Business

Mining merger talks see FTSE 100 end week on high

The FTSE 100 ended a record-breaking week in fine style, pushing back towards record levels, boosted by a possible mega-mining deal and a rebound in the oil price.

The FTSE 100 index closed up 79.91 points, 0.8%, at 10,124.60.

The FTSE 250 index ended up 144.50 points, 0.6%, at 23,036.80, and the AIM All-Share was up 5.57 points, 0.7%, at 790.42.

For the week, the FTSE 100 rose 1.7%, the FTSE 250 firmed 2.8% and the AIM All-Share advanced 3.1%.

Renewed merger talks between Rio Tinto and Glencore sparked gains across listed miners, with M&A seen as key to sector growth.

The discussions, confirmed by Glencore late Thursday, will likely take the form of an all-share merger, structured as Rio Tinto acquiring Glencore via a court-sanctioned scheme of arrangement.

Under UK takeover rules, Rio has until February 5 to announce a firm intention to make an offer.

Glencore jumped 9.6% on the news, leading the FTSE 100 risers, but Rio Tinto fell 3.0%. Other miners gained, with Antofagasta up 4.1%, and Anglo American, which has merged with Canada’s Teck Resources, up 2.7%.

Bank of America said it was “not surprised” by the talks, saying the sector has reached a point where organic growth and portfolio pivots are increasingly difficult for miners of Rio and Glencore’s scale.

“M&A, while not without its risks, mitigates other risks such as project delays, capex overruns and technical issues in ramp-up,” the broker said.

The discussions are the second round of talks in just over a year between the two companies, after Glencore approached Rio Tinto in late 2024, but a deal did not proceed.

RBC Capital Markets said the logic of a Rio–Glencore combination rests almost entirely on copper.

“Glencore offers immediate scale, operating cash flow and a deep copper pipeline, while Rio brings balance-sheet strength,” RBC said.

Elsewhere, BP and Shell rallied 2.4% and 3.0% respectively as the oil price bounced.

Brent oil traded at 63.42 US dollars a barrel at the time of the London equities close on Friday, up from 61.12 US dollars late Thursday.

David Morrison, senior market analyst at Trade Nation, said the oil rebound follows heightened geopolitical risk, including renewed US threats toward Iran and continued efforts by the Trump administration to exert control over Venezuela’s energy sector.

Markets are also factoring in the potential impact of new sanctions targeting buyers of Russian oil, alongside expectations that commodity index rebalancing could bring fresh inflows into crude, he said.

“Despite the recent rally, sentiment remains cautious, with expectations for a sizeable surplus of crude oil later in the year continuing to hang over the market,” he added.

In European equities on Friday, the CAC 40 in Paris closed up 1.4% while the DAX 40 ended 0.5% in Frankfurt, after hitting an all-time high.

In Paris, L’Oreal climbed 6.3% as UBS upgraded to “buy” while BNP Paribas firmed 5.7% as JPMorgan upgraded to “overweight”.

Stocks in New York were higher at the time of the London close on Friday.

The Dow Jones Industrial Average was up 0.4%, heading towards 50,000, the S&P 500 was 0.5% higher and the Nasdaq Composite advanced 0.7%.

US markets were weighing mixed US jobs data and news that the US Supreme Court decided not to release a ruling on the legality of Donald Trump’s tariffs.

The keenly awaited US jobs figures showed total nonfarm payroll employment increased by 50,000 in December, down from a revised 56,000 in November and below the FXStreet-cited consensus of 60,000.

November’s total was revised down from 64,000, while October was revised down by 68,000, from minus 105,000 to minus 173,000, meaning employment in October and November combined is 76,000 lower than previously reported.

But the weak payroll data was offset by news that the unemployment rate edged down to 4.4% from a revised 4.5% in November and below the FXStreet-cited consensus of 4.5%.

Wells Fargo analysts commented: “On balance, we do not believe today’s employment report meaningfully changes the outlook for US monetary policy. The cooling in the labour market still appears to be proceeding at an orderly and gradual pace, which likely will leave the FOMC on hold at its upcoming meeting on January 28.”

Nonetheless, with the unemployment rate “still above our estimate of full employment, underlying inflation slowly cooling and the policy rate setting above neutral, we remain of the view that a couple more rate cuts this year is a reasonable base case,” the broker added.

Morgan Stanley now looks for 25 basis rate cuts from the Fed in June and September, as opposed to its earlier call for cuts in January and April.

“Given the improved economic momentum and the decline in the unemployment rate, we see less need for near-term cuts to stabilise the labour market,” the broker said.

“Instead, we now think the Fed will cut rates as it becomes clear tariff pass-through is complete and inflation is decelerating toward the 2.0% target,” Morgan Stanley added.

The yield on the US 10-year Treasury was quoted at 4.17% on Friday, trimmed from 4.18% on Thursday. The yield on the US 30-year Treasury was at 4.83%, narrowed from 4.85%.

The pound was quoted at 1.3407 US dollars at the time of the London equities close on Friday, down from 1.3431 US dollars on Thursday.

The euro was lower at 1.1631 US dollars from 1.1657 US dollars. Against the yen, the dollar was trading at 158.06 yen, up from 156.93 yen.

Back in London, J Sainsbury endured another tricky day, down 5.8% after mixed third-quarter trading.

The food retailer, which fell on Thursday after rival Tesco’s trading update, slid again after weak non-food sales offset a strong food showing.

Sales at Argos and in clothing and general merchandise fell short of hopes, leaving some analysts questioning whether Sainsbury should ditch Argos altogether.

Dan Coatsworth, head of markets at AJ Bell, said: “Sainsbury’s clearly had a bumper Christmas for grocery sales, enjoying notable success with its premium range. However, Argos continues to be the thorn in its side with another period of weakness.”

The persistent underperformance only “strengthens the argument for Sainsbury’s to get shot of Argos as fast as it can”, he added.

Elsewhere, Fresnillo rose 1.9% after the latest gains in the gold price, while Marks & Spencer gained a further 2.4% on upbeat commentary following Thursday’s well received trading news.

Gold traded at 4,504.56 US dollars an ounce at Friday’s close, up against 4,457.01 US dollars on Thursday.

The biggest risers on the FTSE 100 were Glencore, up 39.6 pence at 452.6p, Antofagasta, up 137.0p at 3,473.0p, Auto Trader, up 21.8p at 593.6p, Shell, up 78.0p at 2,640.0p and Anglo American, up 84.0p at 3,126.0p.

The biggest fallers on the FTSE 100 were J Sainsbury, down 17.40p at 311.60p, Endeavour Mining, down 204.0p at 3,894.0p, Rio Tinto, down 188.0p at 6,006.0p, IAG, down 11.80p at 424.10p, and Vodafone, down 2.45p at 101.20p.

Monday’s local corporate calendar has a trading statement from Oxford Nanopore Technologies.

Later in the week, trading updates are due from housebuilder Persimmon and Premier Inn owner, Whitbread.

Next week’s global economic calendar has US inflation data, eurozone industrial production figures and a UK GDP print.

– Contributed by Alliance News

Business

‘Side Hustle Generation’: Over 50% Of US Gen Z Opting For Extra Gigs Amid Economic Uncertainty

Last Updated:

At least 57% of Gen Z in the US now have side gigs, from retail to gig work, amid economic uncertainty and concerns over the impact of AI on jobs.

Gen-Z is the first generation for whom a 9-to-5 job isn’t essential for achieving financial success. (AI-Generated Image)

Amid widespread economic uncertainty, more than half of the Gen Z population in the United States is opting for side gigs to navigate the job market and for extra cash.

At least 57% of Gen Z in the US now have side gigs, compared to 21% of boomers and older, according to The Harris Poll, which dubbed them “America’s first true ‘side hustle’ generation.”

Most of them are picking up side hustles, from retail to gig work, for extra cash. Younger people “want to work [and] find success, but many of them just feel disillusioned with the opportunities to get there through the traditional career ladder,” Glassdoor chief economist Daniel Zhao told Axios.

Role Of AI

In an August report, Glassdoor researchers said that some of the youths are chasing creative or entrepreneurial goals. Moreover, AI and other technological advances have made it easier for professionals to monetise their skills and passions.

“We’re witnessing a true side hustle generation where work identity lives outside of traditional employment. Additional commentary and research also shows that there’s a growing number of Employee+ workers who diversify income streams without abandoning job security,” Glassdoor said.

“For Gen Z, the day job funds the passion project. Work pays the bills, but identity and fulfilment can come from entrepreneurial pursuits, creative endeavours, or social causes they care about,” it added.

Why Are Gen-Z Opting For Side Gigs?

One of the main reasons for this shift is job anxiety. Recent graduates are struggling to secure jobs, while those with them aren’t seeing the career growth they expect, according to Zhao.

Data shows that the financial optimism for college students has fallen to their lowest level since 2018, mostly due to concerns over unemployment and ‘AI-induced layoffs’. The advent of AI remains the most pressing concern among young workers.

As per The Harris Poll, Gen Z is the first generation for whom a 9-to-5 job isn’t essential for achieving financial success. Side hustles are not merely distractions or fallback options; they are central to Gen Z’s identity, offering creative, entrepreneurial, or activist outlets that main jobs cannot supply.

“It definitely makes me feel more financially secure,” Katie Arce, who works full-time in e-commerce and picks up shifts at a vintage clothing store in Austin, Texas, told Axios.

United States of America (USA)

January 11, 2026, 17:08 IST

Read More

Business

‘Political Stability Has Powered India’s Growth’: PM Modi At Vibrant Gujarat Conference

Last Updated:

PM Modi further emphasised that over the past 11 years, India has emerged as the largest data consumer and built the country’s largest real-time digital platform.

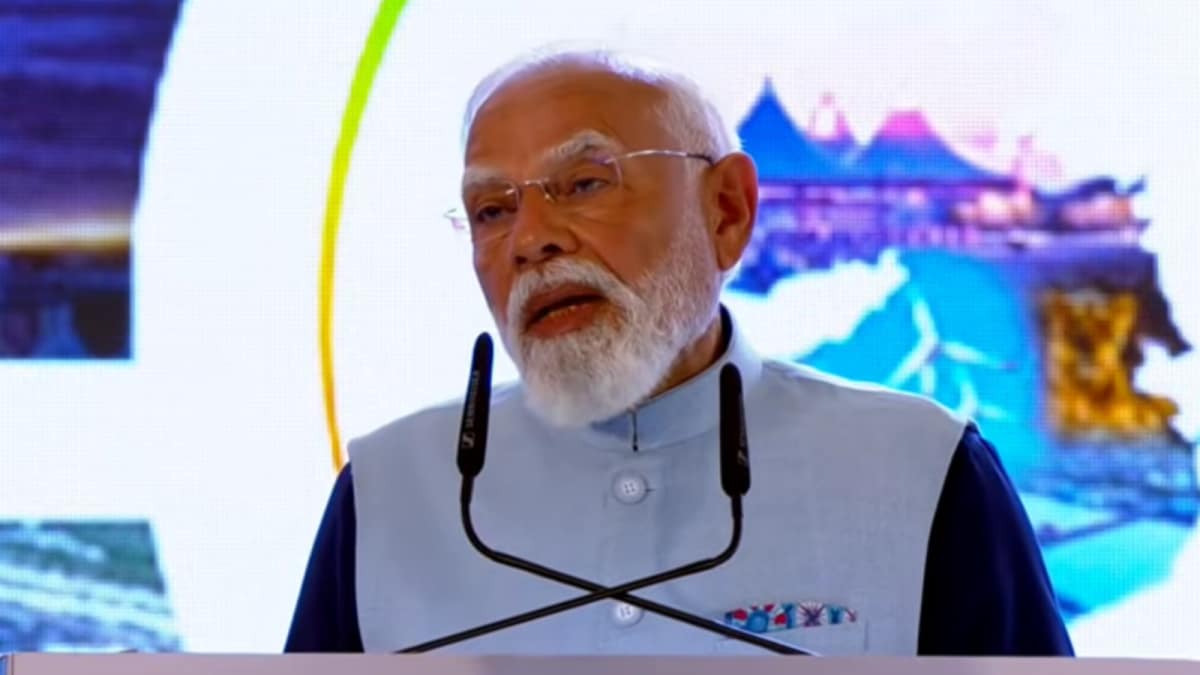

PM Modi speaking at the inauguration of Vibrant Gujarat Regional Conference. (PTI)

Prime Minister Narendra Modi on Sunday said that India’s political stability and strong macroeconomic fundamentals are driving global investor confidence, with Gujarat emerging as a key anchor of the country’s growth story.

While addressing the Vibrant Gujarat Regional Conference in Gujarat, the Prime Minister highlighted India’s economic trajectory, saying that the country is the world’s fastest-growing major economy, with inflation under control and a strong foundation for long-term growth. He said that reform express is driving India’s journey to developed nation status.

He highlighted that India is the largest producer of milk and a leading manufacturer of generic medicines, reflecting the country’s growing strength in both agriculture and pharmaceuticals.

VIDEO | Rajkot: PM Modi (@narendramodi) says, “India is the world’s fastest-growing large economy and inflation is under control. Agricultural production in India is setting new records, and the country ranks number one in milk production. India is also the world’s largest… pic.twitter.com/R6f7tDhoZD— Press Trust of India (@PTI_News) January 11, 2026

He noted that global institutions are increasingly bullish on India, with the International Monetary Fund (IMF) describing the country as the engine of global growth.

“India is the world’s 3rd largest startup ecosystem, 3rd largest aviation market, we are in the top 3 metro networks of the world,” he said, asserting that the country is heading to become the world’s 3rd largest economy.

PM Modi further emphasised that over the past 11 years, India has emerged as the largest data consumer and built the country’s largest real-time digital platform. He highlighted that India is now the second-largest mobile manufacturer, whereas earlier the country imported nine out of ten phones.

The Prime Minister also underlined Gujarat’s contribution to India becoming the world’s third-largest economy, noting that the state has grown across sectors. He said regions like Saurashtra and Kutch, once seen as remote, have now become major drivers of Atmanirbhar Bharat and investment-led growth.

Highlighting Saurashtra’s manufacturing strength, with over 2.5 lakh MSMEs producing goods ranging from basic tools to high-precision aircraft components, PM Modi pointed to the region hosting the world’s largest ship-breaking yard and being a major hub for tile manufacturing.

He further said that India’s first semiconductor fabrication plant is coming up in Dholera, with the land ready and a predictable policy environment supporting long-term growth.

Vibrant Gujarat Regional Conference

PM Modi on Sunday inaugurated the Vibrant Gujarat Regional Conference for the Kutch and Saurashtra regions.

The event saw the presence of Gujarat Chief Minister Bhupendra Patel and Deputy Chief Minister Harsh Sanghavi, among other dignitaries.

He also inaugurated 13 New Smart Industrial Estates in 7 Districts (Amreli, Bhavnagar, Jamnagar, Kutch, Morbi, Rajkot and Surendranagar) spanning an area of over 3540 Acres by Gujarat Industrial Development Corporation before his address on Sunday.

The two-day conference summit will highlight Gujarat’s leadership in the clean energy sector and its alignment with India’s ‘Panchamrit’ commitments announced by the Prime Minister. These include achieving 500 GW of non-fossil energy capacity by 2030, meeting 50 per cent of energy requirements from renewable sources, reducing projected carbon emissions by 1 billion tonnes, lowering carbon intensity by 45 per cent by 2030, and attaining net-zero emissions by 2070.

Rajkot, India, India

January 11, 2026, 16:22 IST

Read More

Business

EV adoptions gathers pace in 2025: Sales hit 2.3 million units; UP, Maharashtra lead sales – The Times of India

India sold were at 2.3 million units of electric vehicle in 2025, making up 8 per cent of all new vehicle registrations, according to a new report by the India Energy Storage Alliance, based on Vahan Portal data, cited by ANI. This boost was driven by incentives offered by the government and festive seasons. The majority portion of the sales were two-wheelers at 1.28 million units.The total registrations recorded in the overall passenger car market in the year 2025 stood at 28.2 million. Two-wheelers marked the most registrations 20 million registrations, while passenger cars were at 4.4 million and agricultural vehicles recorded 1.06 million. The recorded sales rose steadily throughout the year though slightly improved in the festival seasons due to GST benefits.Electric two-wheelers were the stars of the EV market, grabbing 57 per cent of sales. Three-wheelers came second with 0.8 million units (35 per cent), while four-wheelers logged 175,000 units. The report spotted good progress in electric delivery vehicles, especially in smaller commercial segments.Uttar Pradesh was at the forefront in this, with 400,000 units sold, taking an 18 percent market share in India’s EV segment. Maharashtra followed, with 266,000 units sold, contributing 12 percent to the segment, followed by Karnataka, with 200,000 units sold, contributing 9 percent to the market. The three accounted for over 40 percent in the country’s EV sales.Some smaller states recorded a very encouraging uptake of EVs. Delhi, Kerala, and Goa were able to reach an EV-to-ICE ratio of 14 percent, 12 percent, and 11 percent respectively. Meanwhile, states from the Northeast, Tripura, and Assam, achieved ratios of 18 percent and 14 percent, respectively.A major achievement was recorded in the three-wheeler segment, which attained a market penetration of 32 per cent. The government also created a record with their biggest ever order of electric buses—10,900 unit—valued at a massive Rs 10,900 crore through the PM E-DRIVE scheme.The report also stated that that while smaller vehicles led EV adoption, government efforts to electrify larger commercial vehicles and develop charging infrastructure were setting up India’s EV sector for continued growth beyond 2025.

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment4 days ago

Entertainment4 days agoDoes new US food pyramid put too much steak on your plate?

-

Politics4 days ago

Politics4 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment4 days ago

Entertainment4 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Business6 days ago

Business6 days agoAldi’s Christmas sales rise to £1.65bn

-

Entertainment6 days ago

Entertainment6 days agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon