Business

PSX jumps 1.3% on institutional support | The Express Tribune

Foreign institutional investors were net buyers of Rs37.6 million worth of shares during the trading session. PHOTO: AFP

KARACHI:

The Pakistan Stock Exchange (PSX) witnessed a strong momentum on Thursday as the benchmark KSE-100 index surged nearly 2,200 points, powered by robust institutional buying and renewed interest in blue-chip shares.

The rally, which pushed the index to the intra-day high of over 2,400 points, marked a sharp shift from the sluggish pace in recent days and reflected improving sentiment despite lingering geopolitical and macroeconomic concerns.

At the close of trading, the KSE-100 index posted gains of 2,184.78 points, or 1.34%, and settled at 165,373.31.

“Upward momentum was built as local institutions led the charge,” commented Topline Securities. The local bourse moved higher once again, supported by steady buying from local institutions that kept sentiment positive, it said. The benchmark index touched the intra-day high of 2,422 points, showing solid interest throughout the session. By the close, the market settled at 165,373, gaining 2,185 points. The banking sector stole the spotlight, where Meezan Bank, HBL, UBL and MCB Bank closed higher, aided by healthy volumes.

In the exploration & production sector, OGDC and PPL were not far behind as both stocks attracted investor interest and closed firmly in the green. Index heavyweights – Meezan Bank, Lucky Cement, PPL, OGDC and Engro – contributed around 942 points to the overall gains, Topline added.

Arif Habib Limited (AHL) said that the KSE-100 index finally breached the 164,000 mark, gaining 1.34% day-on-day as market sentiment strengthened, with 75 stocks advancing and 21 declining. Major contributors to the rally were Meezan Bank (+4.42%), Lucky Cement (+3.41%) and PPL (+3.47%), while Pioneer Cement (-0.52%) and PTCL (-0.65%) emerged as key drags on the index.

On the macro front, headline inflation for November 2025 is expected to reach 6.2% year-on-year, with average inflation for 5MFY26 projected at 5%, significantly lower than the 7.9% reading in the same period of last year, AHL said.

In positive developments, Pakistan and its partners were on track to achieve financial close within the next two weeks for the Reko Diq copper and gold project by securing $3.5 billion in funding. Additionally, the Sindh government approved a strategic partnership with China’s ADM Group to establish more than 600 electric vehicle charging stations across the province.

As the market heads into the final session of the week, the benchmark index was up 2.02% week-on-week, with the 164,000 level now expected to act as an important support for a potential move back towards October highs, AHL concluded.

Muhammad Hasan Ather of JS Global wrote that buying momentum strengthened as the KSE-100 index rose 1.3% on robust volumes and broad institutional interest across key sectors. If positive macro sentiment and liquidity persists, the rally could be extended, supported by reforms, external inflows and strong earnings. However, renewed external or policy pressures could reintroduce volatility, warranting close investor attention, he said.

Overall trading volumes were recorded at 498.4 million shares compared with the previous session’s tally of 636.4 million. The value of shares traded during the day was Rs30.6 billion.

Shares of 484 companies were traded. Of these, 289 stocks closed higher, 152 fell and 43 remained unchanged.

Dost Steels was the volume leader with trading in 48.4 million shares, gaining Rs0.57 to close at Rs8.49. It was followed by WorldCall Telecom with 36.7 million shares, gaining Rs0.04 to close at Rs1.86 and Beco Steel with 25.1 million shares, losing Rs0.12 to close at Rs6.58.

Foreign investors sold shares worth Rs1.8 billion, the National Clearing Company reported.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

Chancellor Rachel Reeves urged to scrap fuel duty hike amid oil price fears

The Chancellor has been urged to scrap the proposed hike in fuel duty as concerns have been raised about the conflict in the Middle East.

Rachel Reeves announced last year that the long-held discount in fuel duty would be scrapped from September, with a 1p hike followed by two increases of 2p each in subsequent years.

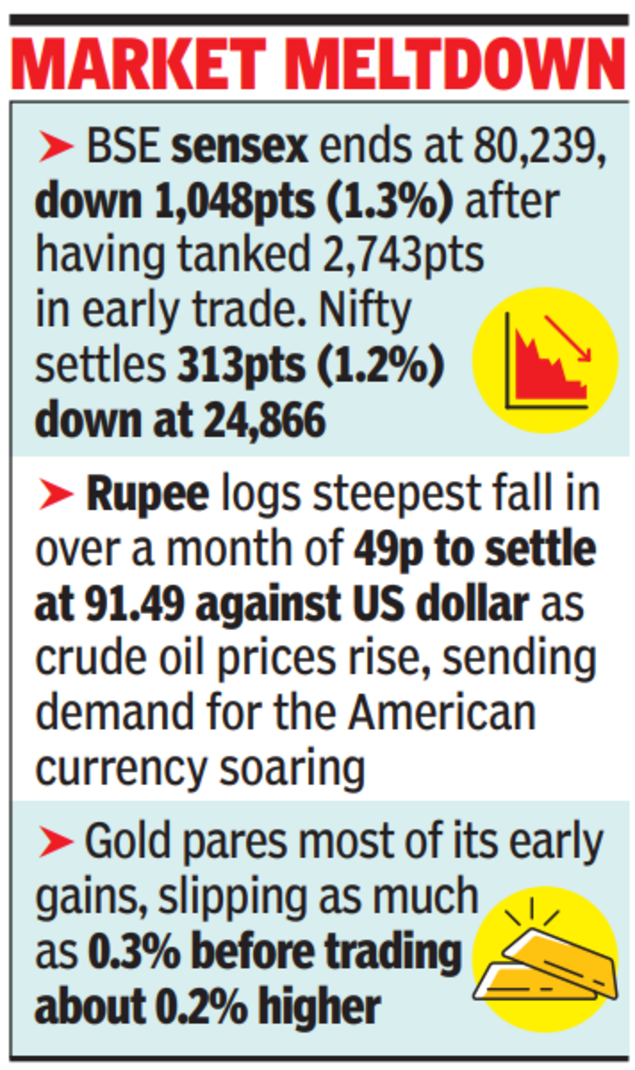

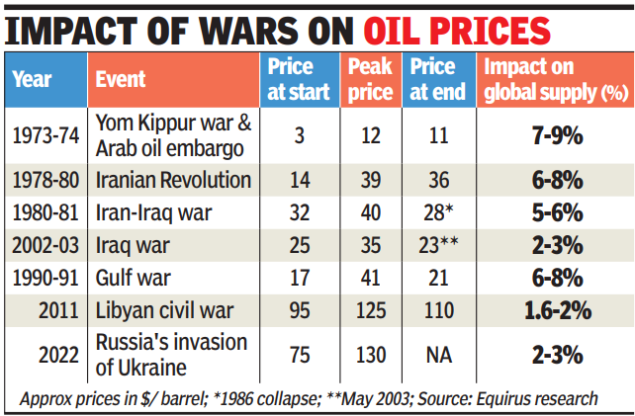

But following the US and Israeli attacks on Iran at the weekend – which killed the country’s Supreme Leader Ayatollah Ali Khamenei – concerns have been raised about the impact of oil price hikes which could hit consumers at the pumps.

Following the attack, the price of oil jumped to 80 US dollars a barrel, with some analysts suggesting it could rise above 100 dollars.

Speaking ahead of the spring statement, SNP economy spokesman Dave Doogan said: ““With real fears that prices at the pump are now set to soar because of the situation in the Middle East – instead of stubbornly doubling down, the Chancellor needs to scrap her price hike plans before motorists face a devastating double hit.

“Oil prices are already spiking – the last thing motorists and businesses now need is another damaging tax hike from the Labour Party.

“The Chancellor needs to see sense, recognise what is unfolding globally, and immediately scrap her plans to hike prices at pumps.

“Everyone knows that Keir Starmer’s Labour Party has broken their promise to cut energy bills by £300 – it would be another slap in the face for families if Labour made the cost-of-living crisis even worse with a plan that will inevitably increase prices.

“After 14 U-turns from this chaotic Labour Government – scrapping their plans to hike fuel duty is one U-turn motorists, businesses and families right across Scotland would actually welcome.”

A spokeswoman for the Treasury said: “We have extended the 5p fuel duty cut from this month to the end of August to support drivers across the country.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%