Business

Memory chip shortage threatens global smartphone and PC markets | The Express Tribune

RAM memory chips are seen in this illustration photo. SOURCE: REUTERS

Global demand for smartphones, personal computers and gaming consoles is expected to shrink this year as companies from Britain’s Raspberry Pi (RPI.L) to HP Inc (HPQ.N) raise sticker prices to offset surging memory chip costs.

The rapid build-out of artificial intelligence infrastructure by US tech firms such as OpenAI, Alphabet-owned (GOOGL.O) Google and Microsoft has absorbed much of the world’s memory chip supply, pushing up prices as manufacturers prioritise components for higher-margin data centres over consumer devices.

Samsung (005930.KS), SK Hynix (000660.KS) and Micron (MU.O), the world’s three largest producers of memory chips, have said in recent months that they were struggling to keep up with demand as they reported rosy quarterly earnings on the back of surging prices for their semiconductors.

But the price surge is rippling through consumer markets.

Research firms IDC and Counterpoint both now expect global smartphone sales to shrink at least 2% this year, in a sharp reversal from their growth outlook a few months ago. That would mark the first annual decline in shipments since 2023.

The PC market is expected to shrink at least 4.9% in 2026, IDC estimated, after an 8.1% growth last year. Meanwhile, console sales are expected to fall 4.4% in the current year after an estimated growth of 5.8% in 2025, according to TrendForce.

PC and Smartphone markets are bracing for contraction

Tough choices for manufacturers

While several firms have already raised prices, industry heavyweights Apple (AAPL.O) and Dell (DELL.N) face a tough choice: take on the costs and sacrifice margins or pass them on to consumers at the risk of stifling demand.

“Manufacturers might absorb some costs, but given the scale of the shortage, it is certainly going to show up as higher prices for consumers,” Emarketer analyst Jacob Bourne said.

“It is going to result in more tepid consumer device sales in 2026. It will be a challenge for these companies that are trying to sell products during a time of broader inflation.”

Pressure is being compounded by expectations that the price increases will persist, possibly into next year. Counterpoint estimates that memory prices will jump 40% to 50% in the first quarter, after last year’s 50% surge.

“Over the last two quarters, we’ve seen 1,000% price inflation in some products, and pricing is continuing to rise,” said Tobey Gonnerman, president of semiconductor distributor Fusion Worldwide.

“Consumers can expect to pay significantly higher prices for laptops, mobile phones, wearables and gaming devices very soon.”

Analysts believe the impact is likely to be most pronounced for manufacturers of low- and mid-range devices, such as Chinese smartphone makers Xiaomi (1810.HK) and TCL Technology (000100.SZ) and PC firm Lenovo (0992.HK).

TrendForce said last year that Dell and Lenovo were planning price hikes of as much as 20% early in 2026.

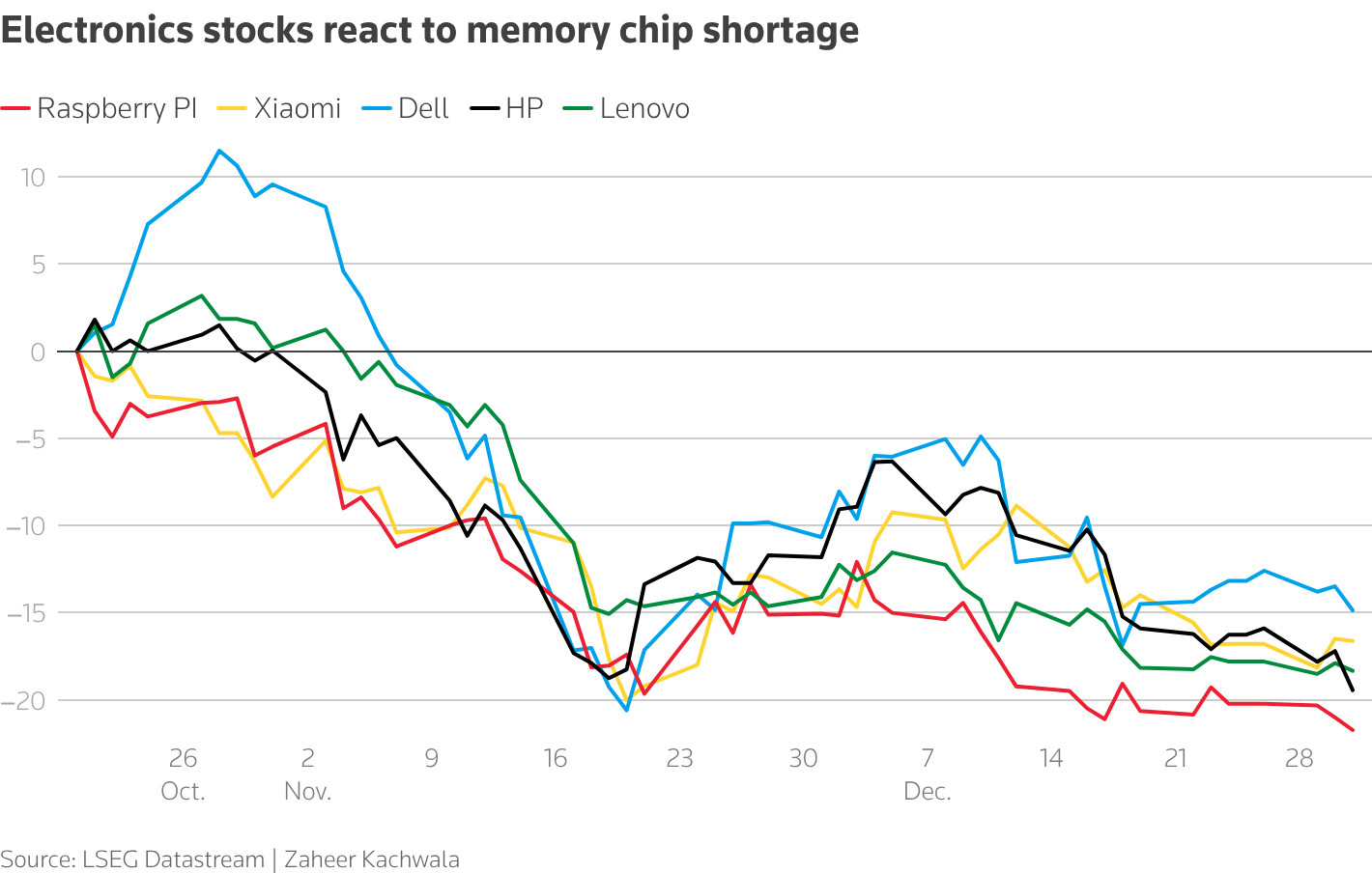

Shares of all Raspberry Pi, Xiaomi, Dell, HP Inc., and Lenovo fell in the last three months of 2025, with Xiaomi posting the biggest drop with a 27.2% decline.

Electronics stocks react to the memory chip shortage

HP CEO Enrique Lores said in November the company would raise PC prices due to “significant” memory chip costs, while Raspberry Pi CEO called the cost surge “painful” in a December blog post announcing price increases for its devices.

The weaker demand outlook could also hamper sales at electronics-focused retailers such as Best Buy (BBY.N), which had already warned last year that tariff-driven price increases could dissuade potential buyers.

Apple will report earnings on January 29, while Dell is slated to report on February 26. Xiaomi usually reports in late March.

Apple’s market power

Some analysts said Apple, with its scale, pricing power and deep supplier network, is better positioned to weather the memory chip price surge than its smaller rivals.

The company typically holds prices of its flagship iPhone lineup in the US steady between its September launch events. Last year, it absorbed the hundreds of millions of dollars in tariff-related costs, instead of passing them on to customers.

“Apple is better-positioned, as it uses contract pricing (rather than more volatile spot pricing) for its purchases, securing better prices,” Morningstar analyst William Kerwin said.

“But it isn’t immune, and may need to raise prices to pass on higher input costs.”

Business

More people have adopted the four-day work week – here’s why

More than 50 organisations collectively employing over 1,400 individuals transitioned to a four-day working week in 2025, according to new figures.

The 4 Day Week Foundation revealed that the total number of employees now benefiting from this model stands at over 6,000 across 253 accredited businesses.

The newly certified employers represent a broad spectrum of industries, including business, consulting, management, charities, technology, retail, housing, engineering, marketing, arts and entertainment, manufacturing, gaming, recruitment, heritage, healthcare, and education.

London saw the highest number of these new accreditations, with Scotland and the North West also showing significant adoption.

Joe Ryle, campaign director for the foundation, said the latest figures show that UK employers no longer have any practical barriers to making the shift.

“These companies are proving that there is nothing stopping organisations in the UK from moving to a four-day week,” he said.

“Across virtually every sector and region, employers are showing that shorter working weeks boost productivity, improve wellbeing and help attract and retain talent – all without cutting pay.

“The question is no longer whether it works, but how quickly others will follow.”

A total of 53 newly accredited organisations permanently adopted a four-day week with no loss of pay last year, the foundation said.

Researchers in the US found last year that working four days a week can help workers protect their mental health.

A team at Boston College said their landmark study had revealed the shift was associated with a high level of satisfaction on the part of both employers and employees.

More than 100 companies and nearly 2,900 workers in the U.S., U.K. Australia, Canada, and Ireland were involved in the study.

That included an improvement in productivity and growth in revenue, a positive impact on physical and mental health, and less stress and burnout.

A 2024 poll of more than 2,000 full-time U.S. workers found that more than half of respondents reported feeling exhausted from chronic workplace stress within the past year.

The main reason that employees had maintained productivity, according to their assessment, is that companies have decreased or cut activities with questionable or low value, including meetings. Instead, meetings became phone calls and conversations via messaging apps.

Another key factor was that employees would use their third day off for doctor’s appointments and other personal errands that they might otherwise try to cram into a work day.

The study, published Monday in the journal Nature Human Behaviour, builds on previous research that has found similar benefits, and comes on the heels of a recent study that found long working hours may alter brain structure.

Business

Bank depositors’ role in funding credit growth on decline: RBI data – The Times of India

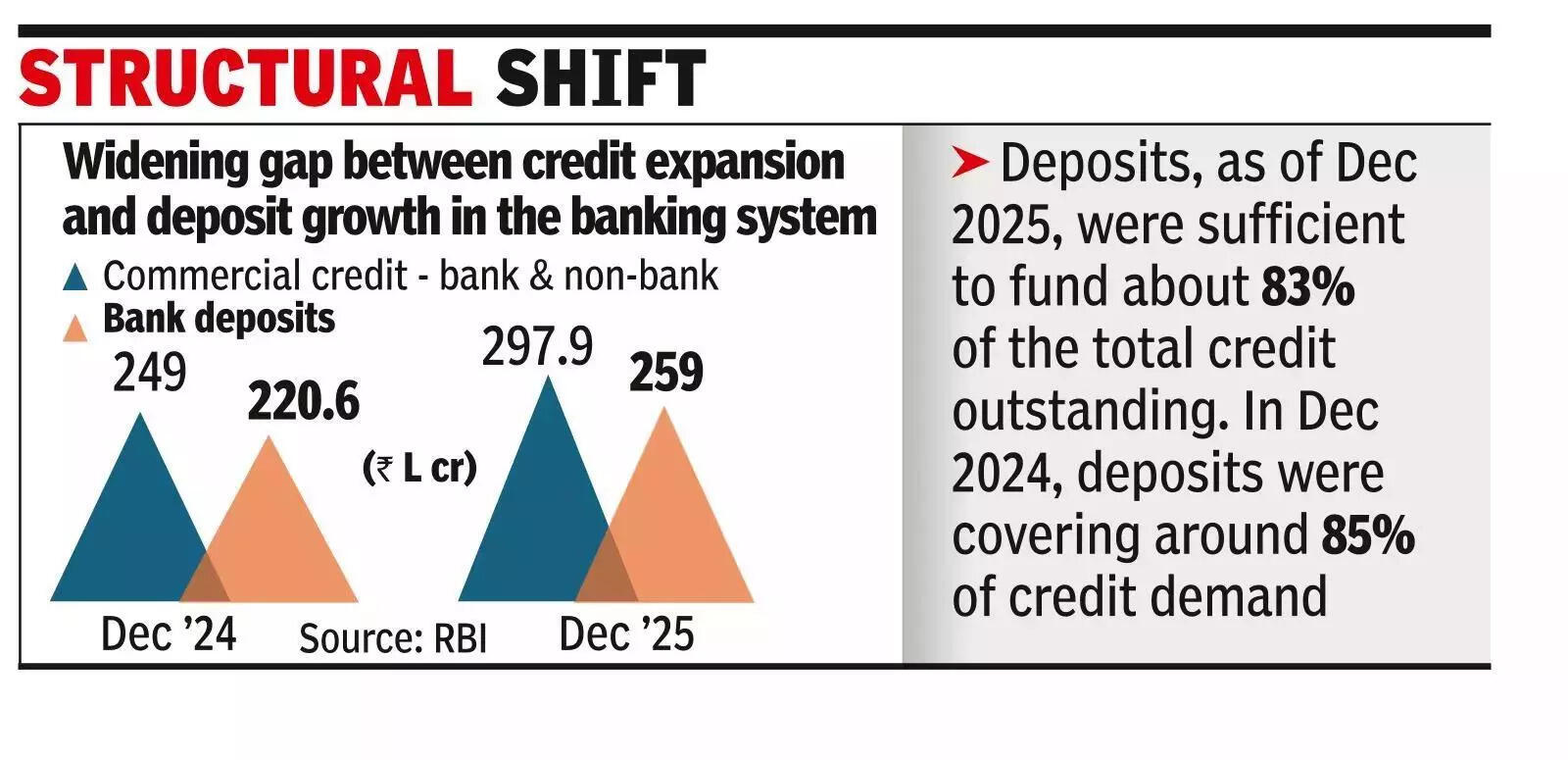

MUMBAI: India’s bank depositor remains the predominant source of credit to the commercial sector, but their relative contribution is steadily declining as credit growth outpaces deposit mobilisation, data for Dec 2025 show.As of Dec 2025, total outstanding credit to the commercial sector (bank and non-bank) rose to Rs 297.9 lakh crore, while bank deposits stood at Rs 249 lakh crore. Deposits were sufficient to fund only about 83% of the total credit outstanding. A year earlier, in Dec 2024, bank deposits amounted to Rs 220.6 lakh crore against total credit of Rs 259.01 lakh crore, covering around 85% of credit demand. The data point to a widening gap between credit expansion and deposit growth in the banking system.

.

The trend reveals a structural shift in India’s credit landscape. Banks remain central to financing the commercial sector, but their deposit base is no longer keeping pace with the demand for credit. The growing reliance on NBFCs, bond markets and foreign borrowings reflects both deeper financial markets and mounting pressure on bank balance sheets as credit demand continues to surge.The first nine months of 2025-26 saw a sharp acceleration in credit flow to the commercial sector. While banks continue to anchor the system, the pace of credit creation has increasingly relied on non-bank channels.Non-food bank credit remained the single largest source of incremental funding. Between Dec 2024 and Dec 2025, bank credit expanded by Rs 25.5 lakh crore, accounting for 65.5% of the total increase in commercial sector credit. Outstanding non-food bank credit stood at Rs 202.3 lakh crore at end-Dec 2025, reflecting a year-on-year growth of 14.4%.

Business

Video: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

new video loaded: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

By Andrew Ross Sorkin, Rebecca Suner, Coleman Lowndes and Laura Salaberry

January 22, 2026

-

Politics6 days ago

Politics6 days agoSaudi King Salman leaves hospital after medical tests

-

Sports1 week ago

Sports1 week agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business7 days ago

Business7 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Fashion6 days ago

Fashion6 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Tech1 week ago

Tech1 week agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech1 week ago

Tech1 week agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech6 days ago

Tech6 days agoPetlibro Offers: Cat Automatic Feeders, Water Fountains and Smart Pet Care Deals

-

Fashion6 days ago

Fashion6 days agoWhoop and Samuel Ross MBE unveil multiyear design partnership