Business

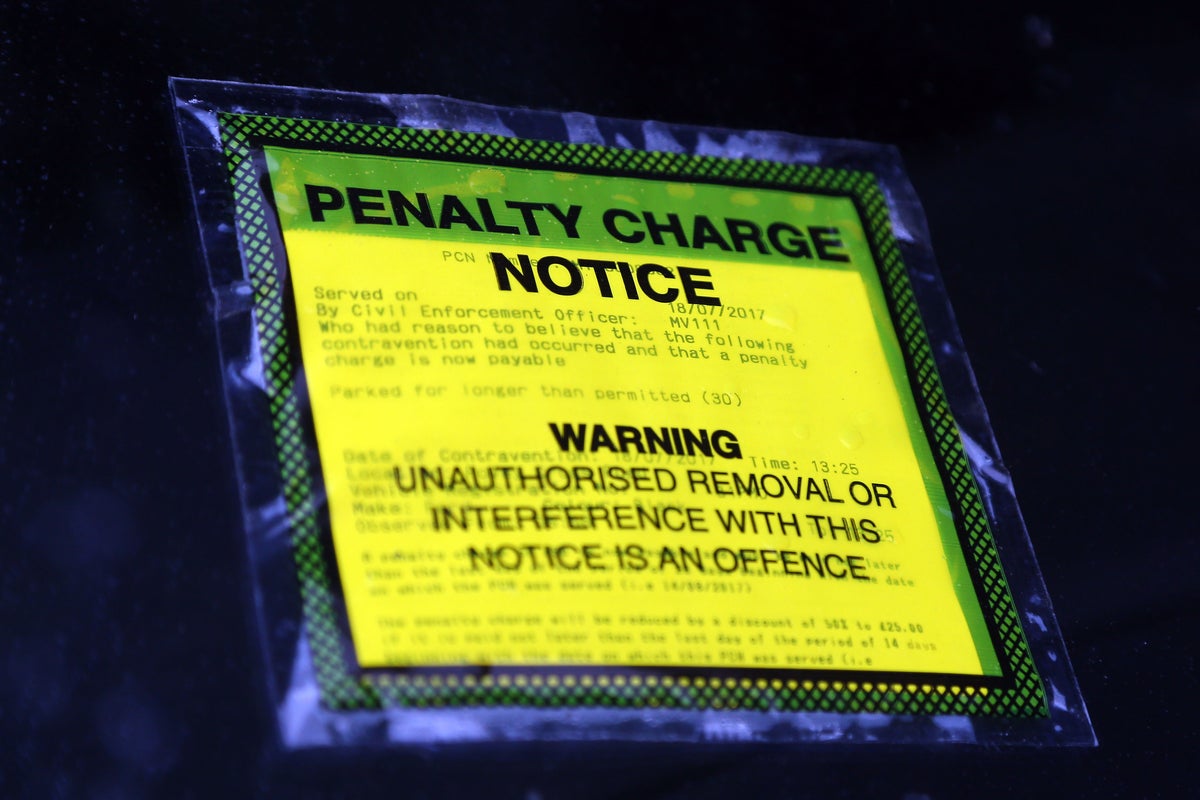

Driver fury as parking ticket debt firms record ‘disproportionately high’ 63% profits

Companies that charge drivers fees for recovering parking ticket debts are operating with an average profit margin of more than 60 per cent, a Government document has disclosed.

The Ministry of Housing, Communities and Local Government (MHCLG) stated that this figure indicates a “market failure”, while the AA branded the margins “disproportionately high”.

Debt recovery agencies are employed by parking operators to pursue payment for unpaid tickets, often adding up to £70 in additional fees per ticket for drivers.

These charges were set to be banned when the then-Conservative government introduced a code of practice in February 2022, but this was withdrawn four months later after a legal challenge by parking companies.

A new consultation document setting out the current Labour Government’s proposed code stated the £70 cap is “likely to be higher than can be reasonably justified” but it is “seeking further evidence”.

It added that recovery agencies have “an average profit margin of approximately 63 per cent”.

This is “comparable to highly innovative companies” despite the businesses involved providing “standard services such as payment plan provision”, according to the document.

It continued: “We therefore do not consider them to be providing significantly innovative services, and as such the high profits may be indicative of these firms having too much control over the market, thereby indicating that there is a market failure.”

Parking operators can take drivers to court if they continue to resist paying for tickets.

The MHCLG said debt recovery agencies would break even with fees of approximately £26 per ticket, if the proportion of those paying was stable.

Jack Cousens, head of roads policy at the AA, said: “The 63 per cent profit margin feels disproportionately high for the services provided.

“This only highlights the need to curb the sector and ensure balance for all.

“There remains an overzealous cohort among some private parking operators where they hand over cases to debt recovery firms for seemingly innocuous charges.”

He added that the ban on debt recovery fees in the original consultation was “the right position” and claimed the latest version “falls short of the mark”.

Steve Gooding, director of motoring research charity the RAC Foundation, said: “The profit margins revealed by the Government help explain why there are now more than 180 private parking firms buying vehicle keeper records from the DVLA so they can send demands to drivers – it’s a huge and profitable business.

“The private parking industry’s failure over time to be more open about its activities is part of the problem and its ongoing reluctance to open its books to official scrutiny shows why ministers must follow through with plans to bring transparency and independence to this sector.”

Recent analysis by the PA news agency and the RAC Foundation found 4.3 million tickets were issued by private companies to UK drivers between April and June.

That was a 24 per cent increase compared with the same period last year.

A BPA spokesman said it “strongly disputes the Government’s profit calculations” and called on it to “publish the methodology behind these figures”.

He continued: “The numbers presented are misleading and fail to reflect the reality of the debt resolution sector.”

He insisted the purpose of debt recovery fees is “not to generate profit but to act as a fair and effective deterrent against deliberate non-payment”.

An MHCLG spokesperson said: “This Government inherited a private parking market that lacks transparency and protection for motorists.

“We share their frustration, which is why our private parking code of practice will drive up standards in the industry and hold parking operators to account.

“We consulted on the current cap on debt recovery fees and will publish our response as soon as possible.”

Business

Warner Bros Discovery Inks USD110 Billion Deal with Paramount Skydance

Last Updated:

Warner Bros Discovery signed a SUD 11 billion deal with Paramount Skydance Friday morning, as revealed in a global town hall audio clip.

Warner Bros signs USD 110 billion deal with Paramount (Image for representation)

Warner Bros Discovery (WBD.O) signed a SUD 110 billion deal with Paramount Skydance (PSKY.O) Friday morning, the two companies announced, marking one of the most consequential media mergers in recent history.

“Netflix had the legal right to match the PSKY offer. As you all know, they ultimately decided not to do that. That then resulted in a signed agreement with PSKY as of this morning. So that’s where everything stands,” Bruce Campbell, Warner Bros’ chief revenue and strategy officer, said, as quoted by news agency Reuters.

The companies revealed that the deal is expected to close in the third quarter of 2026.

The deal was inked as Netflix declined to match Paramount’s latest USD 31-per-share offer, pulling out of the bidding war for Warner Bros. Discovery’s studio and streaming assets.

According to the Reuters report, citing sources, Warner Bros received the contracts from Paramount on Saturday and within the following two days, it announced that Paramount’s offer was superior.

The deal was immediately approved by board of directors of both media giants, said the companies in a joint statement.

The deal is “subject to customary closing conditions, including regulatory clearances and approval by WBD shareholders, with a vote expected in the early spring of 2026″, the statement read.

Interestingly, Paramount Skydance is headed by David Ellison, the son of Silicon Valley billionaire Larry Ellison, a close ally of President Donald Trump.

“By bringing together these world-class studios, our complementary streaming platforms, and the extraordinary talent behind them, we will create even greater value for audiences, partners and shareholders — and we couldn’t be more excited for what’s ahead,” David Ellison said in a statement.

NOT A ‘MUST HAVE’

In a stunning move hours later, Netflix announced it would not match Paramount Skydance’s latest offer to acquire Warner Bros Discovery. Netflix co-CEOs Ted Sarandos and Greg Peters asserted that “this transaction was always a nice to have at the right price, not a ‘must have’ at any price.”

TRUMP YET TO COMMENT

At one point, President Donald Trump said he might weigh in on the agreement. However, he told NBC News in early February that he would not be “involved” in the proceedings.

Then, last week, he issued a warning to Netflix, saying it would “pay the consequences” if it did not fire board member Susan Rice, an ex-official of the Biden administration.

During a podcast, Rice had said the entities that “take a knee” to the President would be “held accountable” when Democrats return to the office.

Meanwhile, the President is yet to comment on the deal.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

Washington D.C., United States of America (USA)

February 28, 2026, 07:48 IST

Read More

Business

UAE makes history: Central Bank launches world’s first sovereign financial cloud with AI for secure digital finance – The Times of India

In a bold leap that could redefine how modern financial systems operate, the Central Bank of the United Arab Emirates (CBUAE) has announced the launch of what it calls the world’s first sovereign financial cloud services infrastructure, a secure and AI-powered digital backbone designed specifically for the nation’s financial sector. This initiative, developed in partnership with Core42 (a subsidiary of AI and technology group G42), aims to position the UAE at the forefront of secure, sovereign digital finance and bolster its reputation as a global hub for innovative financial services.The platform, known as the Sovereign Financial Cloud Services Infrastructure (SFCSI), is set apart from traditional cloud environments by its focus on data sovereignty, integrated cybersecurity and unified multi-cloud management, all underpinned by advanced artificial intelligence and real-time analytics. In practical terms, this means the UAE’s financial sector will be able to process, analyse and automate critical banking functions with unprecedented speed and regulatory control, securely within national borders.

What makes the UAE’s sovereign financial cloud revolutionary

Unlike most cloud services, which are operated by global providers and often host data far from the jurisdictions that regulate them, the SFCSI is built on a fully isolated and centralised infrastructure that ensures critical financial data remains within the UAE’s legal and security perimeter. Governments and regulators see this as key not just for privacy but for economic and strategic sovereignty in a world where data and finance increasingly intersect.This approach mirrors broader global trends toward digital sovereignty, where countries aim to protect sensitive infrastructure from foreign interference, whether from geopolitical tensions or shifting international data laws. By embedding regulatory controls and governance tools directly into the cloud platform itself, the CBUAE is seeking to reduce reliance on foreign systems and strengthen confidence in the nation’s financial resilience.Core42’s involvement is not just as a technical builder; the partnership brings integrated artificial intelligence and advanced analytics directly into the financial backbone. This allows licensed financial institutions and the CBUAE to automate operational processes intelligently, analyse real-time data for risk and performance insights, improve decision-making with predictive models and enhance customer service through automated, data-driven workflows.In a world where financial services are rapidly becoming more complex and interconnected, AI integration at the infrastructure level offers both competitive edge and stronger defences against threats like fraud, system failure or cyber-attacks. The new system also provides a single management framework for multiple cloud services, giving licensed financial institutions the flexibility to administer a range of cloud environments, including private and hybrid setups, seamlessly and securely. This capability is particularly valuable for institutions that need to balance agility and innovation with strict regulatory compliance.

Implications for the UAE and global financial landscape

For the UAE’s banks, insurers and fintech startups, the SFCSI represents a foundational piece of digital transformation. Regulatory oversight will be more immediate and nuanced, while institutions can scale new digital products, from personalised banking apps to smart payment systems, without compromising on security or compliance.Officials from the CBUAE emphasised that the platform will serve the entire licensed financial sector, reinforcing not just operational resilience but also long-term sustainable growth as financial services evolve. The central bank’s leadership views this as a pivotal step in strengthening the nation’s competitiveness on the world stage.The UAE’s move toward a sovereign financial cloud resonates with a broader global push for digital control over critical infrastructure. Various countries are debating how to balance openness to global technology with the need to protect sensitive financial and governmental data, a tension that’s only grown more pronounced as cyber threats increase and geopolitical competition around tech intensifies. By being among the first to embed sovereign control, AI capabilities and cloud innovation at this scale, the UAE is signalling that it intends to lead in secure, regulated digital finance, not just participate in it.While this cloud platform is targeted at the financial sector, its development aligns with the UAE’s wider strategy of integrating AI and digital infrastructure across governance, public services and enterprise systems. The inclusion of AI, real-time analytics and automation at a national infrastructure level could help catalyse further technological development in related fields such as central bank digital currencies (CBDCs), national payments innovation and cross-border financial integration.

What UAE’s sovereign financial cloud platform means for everyday users and institutions

For banks and financial firms, the SFCSI offers a more efficient way to innovate and comply with regulations, potentially making services faster, more secure and easier to tailor to customer needs. For consumers and businesses, the shift could translate into:

- More secure banking services with enhanced protections.

- Better digital experiences built on real-time insights.

- Faster product rollouts as institutions leverage automated, AI-powered infrastructure.

- Greater confidence in data privacy and national sovereignty

The rollout of such an infrastructure may also attract international finance players, tech investors and startups looking to base operations in a secure, innovation-friendly jurisdiction. The Central Bank of the UAE (CBUAE) has unveiled what it calls the world’s first sovereign financial cloud services infrastructure, developed with technology partner Core42.The Sovereign Financial Cloud Services Infrastructure (SFCSI) is designed to ensure data sovereignty, robust cybersecurity, AI integration, and unified multi-cloud management for the UAE’s financial sector. Built with advanced AI and analytics, it will enhance automation, real-time decision-making and innovation within licensed financial institutions. The move reinforces the UAE’s ambitions to be a global leader in secure, digital finance, aligning with broader global trends toward sovereign digital infrastructure.

Business

What the Warner Bros deal could mean for streaming, cinemas and news

Rodney Benson, a media professor at New York University, called the deal “concerning”, would leave America’s largest media companies further concentrated in the hands of conservatives. Many of those owners, including the Ellison family, have separate, non news-related business interests that depend on government contracts or regulation and are therefore particularly vulnerable to pressure, he adds.

-

Tech1 week ago

Tech1 week agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Business1 week ago

Business1 week agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Fashion1 week ago

Fashion1 week agoICE cotton ticks higher on crude oil rally

-

Tech1 week ago

Tech1 week agoDonald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past

-

Entertainment1 week ago

Entertainment1 week agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Politics6 days ago

Politics6 days agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Business7 days ago

Business7 days agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Sports1 week ago

Sports1 week agoBrett Favre blasts NFL for no longer appealing to ‘true’ fans: ‘There’s been a slight shift’