Fashion

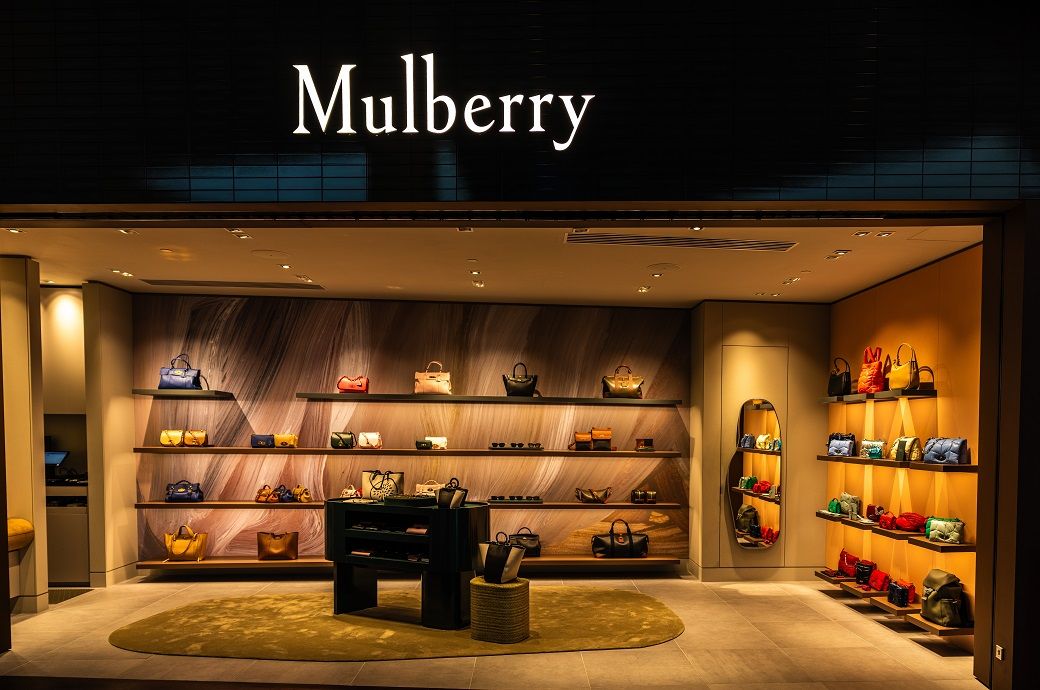

UK’s Mulberry’s Q3 sales rise 5.3% on festive full-price demand

The full-price retail sales jumped 19 per cent despite a highly promotional wider market, driven mainly by stronger digital and e-commerce performance reflecting improved product newness and sharper pricing architecture.

Mulberry Group has posted a solid Q3 to December 27, 2025, with total sales up 5.3 per cent and LFL retail and digital sales rising 11 per cent, driven by strong festive demand and a higher full-price mix.

Full-price sales jumped 19 per cent, with growth across the UK, US and Europe, reflecting positive customer response to its ‘Back to the Mulberry Spirit’ strategy.

In the UK, total retail and digital sales increased 3.5 per cent, with LFL growth of 6.5 per cent, as Mulberry’s renewed focus on its domestic customer drove a higher proportion of full-price online sales. The US delivered accelerated growth of 12.7 per cent, while Europe (excluding the UK) recorded a 14.9 per cent increase, supported by a 27.2 per cent jump in LFL sales, Mulberry said in a press release.

Asia Pacific sales rose 0.8 per cent overall, even as the group continued to right-size its store estate, with LFL sales up a robust 12.2 per cent following a strong double 11 festivals in November 2025.

The group said the performance reflects its strategy to simplify the business, refresh the brand and better leverage customer insights, helping Mulberry reconnect with its core audience while attracting new shoppers across both physical and digital channels.

“We have delivered a strong performance during the festive period. While there remains plenty more to be done, it is encouraging to see the early signs of our ‘Back to the Mulberry Spirit’ strategy delivering. We have maintained disciplined cost control, while at the same time growing full-price sales by having products that resonate at the right price,” said Andrea Baldo, chief executive office (CEO) of Mulberry Group.

He added that growth across regions shows Mulberry’s products are resonating globally as the brand rebuilds its cultural relevance. “The response to our Christmas campaign has been in line with expectation, with particularly strong demand for the Roxanne, the Hackney and the continued resurgence of the Bayswater,” added Baldo.

Mulberry enters the final quarter of its financial year, running from January to March 2026, with what it described as good momentum, as it continues to pursue its goal of building a sustainable and profitable luxury lifestyle brand, added the release.

Fibre2Fashion News Desk (SG)

Fashion

India revises raw jute stock limits to curb hoarding

The move comes as raw jute prices have climbed well above the minimum support price for the 2025-26 season, triggering concerns among stakeholders over availability and market volatility, the Ministry of Textiles said in a press release.

India’s Jute Commissioner has revised raw jute stock limits under the Jute and Jute Textiles Control Order, 2016, amid prices rising well above MSP levels.

The move aims to curb hoarding, stabilise supply, and check speculation.

Entities must declare stocks fortnightly, reduce excess holdings within ten days, and face penalties under the Essential Commodities Act for violations.

Under the revised norms, raw jute balers with baling presses on their premises are permitted to hold a maximum of 1,200 quintals at any time. Other stockists, excluding balers, can hold up to 25 quintals, while unregistered raw jute traders are restricted to a maximum of 5 quintals. Jute mills and processing units are allowed to stock raw jute equivalent to a maximum of 45 days’ consumption, based on current production levels.

All entities engaged in stocking raw jute have been directed to declare and update their stock positions fortnightly on the Jute SMART portal. Those holding stocks beyond the prescribed limits must reduce excess quantities within ten days of the order, physically deliver the surplus to consignees, and submit compliance reports with supporting documents to the Jute Commissioner’s office no later than February 10, 2026.

The order also clarifies that where raw jute is stored at a single premise under the names of multiple traders, stockists, or balers, the total quantity at that location must remain within the applicable limits.

To ensure strict compliance, authorised officials have been empowered to inspect premises and records and seize excess stocks found in violation of the order. State governments have also been requested to assist in enforcement actions against entities involved in hoarding.

Any violation of stock declaration requirements or stock limits will invite punitive action under the Essential Commodities Act, 1955. Penalties, confiscation of stocks, and action against false statements will be taken under the relevant sections of the Act, added the release.

According to the government, unchecked price volatility and speculative increases pose a risk to the jute industry, potentially disrupting production and employment. The revised stock limits are aimed at stabilising raw jute supply, preventing market manipulation, and safeguarding the interests of farmers, manufacturers, and consumers across the country.

Fibre2Fashion News Desk (SG)

Fashion

UK clothing exports rise 2.7% to in Nov 2025

UK clothing exports rose 2.73 per cent year on year to £301 million (~$403.07 million) in November, supported by a month-on-month rebound.

However, textile fabric and fibre exports declined, reflecting weak European manufacturing demand and cautious buying.

Quarterly and annual data underline broader pressure on UK textile and apparel exports amid subdued consumer demand and post-Brexit frictions.

Source link

Fashion

UAE, India unveil road map to hit $200-bn in bilateral trade by 2032

Prime Minister Narendra Modi also invited UAE sovereign wealth funds to consider joining the second Infrastructure Fund, to be launched this year.

India and the UAE will more than double bilateral trade to over $200 billion by 2032.

This was part of a dozen outcomes at the end of the UAE President’s visit to New Delhi.

Key outcomes include a pact under which India’s HPCL will buy 0.5 MMPTA of LNG from UAE’s ADNOC Gas for a 10-year period starting 2028.

First Abu Dhabi Bank and DP World will set up offices and operations in Gujarat’s GIFT City.

Key outcomes of the visit include a long-term agreement under which Hindustan Petroleum Corporation Limited (HPCL) will purchase 0.5 million metric tonnes per annum (MMPTA) of liquefied natural gas from Abu Dhabi National Oil Company Gas (ADNOC Gas) for a 10-year period starting 2028.

A joint statement issued after the visit said UAE companies First Abu Dhabi Bank and DP World will set up offices and operations in Gujarat’s GIFT City. While the former will set up a branch to support trade and investment linkages, the latter will operate from GIFT City, including leasing ships for its global operations.

A letter of intent was signed between the Gujarat government and the UAE Ministry of Investment for developing the Dholera Special Investment Region in the state.

The partnership will include the development of strategic infrastructure like an international airport, a pilot training school, a maintenance, repair, and overhaul facility, a greenfield airport and a smart urban township, along with projects related to railway connectivity and energy infrastructure.

Fibre2Fashion (DS)

-

Entertainment1 week ago

Entertainment1 week agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Politics5 days ago

Politics5 days agoSaudi King Salman leaves hospital after medical tests

-

Sports1 week ago

Sports1 week agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business6 days ago

Business6 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Fashion5 days ago

Fashion5 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Tech6 days ago

Tech6 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech1 week ago

Tech1 week agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech5 days ago

Tech5 days agoPetlibro Offers: Cat Automatic Feeders, Water Fountains and Smart Pet Care Deals