Business

Ask Dhirendra: ‘If I know markets go up in the long run, why do short-term losses bother me so much?’ – The Times of India

“‘If I know markets go up in the long run, why do short-term losses bother me so much?’This is one of the most honest questions an investor can ask.On paper, you know the logic. You’ve seen all the charts: “Sensex 100 to 70,000”, “Nifty over 20–25 years”, “equity beats inflation in the long run”. You nod wisely when someone says, “Equity is for the long term.”And then one fine day, you open your app, see your portfolio down 8–10 per cent, and your stomach drops.The mind says, “Long term”.The heart says, “Bas, ab yeh band karo.”Let’s start with some sympathy: there is nothing wrong with you. Your brain is not designed for SIPs; it is designed for survival.When our ancestors saw red (blood, fire, and danger) the correct response was to panic and run. Today, your app shows red numbers, and your brain uses the same wiring: “Danger, danger, get out.” The problem is that the stock market is the only place where running at the wrong time converts a temporary fall into a permanent loss.It helps to see what “short term” and “long term” actually look like in numbers.

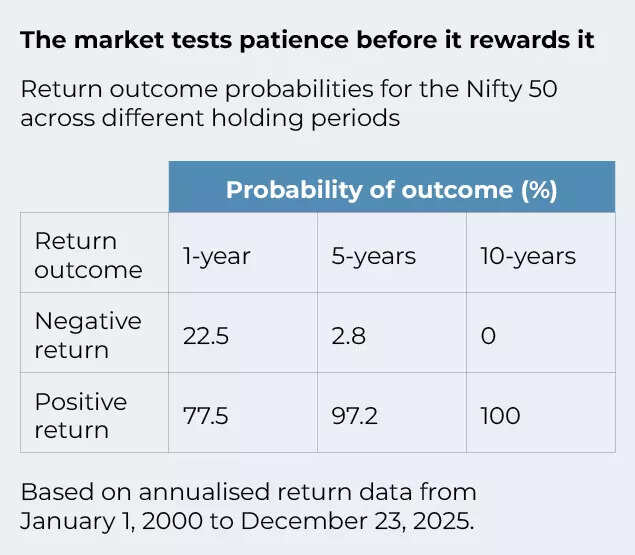

The market tests patience before it rewards it

When we look at this kind of data at Value Research, the pattern is always similar. Over the course of a year, losses are frequent. Over ten-year periods, they shrink dramatically. So the market is not misbehaving when it falls in a single year. It’s behaving exactly like a market. It is unrealistic to expect a smooth, linear upward graph.There’s another uncomfortable truth. You don’t look at your portfolio like a long-term investor; you look at it like a daily scorecard. Every time you open the app, the number on top becomes a verdict on your intelligence. Up means “I am smart”; down means “I am stupid.” Of course, you don’t want to feel stupid for three months in a row.Now we put some more structure on this feeling.Imagine you start a ₹10,000 monthly SIP in a good, diversified equity fund for 15–20 years. Somewhere along the way, there is a year when the market is down 20 per cent.There are only three things that can happen in that year:

- You panic and stop your SIP or redeem.

- You grit your teeth and do nothing.

- You not only continue but increase your investments.

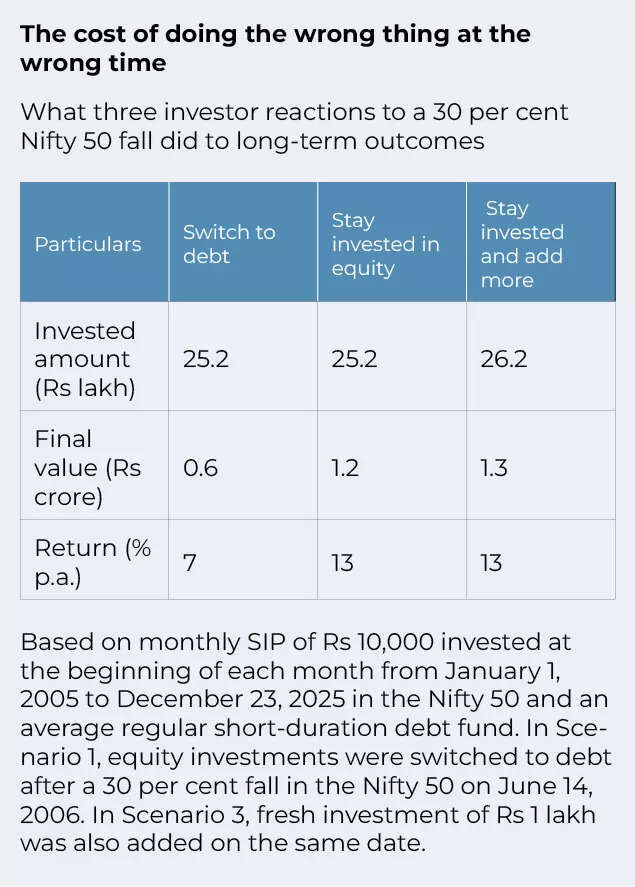

The cost of doing the wrong thing at the wrong time

When we run such scenarios at Value Research, the surprising part is this: the investor who simply does nothing in bad years often beats the one who keeps jumping around trying to avoid pain.So why can’t we “do nothing” easily?Partly because we confuse volatility with failure, a minus 10 per cent year feels like a verdict on our choice rather than a normal part of the journey. And partly because we mix up time horizons. We say, “This is for my retirement in 2045,” and then behave as if the performance over the last 45 days is all that matters.One practical way to calm yourself is to separate money by purpose. If you put all your money into the market and then need some of it next year, of course, every fall will feel catastrophic. But if you’ve done the boring work—kept an emergency fund, kept short-term money in safer avenues—then the equity money is truly long-term. You’re not going to need it next Diwali, so you don’t have to judge it every Diwali.Another trick is to change what you watch.Instead of staring at the absolute value, look at two different things:

- How much time do you have left before you actually need this money?

- How much of your target have you already accumulated?

At Value Research, our planning tools and advice try to shift people from “portfolio value today” to “probability of meeting your goal over time”. It’s much easier to tolerate a bad year in the market if you see that you’re still broadly on track for your long-term destination.And finally, accept this: you don’t have to enjoy seeing losses. You just have to not overreact to them. The test of a good investment is not whether it goes up every quarter; it’s whether it helps you reach your goals over ten or twenty years, without making you do something foolish in between.So if you know markets go up in the long run but short-term losses still bother you, that just means you’re human. Good. Stay human. Just put a system around your humanity:

- Keep your emergency and near-term money out of harm’s way.

- Use equity only for genuinely long-term goals.

- Decide your SIPs when you are calm, and refuse to renegotiate them with your panicked future self.

Red numbers on a screen are not a verdict on your intelligence. Most of the time, they’re just the market’s way of asking, “Did you really mean it when you said long term?”If the answer is yes, close the app and let time do the arguing for you.If you have any queries for Dhirendra Kumar you can drop us an email at: toi.business@timesinternet.in(Dhirendra Kumar is Founder and CEO of Value Research)

Business

Anthropic At $380 Billion Surpasses India’s Top IT Firms Combined As AI Fears Rock Stocks

Last Updated:

Anthropic’s AI tools have triggered a sharp decline in Indian IT stocks like TCS, Infosys, Wipro, eroding Rs 3,11,873 crore in market value.

Anthropic’s valuation surpassed combined value of total IT firms in India

The entire Information Technology (IT) industry in India is battering with the existential threat, which comes on the heels of rising generative AI, posing doubts over the viability of their business model.

Stocks of the IT industries, including Tata Consultancy Services (TCS), Infosys, Wipro, etc., hit brutally over the past week. This was triggered with the launch of new AI tools by Anthropic’s Claude for Cowork, which is like an office teammate helping the user to do tasks such as file sorting, reading legal drafts, etc.

Recommended Stories

-

From TCS To Infosys: Top IT Stocks Wipe Out Rs 3 Lakh Crore In Market Value

-

Black Friday For IT Stocks? TCS, Infosys, Wipro Seen Under Pressure As US Tech Slumps

-

Infosys, TCS, TechM And Other IT Stocks Slide Up To 5% On Renewed AI Concerns After US Jobs Data

-

Stocks To Watch: Coal India, IRCTC, SpiceJet, Wipro, Infosys, GAIL India, Biocon, And Others

Anthropic’s Valuation vs Nifty IT Index

Anthropic’s phenomenal valuation rise has surpassed the combined value of India’s top IT firms. Standing at a valuation of $380 billion, the US-based AI company has eclipsed India’s Nifty IT index, whose market cap was at $296.4 billion by the time of writing this report.

Investors are accelerating their exit from technology stocks as concerns intensify that advanced artificial intelligence tools could disrupt core segments of the global software and IT services industry.

This week alone, TCS, Infosys and HCL Technologies dragged 9-11 per cent.

The sharp correction has wiped out substantial investor wealth. Based on intraday lows, the combined market capitalisation of the top five domestic IT companies has eroded by nearly Rs 3,11,873 crore this week.

TCS emerged as the biggest laggard, losing Rs 1,28,800 crore in market value, with its market capitalisation slipping to Rs 9,35,253 crore. The fall also pushed it to the fifth-most valued listed company from the fourth position.

Infosys has seen its market capitalisation shrink by Rs 91,431 crore following a 15 per cent decline this week. HCL Technologies has lost Rs 53,647 crore in market value over the past five trading sessions. Wipro and Tech Mahindra have also recorded declines, with their market capitalisations falling by Rs 22,762 crore and Rs 15,233 crore, respectively, during the same period.

| Company Name | Mcap ($Billion) |

| Tata Consultancy Services | 107.4 |

| Infosys | 61.2 |

| HCL Technologies | 43.6 |

| Wipro | 24.8 |

| Tech Mahindra | 16.6 |

| LTIMindtree | 16.7 |

| Persistent Systems | 9.5 |

| Oracle Financial Services Soft | 6.4 |

| Coforge | 5 |

| Mphasis | 5.2 |

| Total | 296.4 |

Source: Bloomberg

Anthropic’s Recent Funding Round

Anthropic has recently raised $30 billion in Series G funding led by GIC and Coatue, valuing Anthropic at $380 billion post-money, as announced by the company in the press release.

The investment will fuel the frontier research, product development, and infrastructure expansions that have made Anthropic the market leader in enterprise AI and coding.

February 14, 2026, 09:15 IST

Read More

Business

Piyush Goyal Dismisses Rahul Gandhi’s Farmer Meet Video, Rebuts ‘Fake Narrative’ On India-US Trade Deal

Last Updated:

The minister offered a detailed reality check to counter what he termed ‘Rahul ji’s fakery’

Goyal reiterated that Prime Minister Narendra Modi’s policies are intrinsically linked to farmer welfare. (File Photo: PTI)

Union Commerce Minister Piyush Goyal has accused Congress leader Rahul Gandhi of orchestrating a “fake narrative” aimed at provoking India’s farming community. Responding to a video released on social media by the Leader of the Opposition on Friday, Goyal dismissed the interaction as a stage-managed performance featuring Congress activists masquerading as genuine farmer leaders. He asserted that the dialogue followed a predetermined script designed to mislead the public regarding the safeguards in the recent India-US trade deal.

Rahul Gandhi has alleged that “any trade deal that takes away the livelihood of farmers or weakens the food security of the country is anti-farmer”. He was pointing to the recently concluded India-US framework agreement for bilateral trade, which is expected to be signed after tweaks by the end of March.

Piyush Goyal offered a detailed reality check to counter what he termed “Rahul ji’s fakery”, placing on record that the Narendra Modi government has fully protected the interests of annadatas, fishermen, MSMEs, and artisans. The minister categorically clarified that sensitive crops like soyameal and maize have been granted no concessions whatsoever in the agreement, ensuring that domestic farmers remain shielded from competitive pressure. He criticised the opposition for repeating “baseless allegations” in an attempt to instill unnecessary fear among the rural population.

Addressing specific claims regarding apple and walnut imports, the minister provided a technical breakdown of the protectionist measures in place. He noted that while India already imports approximately 550,000 tonnes of apples annually due to high domestic demand, the new US deal does not allow unlimited entry. Instead, a strict quota has been established, far below current import levels, and subject to a Minimum Import Price (MIP) of Rs 80 per kg. With an additional duty of Rs 25, the landed cost of US apples will be roughly Rs 105 per kg—significantly higher than the current average landed cost of Rs 75 per kg from other nations—thereby ensuring Indian growers are not undercut. Similarly, for walnuts, the US has been offered a modest quota of 13,000 metric tonnes against India’s total annual import requirement of 60,000 metric tonnes, making it impossible for the deal to harm local producers.

Goyal also took a swipe at the historical record of the Congress party, pointing out the irony of its current stance. He reminded the public that during the Congress-led UPA era, India imported nearly $20 billion worth of agricultural products, including dairy items, which the current administration has strictly excluded from the US pact. He challenged Rahul Gandhi to explain his “betrayal of farmers” and questioned how much longer the opposition intended to peddle fabricated stories.

Concluding with the slogan “Kisan Surakshit Desh Viksit”, Goyal reiterated that Prime Minister Narendra Modi’s policies are intrinsically linked to farmer welfare. He maintained that the India-US agreement is a balanced framework that opens new markets for Indian exports like basmati rice and spices while keeping the nation’s agricultural backbone secure.

February 14, 2026, 05:29 IST

Read More

Business

AI disruption could spark a ‘shock to the system’ in credit markets, UBS analyst says

Mesh Cube | Istock | Getty Images

The stock market has been quick to punish software firms and other perceived losers from the artificial intelligence boom in recent weeks, but credit markets are likely to be the next place where AI disruption risk shows up, according to UBS analyst Matthew Mish.

Tens of billions of dollars in corporate loans are likely to default over the next year as companies, especially software and data services firms owned by private equity, get squeezed by the AI threat, Mish said in a Wednesday research note.

“We’re pricing in part of what we call a rapid, aggressive disruption scenario,” Mish, UBS head of credit strategy, told CNBC in an interview.

The UBS analyst said he and his colleagues have rushed to update their forecasts for this year and beyond because the latest models from Anthropic and OpenAI have sped up expectations of the arrival of AI disruption.

“The market has been slow to react because they didn’t really think it was going to happen this fast,” Mish said. “People are having to recalibrate the whole way that they look at evaluating credit for this disruption risk, because it’s not a ’27 or ’28 issue.”

Investor concerns around AI boiled over this month as the market shifted from viewing the technology as a rising tide story for technology companies to more of a winner-take-all dynamic where Anthropic, OpenAI and others threaten incumbents. Software firms were hit first and hardest, but a rolling series of sell-offs hit sectors as disparate as finance, real estate and trucking.

In his note, Mish and other UBS analysts lay out a baseline scenario in which borrowers of leveraged loans and private credit see a combined $75 billion to $120 billion in fresh defaults by the end of this year.

CNBC calculated those figures by using Mish’s estimates for increases of up to 2.5% and up to 4% in defaults for leveraged loans and private credit, respectively, by late 2026. Those are markets which he estimates to be $1.5 trillion and $2 trillion in size.

‘Credit crunch’?

But Mish also highlighted the possibility of a more sudden, painful AI transition in which defaults jump by twice the estimates for his base assumption, cutting off funding for many companies, he said. The scenario is what’s known in Wall Street jargon as a “tail risk.”

“The knock-on effect will be that you will have a credit crunch in loan markets,” he said. “You will have a broad repricing of leveraged credit, and you will have a shock to the system coming from credit.”

While the risks are rising, they will be governed by the timing of AI adoption by large corporations, the pace of AI model improvements and other uncertain factors, according to the UBS analyst.

“We’re not yet calling for that tail-risk scenario, but we are moving in that direction,” he said.

Leveraged loans and private credit are generally considered among the riskier corners of corporate credit, since they often finance below-investment-grade companies, many of them backed by private equity and carrying higher levels of debt.

When it comes to the AI trade, companies can be placed into three broad categories, according to Mish: The first are creators of the foundational large language models such as Anthropic and OpenAI, which are startups but could soon be large, publicly traded companies.

The second are investment-grade software firms like Salesforce and Adobe that have robust balance sheets and can implement AI to fend off challengers.

The last category is the cohort of private equity-owned software and data services companies with relatively high levels of debt.

“The winners of this entire transformation — if it really becomes, as we’re increasingly believing, a rapid and very disruptive or severe [change] — the winners are least likely to come from that third bucket,” Mish said.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout