s Christmas sales rise to £1.65bn

-

Business4 days ago

Business4 days agoTrump moves to ban home purchases by institutional investors