Business

FTSE 100 nudges higher but weak data dents pound

The FTSE 100 posted modest gains on Tuesday, outperforming European and US peers, while weak UK data put sterling under pressure.

The FTSE 100 index closed up 9.90 points, 0.1%, at 9,452.77. The FTSE 250 ended 36.14 points lower, 0.2%, at 22,028.18, and the AIM All-Share dropped 2.91 points, 0.4%, to 789.56.

The UK unemployment rate unexpectedly rose in the three months to August, numbers showed.

According to the Office for National Statistics, the jobless rate was 4.8% in the three months to August, rising from 4.7% in the three months to July.

It had been expected to stay at 4.7%, according to consensus cited by FXStreet.

The ONS said payrolled employees in the UK fell by 93,000 on-year in August alone but did rise by 10,000 on-month.

In the early estimate for September, which the ONS warns is likely to be revised, payrolled employees fell by 100,000 on-year and by 10,000 on-month to 30.3 million.

Annual growth in regular earnings, so excluding bonuses, was 4.7% in the three months to August, easing from 4.8% in the three months to July. The figure landed in line with consensus.

Deutsche Bank’s chief UK economist Sanjay Raja said “one thing is clear, slack continues to build in the labour market”.

“Wage pressures are easing on the back of softening labour market and hiring plans remain stalled,” he added.

“Bottom line, we continue to think that a [fourth quarter 2025] rate cut may be underpriced by markets. We hold on to our view for a December 2025 rate cut.”

Citi said the jobs and wage growth figures add to its conviction that Bank of England meetings in November and December are “live”.

“Inflation data next week will be an important test with an undershoot likely to trigger further repricing towards an additional cut this year,” the broker said.

Elsewhere, a leading policymaker at the Bank of England warned that there is a “rising” risk that the UK economy could see a “more forceful downturn” because of higher borrowing costs.

Alan Taylor, a member of the central bank’s nine-strong Monetary Policy Committee, said there was a small but growing chance that the UK will witness negative growth and “recession dynamics start to kick in”.

He cautioned that it is “increasingly likely” that the UK economy will fall into a “weakened state for a sustained period”, with inflation sliding below target levels.

He said he believes this could lead to “undue damage” to economic activity in the UK.

The pound was quoted lower at 1.3294 US dollars at the time of the London equity market close on Tuesday, compared to 1.3331 US dollars on Monday.

The euro stood at 1.1591 US dollars, higher compared to 1.1569 US dollars. Against the yen, the dollar was trading at 151.83 yen, lower compared to 152.30 yen.

In European equities on Tuesday, the CAC 40 in Paris closed down 0.2%, while the DAX 40 in Frankfurt ended 0.6% lower.

Stocks in New York were down at the time of the London close. The Dow Jones Industrial Average was down 0.2%, the S&P 500 was 0.5% lower, while the Nasdaq Composite declined 0.9%.

Wall Street’s drop came despite strong third quarter results from investment banks JPMorgan, Goldman Sachs and Citi, which all beat market expectations.

Citi climbed 1.2%, but JPMorgan fell 2.0% and Goldman Sachs dropped 2.8%.

JPMorgan chief executive Jamie Dimon cautioned: “There continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.”

The yield on the US 10-year Treasury was quoted at 4.05%, widened from 4.04% at the time of the London equities close on Monday. The yield on the US 30-year Treasury stood at 4.64%, stretched from 4.62%.

On the FTSE 100, easyJet climbed 8.0% as Italian daily Corriere della Sera reported shipping firm Mediterranean Shipping is among those mulling investing, or taking full control of the budget carrier.

MSC is working in tandem with an investment fund, Corriere said, citing three sources familiar with the matter.

EasyJet is “landing on the desks of several individuals” interested in investing in it, Corriere reported.

Bookmaker Entain climbed 1.8% as its US joint venture BetMGM reported a strong third quarter, with first-half momentum continuing and full-year guidance raised.

Owing to the strong performance full-year net revenue guidance for BetMGM was lifted to at least 2.75 billion US dollars from 2.7 billion US dollars, and Ebitda is now anticipated at approximately 200 million US dollars, from at least 150 million US dollars.

But IMI fell 0.9% as RBC Capital Markets lowered to “sector perform” from “outperform”.

The downgrade reflects “valuation, rather than a fundamental change in our view”, RBC analyst Mark Fielding explained, noting IMI is a “high quality” business.

He pointed out IMI shares are up 26% year-to-date while he also feels the firm cannot avoid some impact from wider end market uncertainties.

On the FTSE 250, Mitie jumped 14% as it upgraded operating profit guidance and launched a new £100 million share buyback, following solid first-half revenue growth and continued progress with the integration of its recent Marlowe acquisition.

Housebuilder Bellway firmed 5.3% after announcing a £150 million share buyback and reporting a 21% increase in annual pre-tax profit as revenue climbed 17%.

But Morgan Advanced Materials dropped 6.6% after its second downbeat trading update in three months, warning of increasing uncertainty in European industrial markets.

Gold traded at 4,141.29 US dollars an ounce on Tuesday, up from 4,093.56 US dollars on Monday. Brent oil traded at 61.87 US dollars a barrel, down from 63.40 US dollars late Monday.

The biggest risers on the FTSE 100 were easyJet, up 37.2p at 501.2p, Persimmon, up 30.0p at 1,199.0p, Berkeley Group, up 94.0p at 4,034.0p, Next, up 250.0p at 12,635.0p and Centrica, up 3.15p at 173.0p.

The biggest fallers on the FTSE 100 were Spirax, down 285.0p at 6,645.0p, Anglo American, down 84.0p at 2,915.0p, Croda, down 76.0p at 2,662.0p, Antofagasta, down 69.0p at 2,758.0p and Weir Group, down 54.0p at 2,794.0p.

Wednesday’s global economic diary has inflation data in China overnight, eurozone industrial production figures and the US Beige Book.

Wednesday’s UK corporate calendar has a trading statement from recruiter PageGroup and bingo and casino operator Rank.

Contributed by Alliance News

Business

Bharat Coking Coal IPO To List Tomorrow: GMP Indicates Over 50% Bumper Gains

Last Updated:

Bharat Coking Coal IPO, a Coal India subsidiary, lists on BSE and NSE January 19, 2026, with a strong GMP.

Bharat Coking Coal IPO: Listing Price Prediction. Shares to be listed tomorrow, January 19, 2026.

Bharat Coking Coal IPO Listing Price Prediction, GMP: The allotment of the Bharat Coking Coal IPO was concluded on January 14, 2026. Now, investors are eyeing the listing of the shares on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), which is likely to take place on Monday, January 19, 2026.

The investors who have been allotted the unlisted shares of the Bharat Coking Coal IPO might be checking the grey market premium regularly.

The IPO was open for public subscription between January 9 and January 13. It received a massive overall subscription of 143.85 times subscription. Its retail category received 49.37x subscription, its non-institutional investor (NII) category received 240.49 times subscription, and its qualified institutional buyer (QIB) portion got 310.81 times bidding.

Bharat Coking Coal IPO Listing Date

The shares of Bharat Coking Coal Ltd (BCCL), a subsidiary of Coal India Ltd (CIL), will be listed on both the BSE and the NSE on January 19, Monday.

Bharat Coking Coal IPO Listing Price Prediction, GMP Today

According to market observers, unlisted shares of Bharat Coking Coal Ltd are currently trading at Rs 35.4 apiece in the grey market, which is a 53.91 per cent premium over the IPO price of Rs 23. It indicates a strong listing gains for investors. Its listing will take place on Monday, January 19.

The GMP is based on market sentiments and keeps changing. ‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Bharat Coking Coal IPO Allotment Status

The Bharat Coking Coal IPO allotment has already been finalised.

The allotment status can be checked online by following these steps:

Via Official Registrar

1) Visit registrar Kfin Technologies’ portal – https://ipostatus.kfintech.com/.

2) Under ‘Select Company’, select ‘Bharat Coking Coal Limited’ from the drop-box.

3) Enter your application number, demat account, or permanent account number (PAN).

5) Then, click on the ‘Submit’ button.

Your share application status will appear on your screen.

Via the BSE

1) Go to the official BSE website via the URL — https://www.bseindia.com/investors/appli_check.aspx.

2) Under ‘Issue Type’, select ‘Equity’.

3) Under ‘Issue Name’, select ‘Bharat Coking Coal Limited’ in the drop box.

4) Enter your application number, or the Permanent Account Number (PAN). Those who want to check their allotment status via PAN can select the ‘Permanent Account Number’ option.

5) Then, click on the ‘I am not a robot’ to verify yourself and hit the ‘Search’ option.

Your share application status will appear on your screen.

Via NSE’s Website

The allotment status can also be checked on the NSE’s website at https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids.

Bharat Coking Coal IPO: More Details

According to the red herring prospectus (RHP), the maiden public issue is entirely an offer for sale (OFS) of 46.57 crore equity shares by Coal India.

The listing of BCCL is part of the government’s broader divestment push in the coal sector, aimed at unlocking value in Coal India’s subsidiaries and enhancing transparency through market discipline.

In its prospectus, the company stated that the IPO will help achieve the benefits of listing.

BCCL will make its stock market debut on January 16. The company said that half of the issue size has been reserved for qualified institutional buyers, 35 per cent for retail investors and the remaining 15 per cent for non-institutional investors.

Last year, Central Mine Planning and Design Institute Ltd (CMPDIL), another wholly-owned arm of Coal India, had also filed its draft papers with Sebi for an IPO via the OFS route.

While BCCL is a coal-producing entity, CMPDIL serves as Coal India’s technical and planning arm.

Bharat Coking Coal was the largest coking coal producer in India in fiscal 2025, according to a Crisil report. It produces various grades of coking coal, non-coking coal and washed coals for applications primarily in the steel and power industries.

The company was incorporated in 1972 to mine and supply coking coal concentrated in mines located at Jharia, Jharkhand and Raniganj, West Bengal coalfields.

The public sector firm has expanded operations significantly over the years, with coal production increasing from 30.51 million tonnes in fiscal 2022 to 40.50 million tonnes in fiscal 2025, which is an increase of 33 per cent. Its coal production stood at 15.75 million tonnes in the six months ended September 30, 2025, as compared to 19.09 million tonnes in the year-ago period.

The company operates a network of 34 operational mines, including 4 underground mines, 26 opencast mines, and 4 mixed mines as of September 30, 2025.

On the financial front, Bharat Coking Coal’s revenues from operations stood at Rs 13,802 crore and profit of Rs 1,204 crore in FY25.

BCCL’s issue comes against the backdrop of a blockbuster year for the primary market.

In 2025, companies raised a record nearly Rs 1.76 lakh crore through IPOs, buoyed by strong domestic liquidity, resilient investor sentiment and a supportive macroeconomic environment. This surpassed the Rs 1.6 lakh crore mobilised by 90 firms in 2024 and the Rs 49,436 crore raised by 57 companies in 2023.

Disclaimer: The views and investment tips by experts in this News18.com report are their own and not those of the website or its management. Users are advised to check with certified experts before taking any investment decisions.

January 18, 2026, 09:31 IST

Read More

Business

British Gas took 15 months to refund me £1,500. It’s absurd

Dan WhitworthMoney Box reporter, London

Beth Kojder

Beth KojderA woman says it is “absurd” it took British Gas 15 months to produce a final bill and refund more than £1,500 of credit, despite the energy ombudsman telling the firm to do so nearly one year ago.

Beth Kojder moved out of her one-bed flat in south-east London in October 2024 but complained to the ombudsman a few months later when the company did not send her a final bill or refund her credit.

In February 2025 the ombudsman decided in Beth’s favour and told British Gas to carry out her request. But it has no legal powers to force it.

Beth only received the offer of her money this week, just days before her case was due to be heard in a small claims court.

British Gas said it was “implementing the ombudsman’s remedy” for Beth, adding it was “very sorry” for how long it had taken.

Beth told the BBC the process had been “relentless and it’s tiring and it’s completely draining”.

When she moved out of her flat, she asked British Gas for a final bill using the meter readings she provided. She also asked it to refund her £1,700 less a few hundred pounds she expected to owe for her final bill.

“It’s a significant amount of money. Maybe not to British Gas but it is to me,” said Beth, who had her first baby in December. “That’s almost £2,000 I could have done with. Then there’s all the admin.”

Not legally enforceable

When she didn’t receive her final bill or refund she complained to British Gas.

But Beth said she “got nowhere” so took her complaint to the energy ombudsman.

It is an independent, impartial dispute resolution scheme that energy customers can complain to eight weeks after first complaining to their supplier.

Energy suppliers are legally obliged as part of their licence conditions to be a member of an independent customer dispute scheme.

But the energy ombudsman is not a statutory body and it cannot legally force suppliers to act.

In 2024, there were 93,000 complaints accepted by the energy ombudsman with around 70% of those cases ruled in favour of consumers, with suppliers required to take action within 28 days.

In the vast majority of cases, suppliers met that deadline, but in many thousands of cases the deadline was either missed or no action was taken at all.

It has prompted the Department for Energy to look at ways to strengthen the energy ombudsman saying the number of decisions not being implemented quickly enough was too high.

Beth Kojder

Beth KojderIn Beth’s case the ombudsman issued four resolutions in February 2025.

British Gas actioned three minor ones including a written apology and a goodwill credit of £100 for shortfalls in service.

But the decision also required British Gas to “complete the final billing of the account… based on the [meter] readings already provided by Beth.” But 11 months on and that still hadn’t happened.

Beth said the only option she had left was to go down a legal route via a small claims court.

“I just felt completely desperate and like it was the only option to try to get some traction,” she said.

Beth Kojder

Beth KojderBBC Radio 4’s Money Box first contacted British Gas about this case in early December and, up until late Thursday night, Beth was resigned to having to go to the small claims court to get what she strongly feels she’s owed.

Then, British Gas came back with an offer of everything Beth was asking for, which she has happily accepted.

Beth said she was pleased to get the matter resolved but said she was frustrated that it had taken so many months to do so and felt British Gas had “completely failed” to engage with the ombudsman process.

“I still think the fact it’s taken this long to reach [a resolution] is absurd. And the level of intervention that’s been required on my part as a consumer is unbelievable.”

British Gas said: “We’re implementing the Ombudsman’s remedy and, together with Ms Kojder, are finalising a resolution to her claim. We appreciate this has been difficult for her and we’re very sorry for the length of time it has taken to put things right.”

Ofgem’s deputy director of retail compliance, Jackie Gehrmann, told the BBC that in the last year suppliers have paid out £27m in fines and voluntary payment agreements in consumer related issues.

“The message to suppliers is really, really clear. When the ombudsman makes a ruling they should implement that ruling as quickly as possible,” she said.

The DESNZ told the BBC: “We are strengthening the Energy Ombudsman so consumers can be confident that when it has ruled in their favour, action will be taken.”

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

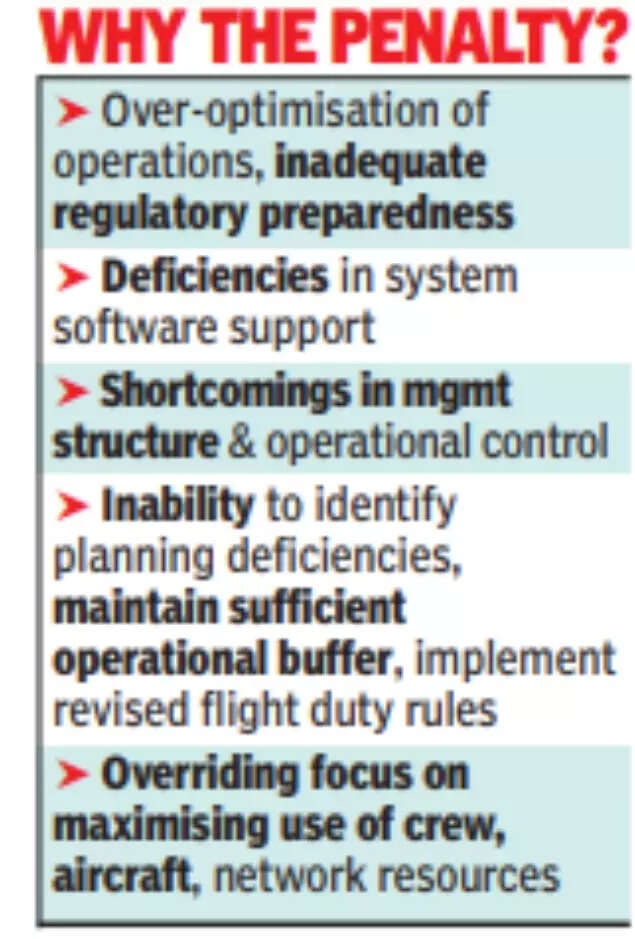

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment5 days ago

Entertainment5 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship