Business

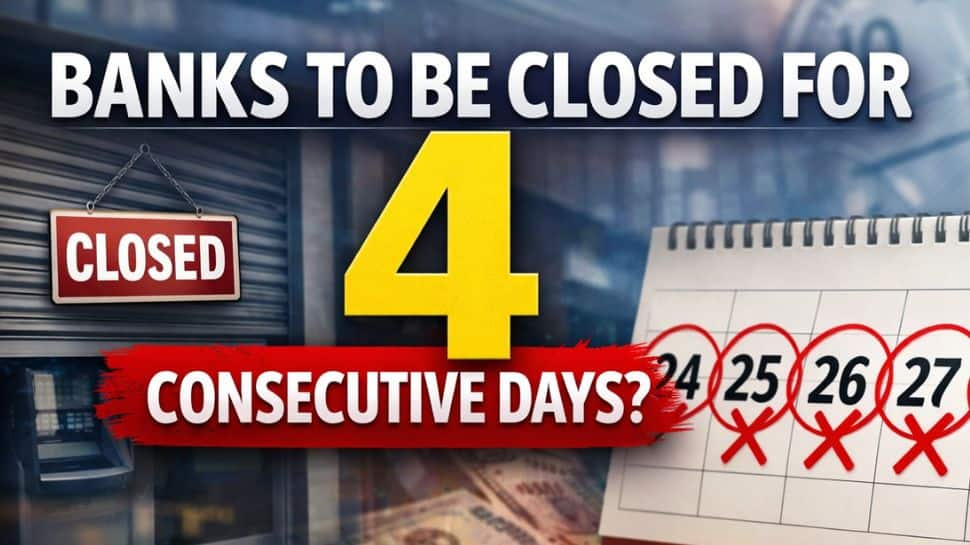

Bank Holiday Alert: Banks To Remain Shut On THESE Dates, Sept 8–14

New Delhi: Planning a bank visit this week? You might want to double-check first. Between September 8 and 14, 2025, many bank branches across India will remain shut on different days due to a mix of national and regional holidays, including Eid-e-Milad, the Friday following Eid, and the usual weekend closures.

Bank Closures Under RBI Holiday List

The Reserve Bank of India (RBI) has listed these holidays under the Negotiable Instruments Act, which covers transactions like cheques and promissory notes. While ATMs and online banking will continue to work, customers won’t be able to access in-person services at branches in the affected regions.

Why Did Mumbai Shift the Eid-e-Milad Holiday to September 8?

In Mumbai, Eid-e-Milad was initially slated for September 5, but the Maharashtra government shifted the holiday to Monday, September 8. The decision came after a request from the Muslim community to ensure harmony with Ganpati Visarjan celebrations on Anant Chaturdashi, which falls on September 6. Because of this change, all public and private banks in Mumbai will stay closed on September 8. (Also Read: CBIC Denies Viral Claims On GST Transition Benefits From Sep 22, Calls Message Misleading)

Full Bank Holiday List (Sep 8–14, 2025)

September 8 (Monday) – Banks closed in Mumbai for Eid-e-Milad

September 12 (Friday) – Banks closed in Jammu and Srinagar for Friday following Eid-i-Milad-ul-Nabi

September 13 (Saturday) – Second Saturday – Nationwide bank holiday

September 14 (Sunday) – Sunday Holiday – All-India (as per RBI rules)

What Can You Do When Banks Are Closed?

Even when branches are shut for holidays, most services remain within your reach. Customers can continue using online and mobile banking, as well as UPI and bank apps, for payments and transfers. ATMs also function normally, ensuring cash withdrawals are available during emergencies. (Also Read: GST Rate Cuts Big Relief For FMCG, Apparel, Footwear, Restaurants: Report)

However, transactions involving cheques and promissory notes are affected. That’s because the RBI issues the annual holiday list under the Negotiable Instruments Act, which governs such instruments. On these declared holidays, processing of cheques and similar paper-based transactions won’t take place.

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

Business

Education Budget 2026 Live Updates: What Will The Education Sector Get From FM Nirmala Sitharaman?

Union Education Budget 2026 Live Updates: Union Finance Minister Nirmala Sitharaman will present the Union Budget 2026–27 on February 1, with a strong focus expected on the Education Budget 2026, a key area of interest for students, teachers, and institutions across the country.

In the previous budget, the Bharatiya Janata Party government announced plans to add 75,000 medical seats over five years and strengthen infrastructure at IITs established after 2014. For 2025, the Centre had earmarked Rs 1,28,650.05 crore for education, a 6.65 percent rise compared to the previous year.

Meanwhile, the Economic Survey 2025–26, tabled in the Parliament of India, points to persistent challenges in school education. While enrolment at the school level is close to universal, this has not translated into consistent learning outcomes, especially beyond elementary classes. The net enrolment rate drops sharply at the secondary level, standing at just over 52 per cent.

The survey also flags concerns over student retention after Class 8, particularly in rural areas. It notes an uneven spread of schools, with a majority offering only foundational and preparatory education, while far fewer institutions provide secondary-level schooling. This gap, the survey suggests, is a key reason behind low enrolment in higher classes.

Stay tuned to this LIVE blog for all the latest updates on the Education Budget 2026 LIVE.

Business

LPG Rates Increased After OGRA Decision – SUCH TV

The Oil and Gas Regulatory Authority (Ogra) has increased the price of liquefied petroleum gas (LPG). According to a notification, the price of LPG has risen by Rs6.37 per kilogram. Following the increase, the price of a domestic LPG cylinder has gone up by Rs75.21. The revised prices have come into effect immediately.

The rise in LPG prices has added to the inflationary burden on household consumers.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports1 week ago

Sports1 week agoTransfer rumors, news: Saudi league eyes Salah, Vinícius Jr. plus 50 more

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoTikTok seals deal for new US joint venture to avoid American ban

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Politics1 week ago

Politics1 week agoTrump revokes Canada’s invitation to join Board of Peace