Business

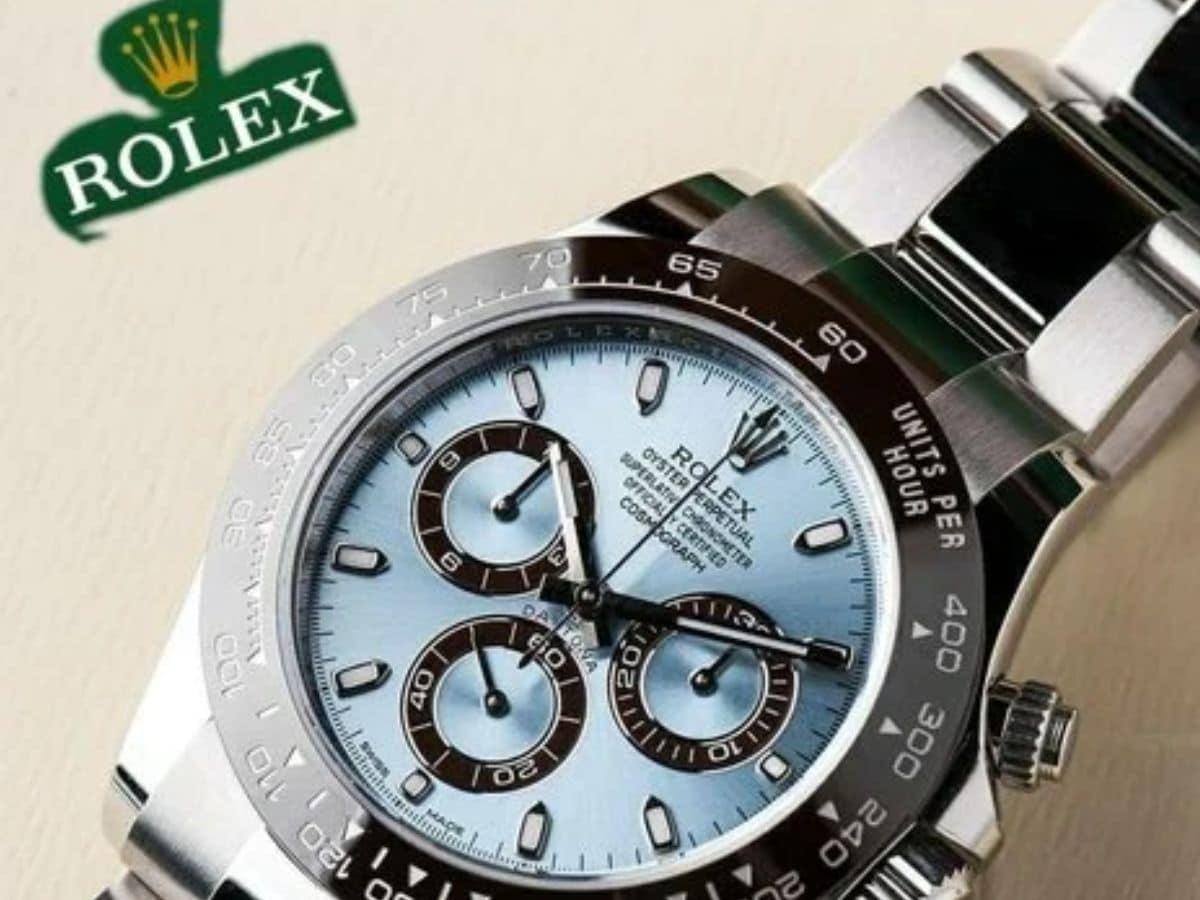

Why Is A Rolex Watch So Expensive? The Hidden Story Will Surprise You

In the rarefied world of luxury goods, few objects trigger as much awe, and as much sticker shock, as a Rolex. Starting at around Rs 4-5 lakh and often requiring a waiting period of several years, the watch has become a symbol of precision, status and engineering excellence. Yet, behind its global appeal lies a history that 99% of people have never heard, one that explains not only its high price, but also the extraordinary trust it commands. (News18 Hindi)

The Rolex story begins quietly in London in 1905, where Hans Wilsdorf and Alfred Davis founded a modest company called Wilsdorf & Davis. They were not selling watches under their own name. Instead, they manufactured finely crafted wristwatches and supplied them to jewellers, who stamped their own branding on the dials before selling them to customers. (News18 Hindi)

Wristwatches, at that time, were not considered accurate enough to replace pocket watches, which dominated the market despite their own vulnerabilities. A pocket watch could stop working if exposed to water or even slight shifts in altitude, but it remained the only reliable tool for timekeeping. (News18 Hindi)

Wilsdorf, however, sensed a shift long before the world did. He realised that a wristwatch, more convenient, more wearable, and more discreet, had the potential to become the preferred timekeeping device if only its precision could match that of a pocket watch. Determined to improve accuracy, he and Davis immersed themselves in experimentation and refinement until they finally succeeded in building what was soon hailed as one of the world’s most precise wristwatches. (News18 Hindi)

As demand for these watches grew, the two founders recognised an irony; jewellers, not the makers, were receiving the credit. The time had come to establish a brand identity of their own. In 1908, they chose a new name, short, crisp, and suitable for the dial, Rolex. Alongside the rebranding came a strategic relocation. Switzerland, already celebrated for its exacting horological standards, became Rolex’s new headquarters. After closing the London office in 1919 due to wartime taxation, the shift to Geneva proved to be a turning point. A “Swiss Made” Rolex did not need much persuasion; the name itself inspired trust, and customers bought the watches readily. (News18 Hindi)

By now, Rolex was not content with precision alone. Wilsdorf envisioned a watch that could defy not only time but the elements. After years of experimentation, the company unveiled the world’s first waterproof wristwatch, the Oyster, in 1926. It was an engineering triumph, but one that needed public proof. Traditional advertising would not be enough to convince sceptics. Wilsdorf responded with a visionary marketing idea. He placed the watch on the wrists of athletes and adventurers. When a young swimmer crossed the English Channel wearing a Rolex that survived the journey unscathed, the company showcased the feat in shop windows across Europe. Confidence in the brand soared. (News18 Hindi)

Through such dramatic demonstrations, Rolex cultivated an identity that blended craftsmanship with adventure. Its watches were not merely accessories; they were instruments of endurance, capable of accompanying human beings to the deepest oceans, the highest mountains and the harshest terrains. (News18 Hindi)

This long heritage of innovation explains, in part, why Rolex watches are costly even today. The materials themselves set them apart. The company uses 904L steel, a metal significantly more expensive and more resistant to corrosion than the 316L steel used by most luxury watchmakers. (News18 Hindi)

Many models incorporate solid gold or platinum, demanding an extraordinary level of craftsmanship and finishing. Every watch undergoes rigorous testing, often surpassing official chronometer certifications. Production remains deliberately limited not because of marketing strategy, but because the manufacturing process is slow, meticulous and resistant to shortcuts. (News18 Hindi)

Over more than a century, Rolex has built not just watches, but a narrative of reliability and endurance that no rival has fully replicated. The true reason behind its high price is not merely the steel, the gold or the platinum. It is the unwavering promise set forth by Hans Wilsdorf; a Rolex must keep accurate time, anywhere on the planet, under any possible condition. That promise has defined the company’s engineering philosophy for generations, and continues to justify the extraordinary value placed on every watch that bears its name. (News18 Hindi)

Business

Top stocks to buy: Stock recommendations for the week starting January 19, 2026 – check list – The Times of India

Stock market recommendations: According to Motilal Oswal Financial Services Ltd, the top stock picks for the week (starting January 19, 2026) are 360 One, and Canara HSBC Life. Let’s take a look:

360 One360 One WAM is a structural growth story given tailwinds from India’s expanding wealth pool, new team onboarding, and synergies from recent acquisitions which underpin long-term growth visibility. It delivered a strong 3QFY26, driven by robust inflows and operating leverage. Operating revenue grew 33% YoY, led by a sharp 45% YoY rise in ARR income, while disciplined cost control reduced the cost-to-income ratio by 320bp YoY to 49.6%, supporting healthy profit growth. PAT grew 20% YoY despite a sharp decline in other income. Growth was fueled by strong net ARR inflows of ₹147b, with record AMC inflows and sustained momentum in wealth management driven by wallet share gains and carry income-led retention improvement. Management remains confident of further CI ratio improvement toward 45–46% as ET Money and HNI businesses move toward breakeven. Management guides for 22–24% AUM growth, translating into 21%/22% revenue/PAT CAGR over FY25-28.Canara HSBC LifeCanara HSBC Life Insurance represents a compelling banca-led compounding story, underpinned by strong distribution moats and significant headroom for efficiency-driven growth. The insurer has consistently outperformed the industry over the past decade by leveraging its deep bancassurance partnerships, led by Canara Bank and complemented by HSBC, which together provide access to a large, sticky, and increasingly segmented customer base.With penetration among Canara Bank customers still very low and branch productivity materially below private-bank peers, incremental gains from better analytics, digital enablement, and branch activation offer a long runway for growth at low acquisition cost. HSBC adds a high-quality layer through affluent, NRI, salary, and corporate customers, supporting superior persistency and value accretion. Alongside this, gradual diversification into agency and other channels improves reach and reduces concentration risk without materially diluting long-term economics. A favorable shift in product mix toward non-par and protection, improving operating efficiency, and rising scale are driving steady expansion in value creation metrics, positioning Canara HSBC Life as a structurally improving, capital-efficient life insurer with sustained growth visibility and strong return potential over the medium term.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

China hits 2025 economic growth target as exports boom

China’s economy grew by 5% last year, as record exports helped the world’s second largest economy meet its annual target.

Beijing had set a goal of “around 5%” economic growth in 2025, despite struggles to boost domestic spending and a prolonged property crisis.

China reported the world’s largest-ever trade surplus last week – the value of goods and services sold overseas compared to its imports – of $1.19tn (£890bn), driven by a rise in exports to markets outside the US, as President Donald Trump continued his tariffs policy.

But official figures released on Monday also showed that China’s economic growth slowed to a rate of 4.5% in the final three months of 2025 compared to a year earlier.

As well as China’s exporters moving away from the American market, China’s economic resilience was helped by lower-than-expected US tariffs after Beijing and Washington agreed a tariffs pause.

While China’s manufacturers continued to boost exports, the country is grappling with a number of issues in its domestic economy.

The country has been struggling with an ongoing property crisis and rising local government debt, which has made businesses more hesitant to invest and consumers cautious about spending.

Other new data on Monday showed that new home prices continued to fall in December, as the government struggled to stabilise the property market. Prices dropped 2.7% last month compared to a year earlier, the sharpest decline in five months. Property investment also fell 17.2% last year.

At the same time retail sales rose by just 0.9% in December, the slowest rate in three years.

But the country’s factory output increased by 5.2% in December from a year earlier, beating the 4.8% growth in November.

China’s leaders have pledged “proactive” policies this year as they look to increase domestic spending and shift reliance away from exports and investments.

Business

Russian Oil Imports: Defying Trump, Indian Companies Snap Up Purchases Despite US Tariff Threats

New Delhi: Even as the United States threatens higher tariffs, a few Indian companies have increased crude oil imports from Russia. The purchases come at a time when overall Russian oil imports into India have fallen because of international restrictions.

Government-owned Indian Oil Corporation (IOC) and Nayara Energy, which is linked with Rosneft, have raised their procurement from Russia this month. The Bharat Petroleum Corporation Limited (BPCL), one of India’s major state-owned oil and gas companies, has also continued buying, though in smaller volumes. Reliance Industries, the biggest Russian oil buyer last year, has not purchased any crude from Russia this month.

Data from analytics firm Kpler shows that in the first half of January, India imported an average of 1.18 million barrels per day from Russia. This is nearly 30 percent lower than the same period last year and below the 2025 monthly average. Compared with December 2025, imports are down by around three percent.

Which Companies Bought Russian Oil

US sanctions have reduced the number of Indian buyers for Russian crude. So far, only the IOC, the Nayara Energy and the BPCL have imported Russian crude this month. The IOC accounts for nearly half a million barrels per day, roughly 43 percent of total Russian crude arriving in India. This is its highest purchase since May 2024 and 64 percent above its 2025 monthly average.

Nayara Energy ranks second, buying about 471,000 barrels per day. That represents 40 percent of Russian crude arriving in India. This is its largest purchase in at least two years and 56 percent higher than its 2025 average.

The BPCL has bought approximately 200,000 barrels per day, slightly above its 2025 average of 185,000 barrels per day.

Companies Not Buying Russian Oil

Reliance Industries has not purchased Russian crude this month. Other companies that stayed out include the Hindustan Petroleum Corporation, the HPCL-Mittal Energy Ltd and the Mangalore Refinery & Petrochemicals Ltd.

Russian suppliers have increased discounts on crude because of falling demand from some Indian and Chinese buyers. Industry officials say that the discount on Russian Urals crude delivered to Indian ports has risen to about $5-6 per barrel. Before US sanctions on Rosneft and Lukoil in October, the discount was around $2 per barrel.

The IOC has increased its January purchases to take advantage of the cheaper prices.

-

Tech6 days ago

Tech6 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Entertainment6 days ago

Entertainment6 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship

-

Sports4 days ago

Sports4 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business1 week ago

Business1 week agoModern seafood processing zone planned at Korangi harbour | The Express Tribune