Business

‘Zero faith’: If Trump’s tariffs are overturned, how easily will businesses get back billions in refunds? It could be a nightmare! – The Times of India

Donald Trump administration’s tariff collections – running into billions of dollars – is threatened in case the Supreme Court decides to strike down the US President’s tariff policies. Trump himself has warned that any decision against his tariff policies would spell disaster.Businesses, which have paid huge amounts in the last few months due to country-based tariffs, believe that getting back refunds in case the tariffs are deemed illegal by the Supreme Court, would be a nightmare.

Tariff refund nightmare

To begin with, this would create administrative challenges involving extensive refund processing. If these nation-specific tariffs are ruled unlawful, the United States might need to return most of the $165 billion in customs duties collected in the current fiscal year to the businesses that paid them, according to a Bloomberg report.However, obtaining refunds will be complicated; reimbursements typically come via paper cheques through a slow process, and whilst the government could expedite mass repayments, experts believe this is doubtful.“The customs authorities won’t simply distribute refunds to importers freely,” Lynlee Brown, global trade partner at EY was quoted as saying by Bloomberg.The uncertainty surrounding the potential refund process exemplifies the broader confusion that businesses and financial markets have experienced since the implementation of Trump’s tariff policies.Several importers have abandoned expectations of receiving reimbursements, even if the court rules in their favour.“I have zero faith we’d ever get anything. Just zero,” expressed Harley Sitner, who owns Peace Vans, a Seattle-based classic camper van repair and restoration business.

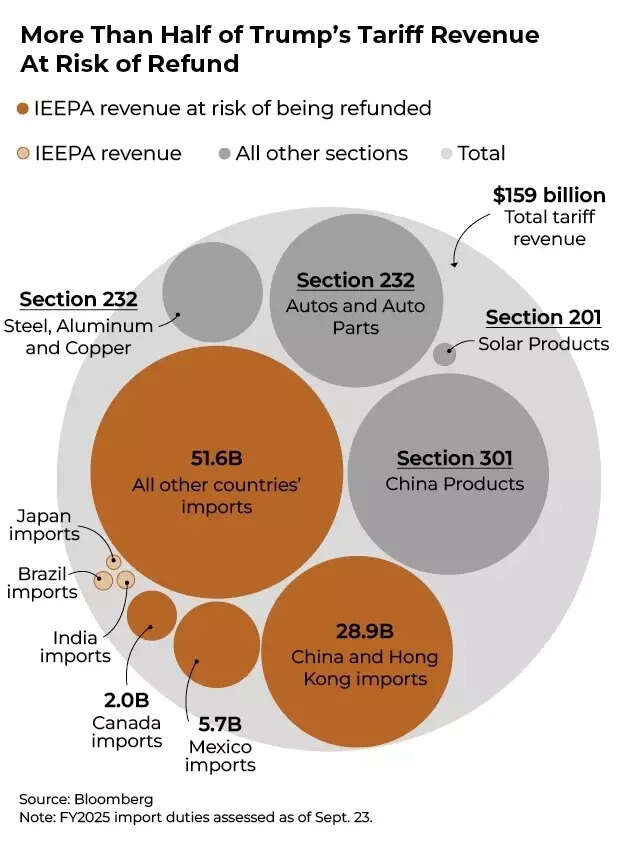

More than half of tariff revenue at risk of refund

Sitner told Bloomberg that the unpredictability of Trump’s trade policies is more problematic than the actual tariff payments, which he views as irretrievable expenses. Following unexpected tariff charges ranging from $221 to $17,000, sometimes arriving months after receiving goods, Sitner has discontinued importing international inventory.“Just yesterday we got a small shipment from Germany worth $2,324 and it came with a $1,164 tariff charge. We can’t back out,” Sitner stated.Various customs brokers report being approached by Wall Street organisations interested in purchasing rights to potential refunds, offering importers an opportunity to recover a portion of their possible entitlements.The significant increase in customs duties – a rise of $95 billion compared to the previous year – is primarily attributed to Trump’s import tariffs affecting multiple economies, which became effective in August, as analysed by Bloomberg Economics. Two lower judicial bodies have ruled that Trump lacked the authority to implement tariffs under the International Emergency Economic Powers Act.Should the Supreme Court uphold these earlier decisions, approximately 50% of the customs duties collected by the United States this year could be subject to refund. However, the process for businesses to reclaim these funds remains uncertain. Despite the government shutdown, tariff-related operations have largely continued uninterrupted.The United States Customs and Border Protection regularly processes refunds for importers in cases of overpayment or regulatory changes, with the Treasury Department issuing the payments. However, this reimbursement process is not automatically initiated.In line with statutory requirements, importers and their customs brokers must adhere to precise timelines and documentation procedures to maintain eligibility for refunds. Currently, the system predominantly relies on paper cheques for disbursement.Despite the Treasury’s directive from the Trump administration to discontinue cheque payments by September 30, the Customs and Border Protection (CBP) only initiated its first phase last Tuesday in what will be an extended implementation process. The system’s completion before any court decision appears unlikely without accelerated efforts.Tom Gould, a customs consultant from Seattle, suggests that potential refunds might result in “it’s possible that we’ll see millions and millions of paper checks being mailed out because each shipment, each customs entry, will have its own.”The process could be problematic. According to the Bloomberg report, due to regulatory requirements, customs refunds are exclusively sent to sanctioned domestic banks in dollars, requiring foreign importers to receive their refunds through international postal services or utilise a broker’s account within the United States.Worryingly, there has been a series of stolen cheque incidents in recent years. According to Gould, refund cheques were intercepted during postal delivery and traded on the dark web before being encashed.The administration possesses various options to expedite refunds, including automated processing of claims using existing system data. CBP has previously implemented refund rationalisation measures.Customs officials developed a framework to facilitate refund disbursement for items eligible under duty exemptions through the Generalised System of Preferences. Despite Congress allowing this programme to expire multiple times since the 1980s, it was subsequently renewed retroactively.Importers would input specific codes indicating GSP eligibility, even during programme inactivity. Gould suggested that the agency could similarly analyse internal data to identify IEEPA code-related tariff payments.Alternative procedures exist, though they might be complex. Legal experts indicate individual importers could be compelled to initiate separate legal proceedings to recover their funds.The authorities might require submission of protests or post-summary amendments, accompanied by comprehensive payment documentation and importer records, despite the government already possessing this information.EY’s Brown recommends importers maintain complete records from CBP’s Automated Commercial Environment platform, documenting entry dates and deadlines systematically to enhance refund possibilities.Despite potential simplified procedures by CBP, the complex nature of financial transactions within supply chains presents additional challenges.For shipments managed through commercial carriers like FedEx Corp. and United Parcel Service Inc., who handle documentation and tariff payments, CBP would direct refunds to the registered importer – the courier service rather than the goods’ owner.This arrangement could generate complications between the actual importers and courier services, creating another obstacle for businesses seeking reimbursement.

Tariff collections: Trump admin may not let go easily

Trump has valued the tariff income, declaring it has restored national wealth. He and his supporters have suggested various uses for these funds, including reducing national debt, supporting struggling agricultural sectors, and potentially distributing payment cheques to US citizens.This suggests the Trump administration will be reluctant to release these funds if the tariffs are invalidated, and they are likely to swiftly implement new levies using alternative legal frameworks should this occur. The Supreme Court is scheduled to review arguments in November regarding this matter.

Business

Ho hum holiday: Retail’s early results show modest growth in critical shopping season

People shop at a mall decorated with holiday lights in Manhattan on Dec. 18, 2025 in New York City.

Spencer Platt | Getty Images

Some retailers provided early holiday results on Monday that showed the crucial shopping season was solid, but didn’t blow away expectations.

Lululemon, which is preparing for a new CEO and staring down a proxy battle with its founder, said in a release it expects its holiday quarter to be “toward the high end” of its previously released guidance. Shoe maker Birkenstock and thrift store Savers Value Village also released lackluster early holiday results.

Lululemon said it expects fiscal fourth quarter revenue to be close to $3.60 billion and earnings to be close to $4.76 per share. Both figures are at the high end of the guidance the company released in December when it announced fiscal third-quarter earnings.

It made no changes to its previous guidance for gross margin, effective tax rate and selling, general and administrative expenses.

Shares were slightly higher in premarket trading.

“We remain focused on executing our action plan to drive improvement in our U.S. business and look forward to the opportunities in front of us,” finance chief Meghan Frank said in a statement.

When announcing last quarter’s earnings on Dec. 11, outgoing CEO Calvin McDonald said the company was “encouraged” by its early holiday performance but acknowledged wide discounting had driven demand during the Thanksgiving holiday period. When the shopping stretch ended, trends slowed, he said at the time.

Like other higher-end brands, Lululemon has historically been very selective with discounts, but it has used them more liberally in recent quarters to offload old merchandise and styles that weren’t resonating with shoppers.

During its fiscal third quarter, margins fell by 2.9 percentage points, due primarily to higher tariffs and the bigger markdowns, it said at the time.

Birkenstock, which didn’t provide specific holiday-quarter guidance last year, said it expects sales in the quarter ended Dec. 31 to grow 11% to €402 million ($470 million). The results appeared to disappoint investors, with shares falling about 3% in premarket trading.

Savers Value Village saw sales grow 8.4% during its holiday quarter, with comparable sales up 5.4%, excluding the impact of an extra week the company had in its calendar. Despite relatively strong growth, the company only reaffirmed its fiscal 2025 adjusted net income and EBITDA outlooks. Shares were slightly higher in premarket trading.

The early results, which were announced ahead of the annual ICR conference in Orlando, Florida, show what many analysts had expected for the holiday shopping season. Wall Street largely anticipated results would be solid, but they wouldn’t show massive gains in consumer spending.

The National Retail Federation previously forecasted retail sales in November and December would rise between 3.7% and 4.2% compared to 2024. That’s solid growth, but when higher prices from tariffs are taken into account, some analysts expect volume growth to be largely flat.

Business

JPMorgan’s looming question: What happens when CEO Jamie Dimon leaves?

As Wall Street’s top bankers huddled in New York last month, preparing to convince Elon Musk’s SpaceX that they should be chosen to lead its upcoming IPO, one firm wasn’t letting its star advisor miss the bake-off.

Among the squad of JPMorgan Chase investment bankers flying 2,500 miles west to California to pitch SpaceX was the lender’s boss, billionaire CEO Jamie Dimon, people with knowledge of the trip told CNBC.

The morning after that pitch meeting, on Dec. 19, Dimon was already back in his customary early Friday perch: sitting in his bank’s New York lobby, taking meetings in full view of the thousands of employees streaming through the building’s turnstiles.

The whirlwind few days highlight the reality of Dimon’s singular impact on JPMorgan, the world’s largest bank by market capitalization.

Dimon marks his 20th anniversary as CEO this month and remains deeply involved across the sprawling businesses of JPMorgan, a giant across Wall Street and Main Street with $4.6 trillion in assets. Half a dozen executives across investment banking, asset management and consumer banking echoed that view.

Which makes the inevitable questions surrounding Dimon’s tenure loom large as he approaches 70 years of age. Dimon has for years maintained, somewhat tongue-in-cheek, that his retirement was perpetually 5 years away. In 2024, for the first time, he acknowledged that window was shrinking.

Will JPMorgan’s era of dominance be over when Dimon exits as CEO?

“Given his track record, anybody else would be a downgrade,” said Ben Mackovak, a bank board member and investor through his firm Strategic Value Bank Partners.

“I’m sure somebody else could grow into the role and surprise people,” Mackovak said. “But on day one, no one is going to be as qualified to run that bank as Jamie.”

Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase & Co., attends the ribbon-cutting ceremony opening the firm’s new headquarters at 270 Park Avenue, in New York City, U.S., October 21, 2025.

Eduardo Munoz | Reuters

In two decades, Dimon took a middle-of-the-pack American lender and, with his unique combination of judgment, paranoia, attention to detail and scope of vision, created a juggernaut of finance that the world hadn’t seen before.

During calm times, he invested aggressively for the future, and during periods of tumult, like 2008 and 2023, he avoided pitfalls that consumed other banks, allowing him to snap up three failed institutions.

Over the past 20 years, the bank’s annual net income soared more than 500% to $58.5 billion in 2024. The firm reports full-year 2025 results on Tuesday.

Now, at a market cap of roughly $900 billion, JPMorgan is worth nearly as much as the next three largest U.S. banks combined: Bank of America, Citigroup and Wells Fargo.

Besides running JPMorgan, Dimon has taken on an outsized role in global finance as a top voice explaining market gyrations or emerging risks and influencing regulators amid policy shifts. It was Dimon’s recession warning on a Fox News segment in April that helped convince President Donald Trump to pivot on his trade policy, igniting a historic relief rally.

“It’s just the aura he has, the credibility that he’s built up in the markets,” said Fitch Ratings analyst Chris Wolfe. “The minute you step out of that role, it’s not like you can just hand that over, your successor doesn’t automatically inherit that. I think that’s the real challenge.”

Potential successors

The question of who could take over for Dimon — who was already a cancer survivor when he nearly died in 2020 from a ruptured aorta — has been openly discussed among investors for more than a decade.

To investors, his most likely successor is currently Marianne Lake, head of the firm’s giant consumer bank and former CFO of the company, followed by Doug Petno and Troy Rohrbaugh, the co-heads of the firm’s commercial and investment bank.

Marianne Lake, chief financial officer of JPMorgan Chase & Co.

Jin Lee | Bloomberg | Getty Images

Other contenders include asset and wealth management head Mary Erdoes and CFO Jeremy Barnum.

“If investors were to do a straw poll today, they’d probably pick Marianne,” said Truist bank analyst Brian Foran.

“The running joke is that she’s a human supercomputer when it comes to banking,” Foran said. “Really, the only question mark people have about her is, she’s so analytical, can she do the kind of ‘rah-rah’ stuff to inspire the sales force?”

Wells Fargo banking analyst Mike Mayo hypothesized that JPMorgan stock could immediately drop 5% if Dimon were to suddenly exit, regardless of the named replacement. (The bank has said Dimon would serve as chairman even after relinquishing the CEO role.)

It’s a somewhat common occurrence on Wall Street for companies with iconic CEOs: The stock premium shrinks, at least for a period, when their longtime leaders announce their departures. For instance, Berkshire Hathaway shares trailed the S&P 500 last year after Warren Buffett said he was stepping down as CEO.

‘Never going to quit’

When asked about CEO succession, JPMorgan executives say that Dimon is as plugged in as ever, and unlikely to step down soon.

Depending on how long he sticks around, that means it’s not necessarily his current direct reports like Lake, Petno and Rohrbaugh who are in line, but more junior executives now being groomed and evaluated for leadership roles, they told CNBC.

“There’s a lot of work going into imagining that day without him,” said a JPMorgan executive who asked not to be named speaking about his boss. “If he stays until he’s 85, it’s not his direct reports that are going to be next in line, its maybe one or two levels down from today.”

“Does he leave a huge vacuum? Yes,” said the executive. “It’s not fatal, though, because we’ve been planning for it. I think there’s combinations of people that together can create the same outcome.”

The CEO of a commercial bank and former JPMorgan executive, who described Dimon as a mentor, also said he didn’t think Dimon would step down soon.

“Jamie’s never going to quit,” said the CEO, who asked for anonymity to speak candidly. “What else would he do where he’s as important as he is now? His friends are all people from work. He loves it.”

Still, beyond the day-to-day management of a company with 318,000 employees, Dimon seems intent on setting up JPMorgan for a future without him.

Legacy values

In recent months, Dimon oversaw the completion of the bank’s new $3 billion headquarters in midtown Manhattan and announced a $1.5 trillion initiative to bolster industries crucial to U.S. interests.

And, perhaps most crucially, he continues to instill his values into the firm’s management team.

Last year, at a conference for JPMorgan’s top 400 executives, Dimon rattled off a list of once-great companies that died though mismanagement. Finance is especially prone to this threat, because of the temptation to manipulate numbers for short-term gain, he said.

“Travelers blew up. Citi blew up, twice. Bear Stearns failed, Lehman failed, I’m here because Bank One screwed up a bunch of businesses,” Dimon said, referring to a predecessor firm to JPMorgan.

“If you look at these things, it’s complacency, it’s bureaucracy, it’s arrogance. A lot of it is dishonest numbers. Failure to set standards,” Dimon said. “These are the cancers that kill companies.”

Nobody knows when Dimon’s last day as CEO will come, except to know that it is approaching. After adjusting his standard 5-year retirement answer to hint at a sooner departure, Dimon hasn’t advanced that clock any further.

“As great as he is, he can’t do this forever,” said Barclays banking analyst Jason Goldberg. “Every day that passes, you’re a day closer to the end.”

— CNBC’s Gabriel Cortes contributed to this report.

Business

Electricity tariff to go down by 93 paisas – SUCH TV

The federal government slashed electricity prices by 93 paisa under the head of fuel adjustment charges (FCA) with effect from November 2025, but kept the basic tariff unchanged.

According to details, the National Electric Power Regulatory Authority (NEPRA) also endorsed the decision of the federal government.

A notification has already been issued in this regard to LESCO and all other electricity supply companies.

The relief will be notified to consumers in the electricity bills and units used in November.

Govt decides not to change the basic tariff

The federal government decided to keep the basic tariff of electricity unchanged.

Earlier, NEPRA sent a summary to cut basis electricity tariff by 62 paisa per unit.

NEPRA fixed the basic electricity tariff for 2026 at Rs33.38 per unit. NEPRA conducted a hearing of the case regarding the imposition of an equal electricity tariff across the country.

Power Division submitted the equal electricity tariff application for 2026. NEPRA approved the cut in electricity tariff and forwarded the approval to the federal government.

NEPRA approved a reduction in the electricity tariff by 62 paisa. Power Division said that the federal government is also giving a subsidy on electricity.

The officials said that the prices of electricity is unchanged. The National grid have an installed capacity of 36,397 megawatts.

Power Division officials said that only dependency on imported fuel is only 26 percent.

The federal government is giving Rs629 billion in subsidies to electricity consumers.

-

Politics5 days ago

Politics5 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Entertainment5 days ago

Entertainment5 days agoDoes new US food pyramid put too much steak on your plate?

-

Sports1 week ago

Sports1 week agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment5 days ago

Entertainment5 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business5 days ago

Business5 days agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoFACI invites applications for 2026 chess development project | The Express Tribune

-

Business1 week ago

Business1 week ago8th Pay Commission: From Policy Review, Cabinet Approval To Implementation –Key Stages Explained