Business

These 26 Stocks Are Expected To Benefit From Upcoming GST Reforms; Details Here

Last Updated:

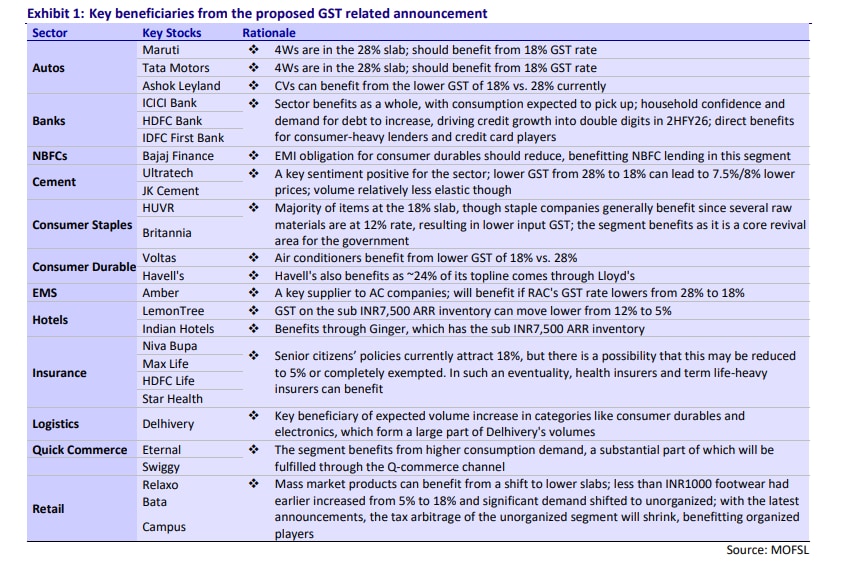

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms.

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards, says MOFSL.

Indian equity markets are set for a strong start to the week as sentiment turns upbeat following Prime Minister Narendra Modi’s Independence Day announcement of a major overhaul in the Goods and Services Tax (GST) structure. The proposed changes, widely referred to as GST 2.0, aim to simplify the tax regime and boost consumption, with analysts flagging multiple sectors that stand to gain.

According to reports, the Centre is considering scrapping the current 12% and 28% GST slabs, realigning most items into the 5% and 18% categories. Certain sin or luxury goods may be placed in a new 40% bracket. The rejig is expected to help stimulate demand and support India’s growth momentum.

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report on August 18 gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms. It said the move could unlock opportunities across autos, cement, consumer staples, durables, retail, and financials, while also easing compliance for businesses.

Autos to Drive Ahead

Motilal Oswal said passenger vehicle makers Maruti Suzuki and Tata Motors, currently paying 28% GST, are expected to benefit significantly if rates are lowered to 18%. Commercial vehicle maker Ashok Leyland may also see demand tailwinds as GST on trucks and buses comes down to 18% from the current 28%.

Banks and NBFCs in Focus

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards. Among NBFCs, Bajaj Finance could see reduced EMI obligations on consumer durables, improving affordability and driving loan growth, according to MOFSL.

Cement and Building Materials to Gain

Lowering GST on cement from 28% to 18% could cut prices by up to 7.5-8%, Motilal Oswal estimates. This would be a key sentiment booster for the sector, especially for majors like UltraTech Cement, JK Cement, and HeidelbergCement (HUWR), given cement’s relatively inelastic demand profile, MOFSL said.

Consumer Staples and Durables

In FMCG, most products currently taxed at 18% may remain unchanged, but companies such as Britannia could benefit as input costs reduce — since many raw materials attract 12% GST today.

Consumer durable companies stand to gain more directly. Voltas could benefit from a lower GST on air-conditioners, while Havells would gain as about 24% of its sales come from Lloyd ACs, which may see a cut from 28% to 18%, according to MOFSL.

Electronics Manufacturing & Hotels

Electronics maker Amber Enterprises, a key supplier to AC brands, is expected to benefit from lower GST on RACs. In hospitality, Lemon Tree Hotels and Indian Hotels may see improved profitability as GST on sub-Rs 7,500 room tariffs is proposed to be cut from 12% to 5%, the brokerage firm said.

Insurance and Financial Services

The GST rejig could also support insurers. Currently, premiums on life and health policies attract 18% GST. Analysts believe this may be reduced to 5% or exempted altogether, boosting affordability and demand. Niva Bupa, Max Life, HDFC Life and Star Health could be key beneficiaries, it added.

Logistics, Retail and Quick Commerce

Delhivery may gain from higher volumes of consumer durables and electronics if demand revives. In quick commerce, Eternal and Swiggy stand to benefit from increased discretionary spending, MOFSL said.

Retailers like Relaxo, Bata and Campus may also be winners as mass footwear (below Rs 1,000) — earlier taxed at 18% from 5% — could shift back into a lower bracket, narrowing the tax arbitrage between organised and unorganised players.

Market Outlook Today

The GST overhaul has been welcomed by markets, with analysts expecting a consumption-driven rally across auto, cement, FMCG, and financial names. Early trends in GIFT Nifty suggest a gap-up opening, with the index trading 266 points or 1.07% higher at 24,921 in pre-market hours.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

view comments

Read More

Business

Govt keeps petrol, diesel prices unchanged for coming fortnight – SUCH TV

The government on Thursday kept petrol and high-speed diesel (HSD) prices unchanged at Rs253.17 per litre and Rs257.08 per litre respectively, for the coming fortnight, starting from January 16.

This decision was notified in a press release issued by the Petroleum Division.

Earlier, it was expected that the prices of all petroleum products would go down by up to Rs4.50 per litre (over 1pc each) today in view of variation in the international market.

Petrol is primarily used in private transport, small vehicles, rickshaws, and two-wheelers, and directly impacts the budgets of the middle and lower-middle classes.

Meanwhile, most of the transport sector runs on HSD. Its price is considered inflationary, as it is mostly used in heavy transport vehicles, trains, and agricultural engines such as trucks, buses, tractors, tube wells, and threshers, and particularly adds to the prices of vegetables and other eatables.

The government is currently charging about Rs100 per litre on petrol and about Rs97 per litre on diesel.

Business

Gold price today: How much 22K, 24K gold cost in Delhi, Patna & other cities – Check rates – The Times of India

Gold prices climbed to a fresh lifetime high in the domestic market on Thursday amid sustained buying by jewellers and stockists, according to the All India Sarafa Association.Gold advanced by Rs 800 to hit a new peak of Rs 1,47,300 per 10 grams (inclusive of all taxes), extending gains for the fifth consecutive session. The yellow metal had closed at Rs 1,46,500 per 10 grams in the previous session.Since the start of 2026, gold prices have surged Rs 9,600, or around 7 per cent, supported by persistent demand in the physical market. In overseas trade, spot gold slipped USD 12.22, or 0.26 per cent, to USD 4,614.45 per ounce, after having touched a record high of USD 4,643.06 per ounce in the previous session.Here is how much gold costs in major Indian cities today:

Gold price in Delhi today

The price of 22K gold in Delhi is Rs 13,140 per gram, down Rs 75, while 24K gold is priced at Rs 14,333 per gram, lower by Rs 82.

Gold price in Chennai today

In Chennai, 22K gold costs Rs 13,290 per gram, up Rs 10, while 24K gold is priced at Rs 14,498 per gram, higher by Rs 10.

Gold price in Mumbai today

Mumbai markets see 22K gold priced at Rs 13,125 per gram, down Rs 75, while 24K gold stands at Rs 14,318 per gram, lower by Rs 82.

Gold price in Ahmedabad today

In Ahmedabad, 22K gold is priced at Rs 13,130 per gram, down Rs 75, while 24K gold costs Rs 14,323 per gram, lower by Rs 82.

Gold price in Kolkata today

Kolkata markets price 22K gold at Rs 13,125 per gram, down Rs 75, while 24K gold stands at Rs 14,318 per gram, lower by Rs 82.

Gold price in Jaipur today

In Jaipur, 22K gold costs Rs 13,140 per gram, down Rs 75, while 24K gold is priced at Rs 14,333 per gram, lower by Rs 82.

Gold price in Hyderabad today

Hyderabad sees 22K gold at Rs 13,125 per gram, down Rs 75, while 24K gold is priced at Rs 14,318 per gram, lower by Rs 82.

Gold price in Bhubaneswar today

Bhubaneswar markets see 22K gold priced at Rs 13,125 per gram, down Rs 75, while 24K gold costs Rs 14,318 per gram, lower by Rs 82.

Gold price in Patna today

In Patna, 22K gold costs Rs 13,130 per gram, down Rs 75, while 24K gold is priced at Rs 14,323 per gram, lower by Rs 82.

Gold price in Lucknow today

Lucknow markets see 22K gold priced at Rs 13,140 per gram, down Rs 75, while 24K gold costs Rs 14,333 per gram, lower by Rs 82.

Business

Serial rail fare evader faces jail over 112 unpaid tickets

One of Britain’s most prolific rail fare dodgers could face jail after admitting dozens of travel offences.

Charles Brohiri, 29, pleaded guilty to travelling without buying a ticket a total of 112 times over a two-year period, Westminster Magistrates’ Court heard.

He could be ordered to pay more than £18,000 in unpaid fares and legal costs, the court was told.

He will be sentenced next month.

District Judge Nina Tempia warned Brohiri “could face a custodial sentence because of the number of offences he has committed”.

He pleaded guilty to 76 offences on Thursday.

It came after he was convicted in his absence of 36 charges at a previous hearing.

During Thursday’s hearing, Judge Tempia dismissed a bid by Brohiri’s lawyers to have the 36 convictions overturned.

They had argued the prosecutions were unlawful because they had not been brought by a qualified legal professional.

But Judge Tempia rejected the argument, saying there had been “no abuse of this court’s process”.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Business1 week ago

Business1 week agoGold prices declined in the local market – SUCH TV