Fashion

The House of Dior Beverly Hills opens on Rodeo Drive

Published

October 1, 2025

In 1990, Dior opened its first store on Rodeo Drive, the first Dior location in North America. Thirty-five years later, the luxury brand owned by the LVMH group has just opened a 60-foot-tall building.

Open to the public since Saturday, the store located at 323 North Rodeo Drive called upon its star architect, Peter Marino, chief designer of Dior boutiques, including most recently, 30 Avenue Montaigne in Paris and the new flagship store House of Dior New York, which opened in August.

The magnificent, undulating stucco façade now revealed its window displays featuring miniature scenes of Paris, including an ultra-detailed model of La Galerie Dior at 30 Avenue Montaigne, complete with characters, realistic settings, and nods to Los Angeles with the “HollywoodDior” sign and the Bel-Air hotel.

“A cinematic journey, a luminous dialogue between Paris and Los Angeles that pays tribute to the house’s timeless couture heritage,” explains Dior’s team, “each offering a living tableau of small scenes from Dior’s odyssey in the United States.”

These animations can also be found on the second floor of the store, in the jewelry section, where a window display pays tribute to designer Christian Dior, accompanied by his faithful dog Bobby.

Surrounded by a garden featuring a dancing sculpture by artist Niki de Saint-Phalle, the boutique reveals an interior with light-colored parquet flooring strewn with antique rugs and a palette of natural, earthy colors. In the center stands the sculptural “Ginkgo” bench designed by sculptor and artist Claude Lalanne in the late 1990s, from which several bouquets of flowers spring forth.

On the ground floor, visitors first discover the space reserved for leather goods and handbags, furnished with seating areas and counters. This is followed by an area dedicated to women’s shoes, decorated with sculptural tables and large speckled benches, and another dedicated to perfumes. A corner showcases the house’s scarves, presented on wall displays and in a large trunk. In each space, Dior silhouettes blend into the decor.

In contrast, the men’s section plays on other motifs and a color palette combining brown, camel, and gray tones. The sunglasses collections, all the leather goods for men, and ready-to-wear are presented here.

The store’s centerpiece, the majestic staircase, a nod to the Barneys New York store in Los Angeles designed by Peter Marino 38 years ago, surrounds a small garden designed by Marino in collaboration with landscape architect Peter Wirtz, offering a panoramic view of the spaces.

There are a number of small lounges dedicated to women’s ready-to-wear in a Parisian apartment-style setting with Dior gray walls, large mirrors, and angel tapestries. Divided by large gold and silver stone walls, the jewelry and fine jewelry area showcases the house’s latest collections in circular metal display cases. There is also an area dedicated to men, with large fitting rooms and two VIP rooms.

Dotted with numerous art pieces by Frederic Heurlier-Cimolai, Adam Fuss, and Horst P. Horst, the boutique also unveils many pieces of furniture in bronze, brass, metal, and aluminum by the Voukenas Petrides studio, artist Audiane Delos, and Maison Leleu.

One floor up, the house opens its VIP area around a huge terrace overlooking the Hollywood sign and its restaurant, Monsieur Dior. The space, whose menu has been designed by San Francisco’s three-star chef Dominique Crenn, is set to open to the public in the last week of October. It features a lounge with a bar and an indoor-outdoor dining room that can accommodate up to 105 guests. The menu is inspired by the golden age of Hollywood and, of course, glamorous fashion.

Copyright © 2025 FashionNetwork.com All rights reserved.

Fashion

India’s real GDP estimated to grow 7.6% in FY26 under new base FY23

Nominal GDP, or GDP at current prices, is estimated to grow at 8.6 per cent to reach ₹345.47 trillion in FY26 against ₹318.07 trillion in 2024-25.

India’s real GDP is estimated to grow at 7.6 per cent to ₹322.58 trillion (~$3.54 billion) in FY26 compared to the first revised GDP estimate of ₹299.89 trillion for FY25 (7.1 per cent growth).

It released the new series of annual and quarterly national accounts estimates with FY23 base.

Real GVA is projected to grow at 7.7 per cent to reach ₹294.40 trillion in FY26 against ₹273.36 trillion in FY25.

Real gross value added (GVA) is projected to grow at 7.7 per cent to reach ₹294.40 trillion in FY26 against ₹273.36 trillion in FY25 (a 7.3-per cent growth rate).

Nominal GVA is estimated to grow at 8.7 per cent to hit ₹313.61 trillion during FY26, against ₹288.54 lakh crore in 2024-25.

Robust economic performance in FY26 is primarily on account of robust real growth observed in the second quarter (8.4 per cent) and third quarter (7.8 per cent).

The manufacturing sector has been the major driver of resilient performance of the economy the consecutive three fiscals after rebasing, a release from the ministry said.

Both private final consumption expenditure and grossed fixed capital formation exhibited more than 7-per cent growth rate in FY26.

Fibre2Fashion News Desk (DS)

Fashion

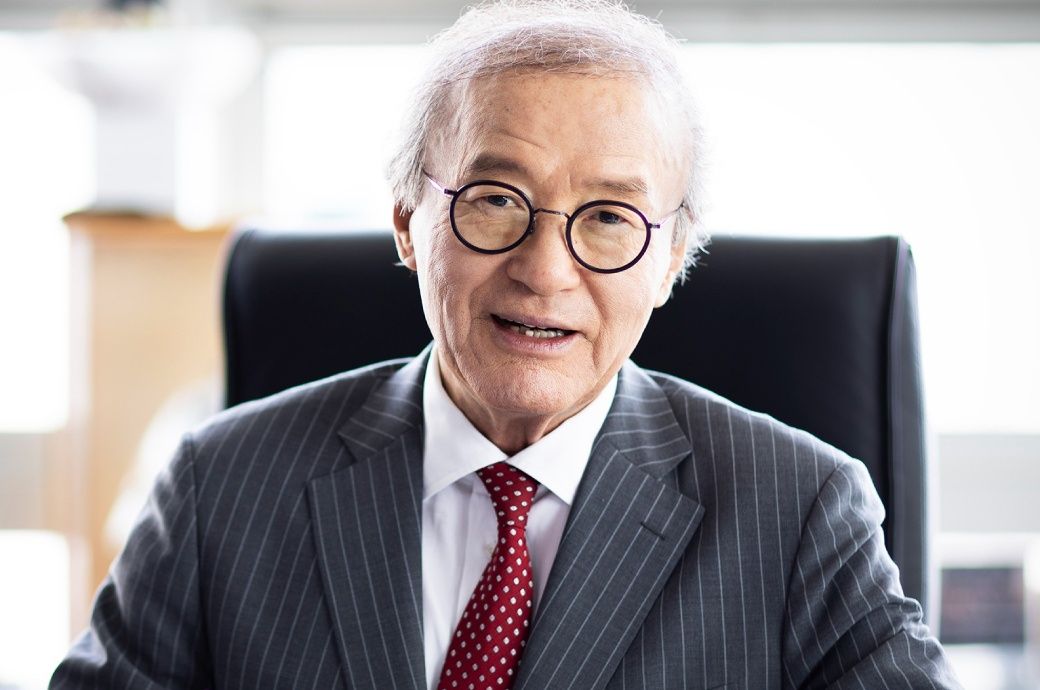

South Korea’s Misto Holdings completes planned leadership transition

The transition marks the formal handover of executive leadership to President and CEO Keun-Chang (Kevin) Yoon, reinforcing management continuity while preserving the founder’s long-term strategic vision.

Misto Holdings founder Gene Yoon has transitioned to honorary chairman in a planned leadership succession, formally handing executive control to president and CEO Kevin Yoon.

The founder, who expanded the group through the FILA global trademark acquisition and the takeover of Acushnet, will continue guiding long-term strategy as the rebranded Misto focuses on governance and sustainable growth.

Gene Yoon founded the business that would become Misto Holdings in the early 1990s, introducing the FILA brand to the Korean market and later leading a series of transformative transactions. In 2007, the company acquired the global FILA trademark rights through a leveraged buyout, followed by the 2011 acquisition of Acushnet Company, owner of the Titleist and FootJoy brands. The transaction was among the largest cross-border deals in Korea’s consumer sector at the time and significantly expanded the group’s global footprint.

Under his leadership, the company evolved into a multi-brand global portfolio spanning sportswear, golf equipment and apparel, generating approximately USD 3.08 billion in annual revenue.

As Honorary Chairman, Gene Yoon will remain closely engaged with the company, providing guidance on long-term strategy and global portfolio development while supporting management from a broader strategic perspective.

The leadership transition marks a new chapter under President and CEO Kevin Yoon, who has spent nearly two decades in senior roles across the group’s global operations, building deep operational and strategic expertise.

The company’s 2025 rebranding to “Misto” underscores its evolution into a global brand house focused on disciplined capital allocation, enhanced shareholder returns and sustainable long-term growth.

“Building on the founder’s legacy, our priority is to expand our global portfolio, strengthen governance and deliver sustainable value creation,” said Kevin Yoon, President and CEO of Misto Holdings.

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (RM)

Fashion

Bangladesh commerce minister seeks Chinese investment in jute sector

-

Tech1 week ago

Tech1 week agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Business1 week ago

Business1 week agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Fashion1 week ago

Fashion1 week agoICE cotton ticks higher on crude oil rally

-

Entertainment1 week ago

Entertainment1 week agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Politics7 days ago

Politics7 days agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoDonald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past

-

Sports1 week ago

Sports1 week agoBrett Favre blasts NFL for no longer appealing to ‘true’ fans: ‘There’s been a slight shift’

-

Business1 week ago

Business1 week agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India