Business

These 26 Stocks Are Expected To Benefit From Upcoming GST Reforms; Details Here

Last Updated:

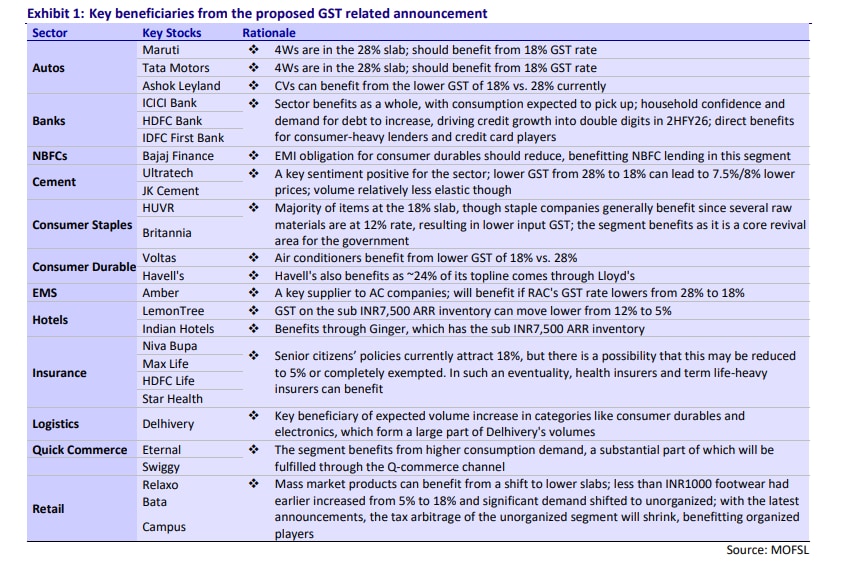

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms.

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards, says MOFSL.

Indian equity markets are set for a strong start to the week as sentiment turns upbeat following Prime Minister Narendra Modi’s Independence Day announcement of a major overhaul in the Goods and Services Tax (GST) structure. The proposed changes, widely referred to as GST 2.0, aim to simplify the tax regime and boost consumption, with analysts flagging multiple sectors that stand to gain.

According to reports, the Centre is considering scrapping the current 12% and 28% GST slabs, realigning most items into the 5% and 18% categories. Certain sin or luxury goods may be placed in a new 40% bracket. The rejig is expected to help stimulate demand and support India’s growth momentum.

Brokerage firm Motilal Oswal Financial Services (MOFSL) in its latest report on August 18 gives a list of 26 stocks that are likely to benefit from the proposed GST ‘big bang’ reforms. It said the move could unlock opportunities across autos, cement, consumer staples, durables, retail, and financials, while also easing compliance for businesses.

Autos to Drive Ahead

Motilal Oswal said passenger vehicle makers Maruti Suzuki and Tata Motors, currently paying 28% GST, are expected to benefit significantly if rates are lowered to 18%. Commercial vehicle maker Ashok Leyland may also see demand tailwinds as GST on trucks and buses comes down to 18% from the current 28%.

Banks and NBFCs in Focus

With consumption expected to pick up, banks such as ICICI Bank, HDFC Bank and IDFC First Bank are set to benefit from stronger credit demand, particularly in consumer loans and credit cards. Among NBFCs, Bajaj Finance could see reduced EMI obligations on consumer durables, improving affordability and driving loan growth, according to MOFSL.

Cement and Building Materials to Gain

Lowering GST on cement from 28% to 18% could cut prices by up to 7.5-8%, Motilal Oswal estimates. This would be a key sentiment booster for the sector, especially for majors like UltraTech Cement, JK Cement, and HeidelbergCement (HUWR), given cement’s relatively inelastic demand profile, MOFSL said.

Consumer Staples and Durables

In FMCG, most products currently taxed at 18% may remain unchanged, but companies such as Britannia could benefit as input costs reduce — since many raw materials attract 12% GST today.

Consumer durable companies stand to gain more directly. Voltas could benefit from a lower GST on air-conditioners, while Havells would gain as about 24% of its sales come from Lloyd ACs, which may see a cut from 28% to 18%, according to MOFSL.

Electronics Manufacturing & Hotels

Electronics maker Amber Enterprises, a key supplier to AC brands, is expected to benefit from lower GST on RACs. In hospitality, Lemon Tree Hotels and Indian Hotels may see improved profitability as GST on sub-Rs 7,500 room tariffs is proposed to be cut from 12% to 5%, the brokerage firm said.

Insurance and Financial Services

The GST rejig could also support insurers. Currently, premiums on life and health policies attract 18% GST. Analysts believe this may be reduced to 5% or exempted altogether, boosting affordability and demand. Niva Bupa, Max Life, HDFC Life and Star Health could be key beneficiaries, it added.

Logistics, Retail and Quick Commerce

Delhivery may gain from higher volumes of consumer durables and electronics if demand revives. In quick commerce, Eternal and Swiggy stand to benefit from increased discretionary spending, MOFSL said.

Retailers like Relaxo, Bata and Campus may also be winners as mass footwear (below Rs 1,000) — earlier taxed at 18% from 5% — could shift back into a lower bracket, narrowing the tax arbitrage between organised and unorganised players.

Market Outlook Today

The GST overhaul has been welcomed by markets, with analysts expecting a consumption-driven rally across auto, cement, FMCG, and financial names. Early trends in GIFT Nifty suggest a gap-up opening, with the index trading 266 points or 1.07% higher at 24,921 in pre-market hours.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

view comments

Read More

Business

Prices for home heating oil in NI rise as Middle East conflict escalates

Global oil prices spike after Iran launched strikes across the Middle East in response to attacks by the US and Israel.

Source link

Business

PSX Rebounds, Gains Over 4,000 Points After Historic Crash – SUCH TV

The Pakistan Stock Exchange (PSX) staged a strong comeback on Tuesday, recovering more than 2,000 points after suffering its steepest one-day decline in history.

The benchmark KSE-100 Index climbed to an intraday high of 156,106.01, gaining 4,133.02 points (2.72%) from the previous close of 151,972.99.

However, volatility persisted, with the index also dipping to an intraday low of 151,258.85, reflecting continued investor caution.

After Monday’s Historic Slump

The rebound follows Monday’s massive crash, when the KSE-100 plunged 16,089.17 points (-9.57%), marking its largest single-day fall ever.

The sell-off was triggered by escalating Middle East tensions and panic-driven mutual fund selling.

Analysts described Tuesday’s rise as a technical rebound, with value investors stepping in after excessive pressure eased.

Global Markets Under Pressure

While PSX showed recovery, global markets remained under strain:

MSCI Asia-Pacific index (ex-Japan) fell 1.5%

Japan’s Nikkei dropped 2.3%

US futures slipped 0.6%

Rising geopolitical tensions have intensified concerns about energy prices and global economic stability.

Oil Prices Surge

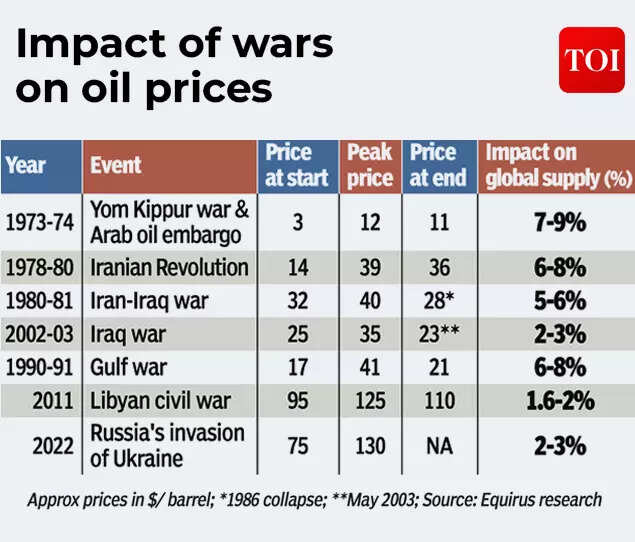

Fears of disruption in the Strait of Hormuz pushed energy markets higher:

Brent crude rose 2% to $79.22 per barrel

Shipping costs for oil tankers surged sharply

European and Asian natural gas prices jumped nearly 40% earlier

Higher oil prices pose inflationary risks for import-dependent economies like Pakistan.

What’s Next?

Market experts say the key question is whether the recovery gains momentum or remains a short-term bounce.

Investor sentiment remains fragile amid geopolitical uncertainty and volatile global energy markets.

Business

US-Israel-Iran war hits oil supplies: How India is preparing for the economic fallout – The Times of India

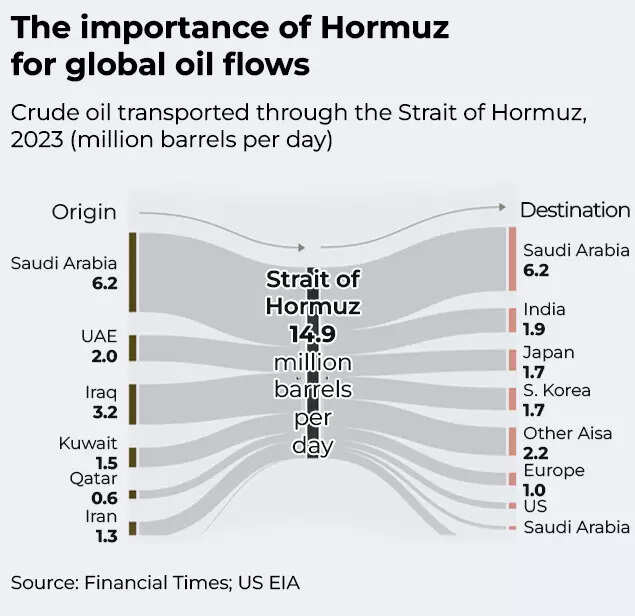

India is looking at several emergency measures to tackle the risk of fuel shortages if shipping through the Strait of Hormuz remains affected for an extended period. Strait of Hormuz in the Persian Gulf is a prominent and vital maritime route for transmit of oil and goods. According to people aware of discussions between the government and industry stakeholders, the options under consideration include curbing exports of petrol and diesel, stepping up crude purchases from Russia, and implementing demand-side steps such as rationing LPG supplies.Even as the Centre and oil firms maintained that there is no immediate scarcity, refiners have begun scouting for alternative crude sources to offset supplies affected by the conflict in West Asia.

The geopolitical strain has pushed up global oil and gas prices. For India, which relies heavily on imports, this surge translates into a higher import bill and adds to inflationary pressures.

India depends on overseas purchases for almost 90 per cent of its crude oil needs. It also relies on imports to meet around 60–65 per cent of its LPG consumption and roughly 60 per cent of its LNG requirement. A significant portion of these supplies originates in West Asia and moves through the Strait of Hormuz, a vital corridor that faces the risk of disruption amid the ongoing conflict.

India to curb oil exports?

With concerns mounting over potential disruptions in crude oil availability, the government is considering measures to encourage refiners to channel a larger share of automobile fuels and LPG toward the domestic market by trimming exports, according to a TOI report. It is also exploring ways to step up cooking gas output to ensure uninterrupted supplies for local consumers.Currently, India sends abroad roughly one-third of its petrol production, about a quarter of its diesel output, and nearly half of the aviation turbine fuel it produces. If necessary, refiners can also channel excess ATF into alternative product streams, they said.

Data from the International Energy Agency shows that 5.9 per cent of India’s petroleum output was exported in 2023. During the period from April to December 2025, the country shipped petroleum products worth nearly $330 billion, with key markets including the Netherlands, the UAE, the US, Singapore, Australia and China. In 2024, petroleum gas exports totalled $454 million, largely destined for Nepal, China and Myanmar. The Reliance Industries Limited refinery at Jamnagar remains the country’s biggest exporter.An executive at an oil company said refiners have already initiated discussions with traders to secure capacity amid concerns over a potential blockade of the Strait of Hormuz. By Monday, global markets were unsettled following QatarEnergy’s decision to halt gas shipments.

LNG and LPG disruptions

The most pressing area of concern is LPG, as the country relies on imports to meet close to two-thirds of its consumption and keeps relatively limited stockpiles. Around 85–90 per cent of LPG imports originate from Gulf nations.Industry assessments indicate that existing inventories, including domestic storage and cargoes that have already passed through the Strait of Hormuz, would be sufficient for less than a fortnight if fresh supplies are halted. To prepare for such a scenario, Indian Oil Corporation, Hindustan Petroleum Corporation Limited, and Bharat Petroleum Corporation Limited have started raising LPG production at select refineries integrated with petrochemical units.Officials are also examining focused demand-management strategies, including the possibility of rationing LPG for consumers who have access to alternate cooking fuels, particularly in rural regions, the people said. India’s crude oil stockpiles are estimated to cover around 17–18 days of consumption, while reserves of refined products such as petrol and diesel could last approximately 20–21 days.LNG inventories are sufficient for about 10–12 days. Without additional shipments through the Strait of Hormuz, these reserves would gradually diminish. Increasing purchases of Russian crude is another option being evaluated, sources told ET.Another industry executive noted that while any disruption could pose short-term challenges, Indian companies maintain a diversified LNG sourcing portfolio, including supplies from the US, with vessels routed via the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. Although oil and gas prices climbed on Monday, efforts remain focused on keeping supply chains operational.

No rise in petrol, diesel prices expected

Officials indicated that pump prices of petrol and diesel are unlikely to be revised upward in the near term. Oil marketing companies continue to adhere to a calibrated pricing strategy, absorbing losses when international rates climb and recovering margins when they ease. Retail fuel prices have effectively remained frozen since April 2022.On a day when Iranian drone strikes damaged sections of a Saudi Aramco refinery and QatarEnergy, the world’s largest LNG producer, announced a temporary halt to exports, Petroleum Minister Hardeep Singh Puri convened a meeting with senior officials and oil company representatives to review the status of crude and gas supplies.“We are closely tracking the fast-changing developments and will take every necessary measure to maintain both the supply and affordability of key petroleum products across the country,” the oil ministry said in a message posted on X.

Measures for Exporters

The government has sought to reassure exporters, saying that it stands prepared to extend necessary support and introduce flexible measures to ease trade operations in view of the uncertainty stemming from tensions in West Asia.At a meeting held in the commerce department and chaired by special secretary Suchindra Misra and DGFT Lav Agarwal, exporters highlighted several areas of concern.

These included risks to perishable consignments already in transit, escalating freight costs, demurrage charges, rerouting of shipments leading to longer transit times, dependence on imported inputs for exports, and potential strain on loan repayments to banks.According to an official statement, authorities are considering setting up a monitoring mechanism or round-the-clock control room to improve inter-agency coordination and swiftly address emerging challenges. The government reiterated its commitment to facilitating trade and signalled openness to granting procedural relaxations in instances of genuine disruption. It also indicated that it would work closely with customs officials to ensure timely clearances and coordinate with banks and insurance companies to ease operational bottlenecks.

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?

-

Tech6 days ago

Tech6 days agoCisco Catalyst SD-WAN users targeted in series of cyber attacks | Computer Weekly