Business

An indicator of commercial real estate transaction volume just improved for the first time this year

Housing block in Warsaw, Poland

Busà Photography | Moment | Getty Images

A version of this article first appeared in the CNBC Property Play newsletter with Diana Olick. Property Play covers new and evolving opportunities for the real estate investor, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large public companies. Sign up to receive future editions, straight to your inbox.

After a pullback in commercial real estate activity earlier this year due to broad economic uncertainty, there are new signs that activity is on the move again.

Capital is increasing and “bidder dynamics” are stabilizing, according to JLL’s global Bid Intensity Index, which saw improvement in July — its first since December.

The index measures bidding activity in order to give a real-time view of liquidity and competitiveness in private real estate capital markets. That, in turn, is an indicator for future capital flows across investment sales transactions.

It is composed of three sub-indices:

- Bid-Ask Spread: Final winning bid vs. the asking price

- Bids per Deal: Average number of bids per deal

- Bid Variability: Pricing variability of final bids

The stabilization in bidding dynamics comes as property sector performance fundamentals are holding up and asset valuations have generally held firm so far this year, despite weaker investor sentiment, according to the report.

“With no shortage of liquidity, institutional investors are returning to the market with more capital sources and a renewed appetite for real estate,” said Ben Breslau, chief research officer at JLL. “While further recovery is expected to be gradual after moderating earlier this year, borrowing costs and real estate values in most markets have stabilized, so we expect momentum to pick up through the second half of the year.”

Bid-ask spreads, the difference between the highest price a buyer is willing to pay for an asset and the lowest price a seller is willing to accept, are narrowing to more healthy levels across multiple sectors. The sector seeing the most improvement is so-called “living,” which is largely multifamily apartments but also includes senior living and student housing.

Retail is doing better than last year, but has been in decline over the last few months as tariffs weigh heavily on that sector. Industrial is the biggest laggard, thanks to supply chain uncertainty also muddied by potential and real tariffs.

Office bid dynamics are showing improvement, driven by a growing number of bidders and more lenders quoting on office loans. Some have called a bottom to the office market after its Covid-induced crash. Investors are bargain hunting in some cases, but as fundamentals strengthen with more return-to-office, overall deal demand is rising.

Bottom line: Investors appear to be accepting uncertainty as the new normal, according to the JLL report. Breslau said that includes accepting higher risk.

“The attractiveness of CRE investments as a long-term store of value remains intact. As more investors move to a ‘risk-on’ mode, coupled with the exceptionally strong debt markets, we expect this will lead to continued growth in capital flows,” he said.

Correction: This article has been updated to correct a reference to Ben Breslau, chief research officer at JLL.

Business

India-US trade: Exports rebound in November; supply-chain shifts and holiday restocking drive recovery, says GTRI – The Times of India

India’s exports to the US bounced back in November after two months of dip. The rebound was largely supported by supply-chain adjustments and pre-holiday season inventory restocking, according to the Global Trade Research Initiative (GTRI). This recovery came despite the US imposing 50 per cent tariffs on Indian goods since August.

November India-US trade snapshot amid higher tariffs

- Exports to the US rose 22.61 per cent in November to $6.98 billion, reversing declines seen between May and September.

- Smartphones (largest export item): Exports fell from $2.29 billion in May to $884.6 million in September, before rising to $1.8 billion.

- Gems and jewellery: Slumped from $500.2 million in May to $202.8 million in September, then rebounded to $406.2 million.

- Machinery and mechanical appliances: Declined to $516.8 million in September, before nearly returning to peak levels at $614.6 million in November.

- Pharmaceuticals: Shipments rose to $669.2 million in November, but remained below May levels.

- Mineral fuels and oils (tariff-exempt): Fell from $291.5 million in May to $251.5 million in September, before climbing to $274.3 million.

GTRI said the rebound came after a sharp fall in exports earlier in the year, triggered by uncertainty surrounding impending tariff hikes. GTRI Founder Ajay Srivastava said US buyers initially delayed orders and ran down inventories. “Once the higher tariffs became certain, exporters and US buyers began adjusting, absorbing part of the cost, renegotiating prices, and shifting toward less-affected or hard-to-substitute products,” he said.However, the think tank also warned that this recovery might not last. They claimed that it was more about adjusting to tougher tariffs rather than a permanent improvement. The think tank also added that businesses were using short-term strategies to cope with the new trade environment.

Business

Charity welcomes living wage rise in January

A social action charity has welcomed the decision to increase the living wage in Jersey to £15.10 per hour in 2026.

The new rate was approved this week and will come into effect at the beginning of January.

The living wage is £1.51 higher than Jersey’s minimum wage which is set to increase to £13.59 per hour from April 2026.

Caritas Jersey CEO, Patrick Lynch, said the living wage was the minimum islanders needed “in order to thrive, and not just survive here in Jersey”.

Mr Lynch said: “This will be good news for many at accredited organisations and their subcontractors, ahead of the new year, when many people will have increased rental costs and also face increases in the cost of some utilities and other day to day expenses.

“The Jersey Living Wage has never been as important as it is now for so many people with poverty unfortunately still increasing and a continued rise in food bank usage in our island.

“Putting that in perspective, in February 2022 one food bank was seeing 195 families; that figure has now risen to over 640 families.

“The majority of the people who form this increase are people in work, on minimum or low wages.”

He added the differential between the minimum wage and the Jersey Living Wage “remained worryingly high” and something “Assembly members should ponder as they debate the budget this week and look ahead to next June’s general election”.

Business

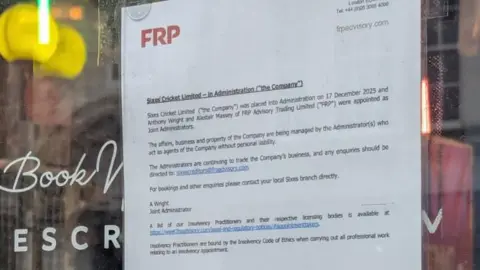

Sixes: Social cricket-themed bar chain goes into administration

Michael RaceBusiness reporter

BBC

BBCSixes, the cricket-themed social chain backed by England captain Ben Stokes, has gone into administration following a “challenging trading period”.

All of the company’s 15 UK-based venues remain open, but one branch in Southampton has closed following the decision, with three staff members losing their jobs.

Administrators FRP Advisory said talks were under way with a “number of interested parties” about a sale for the business and its strongest-performing sites, suggesting some other closures could happen.

Tony Wright, joint administrator, said the priority was to “secure the best outcome for the business” while honouring customer bookings “through the Christmas period and beyond”.

Sixes, which was launched in 2020, is a chain that combines hospitality with cricket. It hosts parties in which people face bowling machines and try to score as many runs as possible.

It is part of a similar social entertainment approach offered by rivals including Flight Club and Boom Battle Bar, and is backed in part by 4Cast, an investment group founded by Stokes, current and former England bowlers Jofra Archer and Stuart Broad, and former player turned agent Mike Turns.

Sixes entered administration last week, before England lost the Ashes following defeat in the third test match against Australia in Adelaide.

It is not known how big a share 4Cast, which injected cash back in 2023, has in Sixes. The BBC has contacted 4Cast for comment.

FRP Advisory said while the business had a “core of strongly performing sites, others have struggled”, amid “fierce competition for experiential venues and reduced consumer spending due to economic uncertainty”.

It said besides the Southampton branch which had closed, its remaining venues and franchises would remain open and all bookings would be honoured through the festive period.

The main job of administration is to try to save the company.

When businesses are losing money, they may borrow some to pay bills, however, if a company cannot pay its debts or borrow any more cash, a team may be brought in to take over from the management and sort out the finances – the process known as administration.

If a business cannot be saved, the company’s belongings may be sold so that some of the borrowed money can be repaid, which is known as liquidation.

The hospitality industry has raised concerns over higher costs facing firms, including business rates and minimum wages, arguing it could lead to jobs losses and businesses folding.

Mr Wright said Sixes had “built a strong brand in the social entertainment space with its unique venues proving very popular with customers”.

“While some locations have struggled in an increasingly competitive market, the business has significant potential, and we’re encouraged by the early interest we’ve received from parties interested in acquiring the brand and its strongest-performing sites,” he added.

“We’re confident that with the right investment and focus, Sixes can build on its core strengths.”

-

Business1 week ago

Business1 week agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Business6 days ago

Business6 days agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Business6 days ago

Business6 days agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Sports6 days ago

Sports6 days agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Tech1 week ago

Tech1 week agoFor the First Time, AI Analyzes Language as Well as a Human Expert

-

Business3 days ago

Business3 days agoBP names new boss as current CEO leaves after less than two years

-

Entertainment6 days ago

Entertainment6 days agoPrince Harry, Meghan Markle’s 2025 Christmas card: A shift in strategy

-

Business6 days ago

Business6 days agoFord to record $19.5 billion in special charges related to EV pullback