Business

Cabinet Clears Rs 7,280-Crore Scheme To Boost Rare Earth Magnet Manufacturing Amid China’s Export Curbs

Last Updated:

The Scheme to Promote Manufacturing of Sintered Rare Earth Permanent Magnets aims to create a REPM manufacturing capacity of 6,000 MTPA, in order to reduce import dependence.

Information and Broadcasting Minister Ashwini Vaishnaw briefs reporters on the Cabinet decisions today.

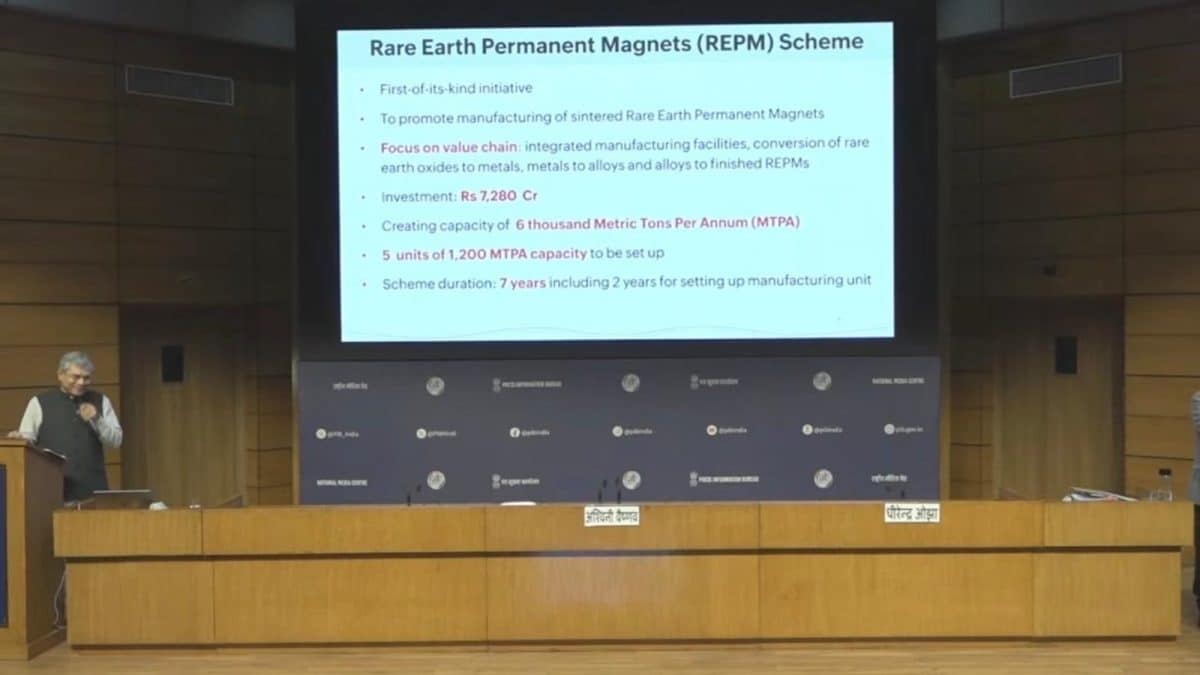

The Union Cabinet, chaired by Prime Minister Narendra Modi, on Wednesday cleared a Rs 7,280-crore incentive scheme to promote domestic manufacturing of rare earth permanent magnets (REPMs). The move comes amid China’s rare earth export control measures, which the country announced on October 9.

The Scheme to Promote Manufacturing of Sintered Rare Earth Permanent Magnets aims to create a REPM manufacturing capacity of 6,000 metric tonnes per annum (MTPA), to reduce India’s import dependence on critical minerals and strengthen its supply chain.

“The scheme will promote manufacturing of rare earth permanent magnets. The aim is to create capacity of 6,000 MTPA (metric tonne per annum),” Information and Broadcasting Minister Ashwini Vaishnaw told reporters.

Rare earth magnets are used in major industries including electric vehicles, aerospace, electronics, medical devices and defence.

Duration Of The Rare Earth Magnet Manufacturing Scheme

The total duration of the scheme will be 7 years from the date of award, including a 2-year gestation period for setting up an integrated Rare Earth Permanent Magnets (REPM) manufacturing facility, and 5 years for incentive disbursement on the sale of REPM.

The scheme envisions allocating the total capacity to five beneficiaries through a global competitive bidding process. Each beneficiary will be allotted up to 1,200 MTPA of capacity.

REPMs Critical Material For Various Industries

“REPMs are one of the strongest types of permanent magnets and are vital for electric vehicles, renewable energy, electronics, aerospace, and defence applications. The Scheme will support the creation of integrated REPM manufacturing facilities, involving conversion of rare earth oxides to metals, metals to alloys, and alloys to finished REPMs,” the Ministry of Heavy Industries said in a statement.

India’s REPM Consumption To Double By 2030

Driven by the rapidly growing demand from electric vehicles, renewable energy, industrial applications, and consumer electronics, India’s consumption of REPMs is expected to double by 2030 from 2025.

Currently, India’s demand for REPMs is met primarily through imports. With this initiative, India will establish its first ever integrated REPM manufacturing facilities, generating employment, strengthening self-reliance and advancing the nation’s commitment to achieve Net Zero by 2070, according to the statement.

‘Landmark Step For Domestic REPM Manufacturing Ecosystem’

“This initiative by the Government of India is a landmark step towards strengthening the domestic REPM manufacturing ecosystem and enhancing competitiveness in the global markets. By fostering indigenous capabilities in REPM production, the scheme will not only secure the REPM supply chain for domestic industries but also support the nation’s Net Zero 2070 commitment,” the ministry said.

It embodies the governments unwavering commitment to build a technologically self-reliant, globally competitive, and sustainable industrial base, in line with the vision of Viksit Bharat @2047.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

November 26, 2025, 16:32 IST

Read More

Business

Warburg to list housing finance company purchased from Shriram – The Times of India

Mumbai: Warburg Pincus-backed housing finance company Truhome Finance ( formerly Shriram Housing) has filed draft papers with capital markets regulator SEBI to raise Rs 3,000 crore through an initial public offering.The IPO will comprise a fresh issue of equity shares of face value Rs 10 aggregating up to Rs 1,500 crore and an offer for sale of equity shares of face value Rs 10 aggregating up to Rs 1,500 crore, according to the draft red herring prospectus filed with SEBI. The offer for sale will be undertaken by promoter selling shareholder Mango Crest Investment, which plans to offload shares worth up to Rs 1,500 crore.Truhome Finance plans to use the net proceeds from the fresh issue to augment its capital base to support future capital requirements, including onward lending and general corporate purposes. The funds will also help the company comply with RBI’s capital adequacy norms as its business expands.The company said the proceeds are expected to be deployed over the financial years ending March 31, 2027 and March 31, 2028.JM Financial, IIFL Capital Services, Jefferies India and Kotak Mahindra Capital Company are the book running lead managers to the issue.Warburg Pincus completed its acquisition of Shriram Housing Finance (SHFL) from Shriram Finance and other sellers in December 2024 for approximately Rs 4,630 crore, marking a strategic shift in India’s housing finance sector.

Business

Ticketmaster parent Live Nation reaches settlement with Department of Justice over antitrust concerns

Signs are seen at the Live Nation NYC headquarters on May 23, 2024 in New York City.

Michael M. Santiago | Getty Images

Live Nation Entertainment has reached a settlement with the Department of Justice over antitrust concerns surrounding its Ticketmaster platform, a senior DOJ official said Monday.

The settlement would see Ticketmaster unwind some of its exclusivity agreements with musical artists and open up the ticketing industry to greater competition. It still needs approval by more than 20 states that had filed suit and by the court.

As part of the settlement, Ticketmaster will offer a standalone third-party ticketing system for other companies like SeatGeek to use its technology. Live Nation has also agreed to divest at least 13 of its amphitheaters and will no longer be able to require artists to use other Live Nation products tied to its venues. It has also agreed to pay roughly $280 million in civil penalties.

Shares of Live Nation rose 5% in morning trading. Live Nation and Ticketmaster did not immediately respond to requests for comment.

Ticketmaster has long faced criticism that its dominance in the live events and ticketing space pushes up prices for consumers. The company has come under heightened scrutiny in recent years from fans who argue that it’s become harder and pricier to snag coveted event tickets.

In 2022, the backlash boiled over when the rollout of tickets for Taylor Swift’s Eras Tour was mishandled, leading to a probe of the company. And in 2024, the DOJ — along with more than two dozen states — sued to break up Live Nation and Ticketmaster, which merged in 2010.

In September, Live Nation was separately sued by the Federal Trade Commission over what the agency called “illegal” ticket resale tactics. The FTC said Ticketmaster controls roughly 80% of major concert venues’ ticketing.

In a Monday statement, New York Attorney General Letitia James said her office would continue to fight against Live Nation’s alleged monopoly even after its agreement with the DOJ.

“The settlement recently announced with the U.S. Department of Justice fails to address the monopoly at the center of this case, and would benefit Live Nation at the expense of consumers. We cannot agree to it,” said James, who is joined by the attorneys general of more than 20 other states.

Business

How the Iran war may affect your bills and finances

The conflict in the Middle East could raise the cost of petrol, household energy bills and even food.

Source link

-

Sports3 days ago

Sports3 days agoPakistan set for FIH Pro League debut | The Express Tribune

-

Politics2 days ago

Politics2 days agoIndia let Iran warship dock the day US sank another off Sri Lanka, say officials

-

Sports1 week ago

Sports1 week agoCollege basketball star suspended by team for spitting toward opposing fan

-

Entertainment1 week ago

Entertainment1 week agoAl Jazeera broadcast interrupted by emergency missile alert in Qatar

-

Entertainment2 days ago

Entertainment2 days agoHarry Styles kicks off new era with ‘One Night Only’ comeback show

-

Business3 days ago

Business3 days agoHome heating oil: ‘Most of my pension has gone on home heating oil’

-

Business1 week ago

Business1 week agoLabour parliamentarians urge UK Government to oppose Rosebank oil field

-

Sports1 week ago

Sports1 week agoMichigan loses L.J. Cason for rest of season with torn ACL