Business

MNCs exit clouds startup growth | The Express Tribune

LAHORE:

At a time when Pakistan is grappling with the departure of some multinational giants, an unexpected surge in new business registrations has added a complex layer to the country’s investment outlook.

The Securities and Exchange Commission of Pakistan (SECP) has recently reported that 14,802 new companies were registered during the first four months of FY26, a development the regulator says reflects strong investor confidence. Yet business leaders warn that such growth does not offset the economic and reputational risks created when global corporations pull out.

The contrasting trends, fresh entrepreneurship on one hand and multinational exits on the other, have raised questions about whether Pakistan is entering a phase of renewal or quietly losing ground in global competitiveness.

Muddasir Masood Chaudhry, Senior Vice Chairman of the Pakistan Industrial and Traders Association Front (PIAF), says the recent uptick in registrations is encouraging, but it cannot overshadow the deeper systemic issues that continue to push international companies away.

SECP data shows that 99.9% of new incorporations were processed online, bringing the total number of registered companies in Pakistan to 272,918. The regulator added that the total paid-up capital recorded during July-October FY26 reached Rs20.59 billion ($74.1 million).

Private limited companies accounted for 59% of new registrations, while single-member firms made up 37%. The IT and e-commerce sectors led the surge with 2,999 new companies, followed by trading (1,954), services (1,807), and real estate development and construction (1,393).

Chaudhry acknowledges these numbers as a positive signal of domestic entrepreneurial activity but stresses that local dynamism alone cannot compensate for the strategic loss caused when major global players leave.

“Every exit of a multinational hurts not just foreign investor sentiment, but also local morale,” he said, adding, “When companies with decades of presence depart, it sends a message that doing business here has become unpredictable.”

The challenges, Chaudhry highlighted, include high corporate taxes, complex regulatory frameworks, heavy utility costs, and restrictions on moving profits abroad. He called on the government to introduce a simpler tax system with fewer, lower-rate taxes, ensure quick resolution of legal matters, and create an investment protection policy that encourages long-term commitment from foreign firms.

The pattern of exits has accelerated in recent years. Some global companies have restructured internationally, reallocating operations and retreating from multiple regions, a trend Pakistan cannot isolate itself from.

Shell Petroleum’s transition to a new operational model and the transfer of certain business units to local partners are one such example. But industry officials say not every departure can be explained by global realignment. Many firms have cited Pakistan’s difficult regulatory environment, profit repatriation restrictions, and high corporate taxation as decisive factors.

One senior executive of a multinational company, who requested anonymity, said, “It’s not that Pakistan lacks potential; the challenge is that the cost of operating here keeps shifting. Whether it’s profit repatriation delays or unexpected changes in tax policy, the uncertainty becomes the biggest barrier.”

Senior market analyst Muhammad Salman said that Pakistan has reached an inflection point. “The rise in new company registrations shows that local entrepreneurship is alive and resilient, but this alone cannot substitute for the stability, technology transfer, and long-term capital that multinationals provide. If Pakistan does not fix tax unpredictability, regulatory complexity, and the high cost of compliance, the divide between local energy and global withdrawal will keep widening.”

Meanwhile, SECP’s data also shows that investment interest is not completely drying up. Though the foreign direct investment (FDI) in the first four months of FY26 dropped by 26% as per the State Bank of Pakistan (SBP), 332 newly registered companies received foreign capital between July and October, spanning sectors from IT to energy and manufacturing.

Nearly 30% of all new incorporations came from around 250 smaller cities and towns, demonstrating the widening reach of digital company registration.

Still, despite these positive signals, Chaudhry insisted that Pakistan cannot afford complacency. “New entrants are always welcome, but the departure of established multinationals is not something we can dismiss,” he said, adding, “When global companies restructure, Pakistan must adapt, but when they leave because our environment is too challenging, that is a warning we must take seriously.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

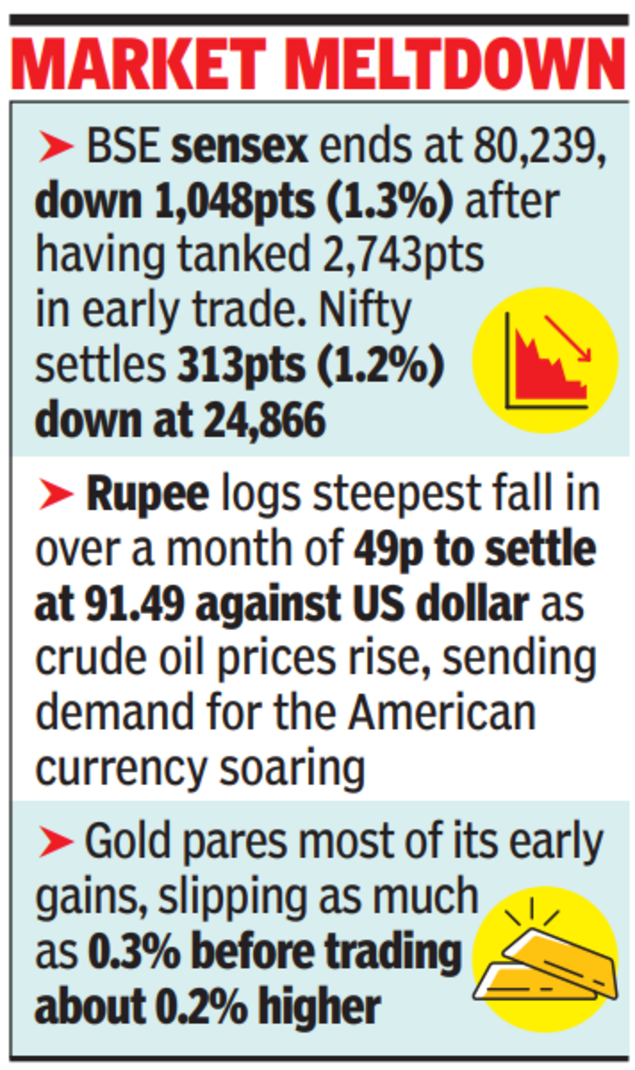

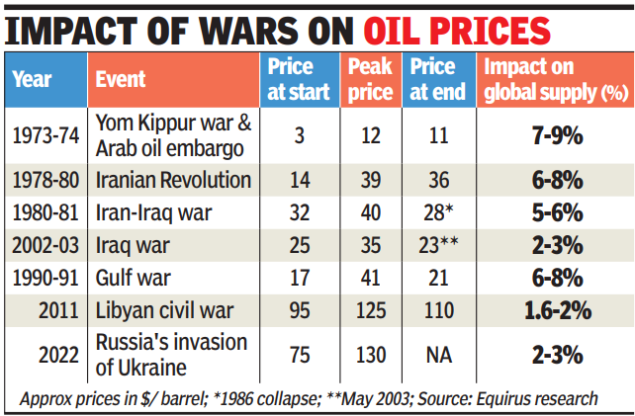

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%