Business

Festive cheer for India Inc: Households splurge on upgrades, go premium – The Times of India

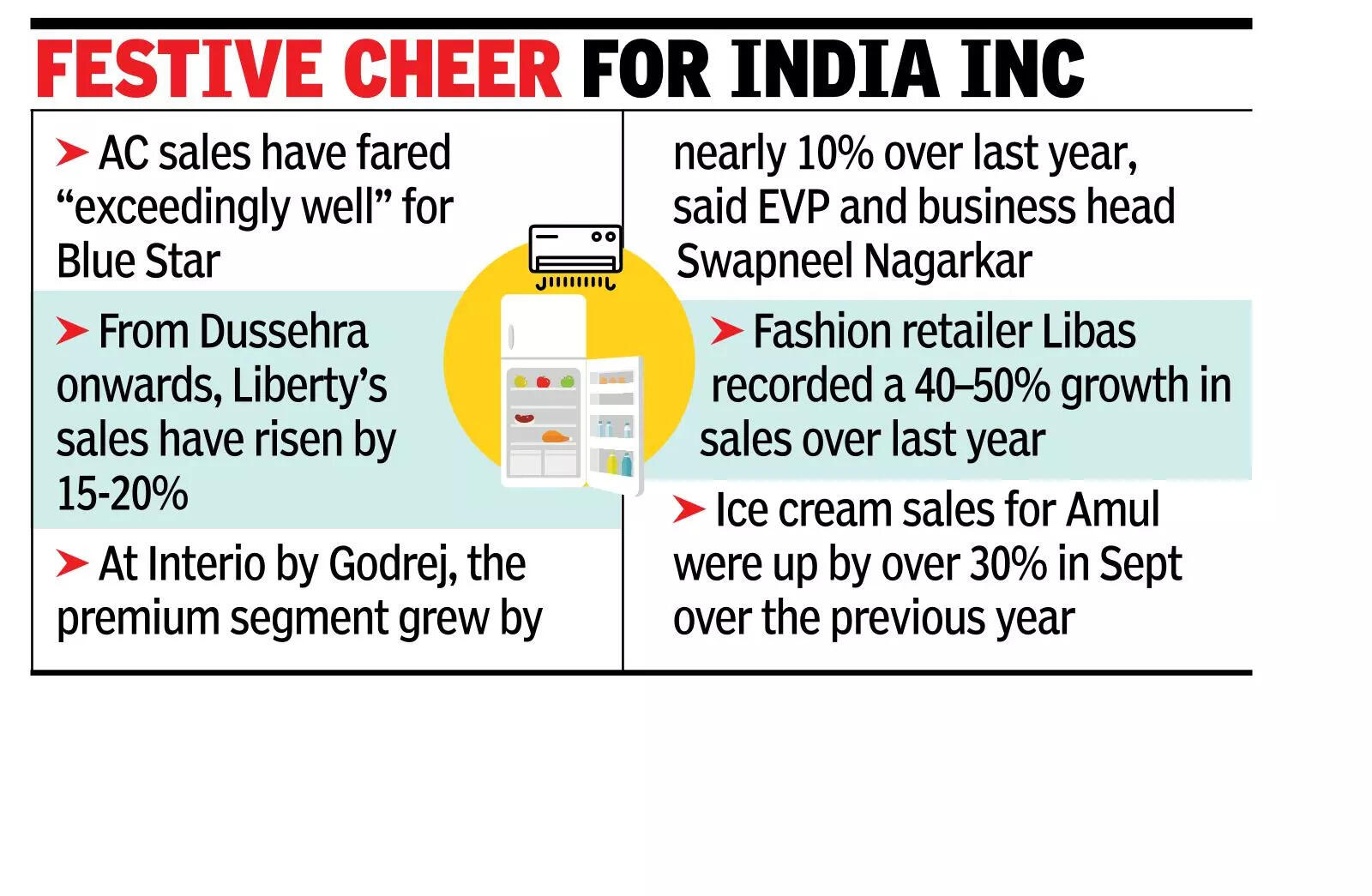

MUMBAI: From smartphones priced over Rs 20,000 to large TV sets, washing machines, premium furniture and AI appliances, Indians splurged on big-ticket purchases and upgrades this Navratri-Dussehra season, keeping up with the premiumisation trend that has been defining festive shopping for quite some time now. Savings made from GST reductions have only allowed more people to expand their budgets and shop across categories, whether or not they have been covered under the ambit of lower taxes. Sales of mass apparel and footwear, segments that have been sluggish for several quarters, picked up as well as GST cuts made products more affordable for the middle class. For retailers and consumer goods companies, the initial issues with regards tothe implementation of GST cuts on the ground has also eased, helping sales, executives said. “Consumers needed time to absorb what the changes in tax meant for pricing and purchase decisions. Once these gains were understood clearly, however, we started observing a strong pick-up. From Dussehra onwards, sales have risen significantly by 15-20%, driven in large part by the effective price relief afforded by the tax cuts. The impact price point for us remains in the range of Rs 1000-Rs 3000, the (price) band that has displayed maximum traction,” Anupam Bansal, MD at Liberty Shoes, told TOI.

AC sales have fared “exceedingly well” and the momentum will continue till Diwali, said B Thiagarajan, MD at Blue Star, adding that more people are showing an inclination to shift to 5-star ACs from 3-star. AC sales will pick up further once the weather becomes conducive for purchases, said Nilesh Gupta, director at Vijay Sales, which has seen a 20% year-on-year growth in sales this festive period. “The sales have been bumper this year. Large TVs did very well and so did washing machines. TVs saw volume growth of 10%-12% which is very good because the segment had been slow,” Gupta said. Among durables, ACs, TVs above 32 inches, and dishwashers have benefited from lower GST cuts. For the appliances business of Godrej Enterprises Group, Navratra sentiments have been better in non-metro markets – registering close to 30% growth over last year, while metros have shown about 12% growth in the same period. “The trend is seen almost across categories, including ACs, which have had price reductions owing to GST but not limited to ACs. Washing machines is an exception which showed strong growth in excess of 30% in both segments with higher growth in the metro territories. The good growth in AC in non-metros can be attributed partially to GST reduction given that festive is not a peak AC selling season,” said business head & EVP Kamal Nandi. Navratri sales hit a decade high this year on GST cuts, TOI had reported. At Interio by Godrej, the premium segment grew by nearly 10% over last year, said EVP and business head Swapneel Nagarkar. “While GST implications for the furniture industry remain unchanged, we observed a notable shift in consumer spending toward categories such as automobiles and premium appliances,” said Nagarkar. Premiumisation remained a defining trend at Amazon. Smartphones above Rs 20,000 grew 50% year-on-year, lifting overall category ASPs by 30%. Fashion retailer Libas recorded a 40-50% growth in sales over last year.

Business

Yes Bank Under Scanner As RBI Summons Executives Over Forex Card Breach

Last Updated:

RBI has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card

Reserve Bank of India headquarters in Mumbai.

The Reserve Bank of India (RBI) has summoned senior officials of Yes Bank following a major data breach involving the Yes Bank–BookMyForex multi-currency forex card, two people aware of the development told The Economic Times (ET).

According to the report, card details and CVV numbers of several users were allegedly compromised. The central bank has sought a detailed explanation from the bank on how its systems may have been breached and the sequence of events that led to the exposure of sensitive customer data.

“The RBI has sought a comprehensive briefing from Yes Bank’s senior management on the root cause of the breach, the timeline of events, and the adequacy of the bank’s cybersecurity framework,” one of the persons cited by ET said. “The regulator wants clarity on how sensitive card data, including CVV numbers, may have been exposed and what immediate containment measures have been implemented.”

Yes Bank declined to comment on the RBI’s queries but said an internal investigation had identified fraudulent transactions involving 15 merchants in a Latin American country on February 24. Transactions worth Rs 2.54 crore were approved across 5,000 customers, while 688 unauthorised attempts amounting to around Rs 90 lakh were blocked. The bank said it is working with the card network to initiate chargebacks and ensure that affected customers do not face financial losses.

Separately, BookMyForex said it does not store customers’ sensitive card information and that its systems were neither breached nor compromised during the period in question.

The RBI has also sought details on how sensitive card data—particularly CVVs—was stored and protected, whether encryption and prescribed security protocols were followed, and why existing cyber controls failed to prevent the breach. In addition, the regulator is reviewing the timeline of detection and reporting, the robustness of third-party risk management and oversight, the number of customers impacted, and the steps taken to block cards, prevent misuse and mitigate losses. It has also asked for clarity on internal accountability, supervisory lapses and remedial measures to prevent a recurrence, ET reported.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

February 26, 2026, 07:53 IST

Read More

Business

The family-owned soda firm that stuck to returnable glass bottles

Soft drinks company Twig’s Beverage has a loyal following for its old-fashioned approach.

Source link

Business

Cost of living: Students praise ‘essential’ food bank service

Queen’s University Belfast says there were more than 10,500 visits by students to its food bank in the students’ union.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash