Business

Banks open as tax gap hits Rs374b | The Express Tribune

The FBR’s performance has deteriorated despite distributing 1,000 cars and increasing salaries by up to 400% to incentivise officers to perform better. Photo: AFP

ISLAMABAD:

As the tax shortfall against the downward revised target widened to Rs374 billion, the central bank on Friday ordered commercial banks to remain open on a holiday in the hope of collecting a few billion rupees more to minimise the yawning gap.

The Federal Board of Revenue (FBR) collected Rs7.15 trillion till the last working day of the month, falling short of the July-January target by a margin of Rs374 billion, according to provisional results compiled till Friday evening. Compared to the same period last year, the collection was nearly 12% or Rs743 billion higher till the last working day.

The FBR expects that the collection would improve by Rs50 billion on Saturday after more companies deposit money on account of super tax arrears.

However, against the original target, the shortfall was as high as Rs597 billion for the July-January period of the current fiscal year, according to the provisional figures. The International Monetary Fund (IMF) had downward adjusted the target due to the slowing economy and a low rate of inflation.

Due to the widening gap, despite recovering some arrears of the super tax after the Federal Constitutional Court judgment in favour of the FBR, the State Bank of Pakistan (SBP) on Friday issued instructions to banks to remain open on Saturday (today).

“To facilitate taxpayers in making over-the-counter (OTC) payments of government duties and taxes, it has been decided, on the request of the Federal Board of Revenue (FBR), that Saturday opening branches of all commercial banks (including NBP branches handling customs collection) shall observe extended working hours from 9am to 5pm,” according to a statement issued by the central bank.

In a functional tax and governance system, banks are not forced to keep their branches open to compensate for the FBR’s failures.

The central bank further stated that banks have been advised to keep their concerned branches open on January 31, 2026, for as long as required to facilitate the Special Clearing for Government transactions conducted by NIFT. Banks shall also ensure uninterrupted availability of their online payment channels, including internet banking, mobile applications, ATMs and other digital platforms, to facilitate the online payment of government duties and taxes, it added.

Prime Minister Shehbaz Sharif is heavily invested in improving the affairs of the FBR but, so far, he has not been able to achieve the desired results.

The Constitutional Court this week ruled in favour of the government in the super tax case, allowing the FBR to recover an estimated Rs190 billion from taxpayers. FBR officials said they have managed to recover at least Rs50 billion on account of super tax, while further recoveries were expected next month.

However, Dr Ikramul Haq, a renowned tax and legal expert, wrote that “the short order of the Federal Constitutional Court, validating super tax under sections 4B and 4C of the Income Tax Ordinance, has unsettled established constitutional jurisprudence governing the limits of parliamentary power to impose ‘taxes on income’.” He stated that the judgment’s paragraph alone collapses under the weight of its own internal contradiction. One cannot, in constitutional logic, exhaust a legislative entry and yet continue to derive further taxing power from the very same entry by merely altering nomenclature, he added.

The FBR’s performance has deteriorated despite distributing 1,000 cars and increasing salaries by up to 400% to incentivise officers to perform better.

The details showed that, against the revised target of Rs3.64 trillion, the FBR collected Rs3.5 trillion in income tax, falling short of the goal by Rs162 billion, though it was 12.5% higher than last year. Sales tax collection amounted to Rs2.44 trillion, falling short of the target by Rs207 billion, but was 11% higher than last year.

Federal excise duty collection remained at Rs462 billion, slightly higher than the revised target, and was also 18% more than the previous fiscal year’s collection. Customs duty collection fell short of the target by Rs30 billion and stood at Rs750 billion.

The FBR paid Rs339 billion in refunds, which were Rs25 billion higher than the previous fiscal year.

Against the monthly target of Rs1.03 trillion, the FBR collected Rs986 billion in January. However, the FBR expects that the collection would cross Rs1 trillion by Saturday evening as it continues to push companies to pay arrears of the super tax.

Business

How inflation rebound is set to affect UK interest rates

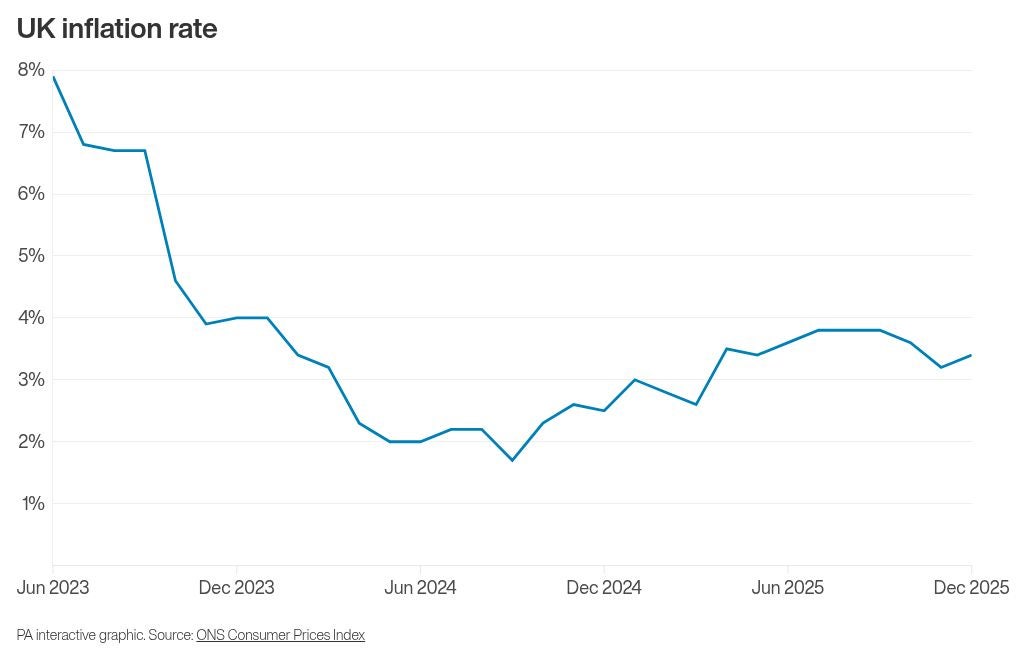

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’